Global Intelligent Building Energy Management Systems Market is segmented By Component (Software, Hardware, Services), By System (Building Energy Software, Building Control Systems, Communication Systems), By End-User (Commercial Buildings, Residential Buildings, Industrial Buildings, Government Buildings), and By Region (North America, South America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Intelligent Building Energy Management Systems Market Size

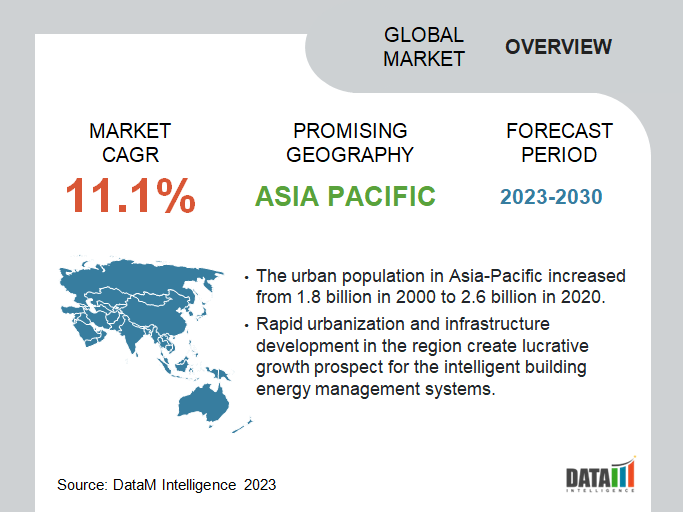

Global Intelligent Building Energy Management Systems Market reached USD 891.6 million in 2022 and is expected to reach USD 2,073.3 mllion by 2031, growing with a CAGR of 11.1% during the forecast period 2024-2031.

Building systems are integrated for improved synchronization, monitoring, and optimization of data on energy use. The latest generation of BEMS work closely with utility companies to inform building owners of when power costs and demand are at their lowest. This knowledge enables them to schedule high power-use activities efficiently, hence reducing their expenditures.

The operators can improve building performance by using the control, monitoring, and alarm features provided by the intelligent building energy management software. Furthermore, above mentioned factprs drives the growth of the global intelligent building energy management systems market.

From September 2–4, 2020, Shanghai Intelligent Building Technology (SIBT) was hosted at the Shanghai New International Expo Centre (SNIEC) in halls W3, W4, and W5. SIBT is committed to examining new modes of applications by integrating 5G, IoT, AI, and other cutting-edge technologies into smart communities, buildings, real estate, offices, parking, and home domains. SIBT is a vital industry platform for fostering corporate growth and inspiring discussions.

With a CAGR of 11.7%, the global intelligent building market is anticipated to increase from USD 60.7 billion in 2019 to USD 105.8 billion in 2024. Building technology will enter its golden age as the 5G era goes on, as seen by the market's explosive expansion in China. Significant drivers of market growth include greater acceptance for IoT technology in building management systems, more attention to space efficiency, and improved standards and regulations. Therefore, Chine holds the half of the rgeional shares and is expected to grow at a highest CAGR.

Intelligent Building Energy Management Systems Market Scope

|

Metrics |

Details |

|

CAGR |

11.1% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Component, System, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

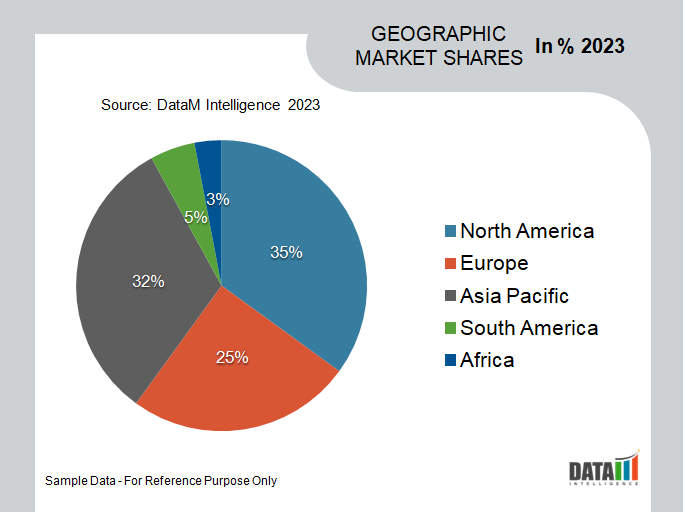

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Component Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Intelligent Building Energy Management Systems Market Dynamics

Integrated Technology for Comfort and Efficiency

Technology has radically changed many industries, including the building and real estate sectors, in the quickly changing world that we live in today. Intelligent buildings have become cutting-edge solutions for producing more livable, effective, and comfortable working and living places.

For instance, Konnect Building Solutions, a progressive Sydney-based home construction business, uses clever technologies to develop energy-efficient homes that minimize their negative effects on the environment and save clients' utility expenses.

Smart buildings prioritize human comfort and well-being in addition to energy control. To promote a better living or working environment, intelligent devices can monitor indoor air quality, modify airflow, and control humidity levels. Individual preferences can also be catered for in personalized settings, enabling occupants to optimize lighting, temperature, and other environmental aspects.

Increasing Demand for Energy Efficiency

The new system offers various levels of energy management integration and may interact with heat pumps, rooftop solar PV systems, and EVs. The importance of energy efficiency in building services has increased recently. Adopting tactics and technology that reduce energy consumption in buildings has become essential due to the growing concern over climate change and the rising cost of electricity.

In October 2022, ABB, a leading provider of Swiss technology, has unveiled a brand-new home energy management and monitoring solution that can be accessed through a single smart home app. The system integrates a smart home system, energy management, and EV charging controls in order to address issues such as rising energy costs, heavy demand on power grids, and an increase in the number of electric vehicles.

Lack of Awareness

The development of the global market may be hampered by a lack of knowledge about Intelligent Building Energy Management Systems (IBEMS). IBEMS adoption is less likely when building owners and facility managers are not aware of its advantages and potential. Lack of knowledge could result in potential customers choosing more traditional or basic energy management systems, which would limit the market penetration of IBEMS.

IBEMS can save you a lot of money by increasing energy efficiency and lowering operating costs. Building owners can miss or undervalue the economic advantages of investing in IBEMS, though, if they are unaware of the possible savings. This can make people reluctant to set aside funds and resources for IBEMS implementation.

Intelligent Building Energy Management Systems Market Segmentation Analysis

The global intelligent building energy management systems market is segmented based on component, system, end-user and region.

Empowering Energy Efficiency and Intelligence in Commercial Buildings

ABB Ability Building Analyzer gathers building data from metres and sensors that are logged in various systems via a secure internet connection. It is a cloud-based SaaS service. It is ideal for commercial buildings of any size and tenant-type, is open and extremely flexible, and enables users to connect to the service from any location.

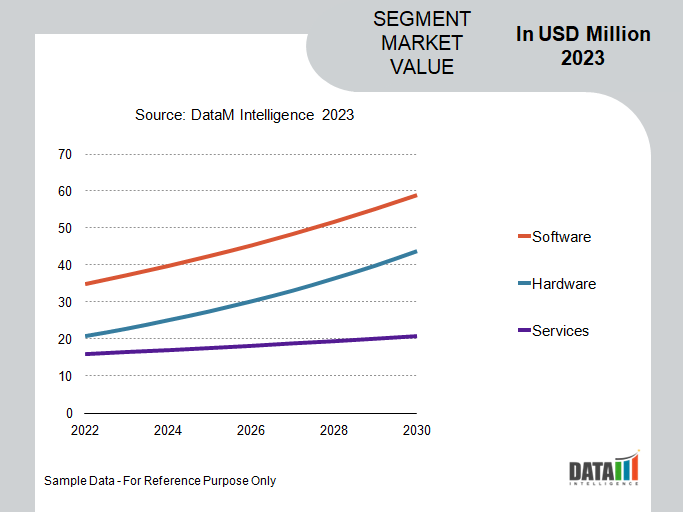

Easy onboarding, commissioning, and help for compliance with legal requirements, industry standards, and organizational sustainability goals are all features of the building intelligence tool. Therefore, the software component segment dominates the global market with more than 1/3rd of the total global segmental market share.

Intelligent Building Energy Management Systems Market Geographical Share

Unleashing the Power of Building Energy Management Systems (BEMS)

Commercial buildings utilize roughly 20% of the energy produced in the US, while both business and residential buildings contribute to about 38% of greenhouse gas emissions, according to the US Department of Energy.

Additionally, the US Energy Information Administration states that more than 70% of the electricity generated in the US is used by commercial buildings. Making global buildings more efficient gives a tremendous chance to contribute to a less wasteful energy future and one with less negative environmental effects, given the high consumption and pollution rates. One of the various tools available for more effective building operation is a BEMS. This in turn drives the growth of the IBEMS market. Therefore, the North America dominates the global intelligent building energy management systems with significant global market share.

Intelligent Building Energy Management Systems Market Companies

The major global players include Siemens AG, Schneider Electric SE, Honeywell International Inc., Johnson Controls International plc, ABB Ltd., Cisco Systems, Inc., Eaton Corporation plc, IBM Corporation, Schneider Electric and BuildingIQ Inc.

COVID-19 Impact On Intelligent Building Energy Management Systems Market

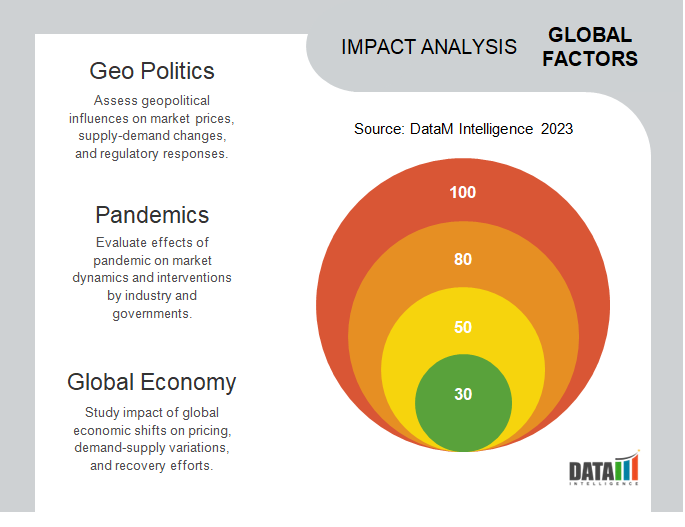

The epidemic caused the IBEMS market to temporarily stall down because of the general economic unpredictability. The installation and use of IBEMS in new buildings were hampered by the suspension or postponement of numerous construction projects. Additionally, some organisations delayed or reduced their expenditures in energy management systems due to financial concerns and budgetary restraints.

The pandemic brought to light how crucial indoor air quality is for stopping the spread of infectious diseases in buildings. As a result, ventilation, air filtration, and monitoring systems—which are frequently integrated with IBEMS—were given more attention. The necessity for enhanced IBEMS features to monitor and optimise indoor air quality variables, such as CO2 levels and ventilation rates, was acknowledged by building owners and operators.

AI Impact

Owing to machine-based artificial intelligence algorithms, it is now possible to exploit the enormous amount of data available to optimize commercial building energy use and enable commercial buildings to participate in markets for flexible demand. A new era of urban energy efficiency is predicted to be led in by the idea of intelligent buildings, requiring for the integration of sensors, big data (BD), and artificial intelligence (AI). Energy usage can be decreased by implementing AI technology in intelligent buildings because of greater automation, control, and reliability.

"Flex2X" is the name of one of these systems, developed by UK-based company Grid Edge. The system works by merging data from an energy management system already installed in a building with data from other sources (like weather reports) and processing the data with artificial intelligence algorithms that can optimize the building's energy use in real time. The algorithms are regarded as "artificially intelligent" due to the fact that they adapt in response to the data they are given, a process known as "learning". This enables the software to forecast the building's energy consumption up to 24 hours in advance using historical data.

Key Developments

- On January 4, 2023, Homes are undergoing a radical change that will increase simplicity, sustainability, and energy efficiency. At the Consumer Electronics Show (CES) in Las Vegas, Schneider Electric, the pioneer in the digital transformation of energy management and automation, unveiled Schneider Home, a first-of-its-kind home energy management solution for homeowners seeking savings, comfort, and energy independence.

- In January 2023, At the Light Middle East and Intelligent Building Middle East 2023 event, which got under way today (January 17) at the Dubai World Trade Centre, ABB, a leader in electrification and automation technologies, presented its smart building management systems (BMS) for the Middle East region.

- On Macrh 7, 2023, With the help of ABB's new smart building management solution, substantial energy savings and carbon reductions are attainable. Opportunities for energy savings of up to 20%, emissions reduction, and maintenance cost savings are provided by a new dynamic building intelligence system. A cloud-based solution offers a real-time gathering of accessible data about buildings and utilities, deep analytics, and data visualisation in a single, user-friendly interface.

Why Purchase the Report?

- To visualize the global intelligent building energy management systems market segmentation based on component, system, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of intelligent building energy management systems market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global intelligent building energy management systems market report would provide approximately 61 tables, 57 figures and 198 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies