Industrial Coatings Market Size

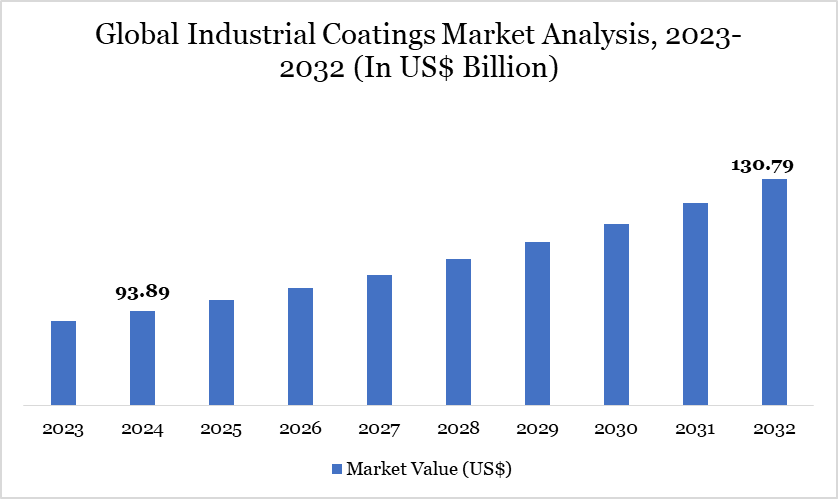

Industrial Coatings Market Size reached US$ 93.89 billion in 2024 and is expected to reach US$ 130.79 billion by 2032, growing with a CAGR of 4.23% during the forecast period 2025-2032.

The global industrial coatings market is seeing significant growth, driven by rising demands in sectors such as automotive, aerospace, construction and manufacturing. These sectors consistently pursue high-performance coatings that improve product durability, provide barrier protection and preserve aesthetic appeal in adverse environmental circumstances.

Industrial coatings have become essential for maintaining product reliability and operational durability. The focus on performance has resulted in increased investments in research and development, promoting innovation in formulations, application techniques and end-use efficiency. Corporations are prioritizing technological advancement to meet functional demands and sustainability issues.

The market is marked by a transition towards environmentally sustainable solutions, such as powder and aqueous coatings, in reaction to stringent global emission restrictions. The ongoing advancement in coating chemistries and technologies presents appealing prospects for manufacturers and investors, particularly for those who can provide value-added, durable and environmentally sustainable solutions.

Industrial Coatings Market Trend

A significant change in the industrial coatings market is the increasing incorporation of ecologically sustainable attributes. This tendency is predominantly driven by rigorous rules in the European Union designed to reduce volatile organic compound (VOC) emissions during a coating's lifecycle. Consumers are progressively favoring powder and water-based coatings instead of conventional solventborne options, in accordance with global sustainability objectives. The European Commission's implementation of the Eco-product Certification Scheme (ECS) strengthens this transition by requiring coatings to have minimal or no VOC emissions.

Concurrently, technology innovations like Artificial Intelligence (AI) and the Internet of Things (IoT) are transforming manufacturing processes. Artificial Intelligence augments error prediction and process optimization, whilst the Internet of Things boosts maintenance efficiency, remote monitoring and real-time asset tracking.

Deloitte reports that IoT-enabled predictive maintenance can decrease planning time by as much as 50% and maintenance expenses by 10%. These advanced technologies are essential in optimizing operations and improving coating quality, signifying a permanent transition towards data-driven and intelligent manufacturing systems.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Type | Acrylic, Alkyd, Polyester, Polyurethane, Epoxy, Fluoropolymer, Others |

| By Technology | Solventborne Coatings, Waterborne Coatings, Powder Coatings, Others |

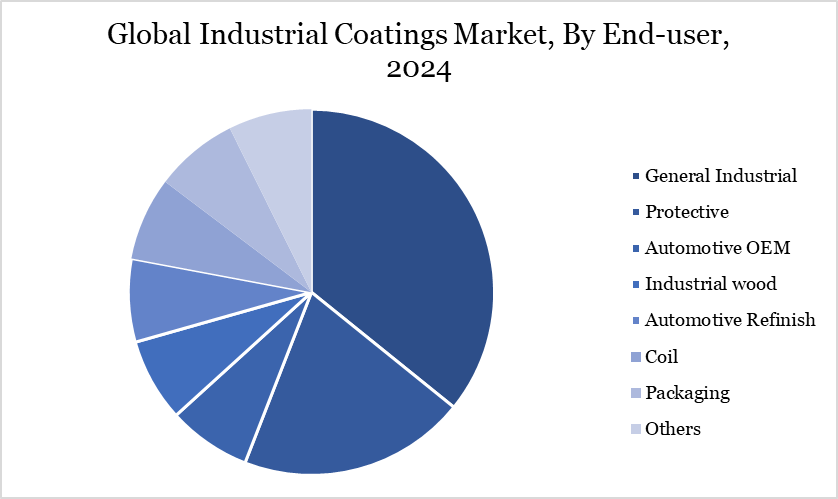

| By End-user | General Industrial, Protective, Automotive OEM, Industrial Wood, Automotive Refinish, Coil, Packaging, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Industrial Coatings Market Dynamics

Environmental Regulations Transform Consumer Preferences and Innovation

The industrial coatings market is significantly influenced by the enforcement of stringent environmental rules, especially in the European Union and Western countries like the US. These standards require significant decreases in VOC emissions across all phases of a coating's lifecycle. Consequently, there has been a notable surge in demand for environmentally friendly alternatives such as powder and aqueous coatings, regarded as safer and more sustainable than solvent-based systems.

The Eco-product Certification Scheme (ECS) functions as a regulatory standard, motivating manufacturers to develop coatings with a reduced environmental impact. This paradigm change is prompting manufacturers to revise conventional formulations and embrace green chemical concepts. Regulatory restrictions are serving as a spur for innovation, driving the rapid advancement of high-performance, VOC-free solutions.

Limitations of Powder Coatings

Industrial powder coatings encounter a significant constraint in producing thin films, hence limiting their use in specific industrial contexts. While these coatings provide consistent material distribution, enhanced flow characteristics and edge build-up management, traditional treatments frequently yield thicker surfaces. This is a problem, particularly when thin and smooth coatings are critical, as in decorative or optical applications. Polyurethane resins have potential for producing thinner coatings owing to advantageous flow properties and economic viability.

Nonetheless, obstacles remain in attaining the requisite substrate smoothness and sufficient surface wetting, both of which are essential for effective thin-film application. Reproducing the smooth, uniform application commonly attained with liquid paint systems continues to pose a technological challenge. The limitations highlight the necessity for more research and development in formulation and application methods to improve the adaptability of powder coatings in precision-oriented applications.

Industrial Coatings Market Segment Analysis

The global industrial coatings market is segmented based on type, technology, end-user and region.

General Industry Fuels Expansion of Coating Technologies

The general industrial leads the industrial coatings market owing to its extensive utilization in conventional manufacturing and infrastructure sectors. This supremacy is propelled by the demand for coatings that provide superior corrosion resistance, chemical resilience and UV protection, all of which aid in minimizing maintenance expenses and prolonging equipment longevity.

As infrastructure development intensifies, especially in emerging economies with growing middle-class populations, the demand for such coatings persists in its upward trajectory. The sector also gains from the use of sustainable solutions, including low and ultra-low VOC formulations, in accordance with changing regulatory criteria. These coatings are progressively utilized in wood items, furniture and ACE (agricultural, construction and earthmoving) machines, necessitating several coating methods customized for intricate surfaces.

Powder coatings are increasingly favored for their low environmental impact and superior performance on small metal components. As enterprises emphasize cost-effectiveness and environmental adherence, the general industrial subsegment is poised for continuous expansion.

Industrial Coatings Market Geographical Share

North America’s Regulatory Framework and R&D Investments Propel Expansion

The industrial coatings market in North America is experiencing significant expansion, propelled by regulatory compliance and heightened research and development investments. The U.S. government has implemented rigorous regulations on air pollution, specifically focusing on VOC emissions, per overarching federal environmental objectives. This regulatory environment is driving manufacturers to implement low-VOC or VOC-free technology, resulting in an increased need for sustainable coatings.

Furthermore, North American firms are allocating resources towards innovation, especially in smart coatings that have self-healing capabilities and environmental adaptability. These coatings are essential in industries such as aircraft and automotive, where operational reliability and product durability are crucial. North America's aggressive stance on sustainability and its leadership in technological integration establish it as a leader in the changing global coatings sector.

Sustainability Analysis

Sustainability has transitioned from a marginal issue to a fundamental component of the industrial coatings sector. Sustainability measures are integrated at every stage of the value chain, from raw material selection to end-product performance. Manufacturers are progressively utilizing natural and recyclable components, like oyster shell powder, which has demonstrated the capacity to substitute 25%–55% of calcium carbonate in emulsion wall paints in Vietnam. This substitute satisfies technical criteria and enhances viscosity and drying time, albeit with certain restrictions in application ease at elevated ratios.

Initiatives to diminish the ecological footprint encompass limiting pollutant emissions, optimizing energy consumption and decreasing waste production. VOC-free coatings are fundamental to these endeavors, directly tackling environmental and health issues. Green coatings adhere to the tenets of the circular economy, promoting effective resource utilization and waste reclamation. With increasing consumer awareness, the demand for coatings that are both high-performing and environmentally sustainable is anticipated to persist, solidifying sustainability as a long-term industry necessity.

Industrial Coatings Market Major Players

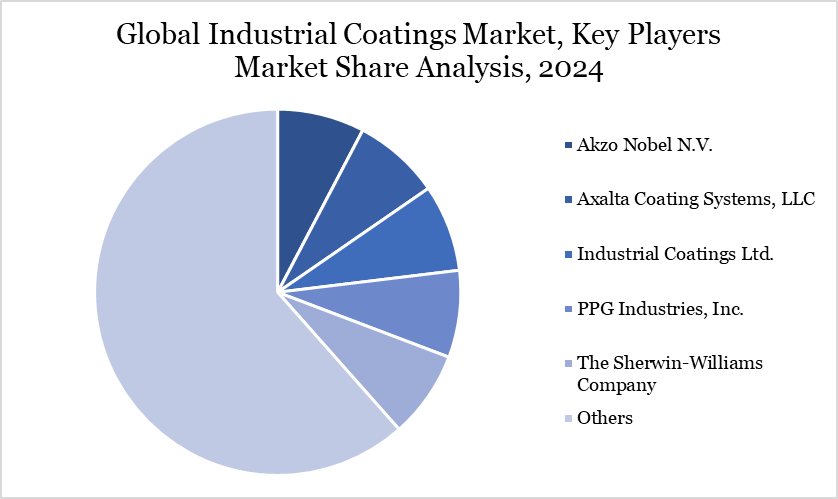

The major global players in the market include Akzo Nobel N.V., Axalta Coating Systems, LLC, Industrial Coatings Ltd., PPG Industries, Inc., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., RPM International Inc., BASF SE, PPG Asian Paints Pvt Ltd.

Key Developments

In March 2023, AkzoNobel launched the Interpon ACE powder coating range to meet the high demands in the Agricultural and Construction Equipment (ACE) sector. AkzoNobel launches Interpon ACE powder coating range to meet the high demand in the Agricultural and Construction Equipment (ACE) sector.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies