Medicinal Foods Market Size

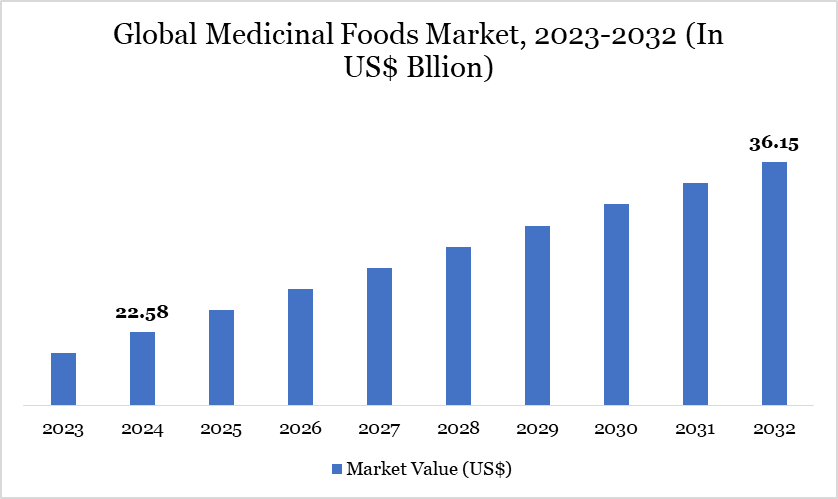

Medicinal Foods Market reached US$ 22.58 billion in 2024 and is expected to reach US$ 36.15 billion by 2032, growing with a CAGR of 6.06% during the forecast period 2025-2032.

The global medicinal foods market is experiencing robust growth driven by increasing health awareness among the global population. The rising prevalence of chronic diseases and an aging population seeking dietary solutions for managing health conditions and enhancing overall well-being. Medicinal foods provide a variety of benefits that extend beyond standard nutrition, aiding in health maintenance and the management of diseases and expanding the market reach.

Advances in food science and technology, along with supportive regulatory frameworks, are expanding the range of products available in different types of medicinal foods. Significant opportunities for market growth lie in emerging markets, where rising incomes and changing lifestyles drive demand, as well as through product innovation, such as personalized nutrition and plant-based ingredients.

Medicinal Foods Market Trend

Diet-related illnesses are driving demand for Food-as-Medicine (FAM), a model using functional and fortified foods to manage or prevent chronic conditions. Unlike supplements, FAM integrates nutrition into daily meals, offering therapeutic benefits and cost-effective health outcomes. The U.S. alone faces over US$ 1.1 trillion in related healthcare costs, reinforcing the urgency for scalable solutions. Key stakeholders, including insurers, startups and healthcare providers, are increasingly investing in this space.

Advances in AI, wearables and personalized nutrition platforms are driving scalable FAM interventions. These technologies enable real-time monitoring and tailored dietary plans. Despite regulatory and clinical integration challenges, the market shows strong growth potential. Companies offering evidence-based, functional food solutions are positioned for long-term success in this evolving sector.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Product | Functional Foods, Fortified Foods, Probiotic and Prebiotic Foods, Nutraceuticals and Others |

By Form | Powder, Tablet and Others |

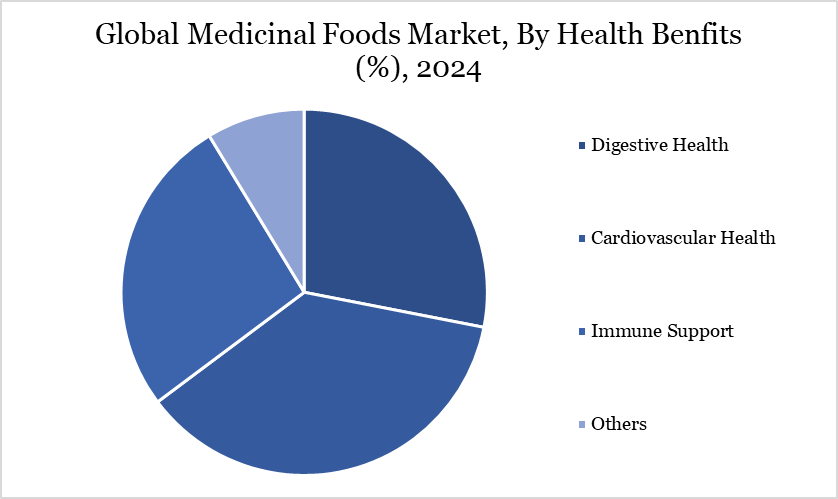

By Health Benefits | Digestive Health, Cardiovascular Health, Immune Support and Others |

By Route of Administration | Oral, Enteral and Others |

By Distribution Channel | Pharmacies, Supermarkets/Hypermarkets, Specialty Stores, Online Retail and Others |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Medicinal Foods Market Dynamics

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, such as obesity, diabetes and heart disease, is significantly driving the market for products that improve the overall well-being of a person. According to the World Health Organization's statistics, about 1 billion people worldwide are affected by obesity, with 650 million being adults and over 340 million adolescents.

Additionally, the IDF Diabetes Atlas reports that 537 million adults globally are living with diabetes, which is expected to rise to 643 million by 2030. Further, WHO estimates that cardiovascular diseases are the top cause of death worldwide, accounting for approximately 17.9 million fatalities annually. As people become more health-conscious and seek ways to better health, the demand for food products that add medicinal is increasing rapidly driving the market growth.

High Costs of Medicinal Foods

High costs associated with the development, production and marketing of medicinal foods significantly restrain the growth of the global market. These expenses encompass extensive research and development, rigorous clinical trials and navigating complex regulatory approval processes. As a result, companies face substantial financial barriers that can limit their ability to introduce new products and scale up production efficiently.

The financial strain hampers innovation and market entry and also creates a competitive disadvantage. Preferences and acceptance of medicinal foods can vary widely across different cultures and regions. With the higher costs of these products, consumers look out for replacements to complement the medicinal benefits with a cheaper range. Medicinal foods often compete with pharmaceuticals and traditional treatments.

Medicinal Foods Market Segment Analysis

The global medicinal foods market is segmented based on product, form, health benefits, route of administration, distribution channel and region.

Increasing Digestive Health Issues

The global medicinal foods market is segmented based on health benefits into digestive health, cardiovascular health, immune support and others. The digestive health segment accounted for the largest share of the global market. There is increasing awareness about the importance of gut health and its connection to overall well-being. This awareness has led to greater consumer interest in medicinal foods.

The high prevalence of gastrointestinal issues highlights the dominance of digestive health in the global medicinal foods market. According to a comprehensive multinational study by the National Institutes of Health, over 40% of the global population suffers from gastrointestinal problems, with diarrhea affecting 4.7%, constipation 11.7% and irritable bowel syndrome (IBS) 4.1% of people.

The widespread occurrence creates substantial demand for products designed to support digestive health, such as probiotics, prebiotics and fiber-enriched foods. The significant number of individuals experiencing these conditions drives the market for medicinal foods aimed at alleviating symptoms and promoting overall digestive well-being, underscoring the importance of this segment in addressing a major global health concern.

Medicinal Foods Market Geographical Share

Rising Prevalence of Health Concerns in North America

North America dominates the global medicinal foods market. Regional consumers are increasingly seeking out medicinal foods for their potential health benefits, such as managing diabetes, improving cardiovascular health and enhancing overall wellness. There is a high prevalence of obesity and diabetes in North America, affecting over 41.9% of adults, 19.7% of children with obesity and approximately 37.3 million Americans with diabetes.

The widespread health challenge creates a high demand for medicinal foods tailored to manage these conditions, leading to extensive innovation and the development of specialized products. The presence of a highly developed healthcare system and rapid investments in R&D for pharmaceuticals and nutritional sciences fuels the development of new medicinal foods and dietary supplements in the region, fueling the market growth.

Sustainability Analysis

The medicinal foods market is increasingly aligning with sustainability goals through eco-conscious ingredient sourcing, clean-label formulations and packaging innovations. Companies are adopting plant-based organic and locally sourced raw materials while minimizing chemical processing and reducing reliance on synthetic additives. Recyclable, biodegradable and lightweight packaging solutions are being introduced to reduce carbon footprints, alongside investments in renewable energy and energy-efficient manufacturing systems.

Social and governance efforts focus on equitable access to nutrition, ethical sourcing and transparent supply chains. Leading companies like Nestlé Health Science are integrating sustainability into core strategies through regenerative agriculture, ESG-aligned R&D and circular economy practices. These initiatives not only support public health but also drive long-term business resilience and compliance with global ESG standards.

Medicinal Foods Market Major Players

The major global players in the market include B Braun SE, Abbott Nutrition, Danone S.A., Mead Johnson & Company, LLC., Meiji Holding & Co, Ltd., Ajinomoto Cambrooke Inc., Nestle Health Sciences, Perrigo Company plc., Dutch Medical Food BV. and Hearthside Food Solutions, LLC.

Key Developments

In September 2024, Dutch Medical Food B.V. partnered with Pristine Pearl Pharma to launch targeted medical nutrition products in India, addressing conditions like cancer, pediatric malnutrition and COPD. This strategic move combines global expertise with local reach to improve patient outcomes and support advanced clinical nutrition across the country.

In January 2024, Bitewell launched a personalized digital “farmacy” that offers health-focused groceries and meals based on users’ conditions and goals. Available through health plans and wellness programs, it restricts purchases to nutritious options and delivers nationwide. The platform supports food-as-medicine adoption by offering consumer insights and promoting healthier choices.

In March 2023, Nutrazee, an Indian company, unveiled Nutrazee Probiotic Gummies, which are designed to enhance digestive and immune health for both children and adults.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies