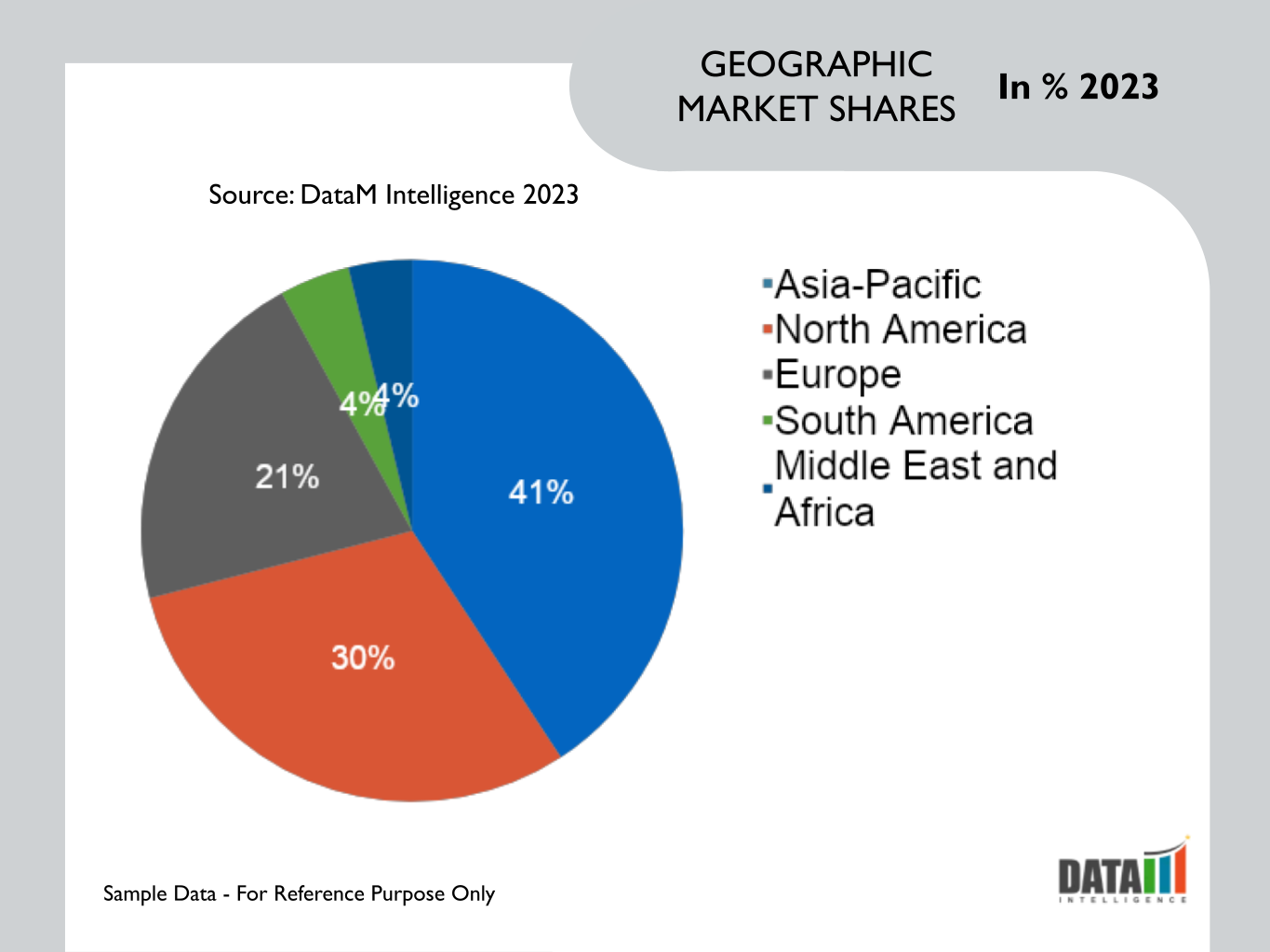

Global Lubricant Packaging Market is segmented By Material (Plastic, LDPE, Others), By Product (Engine Oil, Gear and Transmission Oils, Hydraulic Fluids, Industrial Oils, Greases, Automotive Lubricants, Others), By End-User (Automotive, Metal Working, Oil & Gas, Power Generation, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030.

Lubricant Packaging Market Overview

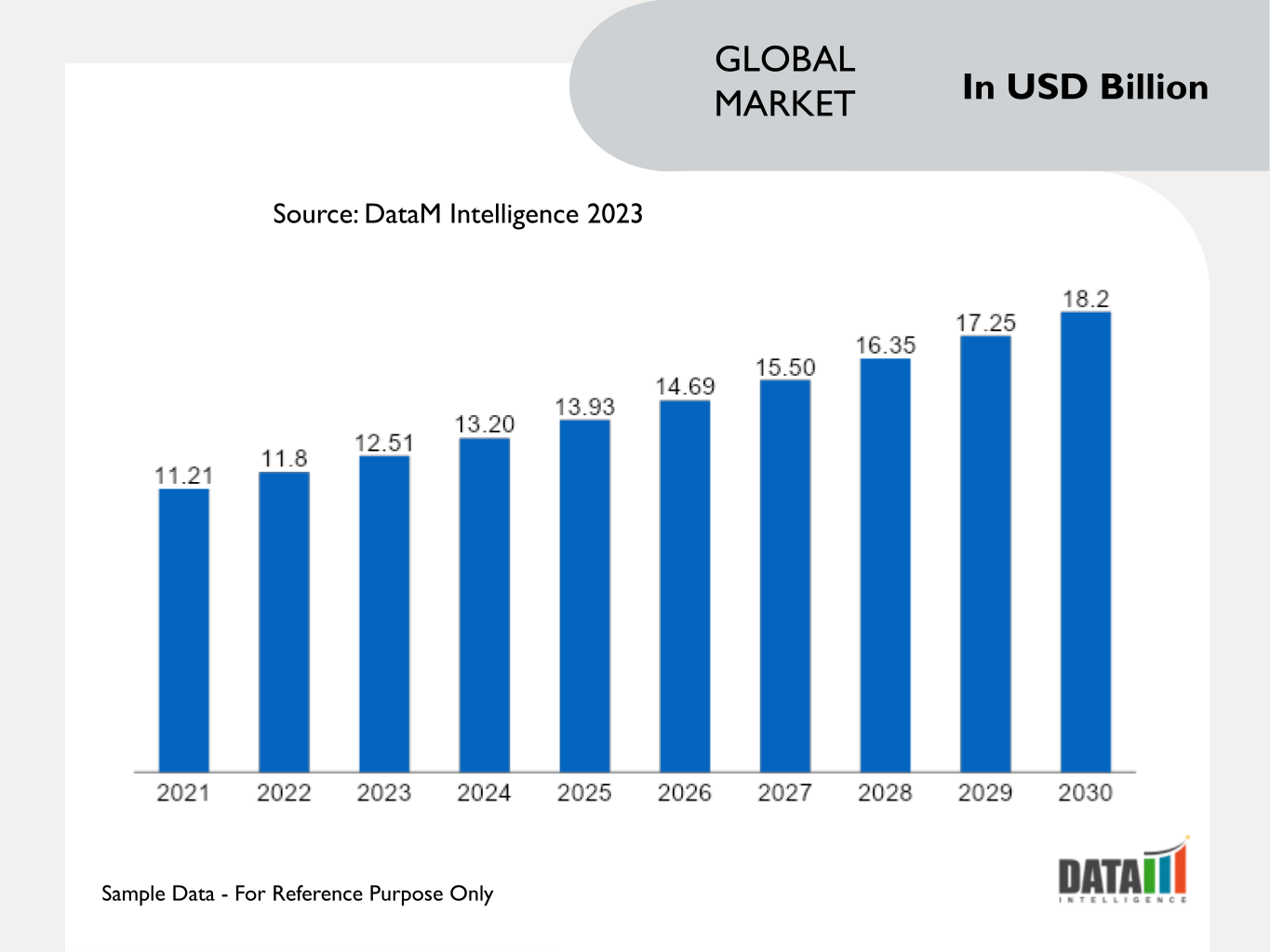

Global Lubricant Packaging Market reached US$ 11.8 billion in 2022 and is expected to reach US$ 18.2 billion by 2030, growing with a CAGR of 6.2% during the forecast period 2023-2030.

The lubricant packaging market is expected to be driven by the automotive industry's demand for high-performance lubricants due to their ability to enhance overall vehicle performance, reduce emissions and extend the lifespan of equipment. Automotive manufacturers and vehicle owners alike are increasingly favoring high-performance lubricants for their ability to optimize performanc,e and lower maintenance costs. The lubricants play a crucial role in reducing friction-related concerns and contribute to overall productivity improvements.

The German Association of Automotive Industry (VDA) predicts a 4% increase in car sales for 2023, bringing the total to 74 million vehicles. A significant portion of lubricant demand comes from routine maintenance, particularly oil changes. As more vehicles are sold, the frequency of oil changes and servicing appointments also rises. An increased number of cars will result in a higher volume of oil changes, leading to a direct increase in the demand for lubricants which subsequently increases the demand for lubricant packaging

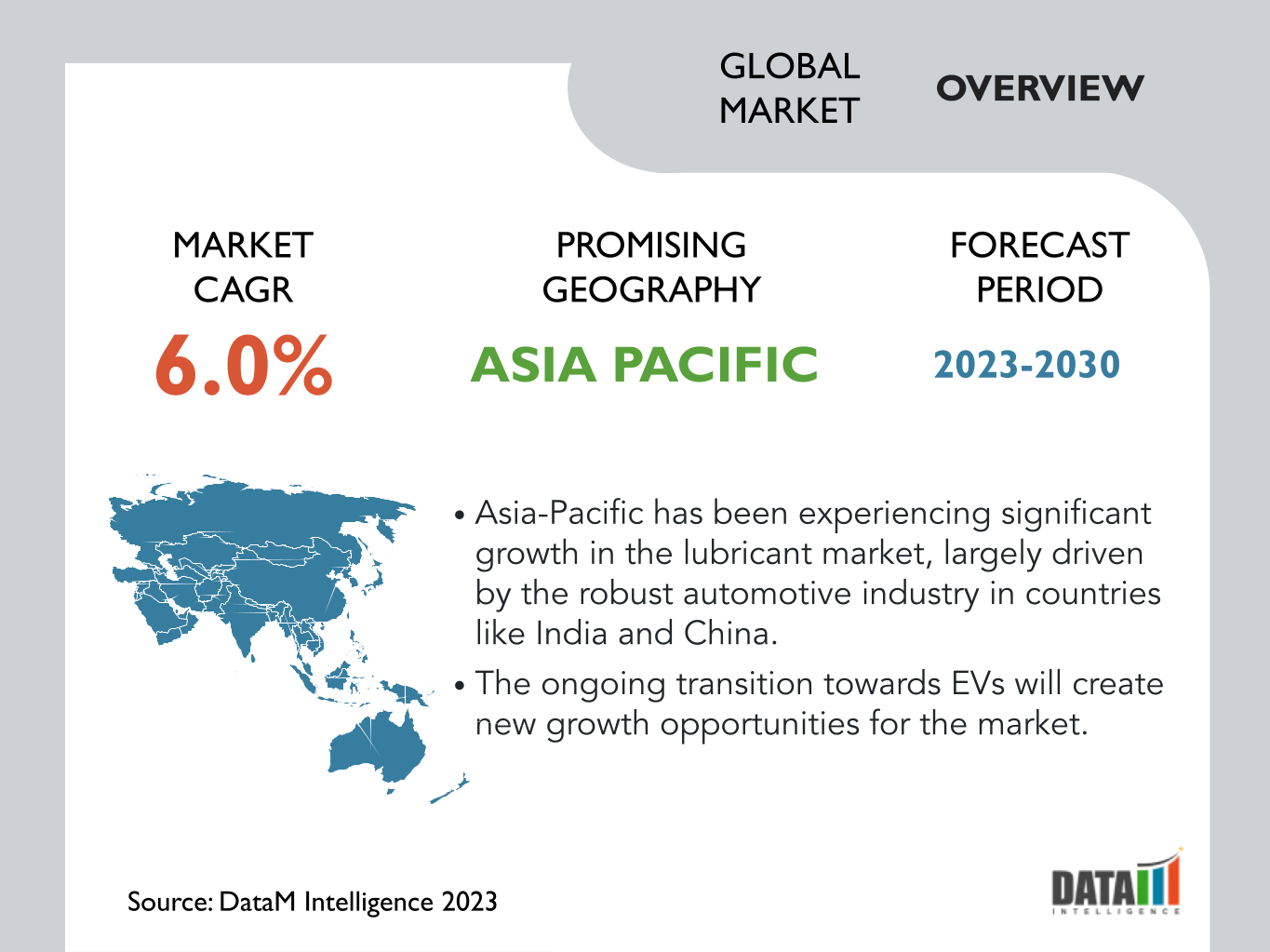

Asia-Pacific has been experiencing significant growth in the lubricant market, largely driven by the robust automotive industry in countries like India and China. According to data from the "Society of Indian Automobile Manufacturers," India's domestic automotive sales reached 20.1 million units in the year 2022-2023, showing a notable increase from the previous year's sales of 17.6 million units in 2021-2022. The growth in automotive sales directly correlates with an increased demand for lubricants and its packaging.

Lubricant Packaging Market Scope

|

Metrics |

Details |

|

CAGR |

6.2% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Material, Product, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report Request for Sample

Lubricant Packaging Market Dynamics and Trends

Growth of the Automotive Industry transforming Lubricant Market

The lubricant packaging market is expected to be driven by the growing automotive industry, as car sales rise and more vehicles are added to the global automotive fleet, there is a corresponding increase in the number of engines and mechanical components that require lubrication. Each vehicle's engine, transmission and various moving parts need proper lubrication to function efficiently and reduce wear and tear. This higher number of vehicles translates to a larger overall demand for lubricants which subsequently increases the demand for lubricant packaging.

Furthermore, new innovations and advancements in lubricants packaging for automotive is a significant factor for the markets growth Valvoline Inc., a U.S.-based, leading worldwide supplier of premium branded lubricants and automotive services, announced the retail launch of its newest gear-oil packaging innovation, FlexFillTM. The patented FlexFill bag will make changing synthetic gear oil easier all while providing a more flexible, less wasteful automotive experience.

Oil Industry Expansion

The lubricant packaging market is expected to be driven by growing oil industry worldwide, as the lubricant market and the oil market are closely interconnected due to the fact that lubricants are derived from base oils which are often refined from crude oil. An increase in global oil supply can positively influence the supply of base oils which enables lubricant manufacturers to meet the growing demand for lubricants.

Furthermore, according to IEA, the projected global oil demand growth mentioned in the report (2.2 mb/d) indicates an increasing need for various oil-based products, including lubricants. As industrial and transportation activities rise, the demand for lubricants, which are derived from oil base stocks, is likely to follow suit. The growth in oil demand can signify an expanding market for lubricants as industries require adequate lubrication for their machinery and equipment which further increases the demand for lubricant packaging

Impact of Growing EVs

The growing EV worldwide is significantly impacting the lubricant market, in EVs, the absence of an internal combustion engine and complex transmission systems means that there are fewer critical components that need regular lubrication. The primary power source in EVs is the battery, which powers electric motors. These electric motors have fewer moving parts compared to the complex engine and transmission systems in ICE vehicles. As a result, the need for lubrication in the drivetrain of EVs is significantly reduced.

The transportation sector, particularly road vehicles, is a major consumer of oil. This reduction in oil demand can directly impact the demand for lubricants, which are derived from oil-based stocks. BloombergNEF estimates that the shift towards electric vehicles is significantly reducing daily oil demand. According to their calculations, electric vehicles are already responsible for a reduction of approximately 1.5 million barrels of oil demand per day. This reduction is a significant concern for the lubricant industry which further decreases the demand for lubricant packaging.

Lubricant Packaging Market Segmentation

The global lubricant packaging market is segmented based on material, product, end-user and region.

Revolutionizing Engine Oil with Advancements for Efficiency and Performance

Engine oil holds the largest segment in the lubricant packaging market with new advancements to meet the demands of customers and adhere to regulations for fuel efficiency and emission control. The growth of the automotive industry, both in terms of vehicle production and vehicle ownership, is a significant driver for the engine oil packaging market. As more vehicles are manufactured and sold, the demand for engine oil increases, leading to a higher demand for packaging solutions.

Manufacturers are focusing on innovative packaging solutions that enhance user experience, reduce waste and improve the ease of use. Castrol India is taking a step towards sustainability by introducing more environmentally friendly packaging for its engine oil brand, Castrol Power1 Ultimate. The brand will now be packaged in 100% post-consumer recycled bottles made from reprocessed plastic waste instead of virgin plastic. This initiative aims to decrease plastic waste, reduce carbon emissions and support a circular economy.

Global Lubricant Packaging Market Geographical Penetration

Automotive and Oil Sectors Propel Lubricant Demand in Asia-Pacific

Asia-Pacific is the largest region for the lubricant packaging market, driven by the growing automotive and oil industry in the region. As the automotive industry expands, there is a parallel rise in the need for lubricants to maintain the smooth operation and longevity of vehicles. China's automotive industry is one of the largest in the world, with a massive number of vehicles on the road. As the number of vehicles increases, so does the demand for lubricants and its packaging to keep these vehicles running smoothly.

According to "CEIC Data," China's automobile sales data indicates that there were around 26.8 units sold in 2022, marking an increase from the previous year's sales of around 26.3 million units in 2021. This growth in China's automotive sector also has a direct impact on the lubricant market. The substantial growth in automotive sales in countries like India and China is positively influencing the lubricant and its packaging market in the Asia-Pacific region.

Lubricant Packaging Market Key Players

The major global players in the market include Graham Packaging, Plastipak Packaging, Berry Global, RPC Group, Amcor, Greif, Crown Holdings, Ardagh Group, Silgan Holdings and Mauser Packaging Solutions.

COVID-19 Impact

COVID-19 made a significant impact on lubricant packaging market resulted in a sudden and significant decrease in economic activity across various sectors. This decrease is likely to lead to a recession, impacting the overall demand for lubricants. The pandemic led to a decline in vehicle usage, maintenance intervals and vehicle sales in the transportation sector. With people working remotely and reduced use of public transit, the demand for lubricants in this sector significantly dropped.

Furthermore, the industrial sector also experienced disruptions due to production shutdowns. This led to a decline in the demand for industrial lubricants. The lockdowns and reduced travel had a significant negative impact on the demand for passenger vehicle lubricants. Maintenance cycles were disrupted and vehicle usage decreased. Also, lubrication played a critical role during the resumption of industrial activities. Corrosion and equipment malfunction due to prolonged shutdowns underscored the importance of proper lubrication.

Russia-Ukraine War Impact

The Russia-Ukraine war made a significant impact on the lubricant packaging market resulting conflict has led to disruptions in supply chains, industries and economies, impacting both the demand and supply of lubricants. The invasion of Ukraine by Russia caused a sudden spike in crude oil prices, which were already rising due to factors like global economic recovery from the COVID-19 pandemic and low investment in the oil and gas sector. The uncertainty and geopolitical tensions resulting from the war have highlighted the vulnerability of the energy industry and the need for resilience.

Some countries released oil from their strategic reserves to stabilize prices and supply, while others aimed to boost domestic production. Additionally, countries that heavily relied on Russian energy imports have started exploring alternative sources to ensure energy security. The situation has prompted nations to reconsider their energy policies and diversify their energy mixes to reduce dependence on a single supplier. As the conflict continues, the global lubricant market will likely continue to be influenced by geopolitical dynamics and efforts to ensure energy stability.

Key Developments

- In June 2022, ExxonMobil unveiled its next-generation Mobil Super range of lubricants, featuring enhanced packaging and refreshed labels. This advanced synthetic passenger vehicle lubricant is designed to meet the latest BS-VI specifications and offers notable technological advancements. The updated packaging includes a QR-code-based anti-counterfeit feature on the bottles, allowing consumers to authenticate the products easily.

- In January 2022, Shell joined forces with SCG Chemicals to introduce the 'Eco-friendly Lubricant Bottles,' offering top-notch products in environmentally conscious packaging. The collaborative effort between The Shell Company of Thailand Limited and SCG Chemicals led to the development of these bottles made from high-quality Post-Consumer Recycled Resin (PCR), a robust material suitable for logistics that maintains the exceptional quality of the products. This initiative aligns with Shell's 'Powering Progress' strategy, which aims to deliver net-zero emission products and services by 2050.

- In March 2023, Wolf made a significant stride towards sustainability by introducing eco-friendly packaging solutions that align with their commitment to sustainable mobility. This innovative packaging, known as the Bag in Box solution, represents a groundbreaking approach to reducing waste while maintaining functionality and convenience.

Why Purchase the Report?

- To visualize the global lubricant packaging market segmentation based on material, product, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of cement market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global lubricant packaging market report would provide approximately 61 tables, 64 figures and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies