Industry Outlook

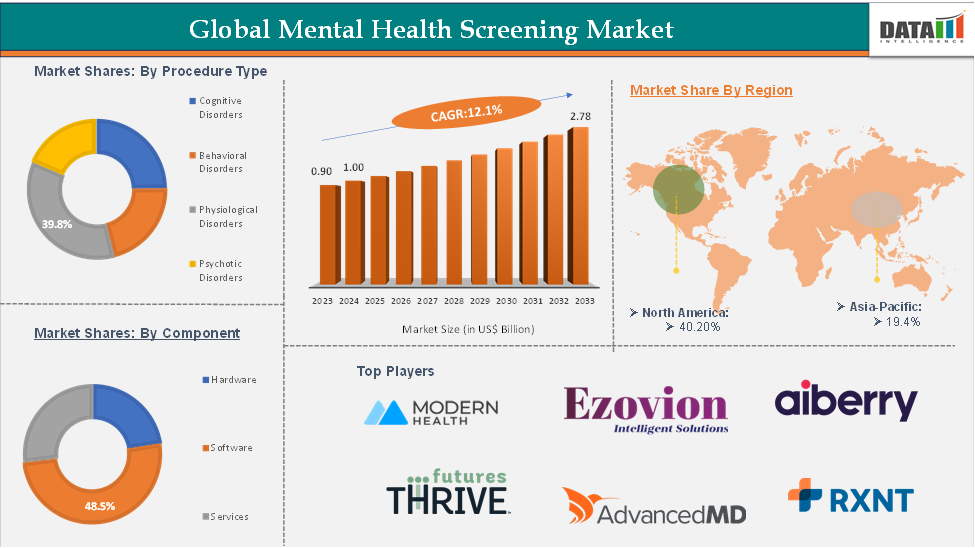

The global mental health screening market reached US$ 0.90 billion in 2023, with a rise of US$ 1.00 billion in 2024, and is expected to reach US$ 2.78 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025-2033.

The mental health screening market is undergoing a transformation driven by rapid advancements in digital health technologies, including AI-powered diagnostic tools, mobile-based assessments, and wearable-integrated monitoring systems. These innovations enable real-time symptom tracking, early detection of mental health conditions, and personalized screening approaches. Integration of big data and genomics is enhancing the ability to identify at-risk populations and predict mental health trends.

Executive Summary

Market Dynamics: Drivers & Restraints

Driver: Rising prevalence of mental disorders

The rising prevalence of mental disorders is expected to be a major driving force behind the growth of the mental health screening market. Conditions such as depression, anxiety, bipolar disorder, PTSD, and substance abuse have seen a significant increase globally, driven by factors like urbanization, social isolation, economic stress, and lifestyle changes.

For instance, according to the World Health Organization in 2023, Mental health has become a major public health concern globally, with over 1 billion people affected by mental, neurological, and substance use disorders. The burden is particularly significant in the Eastern Mediterranean Region, where an estimated 14.7% of the population is living with a mental health condition, marking the second-highest prevalence among all WHO regions. This surge in mental health issues has led to greater demand for early detection and intervention, pushing healthcare systems, employers, and digital health platforms to adopt more comprehensive screening tools. As awareness grows and stigma around mental illness gradually decreases, routine mental health screening is becoming an essential part of preventive care, further propelling market expansion.

Restraint: Lack of mental health professionals

The lack of mental health professionals poses a significant challenge to the growth of the mental health screening market. While demand for mental health screening is rising due to increased awareness and prevalence of disorders, many regions face severe shortages of trained psychiatrists, psychologists, and counselors. This gap limits the capacity for accurate diagnosis, follow-up care, and interpretation of screening results. Even with digital tools and AI-driven platforms, human oversight remains crucial in confirming diagnoses and initiating treatment plans.

For more details on this report, Request for Sample

Segment Analysis

The global mental health screening market is segmented based on disorder type, screening method, component, age group, end-user, and region.

Treatment Type:

The physiological disorders segment is estimated to have 44.4% of the mental health screening market share.

The physiological disorders segment is projected to hold a significant share of the mental health screening market, driven by the rising global prevalence of conditions such as bipolar disorder, eating disorders, substance abuse, depression, anxiety, and post-traumatic stress disorder (PTSD). These disorders represent some of the most commonly diagnosed mental health conditions worldwide, prompting increased demand for early detection and intervention.

For instance, according to the 2021 Global Burden of Disease study, there were approximately 444 million new cases of mental disorders worldwide, with an age-standardized incidence rate (ASIR) of 5,460 per 100,000 population, representing a 16% increase since 2019.

Growing public awareness, government support, and advancements in digital screening tools have further accelerated screening efforts. As mental health becomes a greater priority across healthcare systems, this segment is expected to remain a key area of focus in clinical practice and research.

Geographical Analysis

The North America mental health screening market was valued at 40.20% market share in 2024

North America is expected to dominate the mental health screening market due to several key factors. The region has a high prevalence of mental health disorders, coupled with increasing public awareness and reduced stigma around mental health care. Strong healthcare infrastructure, widespread adoption of advanced digital screening technologies, and significant government support through policies and funding further drive market growth.

Additionally, North America benefits from the active involvement of major technology companies and startups developing AI-powered and telehealth screening solutions, making mental health services more accessible. For instance, in June 2025, Wysa, a global leader in AI-driven mental health support, announced the U.S. launch of Wysa Gateway, an AI-powered chatbot aimed at improving how therapy providers and health plans connect patients to care. Wysa Gateway automates clinical screenings using advanced AI, offering a faster, more accurate, and personalized entry point into therapy services.

Growing employer initiatives promoting employee mental wellness and well-established reimbursement frameworks also contribute to the region’s leadership in the market.

Major Players

The major players in the mental health screening market include Modern Life, Inc., FuturesThrive, Aiberry, Ezovion, AdvancedMD, Inc., Networking Technology, Inc. dba RXNT, Amaha, Wellin5 Innovations Inc., among others.

Key Developments

In July 2025, Google unveiled two new artificial intelligence initiatives aimed at helping mental health organizations scale evidence-based interventions and advance research into treatments for anxiety, depression, and psychosis.

In May 2025, JD Health’s Mental Health Service Center introduced a range of AI-powered service initiatives at a conference in Beijing. The new offerings include an AI therapeutic companion called “Small Universe for Chatting and Healing,” designed to provide emotional support to users, along with multimodal diagnostic and digital management tools for healthcare professionals. This marks JD Health as the first AI-driven online mental health service platform in China.

Report Glimpses

Metrics | Details | |

CAGR | 12.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Disorder Type | Cognitive Disorders, Behavioral Disorders, Physiological Disorders, Psychotic Disorders |

Screening Method | Self-Reported Questionnaires, Clinical Interviews, Observation-Based Assessments, Biomarker Testing, Others | |

| Component | Hardware, Software, Services |

| Age Group | Children, Adults (Age 19-64), Seniors (Age 65 and above) |

| End-User | Hospitals and Clinics, Educational Institutions, Workplaces, Homecare Settings |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global mental health screening market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Healthcare IT-related reports, please click here