Japan Assistive Devices Market – Industry Trends & Overview

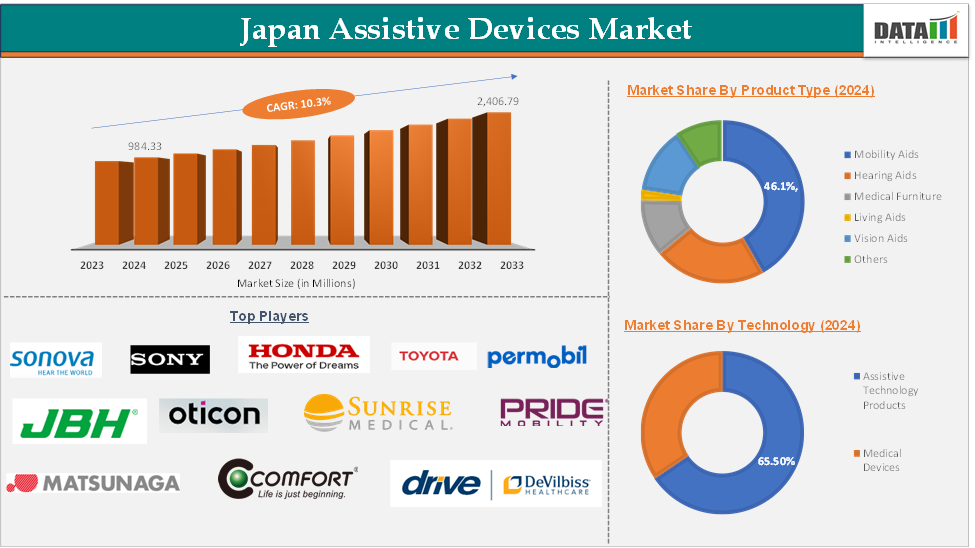

Japan Assistive Devices Market reached US$ 984.33 Million in 2024 and is expected to reach US$ 2,406.79 Million by 2033, growing at a CAGR of 10.3 % during the forecast period 2025-2033.

The Japan assistive devices market refers to the sector providing products and technologies that help people with disabilities or age-related impairments maintain independence and improve quality of life, including mobility aids, sensory devices, and smart home solutions.

Driven by Japan’s rapidly aging population, the highest proportion of elderly citizens globally, along with a rising prevalence of chronic diseases and disabilities, the market is expanding steadily. Key opportunities stem from advances in AI, robotics, and IoT, which are making devices more intuitive, personalized, and effective, as well as strong government support and policy initiatives aimed at improving accessibility and affordability.

Current trends include a shift toward home-based and personalized care, integration of smart technologies, and growing demand for mobility impairment devices due to conditions like arthritis and stroke.

Executive Summary

For more details on this report – Request for Sample

Japan Assistive Devices Market Dynamics: Drivers

Innovations in assistive technology

Innovations in assistive technology have significantly contributed to the growth of the Japanese assistive devices market, with developments enhancing both the accessibility and functionality of products designed for individuals with disabilities and the elderly population. In the mobility aids sector, new lightweight, comfortable wheelchairs have been introduced, offering longer battery life and greater user independence.

The integration of artificial intelligence (AI) further personalizes these technologies, making them more intuitive and efficient. These advancements are transforming assistive devices into essential tools that significantly improve quality of life, especially as Japan’s aging population continues to drive demand for such technologies.

For instance, in January 2025, Yamaha Motor is taking a major leap forward with the global launch of its JWG-1 electric wheelchair power unit. The company’s first full redesign in a decade. The JWG-1 is designed to retrofit manual wheelchairs, transforming them into electric-powered models with enhanced features such as improved LCD controller visibility, a new lever throttle, greater maximum load capacity, increased torque, and a lighter battery. All these factors demand the Japan assistive devices market.

Japan Assistive Devices Market - Market Dynamics: Restraints

High cost of assistive devices

One of the significant constraints facing the Japanese assistive devices market is the high cost of assistive devices, which limits accessibility for many potential users. Products like advanced mobility aids (e.g., powered wheelchairs, smart scooters) and hearing aids can be expensive due to the cost of cutting-edge technology, advanced materials, and customized features.

For instance, high-quality powered wheelchairs can range from ¥500,000 to ¥1,500,000 ($3,500 to USD 10,000) in Japan, while hearing aids can cost around ¥100,000 to ¥400,000 ($700 to USD 3,000) for top-end models.

Such high costs create significant financial barriers for many individuals, especially in a market where a substantial proportion of the population is elderly and may have fixed incomes. The demand for assistive devices is also increasing with Japan's aging demographic. By 2025, nearly 30% of the population will be 65 years or older, putting further strain on consumers’ ability to afford these devices.

Furthermore, public and insurance coverage for these products is often limited, which exacerbates the affordability issue, making it harder for many people to access the assistive devices they need to maintain their independence and quality of life. Thus, the above factors could be limiting the Japan assistive devices market's potential growth.

Japan Assistive Devices Market Segment Analysis

The Japan assistive devices market is segmented based on product type, technology, and end-user.

Product Type:

The mobility aids product type segment is expected to hold 46.1% of the Japan assistive devices market in 2024

The mobility aids segment is a cornerstone of the Japanese assistive devices market, addressing the critical needs of an aging and mobility-impaired population. This segment includes a wide range of products from manual and powered wheelchairs to walkers, rollators, canes, and scooters that are designed to improve mobility and independence.

Advanced features such as lightweight materials, enhanced battery performance, and even smart technology integrations like autonomous driving assistance are making these devices more efficient and user-friendly. These innovations not only help users move more safely and comfortably but also support greater independence in daily life.

Additionally, key players in the industry have innovative launches that would drive this segment's growth in the Japanese assistive devices market. For instance, in December 2024, May Mobility launched an autonomous vehicle (AV) service in Fukuoka, Japan, in collaboration with Toyota's e-Palette mobility platform. This service, which operates at Toyota Motor Kyushu’s Miyata factory, uses a customized version of the e-Palette battery-electric vehicle to provide an efficient and effective transit option for factory employees and guests. These factors have solidified the segment's position in the Japan assistive devices market.

Japan Assistive Devices Market Major Players

The major players in the Japan assistive devices market include Sonova., Sony B.V., Honda Motor Co., Ltd., Toyota, Matsunaga, WHILL, Inc., Oticon Inc., Comfort., Anhui JBH Medical Apparatus Co., Ltd, Sunrise Medical, Permobil, DRIVE MEDICAL GMBH & CO. KG, Invacare Corporation, Pride Mobility Products Corp., and HurryCane, among others.

Key Developments

In April 2025, Transreport will collaborate with Hankyu Corporation to introduce the Passenger Assistance Web, a platform aimed at improving accessibility for passengers with mobility challenges across Japan's rail network. This web-based tool allows users to pre-set their assistance needs by creating personalized profiles before their trips.

In February 2025, Tokyo, researchers demonstrated a humanoid robot called AIREC. This robot, weighing 150 kg (about 330 lbs), is equipped with artificial intelligence and is designed to assist with caregiving tasks for the elderly. During the demonstration, AIREC gently placed one hand on a man’s knee and another on his shoulder, then carefully rolled him onto his side, a common maneuver used in caregiving to change diapers or prevent bedsores.

Market Scope

Metrics | Details | |

CAGR | 10.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Mobility Aids, Hearing Aids, Medical Furniture, Living Aids, Vision Aids, Others |

Technology | Assistive Technology Products, Medical Devices | |

End-User | Hospitals, Home Care Settings, Assisted Living Facilities, Others | |