Loitering Munition Market Size

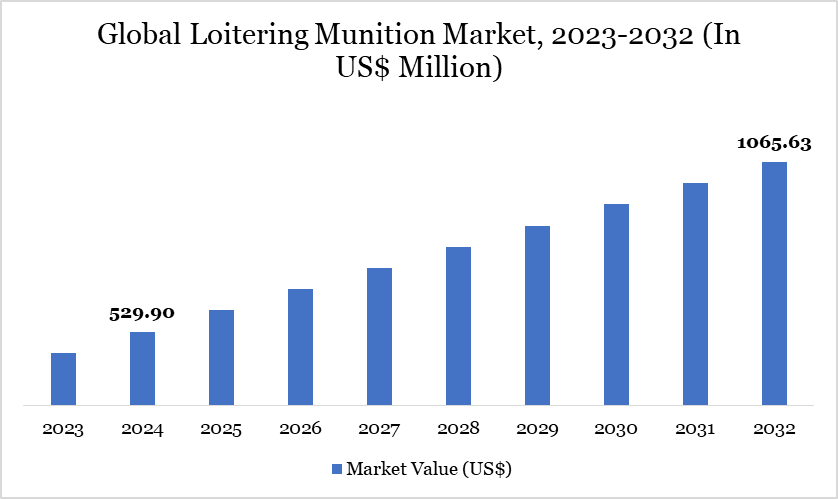

Global loitering munition market reached US$ 529.90 million in 2024 and is expected to reach US$ 1056.63 million by 2032, growing with a CAGR of 9.01% during the forecast period 2025-2032.

The global loitering munition market is witnessing significant growth due to increasing demand for precision strike capabilities and evolving modern warfare tactics. These munitions combine the functions of drones and missiles, offering real-time surveillance and rapid attack on time-sensitive targets. Rising defense budgets, geopolitical tensions, and military modernization programs, especially in regions like North America, Europe, and Asia-Pacific, are driving market expansion.

Loitering Munition Market Trends

One of the biggest trends is the integration of artificial intelligence (AI) and autonomous technologies. The integration of artificial intelligence (AI) and autonomous technologies is transforming the global loitering munition market by enabling smarter, faster decision-making on the battlefield. AI allows these systems to autonomously identify, track, and engage targets with minimal human input, increasing operational efficiency and precision.

In October 2024, UVision unveiled an Autonomous Multi-Launch Loitering Munition System capable of deploying multiple HERO 120 munitions simultaneously, featuring advanced mission planning capabilities. The newly introduced loitering munition system enhances operational flexibility with autonomous mission management from target identification to neutralization. It integrates with tactical UAS, drones, and C2 systems, using AI for real-time target recognition and decision-making.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | Recoverable, Expandable | |

| By Launch Mode | Air-launched Effect, Vertical Take-off, Canister Launched, Hand Launched, Others. | |

| By Range | Short Range (<15 Kms), Medium Range (16-50 Kms), Long Range (>50 Kms) | |

| By Application | Army, Navy, Air Force | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Demand for Precision Warfare

The growing demand for precision warfare is a major driver of the global loitering munition market. Modern military operations increasingly prioritize minimizing collateral damage while achieving high mission effectiveness. Loitering munitions offers real-time surveillance and the ability to strike high-value or time-sensitive targets with pinpoint accuracy.

In February 2025, Ukraine ordered 6,000 AI-enabled HX-2 loitering munitions from Germany’s defense tech firm Helsing. The HX-2 loitering munitions, ordered by Ukraine, are designed to be resistant to electronic warfare and can strike targets at distances of up to 100 kilometers. The deal aims to bolster Ukraine’s strike drone capabilities amid ongoing. Such developments are accelerating global demand for precision warfare solutions, fueling growth in the loitering munition market.

Regulatory and Legal Challenges

The deployment of autonomous weapons like loitering munitions raises ethical and legal concerns, including issues related to targeted strikes, collateral damage, and compliance with international laws. Additionally, restrictions on exporting defense technologies further limit market expansion. The fear of potential misuse by non-state actors also drives governments to impose tighter controls. Governments and regulatory bodies may impose stringent regulations to address these concerns, potentially hindering market growth.

Market Segment Analysis

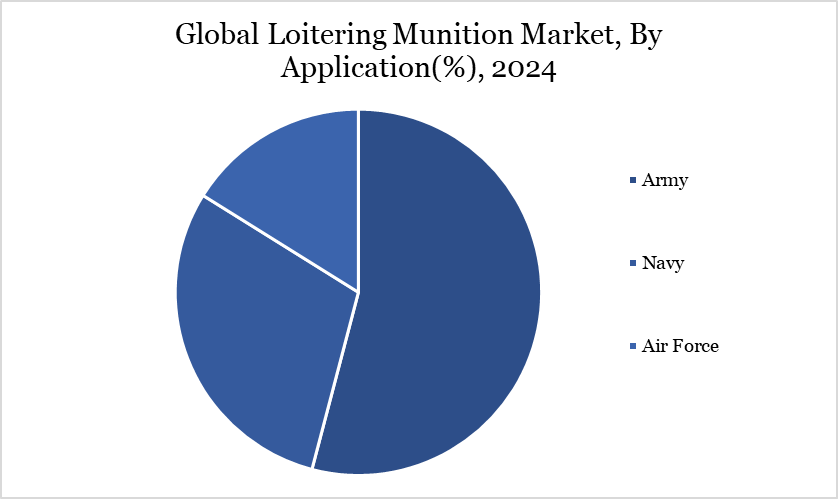

The global loitering munition market is segmented based on the type, launch mode, range, application and region.

Army Dominates Loitering Munition Market Due to High Demand for Tactical Precision Strikes in Modern Warfare

The Army holds a significant share in the loitering munition market due to its strategic need for precision strike capabilities and real-time battlefield intelligence. Loitering munitions offer the Army a cost-effective solution for engaging high-value targets with minimal collateral damage. These systems provide extended surveillance and the ability to abort missions’ mid-flight, aligning with the Army’s operational flexibility. Increased adoption is driven by modernization programs aimed at enhancing rapid response and autonomous combat capabilities.

Companies are driving the loitering munition market through innovation, localization, and strategic defense partnerships. For instance, in June 2024, Johnnette Technologies secured a contract to supply over 150 JM-1 loitering munitions to the Indian Army. These munitions are designed for high-altitude operations, capable of precise strikes at altitudes exceeding 18,000 feet, enhancing India's defense capabilities with Indigenous technology.

Market Geographical Share

North America's Significant Share in the Global Loitering Munition Market Attributed to Advanced Defense Capabilities and High Military Investments

North America holds a significant share in the global loitering munition market due to its advanced defense infrastructure and high military expenditure, particularly by the US. The region's strong focus on modernizing armed forces and incorporating cutting-edge technologies like AI and autonomous systems drives demand. The US Department of Defense actively invests in loitering munitions for tactical advantages in asymmetric warfare. Key market players like AeroVironment and Raytheon are based in North America, fostering innovation and rapid development.

Continuous R&D and strategic defense initiatives further boost regional growth. At AUSA (Association of the United States Army) 2024, UVision announced plans to expand the company's presence in the US defense market, particularly targeting larger conventional forces like the US Army. He outlined a strategic shift from single-loitering munitions to autonomous, multi-launch array systems. UVision currently supplies its Hero-series loitering munitions including the Hero-30, 120, and 400 to special operations units and militaries worldwide.

Technological Analysis

The global loitering munition market is experiencing rapid technological advancement, driven by innovations in AI, autonomous navigation, and real-time data processing. The miniaturization of components and improved propulsion systems have enhanced endurance, range, and precision. Integration with ISR (Intelligence, Surveillance, and Reconnaissance) systems allows for better target acquisition and mission flexibility. AI-enabled decision-making and swarm technology are emerging as key features, enabling coordinated strikes.

The development of recoverable and reusable systems is also gaining traction, improving cost efficiency. In May 2024, Teledyne FLIR Defense unveiled the Rogue 1 loitering munition system at SOF Week in Tampa, introducing a next-gen VTOL unmanned aerial system designed for precision strikes and enhanced survivability. Equipped with advanced EO/IR sensors and a unique recoverable fuzing system, Rogue 1 allows for safe drone recovery when missions are aborted.

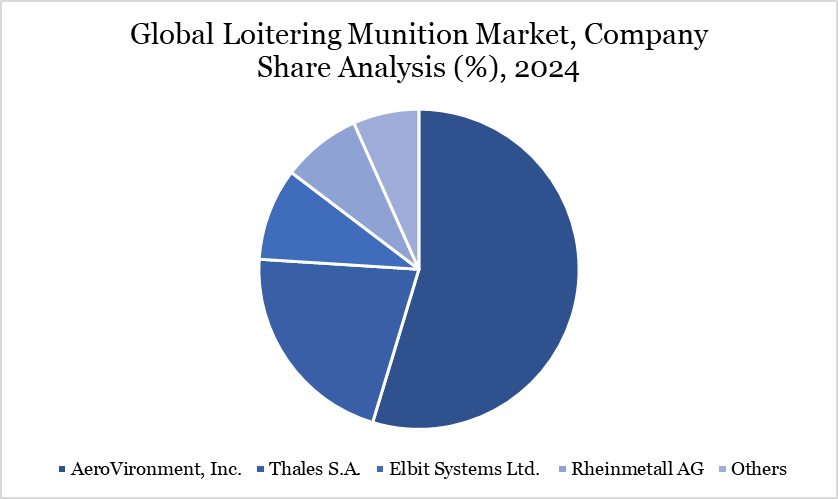

Major Global Players

The major global players in the market include AeroVironment, Inc., Thales S.A., Elbit Systems Ltd., Rheinmetall AG, Uvision Air Ltd., WB Group, Paramount Group, EDGE Group, Israel Aerospace Industries, AEVEX Aerospace and others.

Key Developments

- In April 2025, the German military announced plans to procure loitering munitions, marking its first foray into this technology. This decision reflects Germany's response to evolving security concerns and the observed effectiveness of such drones in recent conflicts.

- In April 2025, India-based IndoWings unveiled the LM-250 loitering munition system, designed for integration with India's Pinaka Multiple Barrel Rocket Launcher (MBRL). This adaptation allows a single Pinaka canister to launch up to 50 LM-250 units simultaneously, enhancing precision strike capabilities.

- In March 2025, China completed the development of the Feilong-60A (Flying Dragon-60), its first modular rocket-based loitering munition. Paired with the SR-5 multiple-launch rocket system, each unit carries two six-tube canisters, enhancing China's precision strike capabilities.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies