Market Overview

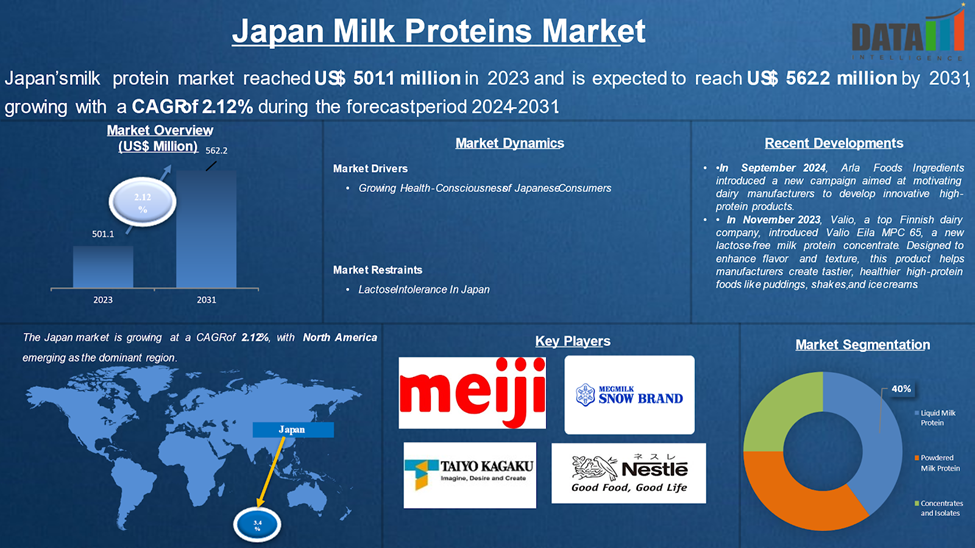

Japan's Milk Proteins Market reached US$ 501.1 million in 2023 and is expected to reach US$ 562.2 million by 2031, growing with a CAGR of 2.12 % during the forecast period 2024-2031.

With an increasing focus on fitness and wellness, many Japanese consumers are turning to milk proteins for muscle building, weight management and overall health. This shift is reflected in the growing popularity of protein supplements, ready-to-drink beverages and meal replacements, for individuals looking for convenient, protein-rich options. Additionally, advancements in dairy processing technology have made milk proteins more affordable and functional, expanding their use in a variety of products.

Functional foods, particularly those supporting gut health and immunity, are another key driver, as Japanese consumers increasingly seek products that contribute to overall wellness. With ongoing government support for the dairy industry and growing awareness of protein’s role in a balanced diet, the milk protein market in Japan is poised for continued expansion, offering diverse products to meet evolving consumer needs.

Market Scope

| Metrics | Details |

| CAGR | 2.12% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Source, Form and Application |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Nature Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report Request for Sample

Market Dynamics

Growing Health-Consciousness of Japanese Consumers

The 25th annual IFCN Dairy Conference, held in Obihiro, Japan, from June 30 to July 2, 2024, highlighted the strong connection between the growing health-consciousness of Japanese consumers and the expanding milk protein market. As Japanese consumers increasingly seek protein-rich options for muscle building, weight management and overall wellness, the demand for milk proteins like whey and casein is rising. This trend was emphasized during the conference, where experts discussed the global dairy sector’s response to increased demand for healthier, functional food products.

Innovations in dairy processing technology, highlighted at the event, have made milk proteins more affordable and versatile, enabling them to be included in a wide range of functional food and beverage products, such as protein supplements and ready-to-drink beverages, further fueling the market. The rising interest in functional foods, particularly those promoting gut health and immunity, aligns with the market’s expansion in Japan.

The growing consumer demand is being supported by government initiatives aimed at raising awareness of the nutritional importance of protein, solidifying milk proteins as an integral part of the country's health-conscious culture. Solutions such as farm cooperation and innovations in dairy processing discussed at the conference are expected to enhance efficiency and productivity, ensuring that milk proteins remain a central part of Japan’s evolving dietary landscape.

Lactose Intolerance In Japan

Lactose intolerance significantly limits the growth of Japan’s milk protein market, with around 73% of the population affected by this condition, according to the World Population Review. Many Japanese consumers avoid dairy products like milk, cheese and yogurt due to the digestive discomfort caused by lactose, reducing the demand for milk-based products. This widespread intolerance makes it challenging for dairy producers to expand their customer base.

Lactose-free and plant-based alternatives, such as soy, almond and oat milk, are becoming increasingly popular. These options typically contain plant proteins instead of milk ones, reducing the demand for dairy-based products. Dairy companies are developing specialized lactose-free options to meet this need, but the added production costs can limit their market appeal.

Segment Analysis

The Japan milk proteins market is segmented based on type, source, form and application.

High Protein Content and Nutritional Benefits of Concentrates and Isolates

The Japan milk proteins market is segmented based on form into liquid milk protein, powdered milk protein, concentrates and isolates. Concentrates and isolates dominate the milk protein market due to their high protein content and nutritional benefits. As health and fitness trends grow, consumers are increasingly seeking products with concentrated forms of protein. Isolates, in particular, appeal to those who prioritize low fat and carbohydrate intake while still achieving a high protein intake.

The growing demand for functional foods and supplements in Japan, where active lifestyles and fitness culture are on the rise is expanding the market reach. Additionally, the ability to easily incorporate these proteins into various food products, such as protein bars and shakes, enhances their popularity. Further, the technological advancements in protein extraction have made concentrates and isolates more efficient to produce, ensuring higher purity and quality.

Competitive Landscape

The major Japanese players in the market include Meiji Co., Ltd., Nestlé Japan Ltd., Miyagi Milk Industry Co., Ltd., Morinaga Milk Industry Co., Ltd., Daiwa Foods Co., Ltd., The Snow Brand Milk Products Co., Ltd., FrieslandCampina (Japan) and Taiyo Kagaku Co., Ltd.

Sustainability Analysis

The milk protein market in Japan holds significant promise for sustainable growth. As consumers become more environmentally aware, there is a rising preference for ethically sourced, sustainable food options, creating opportunities for dairy producers to innovate. Advances in technology, such as precision farming, efficient water management and alternative protein sources like plant-based or lab-grown options, can help reduce the environmental footprint of dairy production.

Japan’s strong emphasis on sustainable agricultural practices and government support further strengthens the potential for a greener dairy industry. By adopting more sustainable practices, such as reducing greenhouse gas emissions and improving waste management, dairy producers can meet consumer expectations and enhance their profitability. As Japan continues to prioritize sustainability, the milk protein sector is well-positioned to thrive by embracing innovation, ethical practices and technological solutions.

By Type

- Casein

- Whey Protein

By Source

- Cow Milk

- Goat Milk

- Sheep Milk

- Buffalo Milk

- Other Source

By Form

- Liquid Milk Protein

- Powdered Milk Protein

- Concentrates and Isolates

By Application

- Food & Beverages

- Nutritional Supplements

- Infant Nutrition

- Pharmaceuticals

- Animal Feed

- Cosmetics & Personal Care

Key Developments

- In March 2024, Kaneka Corporation has launched Pur Natur™, a JAS-certified*1 organic milk made from organic raw milk. Pur Natur brand will introduce its second organic dairy product, following yogurt. The new product will initially be distributed through its affiliate company, Kaneka Foods Corporation, at major retailer LIFE Corporation.

Why Purchase the Report?

- To visualize the Japan milk proteins market segmentation based on type, source, form and application, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous milk proteins market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The Japan milk proteins market report would provide approximately 36 tables, 33 figures and 195 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies