Injectable Drug Delivery Market Size

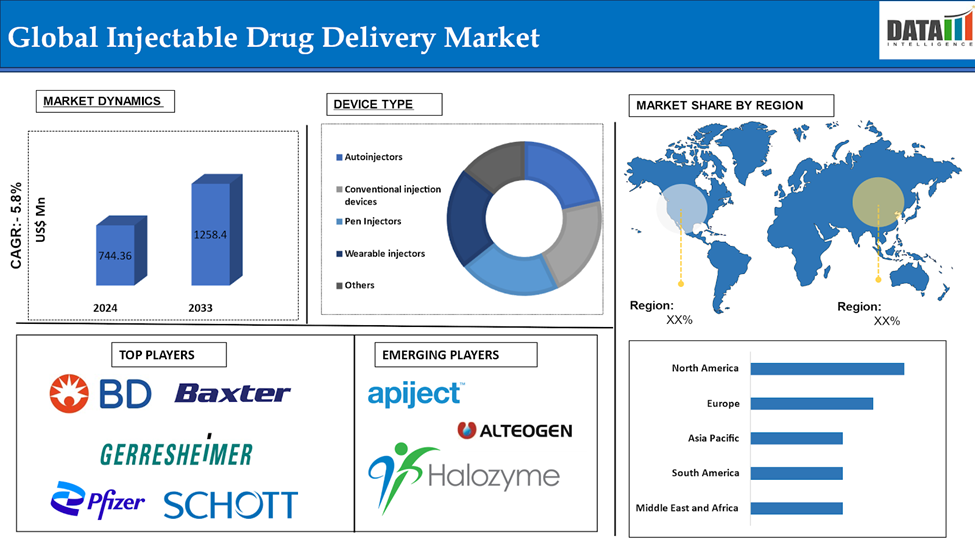

The Global Injectable Drug Delivery Market reached US$ 744.3 million in 2024 and is expected to reach US$ 1258.4 million by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033.

Injectable drug delivery systems are method which are administred through injection, which can be adapted in terms of hydrogel formulations that controlled and sustained release. The systems are intended to provide prolonged release by using many in situ gel systems. This approach tremendously augments the efficacious delivery of drugs as the introduction of medications in the body will be prolonged, which will improve the results of therapeutics and enhance patients' adherence to treatment.

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rise in the Prevalence of Chronic Diseases

The upsurging of chronic diseases incidence such as cancer and diabetes have warranted penetrating technologies to deliver drugs. Where the mass acceptance of invasive techniques will greatly determine the rate of growth of the global injectable drug delivery market. Availability of trained medical experts has promoted their advantages.

For instance, in January 2024, Scientists from this humble University at Chapel Hill in North Carolina formulated a unique method of drug delivery known as the Spatiotemporal On-Demand Patch (SOP) that allows drug release from individual microneedles to be scheduled and triggered via a smartphone or computer command system. Its thin and soft patch platform is designed much like a Band-Aid in order to promote wearability, hence, comfort and convenience for users because this is a key factor involving chronically ill patients.

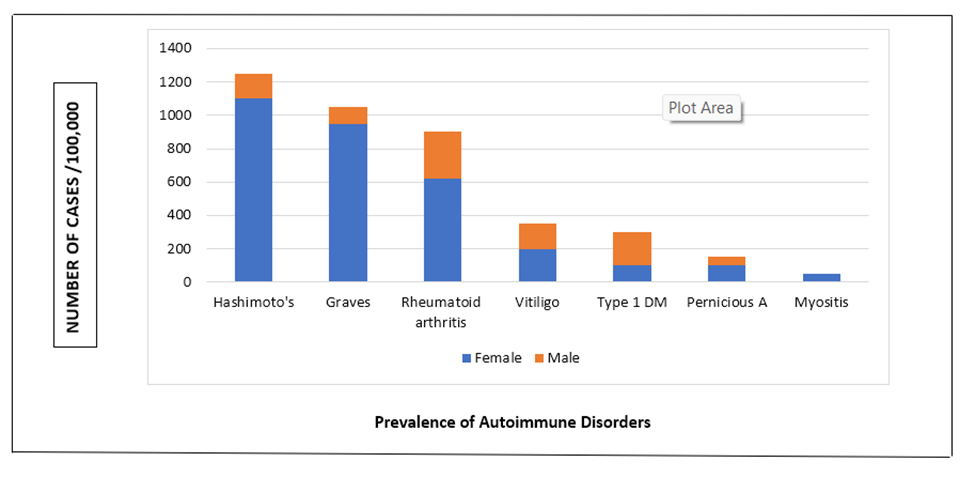

Male and Female Luer ComponentsMoreover, the prevalence of autoimmunities in the US has been estimated on the basis of publications and a supplementary collection of primary data from smaller, well-endowed epidemiological resources states like Scandinavian countries. Estimated combined prevalence of all autoimmune conditions is such that about 3% of the US population is affected-evidence to suggest that some millions, presumes about 10 million people are afflicted.

Complex Manufacturing

The global injectable drug delivery market faces several challenges, including complex manufacturing, patient compliance concerns, competition from alternative methods like oral, transdermal, and inhalation systems, and limited infrastructure for cold chain storage and distribution in low- and middle-income countries. These factors can limit the market's growth potential, as they restrict accessibility and hinder the widespread adoption of injectable treatments. The complexity of manufacturing injectable formulations, the fear of needles and associated pain, and the limited infrastructure for cold chain storage and distribution in low- and middle-income countries further limit the market's potential for growth.

Market Segment Analysis

The global injectable drug delivery market is segmented based on device type, application, usage pattern distribution channel and region.

Device Type:

Autoinjectors from the device segment is expected to dominate the Injectable Drug Delivery market share

The autoinjectors segment holds a major portion of the injectable drug delivery market share and is expected to continue to hold a significant portion of the injectable drug delivery market share during the forecast period.

Autoinjectors segment is expected to grow during the forecast period owing to the factors like siginificant product launches, advancements, moreover, autoinjectors are intuitive and user-friendly designed, requiring only a single button press to administer medication, minimizing errors and ensuring accurate dosing. However, they are not designed for multiple uses, raising sustainability concerns. Despite this, their user-friendly use continues to drive their popularity, with Nemera's PenDURA and PenVARIO platforms facilitating multi-dose pen injector ranges.

For instance, in June 2024, Instron announced the next-generation Autoinjector Testing System for complete functionality testing of pen and autoinjectors to ISO 11608. Developed in close cooperation with pharmaceutical companies and CDMOs, this system allows for measurement of a mixture of essential performances: cap removal, dose accuracy, activation force, injection time, needle depth, and needle guard lockout.

Moreover, in January 2024, Taisho Pharmaceutical Co., Ltd. has announced the launch of Nanozora 30mg Autoinjector for S.C. Injection, a TNFα inhibitor. This single-use autoinjector dosage form, prefilled with the same drug as the syringe dosage form, was launched in December 2022. The device is designed for ease of use, allowing users to inject the drug by pressing against the skin. The needle covering is locked after injection to prevent needle piercing accidents.

Application:-

Oncology segment is the fastest-growing segment in Injectable Drug Delivery market share

The oncology segment is the fastest-growing segment in the injectable drug delivery market share and is expected to hold the market share over the forecast period.

The oncology segment is driving growth in the global injectable drug delivery market, driven by the increasing prevalence of cancer worldwide. With approximately 20 million new cancer cases reported in 2023, the need for effective treatment options is urgent. Injectable drug delivery systems are advantageous in oncology due to their ability to administer complex biologics and immunotherapies for targeted cancer treatments.

Moreover, key market players are developing advanced injectable devices and formulations, including self-injectable devices and smart injectors, to enhance patient compliance and minimize dosing errors and also launching novel products help the segmet to grow during the forecast period.

For instance, Amneal Pharmaceuticals, Inc. announced the launch of PEMRYDI RTU, the first and the only ready-to-use presetation of pemetrexed for injection. Unlike other presentations, this product does not require the cool condition of reconstitution and dilution.

Market Geographical Share

North America is expected to hold a significant position in the Injectable Drug Delivery market share

North America holds a substantial position in the injectable drug delivery market and is expected to hold most of the market share due to increasing burden of chronic illnesses among adults, particularly diabetes, cancer, and autoimmune disorders. Besides, advanced healthcare infrastructure, hefty investment in research and development, and the organization of leading pharmaceutical firms all make the region a great potential market contributor. Moreover, when favorably wrapped with increasing self-injection, such as with insulin pens and further biologics, the reimbursement policies are sufficient to drive up this growing market.

For instance, in October 2023, Enable Injections has received FDA approval for the EMPAVELI Injector for subcutaneous delivery of EMPAVELI (pegcetacoplan), a medication for adults with paroxysmal nocturnal hemoglobinuria. The compact, wearable injector streamlines self-administration and minimizes disruption to patients' daily lives, making it a valuable tool for the treatment of PNH.

Europe is growing at the fastest pace in the Injectable Drug Delivery market

Europe holds the fastest pace in the injectable drug delivery market and is expected to hold most of the market share due to Europe has a good regulatory framework in most major markets, thus favoring uptake of these advanced injectable solutions. The focus on patient-driven drug delivery - such as prefilled syringes - is increasing across Europe, while treatment modalities are directed at home to avoid and limit hospital visits. The investment opportunity in this market further solidifies Europe's foothold in the expansion of the market. The current condition of an aging population with an upsurge incidence of chronic diseases across the region is what drives demand for injectable therapy.

For instance, in November 2024, Swiss medical technology company Ypsomed's has signed a new contract with Danish drugmaker Novo Nordisk, which includes the supply of injection pens for CagriSema, the company's next-generation experimental obesity drug. This deal provides insight into Novo's long-term planning for commercial production for its drug candidates, which are still being tested and hoped to be more powerful successors to its popular Wegovy injection.

Major Global Players

The major global players in the injectable drug delivery market include Becton Dickinson & Company, Baxter International, Inc, Gerresheimer AG, Pfizer Inc, Schott AG, Terumo Corporation, SHL Medical, Owen Mumford, Ypsomed, Union Medico and among others.

Key Developments

- In January 2024, Credence MedSystems, a leading pharmaceutical drug delivery system innovator, has completed Factory Acceptance Testing (FAT) for the production of its Companion injection device platform on its new Clinical Assembly Line.

- In June 2023, Stevanato Group, S.p.A., has introduced Vertiva, an On-Body Delivery System (OBDS) designed for switching between basal and bolus injections and suitable for various subcutaneous therapies. The unique design includes a single-use pod with a pre-filled 3mL ISO cartridge and a multi-use controller, offering sustainability and affordability benefits. The device can adapt to different delivery profiles and administer small-molecule drugs and biologics.

| Metrics | Details | |

| CAGR | 5.8% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Device Type | Autoinjectors, Conventional injection devices, Pen Injectors, Wearable injectors, Others |

| Application | Oncology, Autoimmune Diseases, Hormonal Disorders Orphan Disease, Others | |

| Usage Pattern | Curative Care, Immunization, Other Usage Pattern | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global injectable drug delivery market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 186 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.