Overview

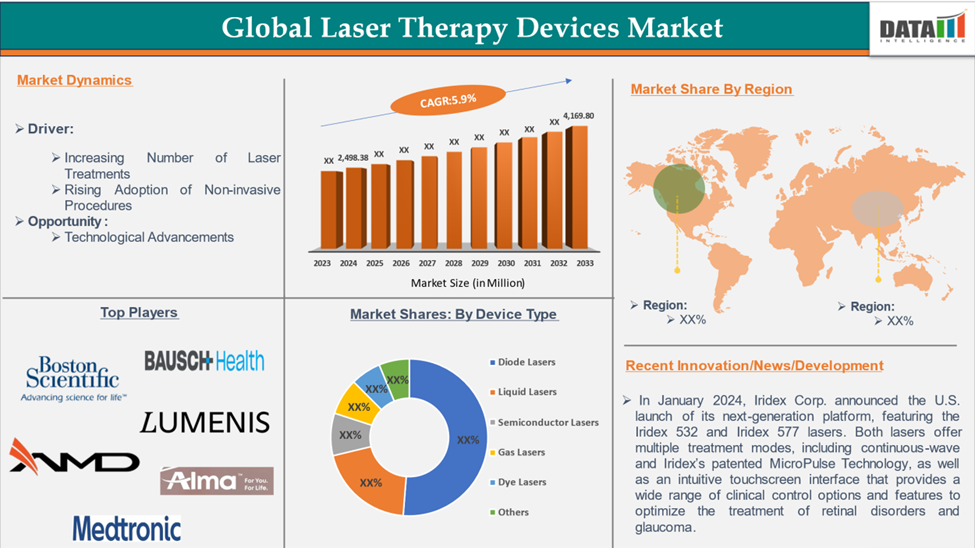

The global laser therapy Devices market reached US$ 2,498.38 million in 2024 and is expected to reach US$ 4,169.80 million by 2033, growing at a CAGR of 5.9% during the forecast period 2025-2033.

Laser therapy devices use focused light to treat various medical conditions by promoting healing, reducing inflammation, and alleviating pain. These devices typically emit low-level laser therapy (LLLT), which penetrates the skin to stimulate cellular repair and enhance blood circulation in the targeted area. Commonly used in physical therapy, dermatology, and pain management, laser therapy is non-invasive and is considered a safe alternative to more traditional treatments like surgery or medication.

It is effective for conditions such as joint pain, arthritis, soft tissue injuries, and even skin conditions like acne or scars. The therapy is usually painless and offers a quick recovery time, making it a popular choice for patients seeking non-surgical options for healing.

Executive Summary

Market Dynamics: Drivers & Restraints

Increasing Number of Laser Treatments

An increasing number of laser treatments is considered to be one of the significant growth factors for laser therapy devices. Laser therapy devices are being used widely for surgeries or treatment purposes. The adoption of this equipment or devices is increasing. The market for these devices is increasing worldwide due to the enhanced number of surgical procedures requiring these devices.

Several laser treatments are being performed every year, which is leading to the adoption of advanced laser devices in several areas, including dermatology and ophthalmology, among others. For instance, according to a report published by the University of Utah Health, it is estimated that nearly 800,000 people in the U.S. choose to undergo LASIK procedures each year.

Additionally, Noninvasive treatments also saw a surge in demand. For instance, according to the report by the American Society of Plastic Surgeons in 2022, Laser vein treatments (sclerotherapy) gained traction, growing by 22% over the three years.

Furthermore, skin resurfacing procedures, which include Dermabrasion, Chemical peel, Lasers – Ablative/Non-ablative, and Microdermabrasion, accounted for almost 3,322,292 in 2022. Also, in 2022, Laser hair removal, IPL treatment, Laser tattoo removal, and Laser treatment of leg veins accounted for 2,915,199. Thus, there is an increasing number of laser treatments, which is expected to increase the demand for laser therapy devices and expand the market.

High Cost of Treatments

The high cost of laser therapy treatments is expected to slow the growth of the market. The initial price of laser therapy devices can be quite expensive, making it difficult for smaller clinics or individual practitioners to afford them. This limits access to the devices, especially in regions with tighter healthcare budgets. Additionally, the ongoing costs for maintenance, training, and necessary supplies can add up, making it harder for healthcare providers to justify the investment. Patients also face the challenge of high treatment costs, particularly in countries where insurance doesn’t cover these therapies.

Segment Analysis

The global laser therapy devices market is segmented based on device type, therapy type, application, end-user, and region.

Device Type

Diode Lasers in the device type segment are expected to dominate the laser therapy devices market

The diode laser is the most prevalent type of laser therapy device. A diode laser uses semiconductor technology to generate a coherent projection of light in the infrared to the visible spectrum. The Diode Lasers segment is expected to hold a major portion of the laser therapy devices market share. This is due to their efficiency over other types and the development of advanced devices by the market players.

It uses a laser beam with a restricted spectrum to target specific chromophores in the skin. Diode lasers have a wide range of uses, including dermatology, dentistry, and surgical procedures. Their capacity to emit light at many wavelengths makes them appropriate for a wide range of therapeutic activities.

These lasers are extremely efficient, converting a large quantity of electrical energy into optical energy. This efficiency translates into cheaper operating costs and longer gadget lifespans. These lasers are often smaller and lighter than other varieties, making them easier to integrate into portable devices and more appropriate for outpatient applications.

Compared to other laser systems, the 800nm diode laser wavelength has the highest melanin absorption and penetration levels. These unique properties make the diode laser the best technology for non-invasive operations like laser hair removal, allowing for effective and safe treatment of all hair and skin types in all body locations.

The increasing number of regulatory approvals, technological innovations, product launches, and research/clinical trial studies propels the market expansion. For instance, in May 2024, the SEA HEART GROUP received the FDA 510K approval for its latest Diode Laser Hair Removal Machine. The 808-diode laser VD910 operates at an optimal wavelength that is absorbed effectively by the melanin in hair follicles. This ensures precise targeting and minimal damage to surrounding skin..

Geographical Analysis

North America is expected to dominate the laser therapy devices market

North America dominates the global laser therapy devices market primarily due to its large population, excellent medical infrastructure, and high-income levels. The advancement of laser therapy devices in a variety of applications, such as neurosurgery, gynecology, and ophthalmology, an increase in pharmaceutical establishments across the region and device approvals, and the presence of key players in the region are all contributing to the growth of the laser therapy devices market.

The presence of a large number of key players and strategies adopted by them in developing and expanding their product portfolios is contributing to the market expansion and also helping to dominate the market share.

The market players are introducing innovative laser solutions for a wide range of purposes. The launch and availability of advanced devices is gaining traction and are expected to contribute to the region’s market expansion. For instance, in March 2024, Reveal Lasers LLC announced the launch of the AlloraPro Laser Workstation, a state-of-the-art device designed for permanent hair reduction and skin rejuvenation treatments.

Additionally, in January 2024, Iridex Corp. announced the U.S. launch of its next-generation platform, featuring the Iridex 532 and Iridex 577 lasers. Both lasers offer multiple treatment modes, including continuous-wave and Iridex’s patented MicroPulse Technology, as well as an intuitive touchscreen interface that provides a wide range of clinical control options and features to optimize the treatment of retinal disorders and glaucoma.

Competitive Landscape

The global market players in the laser therapy devices market include Boston Scientific Corporation, Alma Lasers Ltd, Lumenis Be Ltd., AMD Lasers, Inc., Medtronic, Ziemer Ophthalmic Systems, Bausch Health, IRIDEX Corporation, Koninklijke Philips N.V., and Convergent Dental, Inc., among others.

| Metrics | Details | |

| CAGR | 5.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Device Type | Diode Lasers, Solid State Lasers, Liquid Lasers Semiconductor Lasers, Gas Lasers, Dye Lasers, Others | |

| Segments Covered | Therapy Type | Low-level Laser Therapy (LLLT), High-intensity Laser Therapy (HILT) |

| Application | Dermatology, Cardiology, Dentistry, Gastroenterology, Gynecology, Neurosurgery, Oncology, Ophthalmology, Others | |

| End-User | Hospitals, Ambulatory Surgery Centers, Research Organizations, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming pharmaceutical advancements.

- Type Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global laser therapy devices market report would provide approximately 45 tables, 46 figures, and 180 pages.

Target Audience 2024

- Manufacturers: Pharmaceutical, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.