Medical Spa Market Size

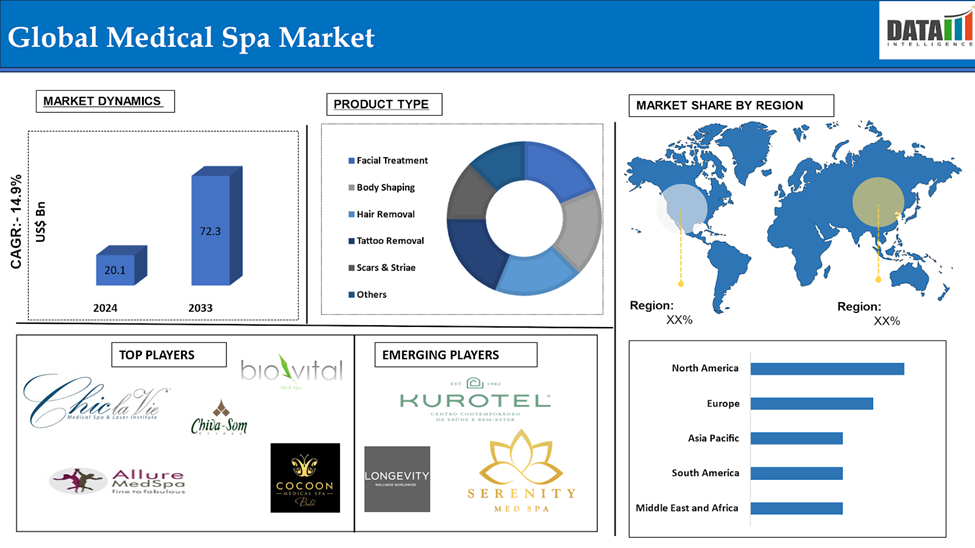

The Global Medical Spa Market reached US$ 20.1 billion in 2024 and is expected to reach US$ 72.3 billion by 2033, growing at a CAGR of 14.9% during the forecast period 2025-2033.

Medical spas, also known as medi-spas or medspas, combine medical procedures typically performed in a doctor's office with the experience of a day spa. They focus on anti-aging treatments, offering non-surgical options that were once only available at a doctor's practice. Some jurisdictions require medical spas to be owned and operated by a qualified physician. Destination spas offer detox, metabolic optimization, medical weight loss, and post-cancer recuperation.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising Demand for Non-Invasive Aesthetic Treatments

The global medical spa market is growing due to the increasing demand for non-invasive aesthetic treatments like laser hair removal, chemical peels, Botox, dermal fillers, and body contouring. These treatments offer minimal downtime, reduced risks, and quicker recovery compared to traditional surgical procedures. The growing population seeks cosmetic enhancements that fit into their busy lifestyles, and medical spas capitalize on this trend by offering advanced, technology-driven solutions in a relaxing and luxurious environment, making them a preferred choice for clients seeking efficacy and comfort.

For instance, in September 2024, Merz Aesthetics launched Ultherapy PRIME, a noninvasive, FDA-cleared medical aesthetics treatment that offers a personalized, long-lasting skin lift in one session with zero downtime. The platform is an evolution of Ultherapy, the Gold Standard for nonsurgical lifting, which has a large body of clinical evidence and high patient satisfaction. Ultherapy PRIME uses advanced ultrasound technology, real-time imaging, and proven results to promote long-lasting results and healthier-looking skin.

Shortage of Skilled and Certified Professionals

The global medical spa market is facing a significant challenge due to a shortage of skilled professionals. Advanced procedures like laser therapies, Botox injections, and chemical peels require high expertise and precision. In regions with scarce practitioners, the quality of services may be compromised, posing risks to clients and damaging spas' reputation. This shortage also limits spas' expansion, particularly in emerging markets, affecting consumer trust and limiting the market's growth and potential reach.

Market Segment Analysis

The global medical spa market is segmented based on service type, age group, service provider and region.

Service Type:

Facial Treatment segment is expected to dominate the Medical Spa market share

The facial treatment segment holds a major portion of the medical spa market share and is expected to continue to hold a significant portion of the medical spa market share during the forecast period.

Facial treatments are a popular and sought-after service in the global medical spa market, addressing various skin concerns like acne, wrinkles, pigmentation, and dullness. With rising consumer awareness of skincare and a desire for youthful skin, facial treatments are increasingly popular. Advancements in skincare technologies, such as hydrafacials and LED light therapy, have further enhanced their efficacy. Facial treatments act as gateway services, introducing customers to the medical spa environment and encouraging them to explore additional offerings. Their non-invasive nature and immediate results make them a cornerstone of the medical spa industry, contributing significantly to revenue and client retention.

For instance, in January 2023, Galderma has launched FACE by Galderma, an augmented reality application that allows aesthetic practitioners and patients to visualize treatment results at the planning stage. FACE by Galderma provides patients with a realistic "before and after" view of possible treatment results, addressing concerns about end results and enhancing patient satisfaction.

Service Provider:-

Single Ownership Medical Spas segment is the fastest-growing segment in Medical Spa market share

The single ownership medical spas segment is the fastest-growing segment in the medical spa market share and is expected to hold the market share over the forecast period.

Single-owner medical spas are a distinct segment of the global market, renowned for their personalized services and strong customer loyalty. These spas, managed by medical professionals or entrepreneurs, offer tailored treatments and foster closer client relationships, resulting in higher satisfaction and retention rates. Despite facing challenges like limited financial resources and limited investment in advanced technologies, they remain competitive by focusing on niche treatments, quality care, and intimate environments. They are especially prominent in localized markets, catering to specific community needs and preferences, contributing to the diversity and resilience of the medical spa industry.

Market Geographical Share

North America is expected to hold a significant position in the Medical Spa market share

North America holds a substantial position in the medical spa market and is expected to hold most of the market share due to high disposable income, wellness focus, partnerships and advanced healthcare infrastructure. The region's demand for non-invasive aesthetic treatments, particularly Botox, dermal fillers, and laser therapies, is driven by a large beauty-conscious population, especially aging adults. The presence of established spa chains and continuous innovation in treatment options further enhances the region's dominance. North American consumers' willingness to spend on luxury wellness services and disposable income allow for investment in advanced technologies and high-end facilities.

For instance, in October 2024, Move Holdings Corp., a Canadian healthcare company, has acquired Fountain Wellness, a multidisciplinary clinic and medical spa in British Columbia. The move will allow Move Health to enter the medical spa and longevity industry, offering a range of skincare and body treatments, including IV treatments, Botox, dermal fillers, PRP, body sculpting, chemical peels, acne treatment, dermaplaning, microdermabrasion, LED light therapy, and laser hair treatments.

Europe is growing at the fastest pace in the Medical Spa market

Europe holds the fastest pace in the medical spa market and is expected to hold most of the market share due to growing emphasis on aesthetic treatments, wellness, and self-care. Consumers are seeking non-invasive procedures, particularly anti-aging treatments like Botox and dermal fillers. The market's expansion is facilitated by the high concentration of luxury medical spas and a well-developed healthcare system. Cultural factors, such as the acceptance of medical aesthetics and interest in beauty trends, particularly among women and the aging population, also contribute to the demand. Europe's adoption of advanced technologies in facial and body treatments and holistic beauty approaches positions it as a key player in the market.

Major Global Players

The major global players in the medical spa market include Chic LaVl, Allure Medspa, Biovital Medspa, Chiva Som, Cocoon Medical Spa, Clinique La Prairie, Hyatt Corporation, True Skin Care Center, Vilalara Longevity Thalassa & Medical Spa, Lanserhof Tigernsu and among others.

Key Developments

- In July 2024, Maya Medi Spa, an aesthetic skincare business, has opened its first physical location in Hyderabad after five years in Bengaluru, offering personalized treatments for various skin issues.

- In June 2023, The Kurotel Longevity Medical Center and Spa in Brazil has become the first South American wellness location to be certified as 'cancer aware' by Wellness for Cancer, the first organization to establish cancer-focused training and business criteria.

| Metrics | Details | |

| CAGR | 14.9% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Service Type | Facial Treatment, Body Shaping, Hair Removal, Tattoo Removal Scars & Striae, Others |

| Age Group | Adolescent, Adult, Geriatric | |

| Service Provider | Single Ownership Medical Spas, Group Ownership Medical Spas, Free Standing Medical Spas, Medical Practice Associated Spas, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global medical spa market report delivers a detailed analysis with 80+ key tables, more than 55 visually impactful figures, and 216 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.