Global Industrial Control Systems (ICS) Security Market: Industry Outlook

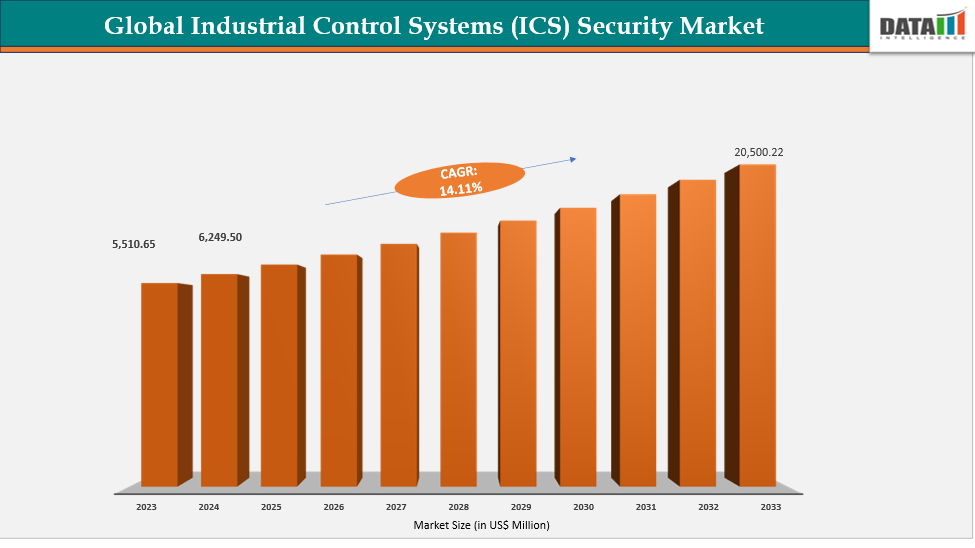

The Global Industrial Control Systems (ICS) Security Market reached US$ 5,510.65 million in 2023, with a rise to US$ 6,249.50 million in 2024, and is expected to reach US$ 20,500.22 million by 2033, growing at a CAGR of 14.11% during the forecast period 2025–2033.

The global industrial control systems (ICS) security market is expanding rapidly as industries throughout the world update their processes and integrate digital technology into critical infrastructure. ICS settings, such as Supervisory Control and Data Acquisition (SCADA) systems, Distributed Control Systems (DCS) and Programmable Logic Controllers (PLCs), were formerly isolated, but their greater accessibility to company IT and cloud platforms has made them vulnerable to cyber attacks. The growing convergence of IT and OT (Operational Technology) is creating a significant need for robust security solutions spanning from intrusion detection and anomaly monitoring to secure remote access and sophisticated threat intelligence

In recent years, several high-profile instances have demonstrated industrial network vulnerabilities. Attacks on power grids, oil and gas facilities and manufacturing units have highlighted the risk of interruption to critical services and even national security. In response, governments and regulatory organizations in North America, Europe and Asia-Pacific have implemented stronger cybersecurity frameworks and standards, including the NIST Cybersecurity Framework, the EU's NIS2 Directive and IEC 62443. The rules compel critical infrastructure operators to invest extensively in ICS security technologies and managed services, with many incorporating artificial intelligence, machine learning and zero-trust architectures to improve resilience.

The ICS security market is likely to gain demand from rapid digitalization, the implementation of Industry 4.0 initiatives and the increased deployment of Industrial Internet of Things (IIoT) devices. The investment impetus is obvious, with both private-sector operators and state institutions prioritizing ICS security as a strategic pillar to maintain operational continuity and national security.

Key Market Trends & Insights

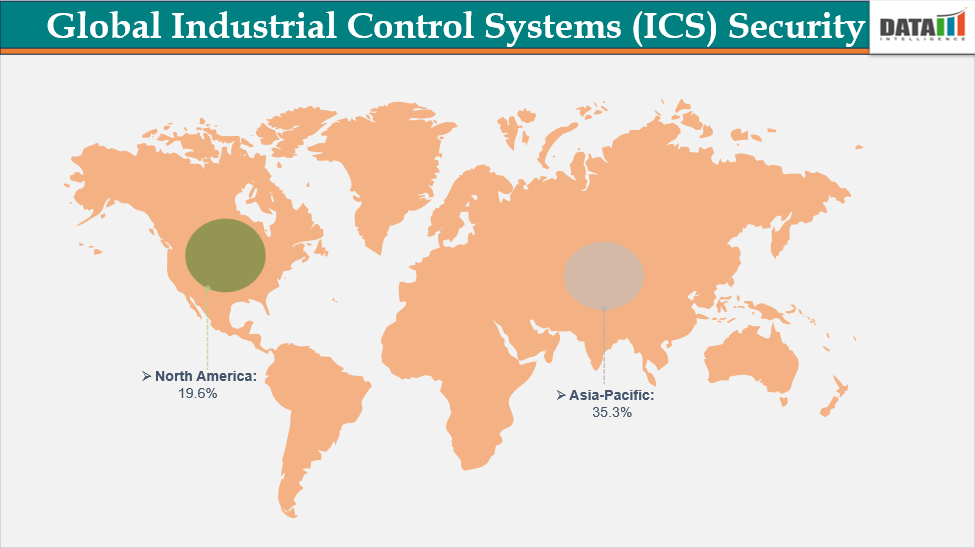

- Asia-Pacific is the largest ICS market, supported by China’s 70,000+ smart factories and Japan’s 60% adoption of ICS-enabled smart manufacturing, making the region the global hub for industrial modernization.

- North America is the fastest-growing region, with the US DOE and CISA driving large-scale ICS integration in utilities, oil & gas, and critical infrastructure modernization projects.

- A major impacting insight is the rising prioritization of ICS cybersecurity, as ENISA reported in 2024 that over 60% of European operators faced supply chain-related ICS risks, pushing governments to enforce stricter compliance and accelerate adoption of secure ICS frameworks.

Market Size & Forecast

- 2024 Market Size: US$ 6,249.50 million

- 2033 Projected Market Size: US$ 20,500.22 million

- CAGR (2025–2033): 14.11%

- Asia Pacific: Fastest growing market in 2024

- North America: Largest market

Market Dynamics

Driver: Rapid Adoption of Smart Manufacturing and Industry 4.0 Initiatives Enhancing ICS Integration

Rapid adoption of smart manufacturing and Industry 4.0 initiatives is driving growth in the Global Industrial Control Systems (ICS) Security Market, as industries increasingly automate and digitize operations. According to Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK), over 50% of manufacturers adopted Industry 4.0 solutions by 2023, heavily reliant on ICS platforms for process control and monitoring. In China, the Ministry of Industry and Information Technology (MIIT) reported over 70,000 digital workshops and smart factories established by 2024, each integrating ICS-driven automation. These initiatives highlight how government-backed modernization programs are accelerating ICS deployment across global manufacturing and critical infrastructure sectors.

Restraint: Rising Vulnerability of ICS to Cybersecurity Threats and Operational Disruptions

Rising vulnerability to cyberattacks is restraining the growth of the Global Industrial Control Systems (ICS) Security Market, as critical infrastructure faces heightened risks. The US Cybersecurity and Infrastructure Security Agency (CISA) reported that in 2023, ICS-targeted incidents increased by over 20%, particularly in energy and water sectors, disrupting essential operations. Similarly, the European Union Agency for Cybersecurity (ENISA) highlighted that more than 60% of industrial operators reported supply chain-related ICS cyber risks in 2024, underscoring the growing challenge of ensuring resilient and secure system operations.

For more details on this report, Request for Sample

Segmentation Analysis

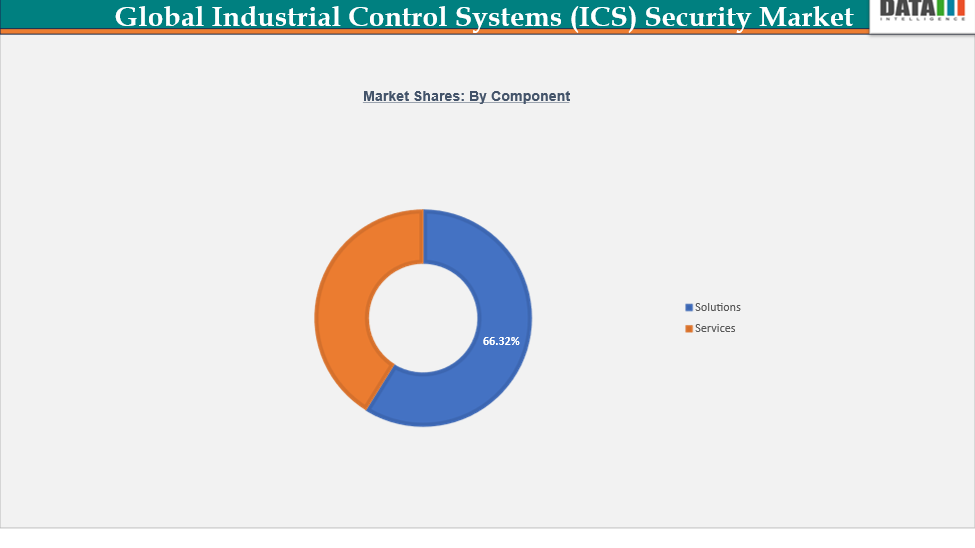

The Global Industrial Control Systems (ICS) Security Market is segmented based on component, security type, end-user, and region.

Component: Solutions segment is estimated to have 42.7% of the industrial control systems (ICS) market share.

The Solutions segment, estimated to account for the largest share of the industrial control systems (ICS) market, is driven by widespread adoption of advanced automation and digital platforms in critical industries. In Japan, the Ministry of Economy, Trade and Industry (METI) reported in 2023 that more than 60% of manufacturers have deployed ICS-integrated smart factory solutions, reflecting the heavy reliance on software-driven control and monitoring platforms.

In the US, the Department of Energy’s 2024 Grid Modernization Initiative highlighted that over two-thirds of utilities are integrating advanced ICS solutions into their operations to improve grid resilience and reduce downtime. Similarly, China’s Ministry of Industry and Information Technology (MIIT) noted that digital workshop initiatives have scaled to more than 70,000 facilities by mid-2024, powered largely by ICS solutions that integrate automation, monitoring, and cybersecurity.

The growth of the Solutions segment is further reinforced by increasing government-backed cybersecurity standards and smart manufacturing incentives worldwide. The European Union Agency for Cybersecurity (ENISA) in 2024 mandated enhanced ICS security frameworks for operators of essential services, driving adoption of advanced ICS solutions across energy and industrial sectors. Meanwhile, South Korea’s Manufacturing Innovation 3.0 program has facilitated the deployment of ICS-driven automation solutions in over 20,000 small- and medium-scale factories, underscoring the reliance on ICS platforms for industrial efficiency and resilience. With governments prioritizing resilient supply chains, energy transition, and industrial modernization, the Solutions segment remains the cornerstone of global ICS adoption.

Geographical Analysis

The Asia-Pacific industrial control systems (ICS) market was valued at 35.3% market share in 2024

The Asia-Pacific ICS cybersecurity market is entering a strong growth phase from 2024 to 2026, fueled by industrial modernization and regulatory action. China’s Ministry of Industry and Information Technology announced a strategy in February 2024 to secure more than 45,000 industrial enterprises and neutralize major cyber risks by the end of 2026. Similarly, New Zealand’s Reserve Bank introduced new cyber-incident reporting standards in 2024, signaling rising oversight for critical systems across the region.

Escalating cyber threats are reshaping operational technology (OT) security priorities. Attacks such as the Midnight Blizzard intrusion reported by Microsoft in 2024 highlight how sophisticated actors exploit remote-access gaps and identity weaknesses. Asia-Pacific operators are increasingly adopting zero-trust frameworks, segmentation, and advanced identity management to protect industrial assets and minimize operational disruptions.

Capacity-building initiatives are expanding cybersecurity skills and collaboration. For instance, Japan’s METI and ICSCoE, with US and EU partners, hosted the JP-US-EU ICS Cybersecurity Week in November 2024, focusing on supply chain resilience, AI-driven attack simulations, and incident response for Indo-Pacific participants.

Technology alliances are also transforming ICS security. For instance, in May 2025, Honeywell partnered with Nutanix to integrate its Experion PKS with Nutanix’s hybrid-cloud platform, creating a modern, secure infrastructure for industrial control systems. Scheduled for the second half of 2025, the solution is designed for energy, manufacturing, chemical, and pharmaceutical operations across Asia-Pacific, enabling scalable, resilient, and cost-efficient environments for critical control applications.

The North America Industrial Control Systems (ICS) market was valued at 19.6% market share in 2024

North America, while smaller in absolute volume compared to Asia-Pacific, is the fastest-growing ICS market due to heightened investment in cybersecurity and modernization of legacy systems. The US Department of Energy noted in 2024 that over 65% of utilities are deploying ICS-based digital control systems to improve energy grid resilience under the Grid Modernization Initiative.

Similarly, the US Cybersecurity and Infrastructure Security Agency (CISA) highlighted that ICS cybersecurity incidents in North America increased by 35% year-on-year in 2023, prompting accelerated adoption of secure and modern ICS platforms across energy, manufacturing, and transportation. In Canada, Infrastructure Canada’s funding of USD 1.5 billion toward smart industrial automation in 2024 further underlines the region’s rapid momentum.

Competitive Landscape

The Global Industrial Control Systems (ICS) Security Market features several prominent players, ABB, Cisco Systems, Inc., Check Point Software Technologies Ltd, Fortinet, Inc., Honeywell International Inc., IBM, AO Kaspersky Lab, Microsoft, Siemens, and Nozomi Networks Inc.

Among these, Cisco Systems, Inc. plays a leading role in strengthening supply chain cybersecurity. The company offers end-to-end zero-trust architecture, threat intelligence, and advanced network protection solutions tailored to critical industries. Cisco collaborates with US federal agencies to secure vendor ecosystems against ransomware and state-backed attacks, with initiatives under the Department of Homeland Security’s supply chain risk management programs. Its global presence ensures resilient cybersecurity frameworks across finance, manufacturing, and defense supply chains.

Market Scope

| Metrics | Details | |

| CAGR | 14.11% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Security Type | Endpoint Security, End-User Security, Network Security, Database Security | |

| Component | Solutions, Services | |

| End-User | Automotive and Transportation, IT & Telecom, Energy & Utilities, Healthcare, Manufacturing, Retail and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The Global Industrial Control Systems (ICS) Security Market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 230 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here