Kidney Stone Management Devices Market Size & Industry Outlook

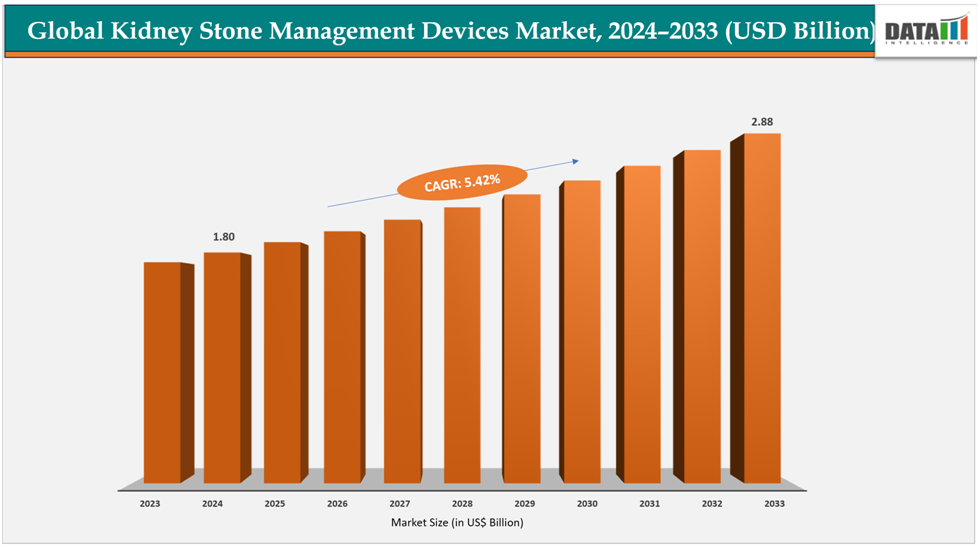

The global kidney stone management devices market size reached US$ 1.71 Billion with a rise of US$1.80Billion in 2024 and is expected to reach US$ 2.88Billion by 2033, growing at a CAGR of 5.42%during the forecast period 2025-2033.

The market for kidney stone management devices is being driven by consumers' increasing demand for non-invasive and minimally invasive methods because they are less painful, have less complications, and recover more quickly than standard surgery, patients choose procedures like ESWL, URS, and laser lithotripsy. Improvements in endoscopic and laser technology have increased the efficacy of treatment, increasing the accessibility and acceptability of these procedures. Adoption is also promoted by cost savings and shorter hospital stays for both patients and healthcare professionals. This change drives innovation, raises the need for specialized equipment, and encourages healthcare facilities to spend money on cutting-edge technology, all of which contribute to the market's expansion.

Owing to the factors like minimally invasive and non-invasive procedures, for instance, in May 2024, Northwell Lenox Hill Hospital became the first facility in New York State to use the CVAC System, a unique, steerable, camera-assisted catheter with suction capabilities for kidney stone removal. The minimally invasive device was endoscopically threaded into the kidney through the urethra, enabling surgeons to effectively extract stones. This approach differed from standard endoscopic laser and shockwave treatments, which often required multiple procedures to achieve comparable results, especially when managing larger or multiple stones.

Key Highlights

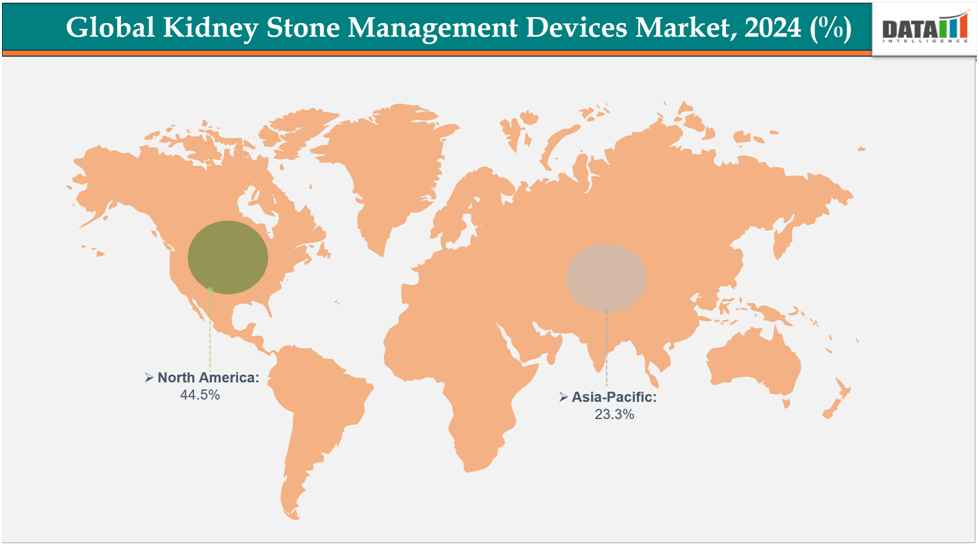

- North America dominates the kidney stone management devices market with the largest revenue share of 44.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.15% over the forecast peri-od.

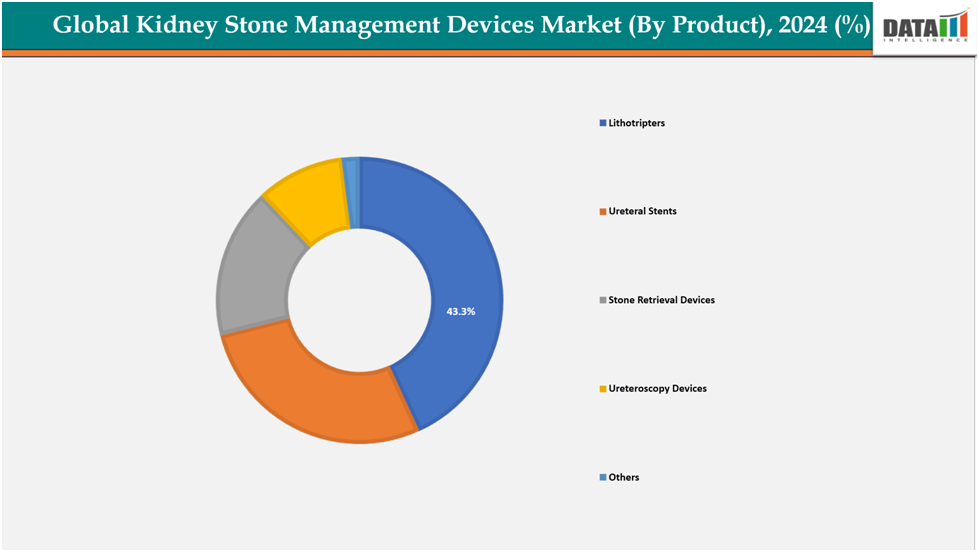

- Based on product, the Lithotripters segmented the market with the largest revenue share of 43.3% in 2024.

- Top companies in the kidney stone management devices market include Boston Scientific Corporation, BD, Olympus America, Hitech Lasers, Dornier MedTech, Bimedis, Status Medical Equipments India Pvt Ltd., EMS ELECTRO MEDICAL SYSTEMS SA, Coloplast Corp, and AA Medical, among others.

Market Dynamics

Drivers:

Increasing prevalence and recurrence of kidney stones are significantly driving the kidney stone management devices market growth

The market for kidney stone management devices is mostly driven by the increasing incidence and recurrence of kidney stones. The patient pool has grown as a result of lifestyle variables such poor diet, dehydration, obesity, and diabetes that have raised the incidence of stones worldwide. High recurrence rates up to 50% within five years mean many patients require repeat interventions, ensuring sustained demand. To reduce treatment burden, minimally invasive procedures like ESWL, URS, PCNL, and laser lithotripsy are increasingly preferred, boosting adoption of advanced devices. Combined with the economic burden of kidney stones, these trends are pushing hospitals and healthcare providers to invest in efficient stone management technologies.

For instance, according to the National Kidney Foundation 2025,each year, more than 500,000 individuals seek emergency medical care for kidney stones. It is estimated that approximately one in ten people will develop a kidney stone during their lifetime, with a similar proportion having already experienced this condition. The prevalence is slightly higher among men (11%) compared to women (9%).

Restraints:

High cost of devices and procedures are hampering the growth of the kidney stone management devices market.

The high expense of kidney stone treatment tools and associated treatments severely limits market expansion. Percutaneous nephrolithotomy (PCNL), ureteroscopy (URS), and extracorporeal shock wave lithotripsy (ESWL) are examples of advanced treatment methods that come with significant procedure costs since they require specialized equipment, skilled people, and hospital infrastructure. These expenses restrict accessibility and affordability, especially in poor nations where patient out-of-pocket spending capacity and healthcare budgets are limited. Furthermore, certain healthcare systems' inadequate payment rules deter consumers from choosing modern procedures, which slows adoption rates and impedes market expansion overall.

For more details on this report, see Request for Sample

Segmentation Analysis

The global kidney stone management devices market is segmented based on product, application, end user, and region.

Product:

The Lithotripters segment from product is dominating the kidney stone management devices market with a 43.3% share in 2024

The market for kidney stone management devices is dominated by the lithotripter segment because of its wide range of therapeutic applications, non-invasive nature, and high patient preference. Devices like as ESWL are perfect for high-risk patients and outpatient settings because they provide efficient stone fragmentation with little recovery time. Further increasing their effectiveness and uptake have been developments in laser technology and its integration with imaging systems. In many healthcare systems throughout the world, lithotripters continue to be the first-line option due to their lower complication rates and support from clinical guidelines. This has led to robust market demand and a dominant market share in the device segment globally.

For instance, inJune 2025, WIKKON received U.S. FDA 510(k) clearance for its U200 Extracorporeal Shock Wave Lithotripter, an advanced non-invasive device that combined effective kidney stone treatment with integrated ultrasound-based stone localization, eliminating the need for radiation exposure and lead shielding.

Application:

The ESWL (Extracorporeal Shock Wave Lithotripsy) segment is dominates the kidney stone management devices market holds a 38.3% of share in 2024

The market for kidney stone management devices is dominated by the ESWL (Extracorporeal Shock Wave Lithotripsy) sector because it is non-invasive, allowing treatment without incisions and lowering hospital stays, recovery times, and patient discomfort. When compared to surgical treatments, it is less likely to cause complications and is quite successful for small to medium-sized stones (≤2 cm). The majority of treatments are performed as outpatients, which increases convenience and lowers medical expenses. Adoption has been further accelerated by technological developments that have improved accuracy, effectiveness, and patient comfort. As kidney stones become more common worldwide, there is a greater need for easily accessible, secure, and affordable treatments like ESWL, which is why it is the recommended option in clinical practice.

For instance, in November 2024, SonoMotion received U.S. FDA de novo clearance for its Stone Cleardevice, an advanced non-invasive solution for the anesthesia-free treatment of post-lithotripsy kidney stone fragments. Stone Clear is the first and only device that delivers external ultrasound pulses to move and facilitate the passage of residual fragments without surgery, allowing treatment in a clinic setting.

Geographical Analysis

North America dominates the global kidney stone management devices market with44.5% in 2024.

North America dominates the global kidney stone management devices market due to a combination of high prevalence, advanced healthcare infrastructure, and strong adoption of technology. Demand for devices is driven by lifestyle factors that enhance the incidence and recurrence of kidney stones, such as obesity, sedentary behavior, and high salt intake. Established medical facilities and specialized urology centers in the area are staffed by qualified specialists and have state-of-the-art equipment such as ureteroscopies, laser lithotripters, and ESWL. The usage of these technologies is further encouraged by widespread insurance coverage and payment. Additionally, the availability of cutting-edge, FDA-approved solutions is guaranteed by the presence of significant device manufacturers and ongoing research and development, technological innovation maintaining market leadership in North America.

Owing to the factors like technological innovation, in February 2023, Boston Scientific received FDA clearance for the LithoVue Elite Single-Use Digital Flexible Ureteroscopy System. The U.S. Food and Drug Administration (FDA) granted 510(k) clearance for the LithoVue Elite Single-Use Digital Flexible Ureteroscopy System, which became the first ureteroscopy system capable of monitoring intrarenal pressure in real-time during ureteroscopy procedures.

Europe is the second region after North America, which is expected to dominate the global kidney stone management devices market with34.5% in 2024.

The European Kidney Stone Management Devices Market is expected to be the second largest globally, with key contributions from countries such as Germany, the UK, and France. The increasing incidence of kidney stones, the region's sophisticated healthcare system, and the quick uptake of cutting-edge treatments including flexible ureteroscopies, non-invasive lithotripsy devices, and ultrasound-based fragment clearance systems are the main drivers of growth. Demand is also being increased by an aging population, risk factors linked to lifestyle choices, and a greater emphasis on early identification and minimally invasive treatment. Europe's dominant position in the global market is being strengthened by supportive regulatory frameworks and activities from organizations like the European Association of Urology (EAU), which are enhancing patient outcomes, speeding up timely intervention, and bolstering preventative treatment.

Germany leads the European kidney stone management devices market due to high healthcare spending, advanced urology infrastructure, and an aging population. Rising kidney stone prevalence drives demand, while early adoption of innovative technologies like ESWL, flexible ureteroscopies, and ultrasound-based fragment clearance devices accelerates growth. The presence of leading MedTech companies further reinforces Germany’s market dominance.

Owing to the factors like MedTech companies, for instance, in June 2024, FARCO-PHARMA, a Germany-based company, acquired Purenum GmbH, which specialized in the mediNiK hydrogel system. This acquisition expanded FARCO-PHARMA's urology portfolio by adding an innovative solution that enabled the effective removal of even the smallest kidney stone fragments during endoscopic procedures.

The Asia Pacific region is the fastest-growing region in the global kidney stone management devices market, with a CAGR of 7.15% in 2024.

The kidney stone management devices market in Asia-Pacific is expanding rapidly, driven by rising cases of kidney stones, improved healthcare access, and greater patient awareness. Countries like China, India, Japan, and South Korea are leading this growth due to better infrastructure, increasing adoption of minimally invasive treatments, and supportive government healthcare initiatives. Technological advancements, growing preference for outpatient procedures, and rising investment in urology services are further fueling demand across the region, making Asia-Pacific a key focus for market expansion.

Japan’s kidney stone management devices market is growing steadily, driven by its aging population, rising incidence of urological conditions, and a strong focus on minimally invasive treatments. High demand for precision tools, such as digital ureteroscopies and laser lithotripsy systems, along with the presence of established medical device manufacturers, further supports the growth of kidney stone treatment solutions in Japan.

For instance, in September 2025, Olympus, a Japan-based company, and Macro Lux Medical, a China-based company, announced a distribution partnership for single-use urology products. The agreement included multiple single-use cystoscopes, ureteroscopies, and suction access sheaths, which were used to access and visualize the bladder and urinary tract for the diagnosis and treatment of urinary diseases and disorders, including kidney stones.

Competitive Landscape

Top companies in the kidney stone management devices market include Boston Scientific Corporation, BD, Olympus America, Hitech Lasers, Dornier MedTech, Bimedis, Status Medical Equipment India Pvt Ltd., EMS ELECTRO MEDICAL SYSTEMS SA, Coloplast Corp, and AA Medical, among others.

Boston Scientific Corporation: Boston Scientific is a leading player in kidney stone management, offering a full range of devices, including single-use ureteroscopies, laser systems, retrieval baskets, and stents. Innovations like LithoVue Elite enable real-time intrarenal pressure monitoring. The company focuses on minimally invasive solutions, workflow efficiency, and broad global market reach.

Key Developments:

- InMarch 2025, Calyxo announced data showing the CVAC System maximized stone clearance while maintaining safe intrarenal pressure. Presented at EAU25, the results confirmed the safety and efficacy of steerable ureteroscopy renal evacuation (SURE). The all-in-one system combined microjet irrigation, simultaneous flow, and a large outflow lumen, which together enhanced fragment aspiration and improved overall kidney stone removal outcomes.

- In November 2025, EndoTheia announced the successful completion of the first-in-human clinical trial for the Flex Stone Basket, the world’s first independently steerable kidney stone basket. This innovative device provides unmatched precision and control during kidney stone removal, representing a significant advancement in urological care and improving procedural efficiency, safety, and patient outcomes in minimally invasive stone management.

Market Scope

| Metrics | Details | |

| CAGR | 5.42% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Lithotripters, Ureteral Stents, Stone Retrieval Devices, Ureteroscopy Devices and Other |

| Application | ESWL, PCNL, ISWL, URS, laser lithotripsy, and Other | |

| End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Other | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Kidney Stone Management Devices Market report delivers a detailed analysis with 62 key tables, more than 58visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here