Medication Management Systems Market: Industry Outlook

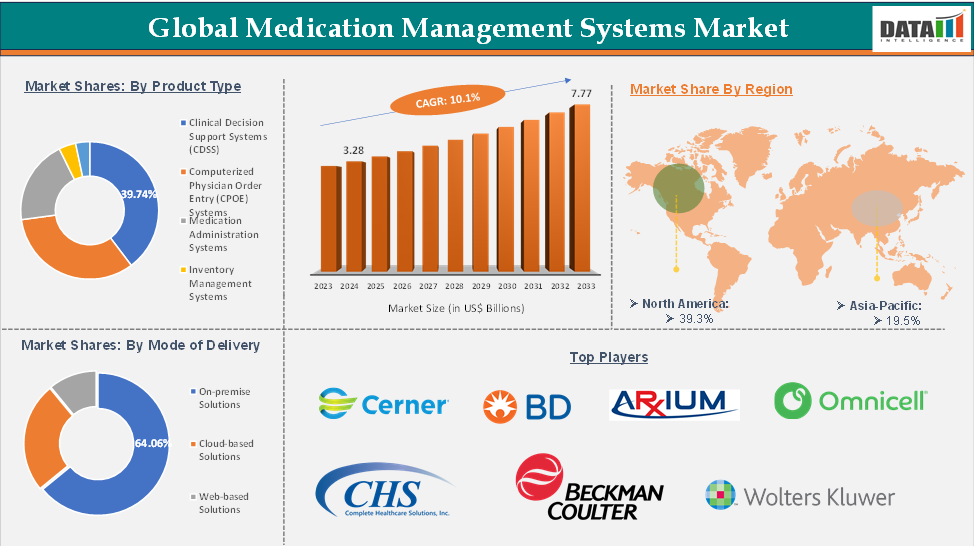

Medication Management Systems Market reached US$ 3.28 Billion in 2024 and is expected to reach US$ 7.77 Billion by 2033, growing at a CAGR of 10.1% during the forecast period 2025-2033.

The global medication management systems market is expanding due to chronic diseases, aging populations, and the need for advanced healthcare technologies. These systems, including CPOE, CDSS, and eMAR, aim to improve patient safety by minimizing errors and enhancing therapy adherence.

Artificial intelligence and machine learning are incorporating these platforms for predictive analytics and personalized treatment strategies. Cloud-based deployment is gaining momentum due to its scalability, cost efficiency, and seamless integration with healthcare infrastructure.

North America dominates the market, while the Asia-Pacific region is emerging as a key growth driver. However, the market faces high upfront costs, data security concerns, and interoperability challenges. Despite these challenges, continuous technological innovation and supportive regulatory environments are expected to foster long-term market growth and adoption of medication management systems worldwide.

Executive Summary

For more details on this report, Request for Sample

Medication Management Systems Market Dynamics: Drivers & Restraints

Driver: Rising investments by market players & hospitals

The global medication management system market is growing due to the increasing investments by technology companies, healthcare software providers, and pharmaceutical companies. These companies are focusing on improving the functionality, scalability, and integration capabilities of these systems to meet the evolving needs of healthcare providers.

Advanced technologies like artificial intelligence (AI), machine learning, and automation are being used to enhance the accuracy and efficiency of medication administration, tracking, and dispensing. AI-powered systems can provide real-time alerts about potential drug interactions or dosing errors, reducing the risk of medication-related harm. Hospitals are also recognizing the importance of medication management systems in improving patient safety and reducing operational inefficiencies.

For instance, in January 2024, SmithRx received an additional USD 60 billion in its Series C funding. This was the second year the company has raised a Series B for USD 20 billion in 2022, and now underscores the firm's mission of paving the way for better accessibility and affordability in prescription drugs. The company aims to change the traditional pharmacy benefit managers (PBMs) model so that patients have access to medications at fair and reasonable prices.

Restraint: Resistance to change among healthcare professionals

The global medication management system market faces significant resistance from healthcare professionals and organizations due to concerns about disruption of workflows, time-sensitive conditions, and the learning curve associated with training staff.

Some healthcare professionals may be skeptical about the effectiveness of new systems, fearing they may not fully integrate with existing processes or improve outcomes. This resistance is particularly strong in environments where staff are already working under significant pressure, such as emergency departments or smaller facilities with limited resources.

Medication Management Systems Market Segment Analysis

The global medication management systems market is segmented based on product type, mode of delivery, end user, and region.

Product Type:

The clinical decision support systems (CDSS) segment of the product type is expected to hold 39.74% of the medication management systems market

Clinical decision support systems (CDSS) are crucial in improving the effectiveness and safety of global medication management systems (MMS). They integrate real-time data analysis and evidence-based guidelines, providing healthcare professionals with actionable insights for informed prescriptions, dosing, and administration. CDSS helps prevent medication errors, improve patient safety, optimize medication regimens, reduce polypharmacy risks, and enhance treatment outcomes, particularly in patients with complex or chronic conditions.

By integrating CDSS into MMS, healthcare providers can enhance clinical workflows, reduce errors, and provide more precise, personalized treatment, ultimately improving patient care and operational efficiency in healthcare settings.

For instance, in June 2024, DocMode unveils AIDE, an AI-driven CDSS for doctors. DocMode, India's leading medical online learning platform, has launched AIDE, a global solution for doctors and healthcare professionals. AIDE, which stands for "Assistant for Improved Decision-making with Evidence in Healthcare," has undergone rigorous clinical testing and feedback with over 600 doctors, aiming to improve clinical decisions and patient outcomes.

Medication Management Systems Market Geographical Analysis

North America dominated the global medication management systems market with the highest share of 39.3% in 2024

North America holds a substantial position in the medication management system market and is expected to hold most of the market share due to the significant launches, patient safety focus, and high technology adoption. The US is leading the way in implementing these systems due to strict regulatory standards like the FDA and HIPAA.

The increasing prevalence of chronic diseases and an aging population in North America are driving healthcare providers to adopt more efficient systems. Moreover, Digital health technologies, particularly in hospitals, are also driving market expansion.

For instance, in October 2024, MedSure Systems launched its new medication adherence technology, achieving a 99.9% medication adherence rate in its first-round trial. This is a significant achievement, as medication adherence is a significant challenge in the healthcare sector, costing over $300 billion and causing over 125,000 premature deaths annually in America. With over 41 million Americans aged 65 and older managing multiple chronic diseases and 75 million Americans over- or underdosing their medications, medication adherence is more critical than ever.

Moreover, in June 2024, PatchRx launched PatchRx Connect, a tool that integrates medication adherence data into a unified care management suite, providing real-time insights to clinical teams without disrupting workflows or affecting patient experience.

Medication Management Systems Market Key Players

The major global players in the medication management system market include Cerner Corporation, Becton, Dickinson and Company, ARxlUM, Omnicell, Inc., Complete HealthCare Solutions, Inc., PatientKeeper, Inc., Beckman Coulter, Inc, Wolters Kluwer N.V, Inferscience and among others.

Industry Key Developments

In July 2024, Omnicell, a pharmacy innovation solutions provider, launched a multi-year innovation programme called XT Amplify to provide long-term benefits to healthcare providers who have invested in its XT Automated Dispensing Cabinet Solutions. The programme ensures that existing cabinets can implement the latest hardware, software, and services, benefiting from frequent updates.

In February 2024, GUARDIAN RFID, a provider of inmate tracking systems, joined the AWS Partner Network and the AWS Public Sector Partner Program, a global network of AWS Partners that utilize expertise and resources to develop and distribute their solutions.

Market Scope

Metrics | Details | |

CAGR | 10.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Clinical Decision Support Systems (CDSS), Computerized Physician Order Entry (CPOE) Systems, Medication Administration Systems, Inventory Management Systems, Medication Analytics Platforms |

Mode of Delivery | On-premise Solutions, Cloud-based Solutions, Web-based Solutions | |

End User | Hospitals, Retail Pharmacies, Long-term Care Facilities, Ambulatory Surgical Centers, Home Healthcare | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |