Market Size

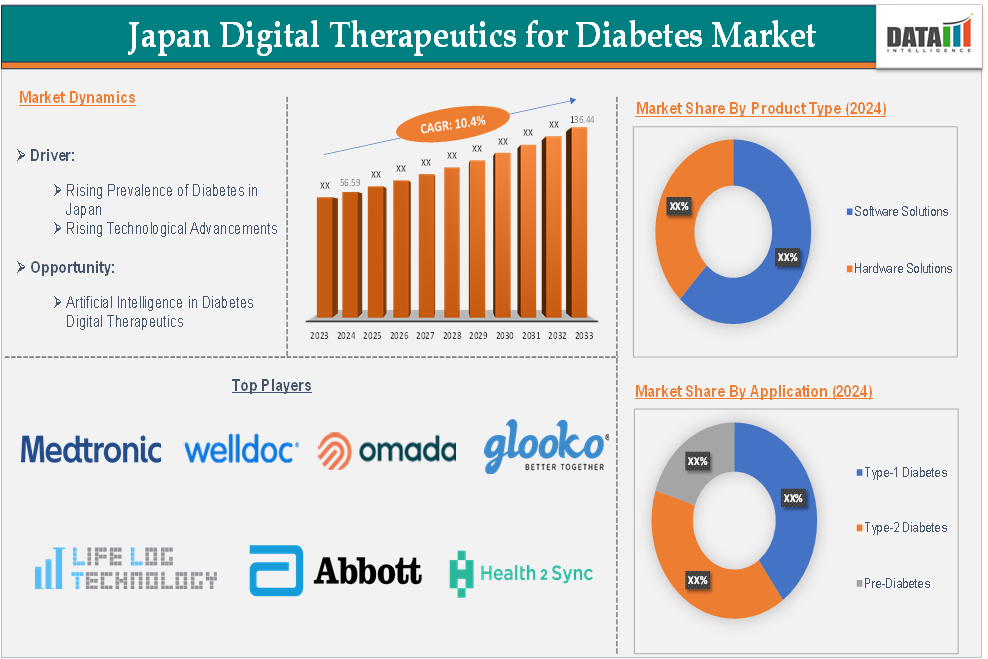

The Japan digital therapeutics for diabetes market size reached US$ 56.59 million in 2024 and is expected to reach US$ 136.44 million by 2033, growing at a CAGR of 10.4% during the forecast period 2025-2033.

Digital therapeutics for diabetes refers to evidence-based, software-driven interventions designed to manage and treat diabetes, primarily focusing on improving health outcomes and managing the condition through technology. These interventions use digital tools, such as mobile apps, wearable devices and connected platforms, to provide personalized treatments and support for individuals with diabetes. Digital therapeutics leverage real-time data collected from patients’ devices (such as glucose meters, wearables or mobile apps) to provide continuous monitoring of blood glucose levels, physical activity, diet and medication adherence.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

The rising prevalence of diabetes in Japan driving the digital therapeutics for diabetes market growth

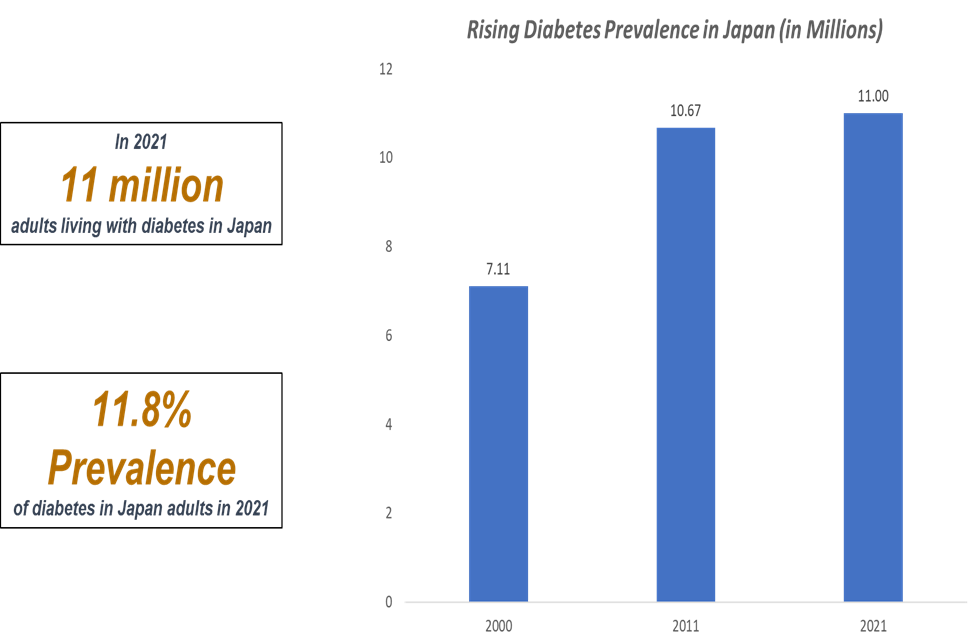

According to the International Diabetes Federation (IDF), 11 million adults in Japan have diabetes. The high prevalence of diabetes is associated with a significant economic burden and can be attributed to lifestyle changes and increased longevity. Japan's aging population, which is one of the oldest in the world (29% of the population is 65 years or older), significantly increases the number of diabetes cases. Older adults are more susceptible to Type 2 diabetes, leading to higher demands for chronic disease management.

The current diabetes management model in Japan is heavily reliant on frequent doctor visits, insulin injections and physical check-ups. This is costly and time-consuming, both for the healthcare system and for patients. As the number of diabetes patients rises, the traditional approach is proving insufficient to handle the increasing volume. Digital solutions like mobile apps, wearable devices (such as continuous glucose monitors) and AI-driven platforms offer remote monitoring, personalized feedback and real-time management. These technologies help reduce the need for frequent visits and allow patients to better track their health from home.

As more people are diagnosed with diabetes, the need for cost-effective, scalable and convenient solutions like digital diabetes management increases. The combination of an aging population, high healthcare costs and government backing for digital health technologies makes a key trend in Japan’s diabetes management market. Using digital health technology to prevent and treat diabetes is the latest trend in diabetes management.

Data privacy and security concerns hampering the growth of Japan digital therapeutics for diabetes market

Japan has stringent data protection laws under the Act on the Protection of Personal Information (APPI), which sets high standards for the storage and sharing of personal and health data. Digital therapeutics companies must comply with these regulations to protect patients’ sensitive health information. The complexity of meeting these regulations adds to the development and operational costs for digital health companies.

The APPI mandates that companies obtaining personal data need explicit consent from patients, which can delay the development and deployment of new digital therapeutic solutions in Japan. Companies must ensure data is securely stored and breaches are immediately reported, creating compliance challenges.

Many Japanese patients may be hesitant to share their health data with digital health platforms due to concerns about privacy and misuse. This mistrust can limit the adoption of digital therapeutics, especially if patients feel unsure about how their data will be used, shared or stored. As digital therapeutics solutions are connected to the cloud and rely on the internet for real-time data sharing, the risk of data breaches or hacking increases. A breach in security could expose patients’ medical and personal data, damaging the reputation of the digital therapeutics provider and leading to legal ramifications.

Market Segment Analysis

The Japan digital therapeutics for diabetes market is segmented based on product type, application and end-user.

Product Type:

The software solutions in the product type segment are expected to dominate the Japan digital therapeutics for diabetes market with the highest market share

Software solutions including mobile apps and digital platforms can provide personalized diabetes management by using real-time data and AI-driven algorithms to deliver customized treatment recommendations. These solutions allow patients to track blood glucose levels, diet, physical activity and medication adherence daily, offering individualized feedback.

For instance, in March 2023, Health2Sync announced its latest version of the Health2Sync App integrates insulin data from Mallya Cap, the connected device dedicated to insulin pens developed by Biocorp and marketed in Japan by Novo Nordisk. This partnership realizes the first data integration of its kind and is expected to help patients on insulin treatment manage their health by capturing multiple data points, including insulin injection logs.

Software solutions, particularly mobile applications, are highly accessible and can be used on smartphones or tablets, allowing patients to manage their diabetes from anywhere. This convenience is especially beneficial for the aging population in Japan, many of whom are managing diabetes and prefer digital tools that offer self-monitoring and remote consultation features.

Major Japan Players

The major Japan players in the digital therapeutics for diabetes market include Welldoc, Inc., Omada Health Inc., Glooko, Inc., Azumio Inc., Abbott Laboratories, Life Log Technology, Inc., Dexcom, Inc., Health2Sync, iHealth Labs Inc. and Medtronic plc among others.

Market Scope

| Metrics | Details | |

| CAGR | 10.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Software Solutions and Hardware Solutions |

| Application | Type-1 Diabetes, Type-2 Diabetes and Pre-Diabetes | |

| End-User | Hospitals, Specialty Clinics, Homecare Settings, Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Japan digital therapeutics for diabetes market report delivers a detailed analysis with 39 key tables, more than 26 visually impactful figures and 158 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.