Market Overview

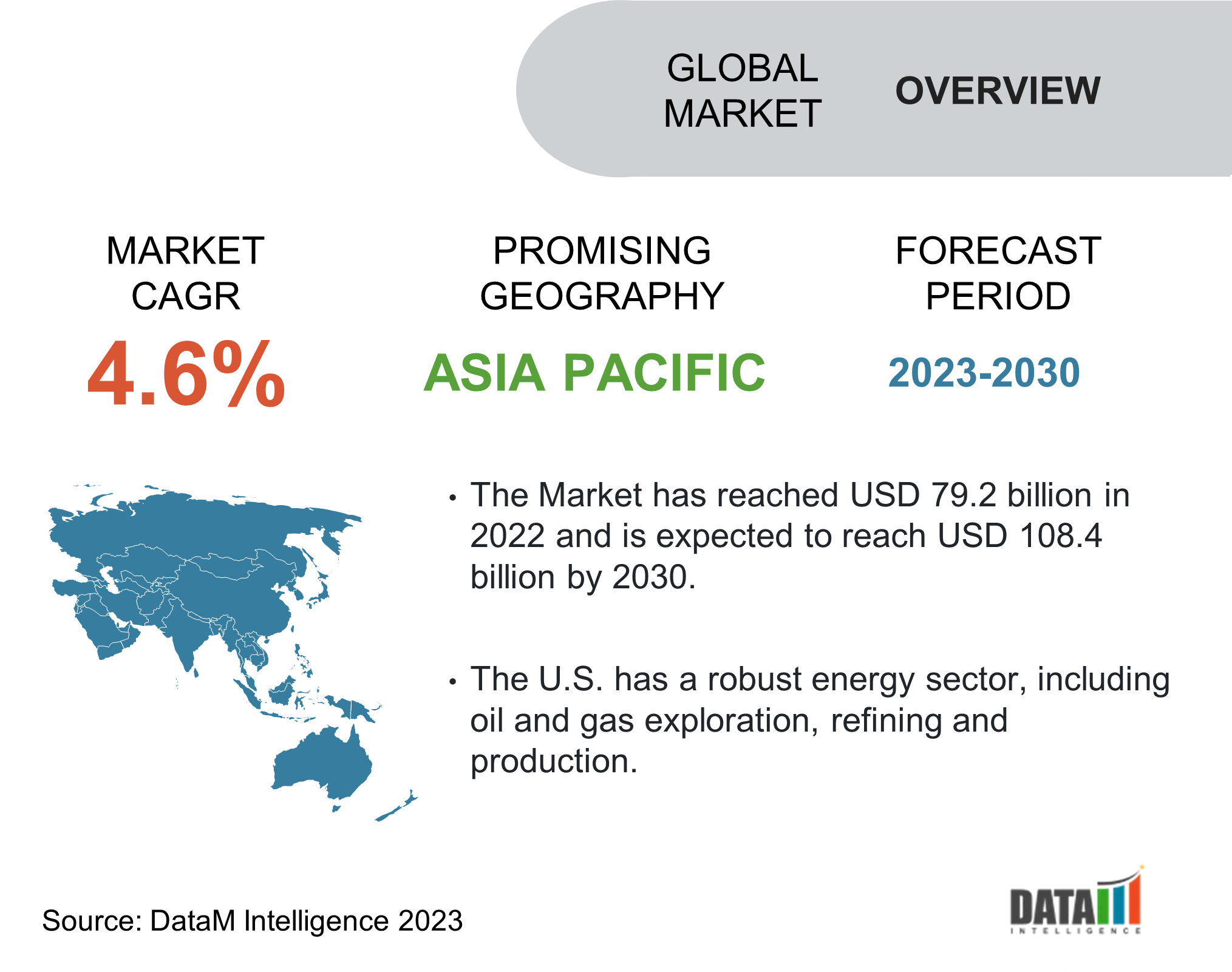

The Global Industrial Valve Market is growing a CAGR of 4.6% during the forecast period 2024-2031. The global industrial valve market is an important sector within the broader industrial equipment and machinery industry. The need for industrial valves has witnessed steady growth over the years, driven by several factors, including increasing demand for energy, particularly in emerging economies.

This fueled the expansion of industries such as oil and gas, power generation and petrochemicals, leading to higher demand for industrial valves. The shale revolution in the U.S. has led to a surge in domestic oil and gas production, creating a higher demand for industrial valves in the energy industry. The development of pipelines, LNG terminals and refining facilities has further driven the need for valves to control the flow and transport of hydrocarbons. Therefore, the U.S. accounted for around 80% of the regional market share in 2022.

Market Summary

| Metrics | Details |

| CAGR | 4.6% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Valve, Material, Size, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To know more Insights - Download Sample

Market Dynamics

Increasing Global Energy Demand

The growing demand for electricity, particularly in developing countries, fuels the expansion of the power generation sector. Developing countries often experience rapid economic growth and urbanization, which leads to increased energy needs.

As economies expand and urban areas grow, electricity is demanded to power industries, commercial establishments, residential buildings, and infrastructure projects. The power generation sector must expand to meet this rising demand, generating incremental opportunities for the global industrial valve market.

The shift towards renewable energy sources, such as solar and wind, also drives the growth of the industrial valve market. As renewable energy installations increase, there is a need for valves in various parts of the infrastructure, such as solar thermal plants, wind farms and hydroelectric dams. Valves play a role in controlling the flow of fluids, such as heat transfer fluids in solar thermal plants or regulating the flow of water in hydroelectric power plants.

Growing Need for New Power Plants and Upgrading of Existing Plants

The growing need for new power plants and upgrading of existing plants has a significant impact on driving the growth of the global industrial valve market. Industrial valves play a crucial role in regulating and controlling the flow of various fluids, such as water, steam, gas and oil, in power plants.

The increasing global demand for electricity, driven by population growth and industrialization, has led to constructing new power plants. These power plants require various industrial valves to handle various applications. For example, gate valves are used for isolation and control of fluid flow, globe valves for regulating flow and check valves for preventing backflow. The installation of new power plants directly drives the demand for industrial valves.

Industrial Valves' Propensity to Malfunction

Malfunctioning valves can result in unplanned downtime, causing disruptions in industrial processes. When valves fail to operate correctly, it can halt production, resulting in productivity loss and reduced overall efficiency. Industries, such as oil and gas, power generation and chemical manufacturing, heavily rely on continuous operations and any valve malfunction can have significant financial implications.

Valves require regular maintenance and occasional repairs to ensure their optimal performance. Malfunctioning valves may need to be replaced or repaired, leading to additional company expenses. The cost of downtime, replacement parts and labor for maintenance and repairs can strain the budget of industrial facilities. As a result, some organizations may delay or avoid investing in new valve installations or upgrades.

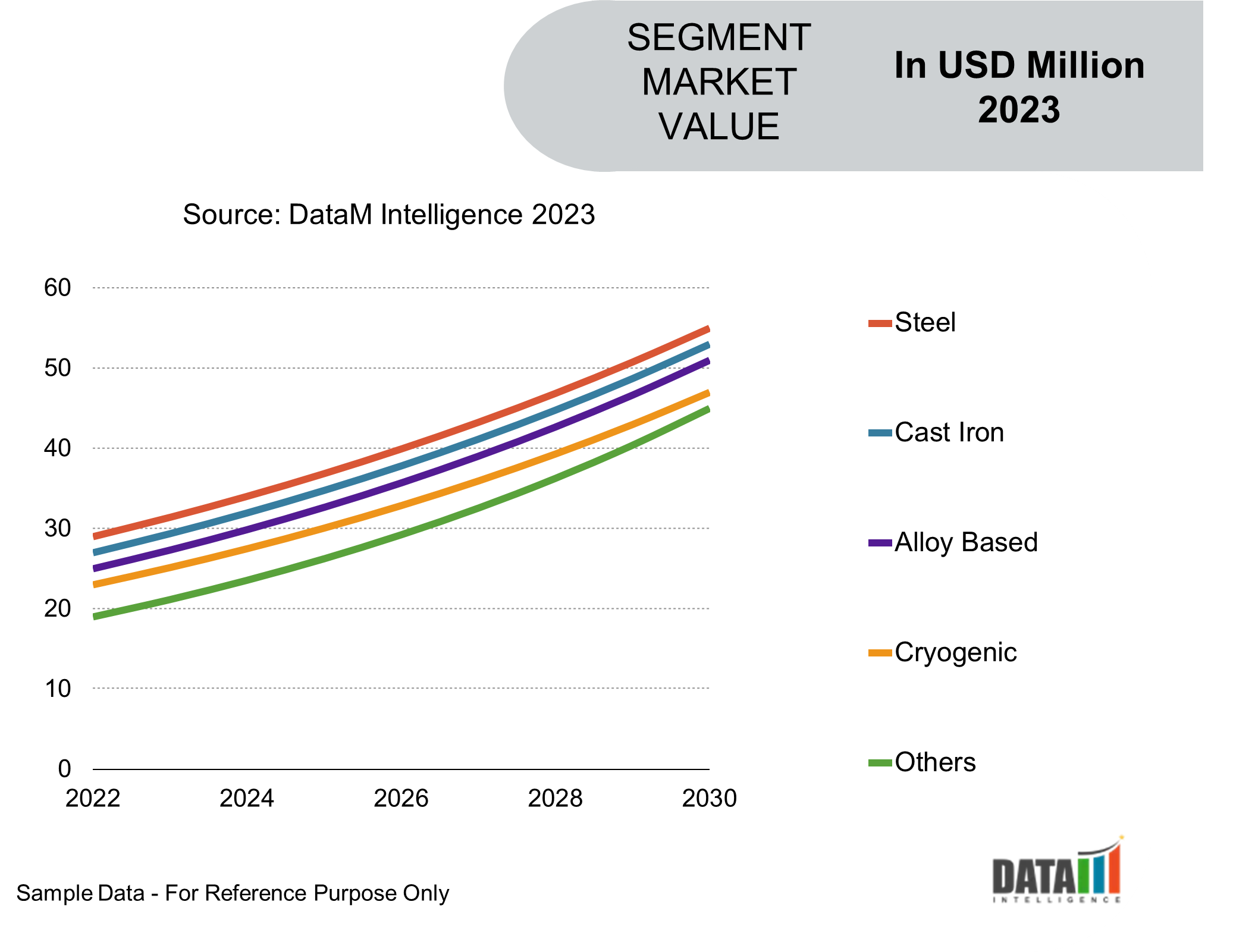

Market Segmentation Analysis

The Global Industrial valve market is segmented based on valve, material, size, application and region.

A Resilient Recovery and Manufacturing Growth Drives the Growth of the Oil & Gas

The oil & gas industry plays a vital role in the global industrial valve market and its growth is significantly driven by a resilient recovery and manufacturing expansion. The oil & gas industry experienced a downturn due to various factors such as fluctuating oil prices and the COVID-19 pandemic.

However, the industry has shown resilience and is witnessing a recovery. As the demand for oil & gas products and services increases, the need for industrial valves in this sector grows. Industrial valves are crucial in controlling the flow of fluids, gases and hydrocarbons in exploration, production, refining and transportation processes. The resilient recovery of the oil & gas industry fuels the demand for industrial valves, thus driving the growth of the oil & gas application segment.

According to OECD statistics, global industrial production increased by 7.2% in 2021, reaching its pre-pandemic level. Global manufacturing value added increased from 16.2% in 2015 to 16.9% in 2021 as a share of the total GDP. Similarly, the value of sales output in the European Union increased by nearly 14% from €4,581 billion in 2020 to €5 209 billion in 2021. Hence, the oil & gas application segment holds more than 31.5% of the global segmental share and is expected to dominate during the forecast period.

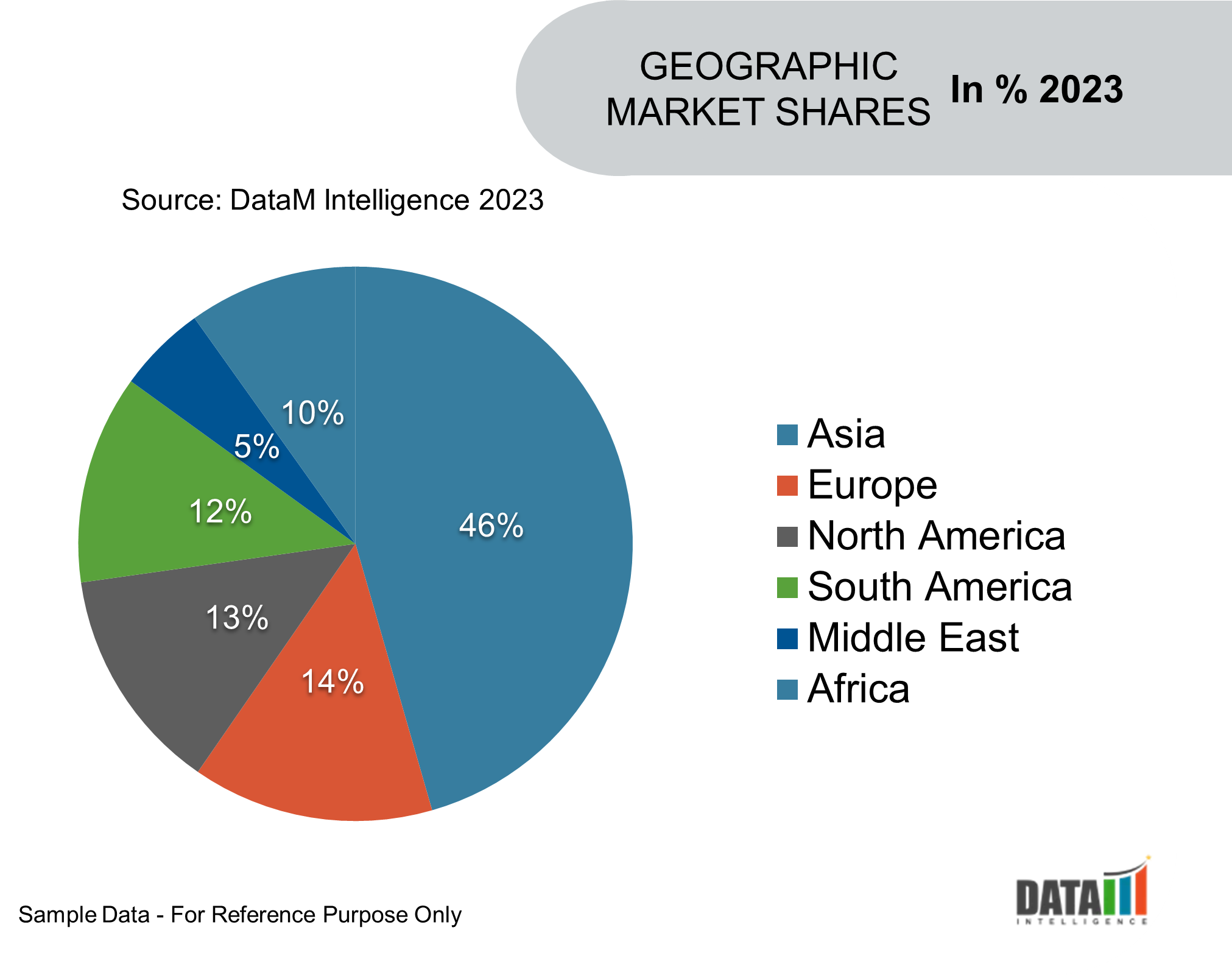

Market Geographical Share

Emerging Opportunities in China Driven by Fuel Demand and Power Generation, Powering the Asia-Pacific Market

Major companies with Chinese headquarters are also consistently introducing high-quality products at affordable prices. Additionally, they use a variety of tactical approaches in an attempt to penetrate into lucrative markets. Additionally, the need for fuel has increased due to population growth and an increase in car sales in China, India and other Asian countries.

According to the U.S. Energy Information Administration (EIA), China now produces 4.9 million barrels of oil and other liquids every day. In order to keep up with this rise in fuel use, the government and other oil and gas companies are on the search for more reserves. As a result, the market for industrial valves in the country will expand. Therefore, Asia-Pacific is expected to hold largest market share in the global industrial valve market during the forecast period.

Industrial Valve Key Players

The major global players include AVK Holding A/S, Avcon Controls Pvt Ltd, Cameron – Schlumberger, Crane Co., Emerson, Flowserve Corporation, Forbes Marshall, Bosch Rexroth, Kitz Corporation and Metso Corporation.

COVID-19 Impact on Market

COVID Impact

Lockdown measures, travel restrictions and temporary closures of manufacturing facilities resulted in delays in the production and delivery of industrial valves. The reduced availability of raw materials and components further affected the supply chain, leading to challenges in meeting market demand.

The economic downturn caused by the pandemic led to a decline in demand for industrial valves across various sectors. Industries such as oil and gas, petrochemicals, power generation and water and wastewater treatment experienced a slowdown in their operations, resulting in reduced investment in valve procurement and replacement projects. The uncertain market conditions and financial constraints faced by companies contributed to a decrease in demand for industrial valves.

AI Impact

Artificial intelligence (AI) is revolutionizing the global industrial valve market in several ways, leading to improved efficiency, productivity and reliability. AI-powered systems can analyze sensor data to predict valve failures before they occur. For instance, by monitoring factors like valve temperature, pressure and vibration, AI algorithms can identify patterns indicative of potential issues. Based on this analysis, maintenance teams can proactively schedule repairs or replacements, preventing costly downtime. This predictive maintenance approach minimizes disruptions and optimizes valve performance.

AI enables real-time condition monitoring of valves. By continuously analyzing sensor data, AI algorithms can detect abnormalities or deviations from normal operating conditions. For example, if a valve's flow rate is inconsistent with historical patterns, AI can trigger alerts to indicate a potential problem. Maintenance teams can then investigate the issue and take corrective action promptly, ensuring optimal valve functionality.

Russia-Ukraine War Impact

Russia is a major supplier of energy to Europe, primarily through pipelines. Industrial valves are crucial components in the transportation and distribution of oil and gas, ensuring efficient and safe operations. As a result, the European energy sector heavily relies on valves sourced from Russia.

The conflict between Russia and Ukraine has led to geopolitical tensions, which can disrupt the supply chain of industrial valves. The manufacturing and distribution of valves may be affected due to trade restrictions, customs issues or transportation challenges. This can lead to delays in deliveries and increased costs for European buyers.

Therefore, the Russia-Ukraine war has introduced uncertainties and challenges to the global industrial valve market, including the European sector. However, the exact impact can vary depending on specific circumstances, geopolitical developments and the resilience of the industry to adapt to changing dynamics.

Key Developments

- On August 22, 2022, An operating company of Helios Technologies, Inc., Sun Hydraulics, just launched a new programme. Sun Common cartridge valves have been developed to provide cross compatibility options and they are reliable, versatile solutions for a wide range of hydraulic systems, from extremely demanding applications needing multidirectional fluid flow to simpler, lower pressure requirements.

- On February 4, 2020, After launching their most latest version of their renowned large-bore, high-pressure API 6A gate valve products, AWC Frac Valves, Inc. rebranded as AWC Frac Technology to kick out 2020 and shifts its emphasis to innovative new solutions for the full frac stack.

- On April 4, 2019, With the launch of a small, simple solenoid valve, Eaton is improving the precision of fluid control in off-highway vehicles. Compared to other presently accessible five-ported directional control valves, the new five-way, three-position proportional ESVL9 screw-in cartridge valve (SiCV) has a built-in load-sense check control and offers a 21% reduction in manifold size.

Why Purchase the Report?

- To visualize the Global Industrial Valve market segmentation based on valve, material, size, application and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous industrial valve market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Industrial Valve Market Report Would Provide Approximately 69 Tables, 81 Figures And 241 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies