Ion Exchange Resins Market Size

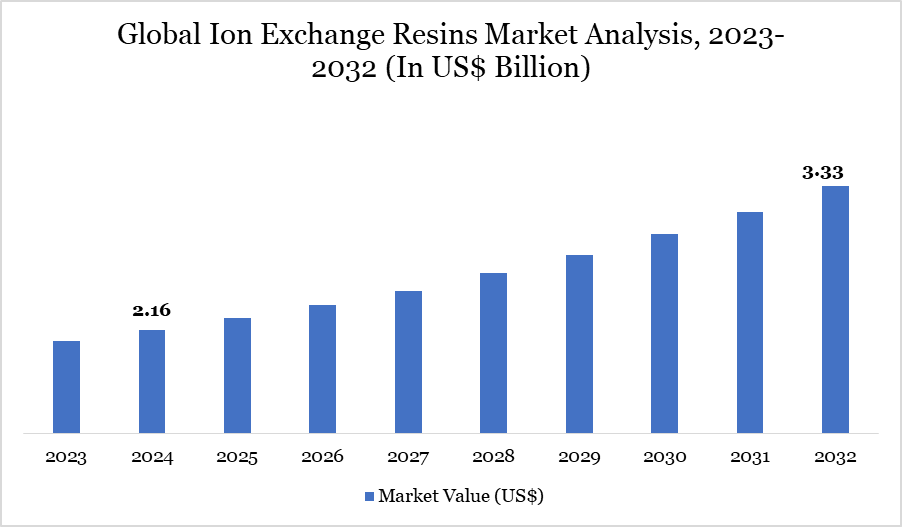

Ion Exchange Resins Market size reached US$ 2.16 billion in 2024 and is expected to reach US$ 3.33 billion by 2032, growing with a CAGR of 5.56% during the forecast period 2025-2032.

The ion exchange resins market is experiencing continuous growth, propelled by an increasing global focus on water quality and the optimization of industrial processes. The swift urbanization and industrial growth, especially in developing countries, are driving the demand for sophisticated purification systems.

Ion exchange resins are essential for the elimination of organic molecules, heavy metals, and other contaminants in diverse sectors such as power generation, medicines, and food processing. Government laws, including the U.S. EPA’s Safe Drinking Water Act, have strengthened the necessity for compliance water treatment technologies. Technological breakthroughs are facilitating the creation of specialty resins with improved selectivity.

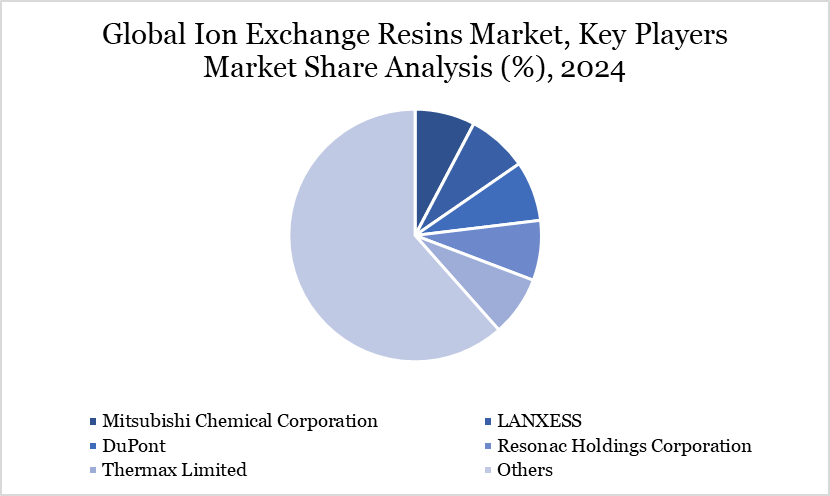

Strategic investments, exemplified by LANXESS’s EUR 80–120 million initiatives in 2023 for a new resin production plant, underscore the industry's dedication to addressing rising worldwide demand. The acquisition of Aquapure Technologies by Evoqua in September 2023 exemplifies the continuing consolidation tendencies aimed at enhancing service capabilities. These dynamics are directing the market towards a strong, innovation-driven growth path.

Ion Exchange Resins Market Trend

The ion exchange resins market is undergoing transformation due to the convergence of industry-specific trends, especially in pharmaceuticals, food and beverage, and energy sectors. In the pharmaceutical business, resins are now essential for active pharmaceutical ingredient purification and regulated drug release, leveraging healthcare infrastructure developments such as India's anticipated US$ 372 billion healthcare market by 2025.

Likewise, demand is rising in the food and beverage sector, where clean-label standards are prompting manufacturers to eliminate heavy metals and improve flavor profiles through ion exchange methods. In the beverage industry, resins facilitate mineral elimination and flavor enhancement, particularly in developing areas where the demand for premium products is increasing.

Furthermore, swift development in nations such as Brazil, Indonesia, and South Africa is driving resin consumption across several applications. Manufacturers are augmenting production with facilities like LANXESS’s next plant, which will have a capacity of 20,000–30,000 cubic meters per year. These improvements guarantee that the market aligns with increasing worldwide demands for purity and performance.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Type | Cation Exchange Resins, Anion Exchange Resins, Others |

| By Application | Water, non-water |

| By End-user | Power Generation, Chemical and Fertilizer, Food and Beverage, Electrical and Electronics, Pharmaceutical, Domestic and Waste Water Treatment, Paper and Pulp, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Ion Exchange Resins Market Dynamics

Nuclear Energy Expansion Promoting Resin Utilization

The expansion and upgrading of nuclear energy infrastructure is rapidly increasing the utilization of ion exchange resins, especially in the power generation industry. These resins are essential for preserving the ultra-pure water used in nuclear reactors, aiding in the management of corrosion, scale, and radioactive contamination.

France generates more than 70% of its electricity from nuclear energy, underscoring the need of ion exchange resins in maintaining plant safety and efficiency. Increasing investments in nuclear energy throughout Europe and the Asia-Pacific region are driving demand for high-performance resins. In thermal power plants, these materials are crucial for the treatment of water utilized in boilers and cooling systems, hence optimizing operational efficiency and reducing equipment degradation.

Wastewater treatment in power plants use ion exchange to eliminate toxic compounds, including fluorides and heavy metals, thereby ensuring regulatory compliance and promoting sustainable water reuse. The continuous expansion of the energy industry is a fundamental growth driver for the worldwide ion exchange resins market.

Regulatory Pressures and Feedstock Volatility Limit Expansion

The ion exchange resins market encounters regulatory obstacles in developing nations, mostly owing to the lack of rigorous water treatment regulations. Countries like as India, Indonesia, Bangladesh, and South Africa frequently depend on inexpensive, basic techniques like chlorination and solar disinfection, which do not effectively remove heavy metals and pathogens.

Over 80% of infections in these areas, including as malaria and cholera, are associated with contaminated water sources. This public health concern highlights the necessity for improved water treatment technologies. Nonetheless, budgetary limitations and inadequate infrastructure persist in obstructing the deployment of contemporary technology such as ion exchange resins.

The absence of regulatory requirements permits industries to release pollutants directly into water bodies, intensifying contamination problems. In the absence of governmental reforms and augmented investment in water infrastructure, these issues will endure, hindering market progress in several rising economies in the Asia-Pacific, South America, and Africa.

Ion-Exchange Resins Market Segment Analysis

The global ion exchange resins market is segmented based on type, application, end-user and region.

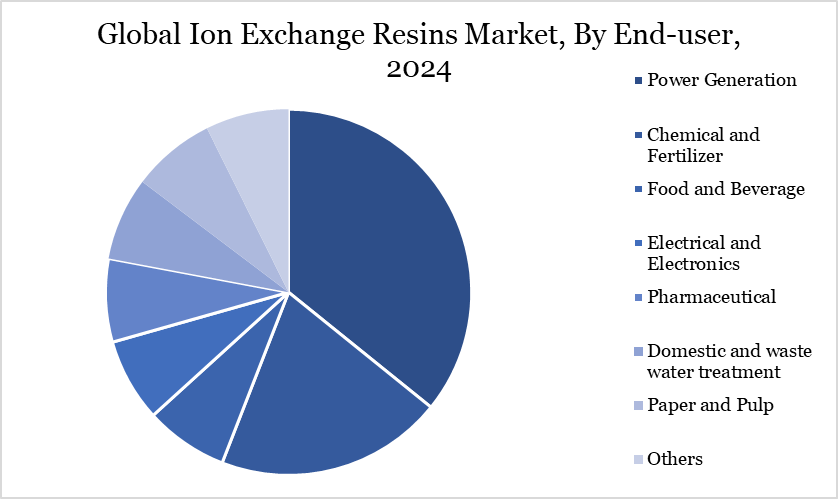

The Power Generation Sector as a Fundamental Driver of Ion Exchange Resin Demand

The power generating sector holds a significant portion of the ion exchange resins market owing to its essential reliance on water purity. In thermal and nuclear power plants, preserving the integrity of water utilized in boilers, condensers, and reactors is crucial for operational efficiency and equipment longevity. Ion exchange resins efficiently eliminate scale-forming ions and impurities that may harm systems, while ensuring adherence to rigorous water quality standards.

Cation and an ion exchange resins are utilized concurrently to soften water and facilitate demineralization, therefore averting corrosion and scale. Additionally, ion exchange resins are progressively employed in wastewater treatment at power plants, enabling the extraction of toxic substances such as fluorides and heavy metals. This treatment guarantees safe discharge and promotes water reuse activities, by global sustainability objectives. With the rise in worldwide electricity demand and the expansion of infrastructure investments, especially in the Asia-Pacific and Europe, the dependence on ion exchange resins in the power industry is anticipated to escalate.

Ion-Exchange Resins Market Geographical Share

Asi-Pacific’s Industrial Expansion and Population Growth Catalyst Resin Absorption

The Asia-Pacific area continues to be the most profitable market for ion exchange resins, driven by swift industrialization, population expansion, and supportive governmental policies. Countries including China, India, Indonesia, and South Korea are experiencing heightened demand in areas such as medicines, petrochemicals, and food processing. China and India are significant manufacturing centers and collectively account for about one-third of the global population, leading to substantial water treatment requirements.

The region's competitive manufacturing sector is enhanced by low labor costs and enough raw supplies, drawing substantial foreign direct investment. In 2023, Indonesia registered US$ 47.3 billion in foreign direct investment (FDI), marking a 13.7% rise from 2022, indicative of a strong industrial forecast.

Policy incentives, such China's VAT exemptions and India's "Make in India" drive, are augmenting industrial activity. Research and development investments are increasing, facilitating resin innovation and implementation. These characteristics collectively position Asia-Pacific as a central hub for the manufacturing and use of ion exchange resins.

Ion-Exchange Resins Market Major Players

The major global players in the market include Mitsubishi Chemical Corporation, LANXESS, DuPont, Resonac Holdings Corporation, Thermax Limited, Graver Technologies, Purolite, DOSHION POLYSCIENCE PVT. LTD., Otto Chemie Pvt. Ltd., Aldex Chemical Company, Ltd and among others.

Sustainability Analysis

Sustainability is becoming a central feature in the ion exchange resins market, as manufacturers and end-users link product applications with environmental goals. These polymers enhance sustainability by facilitating efficient water treatment and recycling, reducing freshwater usage, and promoting industrial zero-liquid-discharge systems. In the energy sector, ion exchange resins facilitate the secure reclamation of treated wastewater, thereby diminishing the environmental impact of energy generation.

In the food and pharmaceutical industries, resins facilitate the purification of products to comply with environmental and health laws without employing harsh chemicals. Furthermore, the advancement in specialized resin research is highlighting extended lifespan performance and decreased regeneration frequency, thus minimizing chemical usage and waste production.

Industry participants such as LANXESS are investing in energy-efficient production facilities, indicating a dedication to sustainable manufacturing practices. The utilization of ion exchange resins is congruent with circular economy ideas, facilitating industries' transition to more sustainable and responsible operating frameworks.

Key Developments

In October 2024, The Mitsubishi Chemical Group (MCG) plans to expand its production capacity of ion exchange resins, which are essential for producing ultrapure water used in semiconductor manufacturing. The expansion was expected to occur at Mitsubishi Chemical's Kyushu-Fukuoka Plant in Kitakyushu City, Fukuoka Prefecture, Japan.

In April 2024, LANXESS launched a new sustainable ion exchange resin named Lewatit S 1567 Scopeblue, aimed at water-softening applications. This innovative product is part of LANXESS's commitment to sustainability and is produced using a solvent-free process, significantly reducing its environmental impact.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies