Overview

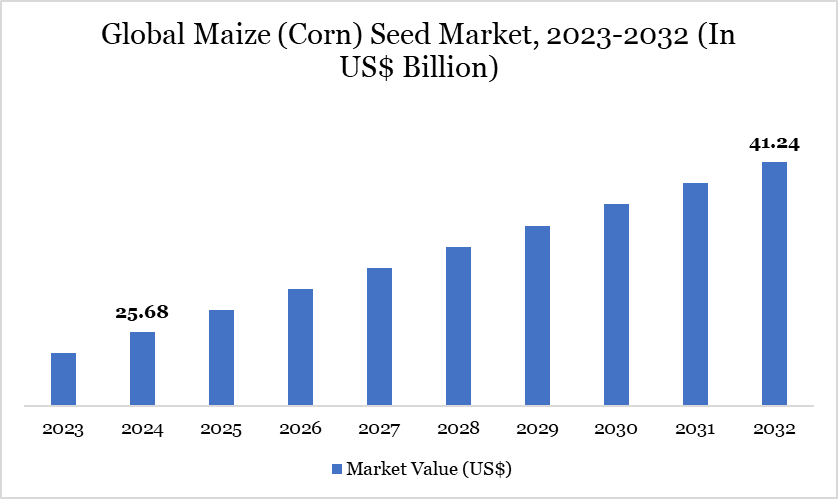

Global maize (corn) seed market reached US$25.68 billion in 2024 and is expected to reach US$41.24 billion by 2032, growing with a CAGR of 6.10% during the forecast period 2025-2032, according to DataM Intelligence report.

Maize is a key crop worldwide. It is primarily used for animal feed, food products, and industrial applications. The global maize corn seed market is influenced by factors such as agricultural practices, technological advancements, and global demand trends. Population growth, increased meat consumption, and industrial applications act as major boosting factors for market expansion.

Rapid technological developments at the global level drive market growth. For instance, in February 2024, Origin Agritech Ltd. introduced a breakthrough by integrating a wild corn gene into its commercial hybrids, boosting plant density and yield by over 10%. This first-of-its-kind enhancement improves photosynthesis and efficiency, with the new hybrid set to replace the current version within two years.

Maize (Corn) Seed Market Trend

The development of high-yielding, disease-resistant, and climate-resilient maize hybrids is a key trend shaping the global corn seed market. As climate change causes unpredictable weather and pest outbreaks, farmers increasingly demand seeds that can withstand such stresses. These advanced hybrids not only improve food and feed security but also help farmers achieve better returns with lower risk.

In September 2024, Prof. Arifin from Brawijaya University's Faculty of Agriculture developed high-yield, early-harvest hybrid corn seeds named Jagung Brawijaya Nusa. The two approved variants, Nusa 1 and Nusa 3, can boost productivity by over 30%, reaching up to 13.7 tons per hectare. These seeds outperform the national average of 9 tons per hectare and are ideal for dryland areas. This type of development encourages increased investment in research and seed technology by both public and private sectors.

Scope

Metrics | Details |

By Type | Field Corn, Sweet Corn, Popcorn, Flint Corn, Dent Corn, Others |

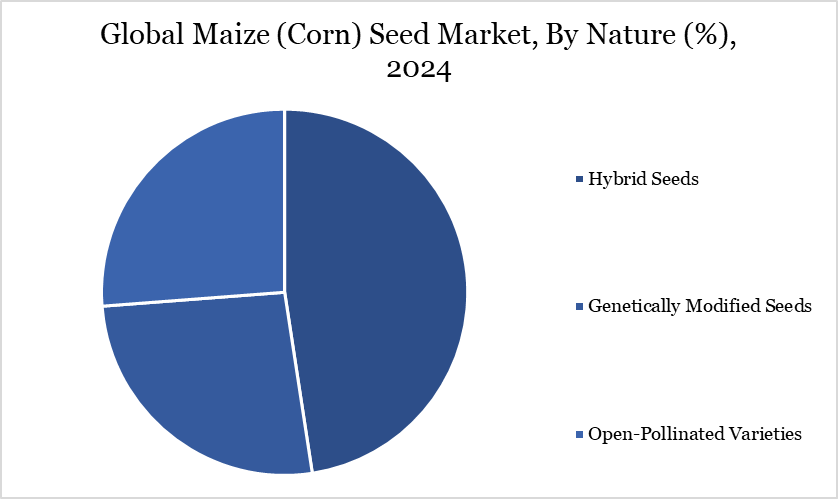

By Nature | Hybrid Seeds, Genetically Modified Seeds, Open-Pollinated Varieties |

By Seed Size | Small Seed Size, Large Seed Size |

By Distribution Channel | Direct Sales, Retail Stores, E-Commerce, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report - Request for Sample

Dynamics

Growing Demand for Maize

Rising global food demand, driven by a growing population and increased maize consumption, drives the market growth. According to the UN, World Population Prospects (2024), the world population reached 8.09 billion in 2023. Globally, maize consumption is distributed as 61% for feed, 17% for food, and 22% for industrial uses. Maize has become a significant industrial crop, with 83% of its global production utilized in feed, starch, and biofuel industries.

The maize role as a critical industrial crop further propels the need for increased maize production to meet diverse and growing demands. In addition, the economic development, urbanization, and food security concerns further fuel the need for higher maize production and improved seed varieties. Maize’s role as a staple food and essential animal feed makes it crucial in meeting these demands efficiently.

Technological Advancements in Maize (Corn) Seed Production

Innovations in seed technology, including hybrid and genetically modified seeds, enhance yields, disease resistance and adaptability and drive the market growth. These technologies address agricultural challenges, increase maize productivity, and meet the growing global demand for maize, thereby stimulating the market's expansion.

For instance, in July 2022, the Seed Production Technology for Africa (SPTA) enhanced maize seed production by creating hybrids with fifty percent non-pollen-producing plants, leading to a 10-20% yield increase. This innovation simplifies the process by eliminating the need for labor-intensive detasseling, reducing costs, and improving seed quality.

In addition, in March 2024, ZeaKal introduced its innovative PhotoSeed technology for corn, which boosts oil content by 23% without affecting yield or protein levels. By enhancing photosynthesis and carbon capture, PhotoSeed increases oil production while maintaining high yields. This breakthrough aims to transform corn's value for growers, industry and consumers.

Climate Change

Climate change acts as a major restraint for the global maize market. Climate change may affect the production of maize (corn) as early as 2030, according to a NASA study in 2021. Extreme weather events like droughts, floods, and heatwaves disrupt production and reduce yields. Unpredictable growing seasons complicate farming, while soil degradation and increased pest and disease pressures further threaten productivity.

Segment Analysis

The global maize (corn) seed market is segmented based on type, nature, seed size, distribution channel, end-user and region.

Superior Performance and Yield Potential of Hybrid Seeds

The global maize (corn) seed market is segmented based on nature into hybrid, genetically modified, and open-pollinated varieties. Hybrid seeds dominate the maize seed market due to their superior performance and yield potential. Produced by cross-breeding two genetically distinct maize varieties, hybrids offer enhanced traits such as higher yields, improved disease resistance, and better adaptability to varied environmental conditions.

The uniform growth and consistent performance of these seeds lead to more predictable and increased yields, which is highly valued by farmers. Additionally, hybrid seeds are more resilient to pests and diseases compared to open-pollinated varieties, further boosting their appeal. The ability to tailor hybrids to specific climatic and soil conditions enhances their market dominance, as they provide farmers with reliable, high-return options, reinforcing their leading position in the maize seed market.

In April 2025, Pioneer, a brand of Corteva Agriscience, launched its first corn hybrid with PowerCore Ultra Enlist biotechnology, the P30001PWUE. Designed for Brazil's southern summer crop season, this hybrid offers advanced weed control with tolerance to four herbicides: Enlist Colex-D, Glyphosate, Glufosinate, and Haloxyfop. The innovation promises greater flexibility and efficiency in managing resistant weeds for farmers.

Geographical Penetration

High Export Potential of Asia-Pacific

Asia-Pacific dominates the global market. Several regional countries are significant maize exporters, increasing the demand for maize seeds to meet both domestic and international market needs. . According to the Food and Agriculture Organization of the United Nations 2023, Asia-Pacific accounted for a total of 389.89 million tons of maize production out of the total of 1.16 billion tons of global production in 2022, with India and China accounting for 33.73 million tons and 277.20 million tons respectively.

With major cultivation areas in states like Karnataka, Madhya Pradesh and Bihar, India produces an estimated 35.67 million tonnes of maize in 2023-24, supporting both domestic needs and international trade. Its export of 14,42,671.48 MT of maize, valued at 443.53 US$ million in 2023-24, to countries such as Vietnam, Nepal, and Bangladesh underscores its pivotal role in the region's maize export dynamics.

The extensive production and export capability, coupled with advancements in agricultural technology, reinforces India's strategic position in meeting the growing global demand for maize and enhancing the region’s prominence in the market. It is experiencing rapid advancements in agricultural technologies and practices, including the adoption of high-yielding and genetically modified maize seeds, contributing to its market dominance.

Sustainability Analysis

The sustainability of the maize (corn) seed market is increasingly influenced by climate resilience, biodiversity, and responsible farming practices. Demand for drought-tolerant and pest-resistant seed varieties is rising due to climate change. However, heavy reliance on genetically modified (GM) seeds raises concerns about seed sovereignty and environmental impact. Companies are investing in regenerative agriculture and sustainable seed production methods to reduce carbon footprints. Overall, the market is gradually shifting towards practices that balance productivity with long-term environmental and social responsibility.

Competitive Landscape

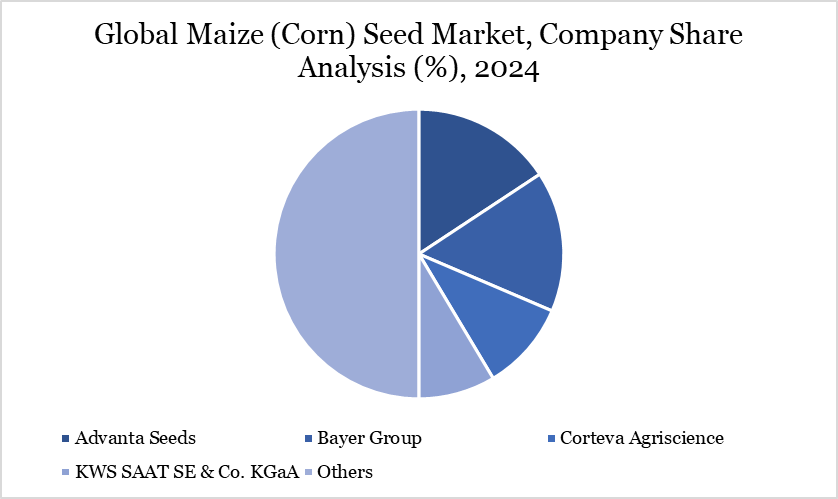

The major global players in the market include Advanta Seeds, Bayer Group, Corteva Agriscience, KWS SAAT SE & Co. KGaA, Syngenta Group, Charoen Pokphand Group, Limagrain Field Seeds India, Kaveri Seeds, Yuan Longping High-Tech Agriculture Co. Ltd. and Nuziveedu Seeds Ltd.

Key Developments

In February 2025, GDM Group (Grupo Don Mario) launched its new corn seed brand, Supra Seeds,in Brazil, marking a strategic move following its 2024 acquisition of KWS Seeds' corn and sorghum operations in South America.

In August 2025, Syngenta unveiled its largest NK Seeds corn portfolio in more than 10 years, introducing eight new hybrids. Canadian growers were given an exclusive preview of the new portfolio and insights into the cutting-edge genetics behind it.

In March 2024, Seed Co launIn August 2025, ched new maize varieties designed to enhance agricultural productivity. These varieties are developed to offer improved yields, better resistance to pests and diseases and adaptability to varying environmental conditions.

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies