Immunotherapy Drugs Market Size

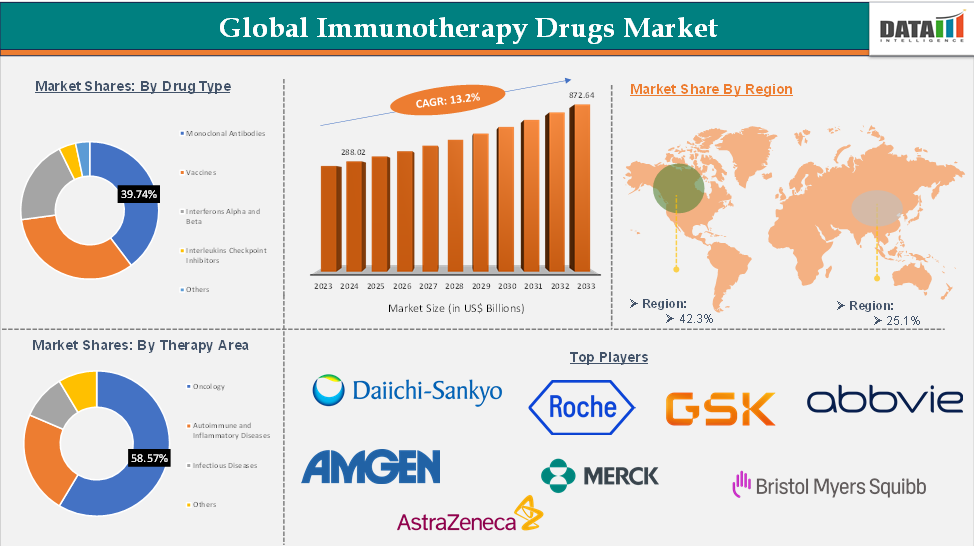

Immunotherapy Drugs Market Size reached US$ 288.02 Billion in 2024 and is expected to reach US$ 872.64 Billion by 2033, growing at a CAGR of 13.2% during the forecast period 2025-2033.

The global immunotherapy drugs market is experiencing significant growth due to the increasing prevalence of cancer, autoimmune disorders, and infectious diseases. Immunotherapy offers targeted, durable, and less toxic treatment alternatives compared to conventional therapies. The market is fueled by biotechnology advancements, R&D investments, and personalized medicine demand. Key segments include monoclonal antibodies, checkpoint inhibitors, vaccines, and cytokines, with oncology remaining the dominant therapeutic area.

North America leads the market due to its strong healthcare infrastructure, high healthcare spending, and early adoption of innovative therapies. Europe follows closely, supported by favorable government policies and a solid biopharmaceutical base. The Asia-Pacific region is poised for the fastest growth.

For more details on this report, Request for Sample

Immunotherapy Drugs Market Dynamics: Drivers & Restraints

Driver: Increasing Prevalence of Cancers

Cancer is a major global health concern, with millions of new cases diagnosed each year. Traditional treatments like chemotherapy and radiation often have severe side effects and limited effectiveness. Immunotherapy, a revolutionary shift in oncology, offers personalized and targeted approaches that leverage the body's immune system to detect and destroy cancer cells. Breakthroughs like immune checkpoint inhibitors, CAR-T cell therapy, and cancer vaccines have shown significant improvements in survival rates for patients with hard-to-treat cancers.

For instance, As per the International Agency for Research on Cancer, globally, nearly 20 million incident cases were reported in 2022. In 2030, nearly 24.10 million cases and in 2040, nearly 29.90 million cases were expected. The increasing number of cancer cases is driving a surge in demand for immunotherapies as an effective alternative to traditional treatments like chemotherapy. This demand accelerates, driving increased investment in research and the development of new immunotherapy options, thereby fueling the cancer immunotherapy market expansion.

The growing number of clinical trials and regulatory approvals for immunotherapeutic drugs reflects their increasing acceptance as frontline treatments in oncology. Rising investments from pharmaceutical companies and government and private sector support for cancer research are accelerating the development of innovative therapies. As awareness of immunotherapy's benefits grows among patients and healthcare providers, the adoption of these treatments is expected to continue expanding rapidly, making cancer a major catalyst for the global immunotherapy drugs market.

Restraint: High Treatment Costs and Limited Accessibility

The immunotherapy drugs market faces challenges due to high treatment costs, limited accessibility for patients in low- and middle-income countries, complex development processes, and personalized approaches. Additionally, inadequate reimbursement policies and infrastructure issues in developing regions hinder widespread immunotherapy adoption, hindering market growth.

Immunotherapy Drugs Market Segment Analysis

The global immunotherapy drugs market is segmented based on drug type, therapy area, end user, and region.

Drug Type:

The monoclonal antibodies (mAbs) segment of the drug type is expected to hold 39.7% in the immunotherapy drugs market

Monoclonal antibodies (mAbs) are laboratory-produced molecules designed to mimic the immune system's attack on harmful cells, such as cancer cells. They bind to specific antigens on cell surfaces, making them highly targeted and effective for treating various diseases. Due to their precision, mAbs minimize damage to healthy cells and often have fewer side effects compared to traditional therapies.

The monoclonal antibodies segment is driving the global immunotherapy drug market growth due to their efficacy, expanding therapeutic applications, and increasing approval of new mAb-based drugs. Advances in genetic engineering and biomanufacturing have led to more targeted antibodies, including bispecific and humanized variants. The rising global burden of cancer and chronic inflammatory diseases has accelerated the adoption of mAbs.

For instance, in February 2024, AbbVie and OSE Immunotherapeutics have partnered to develop OSE-230, a monoclonal antibody designed to resolve chronic and severe inflammation. OSE-230 activates ChemR23, a G-Protein Coupled Receptor target, potentially offering a novel mechanism for chronic inflammation resolution, modulating the functions of macrophages and neutrophils. The antibody is currently in the pre-clinical development stage.

Immunotherapy Drugs Market Geographical Analysis

North America dominated the global immunotherapy drugs market with the highest share of 42.3% in 2024

The North American immunotherapy drugs market is fueled by advanced healthcare infrastructure, high healthcare spending, and advanced medical technologies. The region is home to leading pharmaceutical and biotechnology companies, and the high prevalence of cancer and autoimmune disorders, favorable government policies, and streamlined regulatory pathways, particularly through the FDA, support rapid drug approvals and market access. Personalized medicine adoption and clinical trial investment further contribute to market growth.

For instance, in March 2025, Merck & Co plans to launch a subcutaneously injected version of its cancer immunotherapy, Keytruda, in the U.S. on October 1 2025, with the goal of reaching peak adoption rates within two years. The subcutaneous version is not yet approved by the FDA, with a target of September 23 to decide. The drugmaker believes injecting Keytruda under the skin will reduce patient delivery time.

Asia-Pacific region in the global immunotherapy drugs market is expected to grow with the highest CAGR of 18.5% in the forecast period of 2025 to 2033

The Asia-Pacific region is experiencing market growth due to an aging population, rising chronic disease incidence, and increased awareness of innovative treatment options. Countries like China, India, Japan, and South Korea are investing in healthcare infrastructure and expanding access to advanced therapies. The region's cost-effective manufacturing and rapidly developing biopharmaceutical sector attract global players, while increasing health insurance coverage and regulatory reforms encourage the adoption of immunotherapy drugs.

For instance, in April 2025, China has developed the world's most powerful vaccine booster, capable of amplifying immune responses against tumors and infections up to 150-fold. This technology has the potential to enhance cancer treatments and improve vaccine effectiveness against rapidly mutating viruses like COVID-19.

Immunotherapy Drugs Market Key Players

The major global players in the immunotherapy drugs market include Daiichi Sankyo Company, F. Hoffmann-La Roche AG, GlaxoSmithKline plc, AbbVie, Inc., Amgen, Inc., Merck & Co., Inc., Alligator Bioscience, Bristol-Myers Squibb, Novartis AG, and AstraZeneca and among others.

Industry Trends

- In November 2024, Dr Reddy's Laboratories launched Toripalimab, a drug for treating recurrent or metastatic nasopharyngeal carcinoma in India. Nasopharyngeal carcinoma is a rare, aggressive form of head and neck cancer originating in the nasopharynx. Toripalimab is a new biological entity (NBE) launched by the company.

- In October 2024, A team of universities, hospitals, and industry, led by the Francis Crick Institute and The Royal Marsden NHS Foundation Trust, launched a platform to study immunotherapy response and side effects in cancer. Funded by £9m from the Medical Research Council and £12.9m from industry partners, the programme will involve thousands of UK immunotherapy patients.

Scope

| Metrics | Details | |

| CAGR | 13.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Type | Monoclonal Antibodies, Vaccines, Interferons Alpha and Beta, Interleukins, Checkpoint Inhibitors, Others |

| Therapy Area | Oncology, Autoimmune and Inflammatory Diseases, Infectious Diseases, Others | |

| End User | Hospitals, Clinics, Cancer Research Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |