Mucopolysaccharidoses Market Size

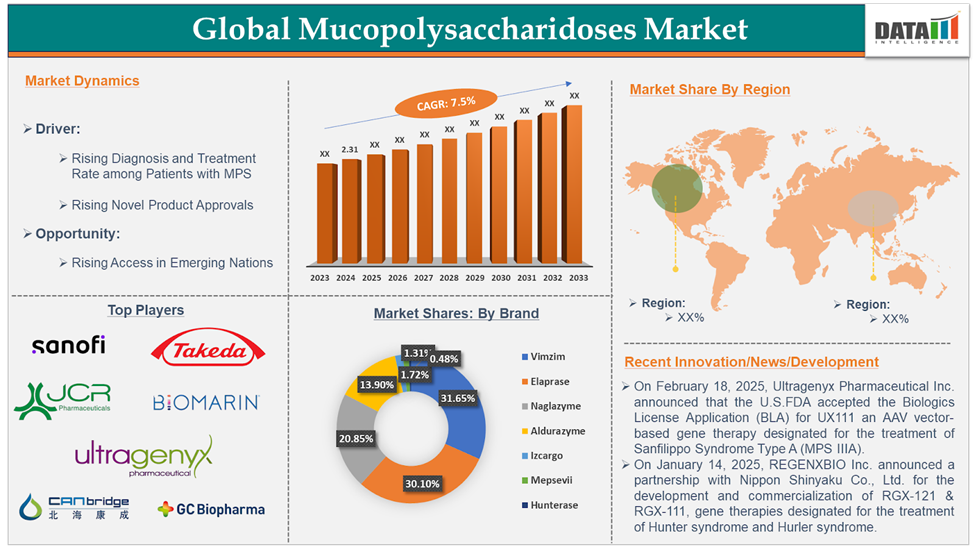

The Global Mucopolysaccharidoses market reached US$ 2,313.08 million in 2024 and is expected to reach US$ 4,389.85 million by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Mucopolysaccharidoses are a group of inherited lysosomal storage diseases caused by genetic mutations in the enzymes that catalyze glycosaminoglycans breakdown. Glycosaminoglycans, also known as mucopolysaccharides, are the carbohydrate molecules that play a crucial role in cell signaling, growth & development of bones, connective tissues, and corneas. These glycosaminoglycans are broken down by 11 different types of enzymes, whose mutation leads to improper or loss of their function. As a result, the glycosaminoglycans accumulate in the blood, brain, spinal cord, and connective tissue, leading to a variety of symptoms ranging from physical dysmorphia to cognitive impairment.

There are seven types of mucopolysaccharidoses categorized based on the associated enzyme deficiency.

| MPS Type | Common Name | Deficient Enzyme |

| MPS I | Hurler, Hurler-Scheie, Scheie Syndrome | α-L-Iduronidase |

| MPS II | Hunter Syndrome | Iduronate-2-sulfatase |

| MPS IIIA | Sanfilippo Syndrome Type A | Heparan N-sulfatase (SGSH) |

| MPS IIIB | Sanfilippo Syndrome Type B | α-N-Acetylglucosaminidase (NAGLU) |

| MPS IIIC | Sanfilippo Syndrome Type C | Acetyl-CoA: α-glucosaminide N-acetyltransferase (HGSNAT) |

| MPS IIID | Sanfilippo Syndrome Type D | N-Acetylglucosamine-6-sulfatase (GNS) |

| MPS IVA | Morquio Syndrome Type A | Galactosamine-6-sulfatase (GALNS) |

| MPS IVB | Morquio Syndrome Type B | β-Galactosidase |

| MPS VI | Maroteaux-Lamy Syndrome | Arylsulfatase B (ARSB) |

| MPS VII | Sly Syndrome | β-Glucuronidase |

| MPS IX | Natowicz Syndrome | Hyaluronidase 1 (HYAL1) |

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising Novel Product Approvals and Development Activities

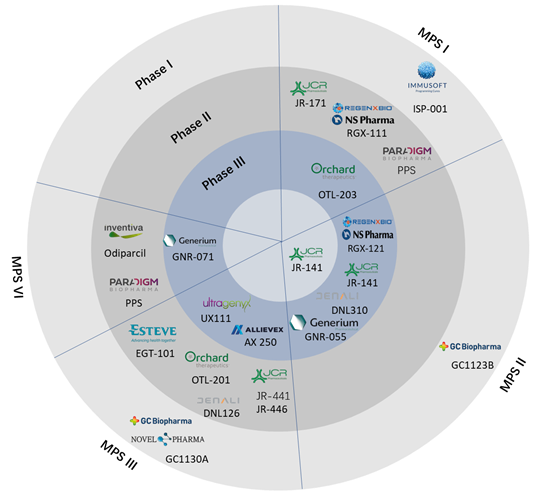

Mucopolysaccharidoses are a group of conditions with high unmet needs. The current research efforts were focused on developing disease-modifying therapies and subsequently launching them into the market. In recent times, the mucopolysaccharidosis treatment landscape has seen traction due to the marketing authorization of several therapies provided by regulatory bodies across the world. Moreover, several pipeline drugs have received clinical milestones and special designations that can expedite their approval process and gain early market access. In the forecast period, several pipeline products are expected to make market entry for some mucopolysaccharidose conditions with high unmet needs, such as Sanfilippo syndrome.

For instance, on February 5, 2025, Ultragenyx Pharmaceutical Inc. reported positive clinical trial data for its novel AAV-based gene therapy UX111, which is aimed at the treatment of patients with Sanfilippo syndrome type A (MPS IIIA). The clinical results showed that UX111 has significantly improved cognitive ability and receptive & expressive communication in treated patients. This is a significant milestone in the Sanfilippo treatment landscape. On February 18, 2025, Ultragenyx announced that the U.S. FDA accepted the Biologics License Application (BLA) of UX111, and it is being considered for priority review. Ultragenyx is seeking accelerated approval, and the decision is expected by August 18, 2025. Once Ultragenyx receives a positive nod, the company will be ready to launch this revolutionary therapy commercially into the market.

Several such pipeline drugs are performing well in clinical trials and are on the verge of regulatory approval. Once these drugs are approved, they are expected to revolutionize the mucopolysaccharidoses treatment landscape.

Below is the representation of key pipeline drugs that are in various clinical phases for different types of mucopolysaccharidoses.

High- Cost of Approved Drugs May Restrain the Market Growth.

Enzyme replacement therapies (ERTs) are the current standard of treatment for MPS, however, patients need to be on long-term therapy. This can be a significant economic burden to the patient who does not have proper insurance coverage and does not meet the stringent rules put forth by the insurance companies. Moreover, several disease-modifying therapies are expected to make market entry in the forecast period. These therapies are expected to have higher prices as compared to the current standard of care ERTs. This can hinder the adoption rate, although the unmet needs are high.

Market Segment Analysis

The global Mucopolysaccharidoses market is segmented based on type, drug, and region.

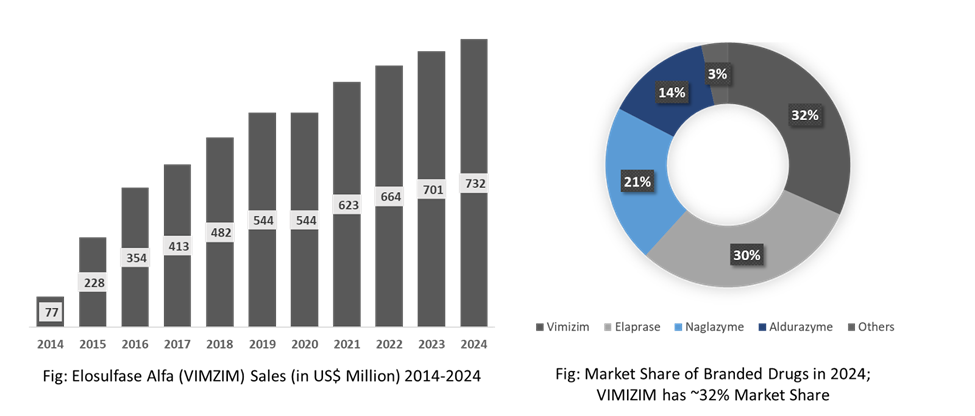

Elosulfase Alfa in the drug segment is dominating the market.

Elosulfase Alfa, sold under the brand name VIMIZIM, manufactured by BioMarin Pharmaceutical Inc. is an enzyme replacement therapy indicated for the treatment of Mucopolysaccharidosis type IVA, also known as Morquio A syndrome. The drug first received marketing authorization in the U.S. in February 2014, followed by EU marketing authorization in April 2014 and Japanese approval in December 2014. Elosulfulase alfa is the first-in-therapy drug for MPS IVA, and no drug has ever been approved since then for the indication. Currently, this drug is the top-selling one in the mucopolysaccharidoses treatment landscape. In 2023, BioMarin reported US$ 701 million in revenue for VIMIZIM, and dataM estimates a revenue of approximately US$ 732 million in 2024. The drug had approximately 32% market share in 2024.

Market Geographical Share

North America dominated the Mucopolysaccharidoses market.

The North America region has the highest market share in the global mucopolysaccharidoses market. The factors contributing to the region's dominance include high diagnosis and treatment rates, first availability of approved drugs,

The patient population in the region, especially in the U.S., is highly aware of their disease and their therapeutic choices. Several non-profit organizations in the U.S. create awareness about the disease, which is the major contributing factor to the high diagnosis and treatment rate. For instance, the National MPS Society is an NGO in the U.S. that supports scientific research, family support, and public awareness of MPS disorders. They raise funds, sponsor events, and advocate for support programs, offering resource guides, emotional forums, and family conferences. Several such organizations that are advocating for MPS patients include The National Organization for Rare Disorders (NORD), Project Alive, Angel’s Hands Foundation, etc. All these organizations are contributing to the improved diagnosis rate of rare diseases like mucopolysaccharidoses.

In addition to the higher diagnosis rate, the percentage of the population receiving treatment is also high. This is due to the availability of disease-modifying therapies at the patient’s convenience. 5 out of seven approved therapies, such as Aldurazyme, Elaprase, VIMIZIM, Naglazyme, and Mepsevii, are available in the region. This represents the region’s higher demand for disease-modifying therapies and how manufacturers favor the region first for their product launch.

In addition to these factors, the high sales generated by market players and the robust clinical pipeline are major factors contributing to the region’s dominance.

Major Players

The major players in the Mucopolysaccharidoses market are Sanofi, Takeda Pharmaceuticals, GC Biopharma Corporate., JCR Pharmaceuticals Co., Ltd., BioMarin Pharmaceutical Inc., and Ultragenyx Pharmaceutical Inc., among others.

Key Developments

- On February 18, 2025, Ultragenyx Pharmaceutical Inc. announced that the U.S. Food and Drug Administration (FDA) accepted the Biologics License Application (BLA) for UX111, an AAV vector-based gene therapy that is being evaluated for the treatment of Sanfilippo Syndrome Type A (MPS IIIA).

- On January 14, 2025, REGENXBIO Inc. announced a partnership with Nippon Shinyaku Co., Ltd. for the development and commercialization of RGX-121 & RGX-111, two novel gene therapies designated for the treatment of Hunter syndrome (MPS II) and Hurler syndrome (MPS I). REGENXBIO will receive US$ 110 million in payment upon deal closure and an additional US$ 700 million for meeting milestones in the future.

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Type | MPS I (Hurler Syndrome), MPS II (Hunter Syndrome), MPS IV (Morquio Syndrome), MPS VI (Maroteaux-Lamy Syndrome), MPS VII (Sly Syndrome), and Others |

| Drug | Laronidase, Idursulfase, Pabinafusp Alfa, Elosulfase Alfa, Galsulfase, Vestronidase Alfa-vjbk, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming pharmaceutical advancements.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global melanoma therapeutics market report would provide approximately 45 tables, 46 figures, and 180 pages.

Target Audience 2025

- Manufacturers: Pharmaceutical, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.