Metal Air Batteries Market Size

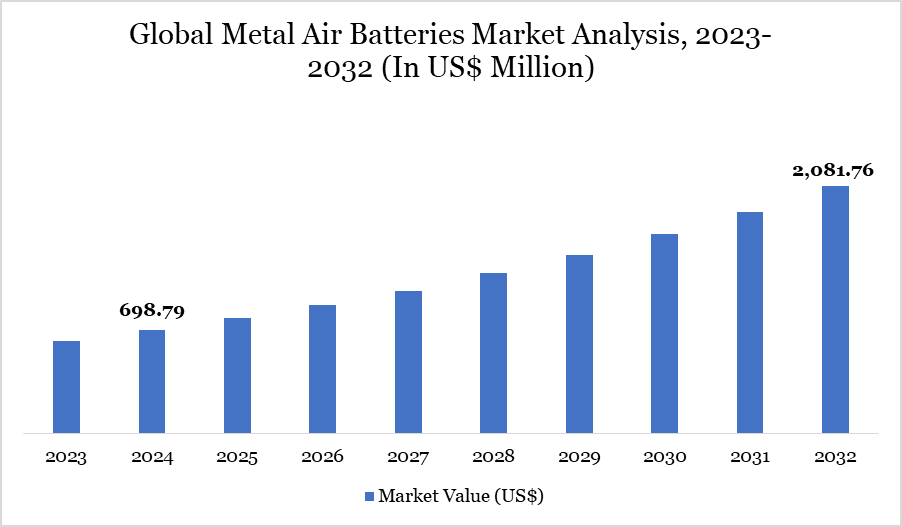

Global Metal Air Batteries Market size reached US$ 698.79 million in 2024 and is expected to reach US$ 2,081.76 million by 2032, growing with a CAGR of 14.62% during the forecast period 2025-2032.

The market for metal-air batteries is expanding as a viable substitute for lithium-ion and lithium-air batteries because of their better energy density, cheaper production costs, and utilization of plentiful metals like iron, zinc, and aluminum. These batteries are thought to be an effective alternative, especially for specialized uses like timepieces, railway signals, and hearing aids.

The batteries replicate the operation of a fuel cell by using air as an oxidant and metal as an anode. Although the market is still in its infancy, it is expected to expand as material science and battery technology progress. However, before metal-air batteries can get wider market acceptance, obstacles like the longer commercialization timetables and the COVID-19 pandemic's effect on demand must be addressed.

Metal Air Batteries Market Trend

The growing use of renewable energy sources like solar and wind is a major trend propelling the metal-air battery industry. Because of their high energy density, metal-air batteries provide a practical way to handle the intermittency of these sources, which calls for effective energy storage devices. The increasing need for dependable storage systems is reflected, for instance, in Germany's ambition to generate 20GW of electricity from offshore wind by 2030.

Growing consumer electronics markets, especially in developing nations, are opening up more prospects for metal-air batteries. Because of their extended operating range, these batteries are also becoming more popular in electric vehicle (EV) applications. The potential for metal-air batteries in the consumer and industrial sectors is expanding along with the need for high-performance, environmentally friendly energy storage options.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details | |

| By Metal | Zinc, Lithium, Aluminum, Iron, Others | |

| By Voltage | Low (<12 V), Medium (12 - 36 V), High (>36 V) | |

| By Type | Primary, Secondary | |

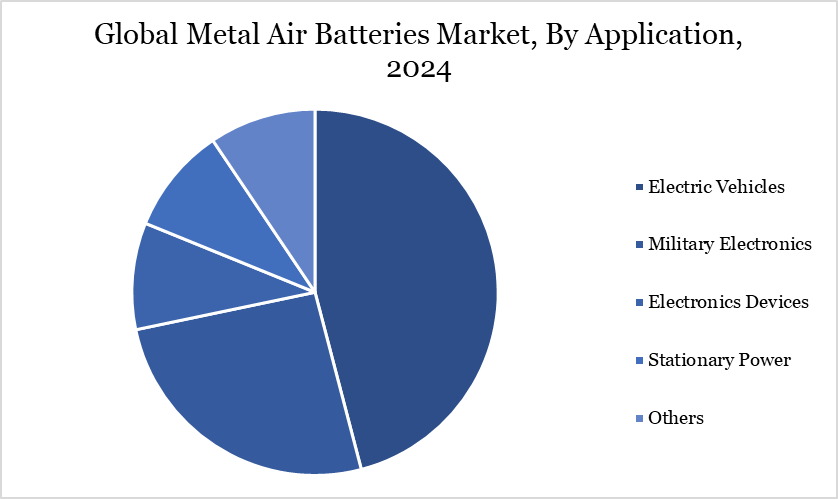

| By Application | Electric Vehicles, Military Electronics, Electronics Devices, Stationary Power, Others | |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Metal Air Batteries Market Dynamics

Growing Electric Vehicle Adoption

The growing use of electric vehicles (EVs) is a major factor propelling the metal-air battery market. Higher performance and longer driving range batteries are becoming more and more in demand as the automotive industry moves toward electrification. Because of its higher energy density and potential for longer-lasting power solutions, metal-air batteries are a good fit for EVs.

Stricter emission standards and a greater focus on sustainability are the main causes of this change. The potential of metal-air batteries in the EV industry is also being further enhanced by ongoing developments in materials science and battery technology, such as enhancements in electrode materials and electrolytes. In the upcoming years, the EV market is anticipated to grow dramatically, and metal-air batteries are well-positioned to help satisfy this need.

Lithium-Ion Battery Competition

The dominance of lithium-ion batteries is one of the main factors limiting the growth of the metal-air battery market. In many industries, like as consumer electronics, electric cars, and energy storage systems, lithium-ion technology is more reliable, well-established, and extensively used. The quick commercialization and deployment of lithium-ion batteries make it difficult for metal-air batteries to increase their market share.

Lithium-ion batteries' commercial position is further reinforced by their demonstrated efficiency and dependability. Furthermore, problems including lower cycle life and some metal-air battery types' inability to be recharged prevent them from being widely used. The market is still dominated by lithium-ion batteries, therefore the metal-air battery industry has a hard time breaking into important markets.

Market Segment Analysis

The global metal air batteries market is segmented based on metal, voltage, type, application and region.

EVs are in Higher Demand due to High Energy Density and Environmental Benefits

Electric vehicles (EVs) have become the market's largest application category for metal-air batteries, due to the global trend toward environmentally friendly transportation options. As countries strive to lower greenhouse gas emissions and fight climate change, the demand for electric vehicles is rising, which is driving this increase. Metal-air batteries are a possible energy storage solution for EVs because they have several advantages over conventional lithium-ion batteries, such as a higher energy density, longer driving ranges, and better performance.

In addition to being more readily available and having longer lifespans than traditional lithium-ion batteries, these batteries are also more environmentally friendly. Metal-air batteries meet the need for cleaner alternatives as the automobile industry moves away from fuel-powered, carbon-rich vehicles.

The adoption of EVs is further accelerated by high oil costs and government subsidies. Even though there are still difficulties, like problems with metal anodes, electrolytes, and air cathodes, continuous improvements in battery technology continue to resolve these issues, guaranteeing the expansion of electric mobility in the future.

Market Geographical Share

North America Leads the Global Metal Air Batteries Market with Increasing Energy Storage Solutions

North America's increasing need for energy storage solutions is the main factor propelling the region's potential to dominate the global metal-air battery market. The growing use of renewable energy, especially solar and wind, which need strong energy storage systems to sustain the grid, is driving the industry. North America is in a good position to create affordable metal-air batteries because it has a wealth of raw materials, such as zinc and aluminum.

The region's emphasis on grid-scale energy storage and electric vehicles (EVs) is driving up demand for high-energy-density batteries. Although there are concerns with metal-air batteries' cycle life and energy density in comparison to lithium-ion batteries, these should be resolved by continued research and development, positioning North America as a market leader.

Sustainability Analysis

The metal-air battery (MAB) business is becoming more and more recognized for its sustainability, because of its enormous potential as an environmentally friendly energy storage option. MABs present a viable substitute for conventional power storage systems in light of growing energy demands and the depletion of fossil fuels.

Compared to lithium-ion batteries, these batteries are more environmentally friendly and less reliant on resources because they use abundant metals like iron, zinc, and aluminum. MABs are more viable for large-scale renewable energy storage and electric car applications due to their energy efficiency, which is 5–30 times higher than that of lithium-ion batteries. Additionally, these batteries' cheap cost and non-toxicity fit perfectly with the global movement toward resource-efficient, sustainable solutions.

There are still issues with the commercial-scale implementation of MABs, including technical difficulties with battery life, rechargeability, and general performance. These constraints are being addressed by ongoing research and development, and as developments proceed, MABs are anticipated to become increasingly important in the future of energy storage systems.

Major Global Players

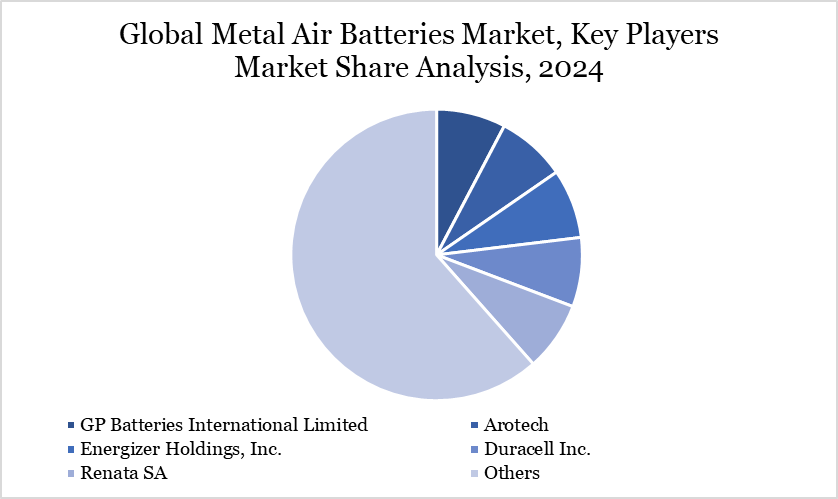

The major global players in the market include GP Batteries International Limited, Arotech, Energizer Holdings, Inc., Duracell Inc., Renata SA, Phinergy, Log9 Materials, Poly Plus Battery, Zinc8 Energy Solutions, Panasonic Energy Co., Ltd.

Key Developments

- In March 2024, at MODEX 2024 in Atlanta, Georgia, Stryten Energy LLC, one of the US-based firms that provides energy storage solutions, introduced a new line of Class I, II, and III lithium batteries under the brand name M-Series Li600.

- In February 2024, with a US$ 12.5 million investment, Indian Oil Corporation Limited, one of the top state-owned multinational energy companies, finished its second round of investment in Phinergy, a top Israeli company, increasing its share of metal-air technology manufacturing to 17%. Phinergy will use the investment to grow its business in India and boost the manufacturing of power backup solutions for the telecom industry.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies