Incretin-Based Drugs Market Overview

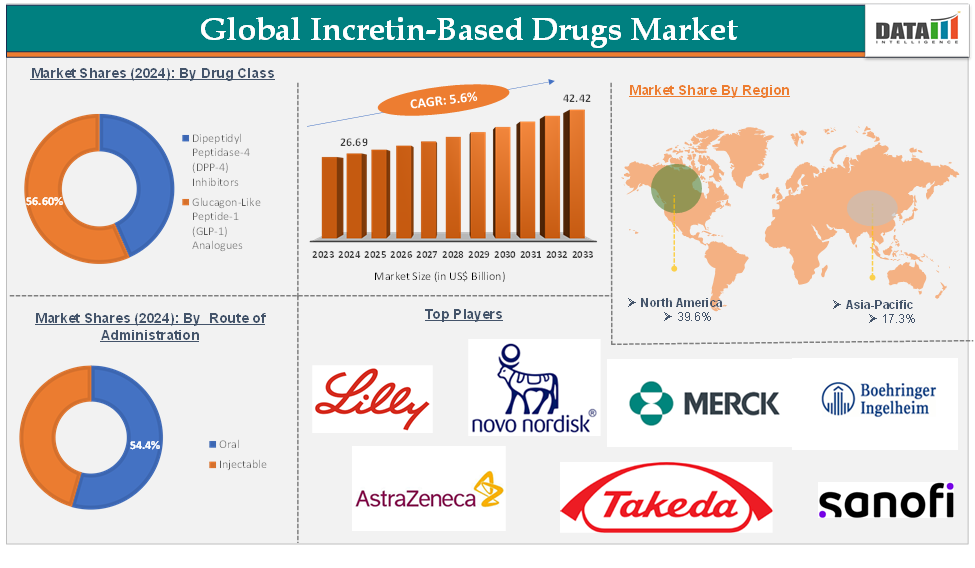

Incretin-Based Drugs Market reached US$ 26.69 Billion in 2024 and is expected to reach US$ 42.42 Billion by 2033, growing at a CAGR of 5.6% during the forecast period 2025-2033, according to DataM Intelligence report.

Incretin-based drugs are a class of antidiabetic medications designed to mimic the effects of incretin hormones, which are naturally produced by the body to help regulate insulin secretion in response to food intake. These drugs are primarily used to treat type 2 diabetes and are recognized for their effectiveness, safety, and ease of use.

Incretin-based drugs are mainly of two types: one is the dipeptidyl peptidase-4 (DPP-4) inhibitors, which include medications such as alogliptin, linagliptin, saxagliptin, and sitagliptin. DPP-4 inhibitors work by blocking the enzyme DPP-4, which breaks down incretin hormones. By inhibiting this enzyme, these drugs prolong the action of incretins, resulting in increased insulin secretion and decreased glucagon levels when blood sugar levels are elevated.

Another one is the glucagon-like peptide-1 (GLP-1) analogues. This group includes drugs like albiglutide, dulaglutide, exenatide, liraglutide, and lixisenatide. GLP-1 analogues mimic the action of the natural hormone GLP-1, enhancing insulin secretion in a glucose-dependent manner, slowing gastric emptying, and promoting satiety, which can aid in weight loss. These factors have driven the global incretin-based drugs market expansion.

Executive Summary

For more details on this report – Request for Sample

Incretin-Based Drugs Market Dynamics: Drivers

Increasing prevalence of type 2 diabetes

The increasing prevalence of type 2 diabetes significantly drives the growth of the global incretin-based drugs market. According to the Centers for Disease Control and Prevention (CDC) data in May 2024, about 1 in 10 Americans has diabetes, with the majority diagnosed with type 2 diabetes. The prevalence of type 2 diabetes is rising, particularly among children, teenagers, and young adults, a trend that has become increasingly concerning in recent years.

While type 2 diabetes typically develops in individuals aged 45 and older, more young people are now being diagnosed with this condition than in the past. However, it is important to note that type 2 diabetes can often be prevented or delayed through lifestyle changes such as improved diet and increased physical activity.

Currently, more than 38 million Americans are living with diabetes, and approximately 90% to 95% of these cases are attributed to type 2 diabetes. All these factors demand the global incretin-based drugs market.Moreover, the rising demand for growing awareness and R&D activities contributes to the global incretin-based drugs market expansion.

Global Incretin-Based Drugs Market Dynamics: Restraints

Lack of supportive reimbursement policies

The lack of supportive reimbursement policies will hinder the growth of the global incretin-based drugs market. Reimbursement policies for incretin-based drugs, such as DPP-4 inhibitors and GLP-1 receptor agonists, often vary significantly across healthcare jurisdictions. In many countries, these medications may be reimbursed under specific conditions, such as requiring prior treatment with metformin or other first-line therapies. This can create barriers for patients who do not meet these criteria, limiting their access to potentially effective treatments.

Many newer incretin-based therapies are not fully covered by insurance plans or may only be available under limited use (LU) or exceptional use (EU) categories. For instance, in Canada, while single-drug products of DPP-4 inhibitors and GLP-1 agonists are often reimbursed, fixed-dose combination (FDC) products may not receive any reimbursement at all. This inconsistency can discourage healthcare providers from prescribing these medications due to concerns about patient affordability. Thus, the above factors could be limiting the global incretin-based drugs market's potential growth.

Incretin-Based Drugs Market Segment Analysis

The global incretin-based drugs market is segmented based on drug class, route of administration, distribution channel, and region.

Drug Class:

The glucagon-like peptide-1 (GLP-1) analogues drug class segment is expected to hold 56.6% of the global incretin-based drugs market in 2024

Glucagon-like peptide-1 (GLP-1) agonists, also referred to as GLP-1 receptor agonists, incretin mimetics, or GLP-1 analogs, are a class of medications utilized in the treatment of type 2 diabetes mellitus (T2DM) and, in certain cases, obesity. Notable examples of drugs in this category include Exenatide, Liraglutide, Dulaglutide, and Semaglutide.

As per the American Diabetes Association (ADA), metformin continues to be the preferred first-line therapy for T2DM. However, the addition of a GLP-1 analogue is recommended for patients who either have contraindications or intolerances to metformin, those with a hemoglobin A1c (HbA1c) level exceeding 1.5% above target, or patients who do not achieve their target HbA1c within three months. This is particularly relevant for individuals with atherosclerosis, heart failure, or chronic kidney disease.

According to the National Center for Biotechnology Information (NCBI) research publication in February 2024, Semaglutide and high-dose Liraglutide have received FDA approval as pharmacologic treatments for obesity and can be prescribed for overweight patients with comorbidities. Research is ongoing regarding the use of GLP-1 analogs in patients with type 1 diabetes mellitus (T1DM), showing favorable results in terms of HbA1c reduction and weight loss. However, challenges such as higher costs and tolerability issues remain significant barriers to the widespread prescription of these medications.

Incretin-Based Drugs Market Geographical Analysis

North America is expected to hold 39.6% of the global incretin-based drugs market in 2024

The increasing prevalence of diabetes, particularly type 2 diabetes (T2DM), is a major driver for the demand for incretin-based drugs in North America. According to the International Diabetes Federation (IDF), approximately 49.3 million adults in North America will be living with diabetes in 2021, with projections indicating this number could exceed 55 million by 2030.

Additionally, high obesity rates around 29.4% in Canada are closely linked to the development of T2DM, further fueling the need for effective treatment options such as GLP-1 receptor agonists and DPP-4 inhibitors. North America hosts a significant number of pharmaceutical companies specializing in diabetes care, including major players like Novo Nordisk, Eli Lilly, AstraZeneca, and Merck & Co. This concentration fosters competition and innovation, leading to the development of new therapies that can capture market share.

The North American market is characterized by a steady stream of product launches and regulatory approvals for new incretin-based therapies. This continuous innovation enhances the treatment options available to healthcare providers and patients, driving market growth. Recent approvals for oral formulations of GLP-1 analogues have particularly improved accessibility and compliance among patients.

For instance, in December 2024, the American Diabetes Association (ADA) issued a new guidance statement advising against the use of compounded GLP-1 receptor agonist (GLP-1 RA) and dual GIP/GLP-1 RA medications that are not approved by the Food & Drug Administration (FDA). The ADA cites concerns about the uncertain content, safety, quality, and effectiveness of these non-FDA-approved compounded products. Thus, the above factors are consolidating the region's position as a dominant force in the global incretin-based drugs market.

Asia-Pacific is expected to hold 17.3% of the global incretin-based drugs market in 2024

The increasing incidence of type 2 diabetes (T2DM) and obesity in the APAC region is a major driver for the demand for incretin-based drugs. The World Health Organization (WHO) has reported alarming trends in diabetes prevalence, with millions of individuals affected. Countries like India and China have some of the highest diabetes rates globally, necessitating effective treatment options such as GLP-1 receptor agonists and DPP-4 inhibitors.

There has been a marked increase in awareness about diabetes management and treatment options among healthcare professionals and patients in the APAC region. Many governments in the APAC region are implementing policies to improve healthcare access and promote diabetes management. These initiatives often include subsidizing medications, enhancing healthcare infrastructure, and launching public health campaigns that encourage early diagnosis and treatment.

Innovations in drug delivery systems, including needle-free injection devices and oral formulations of GLP-1 analogues, are enhancing patient compliance and convenience. These advancements are critical in encouraging the use of incretin-based therapies among patients who may be hesitant to use injectable medications.

India is often referred to as the "diabetes capital of the world," with a staggering prevalence of diabetes affecting approximately 74 million adults, as reported by the International Diabetes Federation (IDF). This number is projected to escalate to 125 million by 2045, representing a nearly 70% increase in the diabetic population.

Incretin-Based Drugs Market Major Players

The major global players in the incretin-based drugs market include Eli Lilly and Company, Novo Nordisk, Merck & Co., Inc., AstraZeneca, Boehringer Ingelheim, Inc., Sanofi, Takeda Pharmaceutical Company Limited, Novartis AG, and Bristol-Myers Squibb Company, among others.

Key Developments

In November 2024, Hanmi Pharm. Co., Ltd. has unveiled promising research on its novel obesity drug, HM17321, which not only promotes fat loss but also significantly boosts lean muscle mass, a major advancement over current GLP-1 therapies that can cause muscle loss during weight reduction. As a peptide-based treatment, HM17321 is expected to offer a more affordable and compatible option compared to costly antibody-based drugs like myostatin-targeting monoclonal antibodies, potentially transforming obesity management by preserving muscle while reducing fat.

Market Scope

Metrics | Details | |

CAGR | 5.6% | |

Market Size Available for Years | 2022-2032 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Dipeptidyl Peptidase-4 (DPP-4) Inhibitors, Glucagon-Like Peptide-1 (GLP-1) Analogues |

Route of Administration | Oral, Injectable | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

The global incretin-based drugs market report delivers a detailed analysis with 59 key tables, more than 49 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.