Hydrogen Bus Market Overview

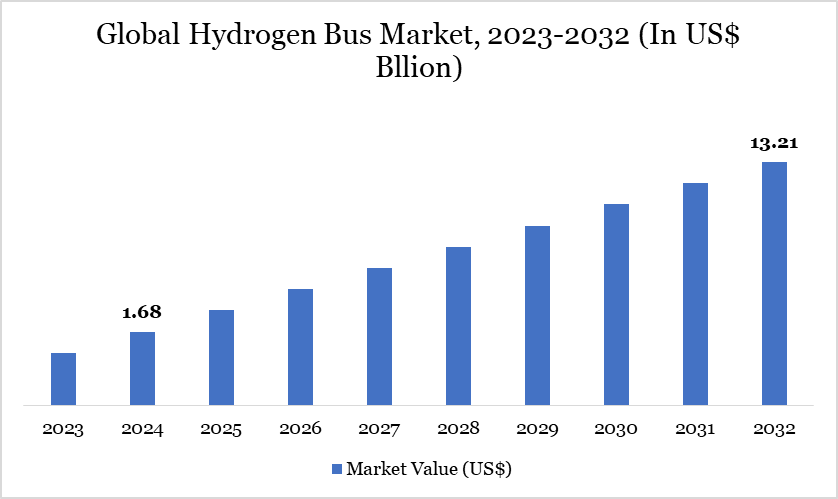

Hydrogen Bus Market reached US$ 1.68 billion in 2024 and is expected to reach US$ 13.21 billion by 2032, growing with a CAGR of 29.4% during the forecast period 2025-2032.

The global hydrogen bus market is rapidly expanding as industries prioritize eco-friendly alternatives to traditional fossil fuel-powered transportation. Hydrogen buses, powered by fuel cells that emit only water, offer a zero-emission solution to reduce urban pollution and reliance on conventional energy sources. As countries transition to clean energy, hydrogen buses are becoming essential in public transportation networks.

Governments across Europe, North America and Asia-Pacific are actively promoting hydrogen-powered vehicles through investments and regulatory frameworks. According to the European Commission, hydrogen fuel cell vehicles (HFCVs) are a critical component of achieving the EU’s climate neutrality goals by 2050, with targeted hydrogen production to reach 10 million tons annually by 2030.

Hydrogen Bus Market Trend

Hydrogen buses are rapidly emerging as a sustainable solution in public transportation, driven by the global push to reduce urban air pollution and carbon emissions. Utilizing fuel cell technology, these buses generate electricity by combining hydrogen and oxygen, emitting only water vapor. Compared to battery-electric models, hydrogen buses offer operational advantages such as longer driving ranges and significantly faster refueling times, making them well-suited for long routes and high-frequency service.

Governments across Europe, Asia and North America are actively investing in hydrogen bus fleets and the supporting refueling infrastructure. As fuel cell technology advances and hydrogen production becomes more cost-effective, particularly from renewable sources, the commercial viability of hydrogen buses continues to improve. This trend positions hydrogen-powered transport as a key pillar in the transition toward low-emission urban mobility.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Bus Type | Single Deck, Double Deck and Articulated Deck |

By Technology | Proton Exchange Membrane Fuel Cell (PEMFC), Solid Oxide Fuel Cell (SOFC), Alkaline Fuel Cell (AFC) and Others |

By Power Output | <150 kW, 150–250 kW and >250 kW |

By Application | Urban Public Transportation, Intercity/Regional Transportation, Port and Logistics Operations, Mining and Construction, Waste Management and Others |

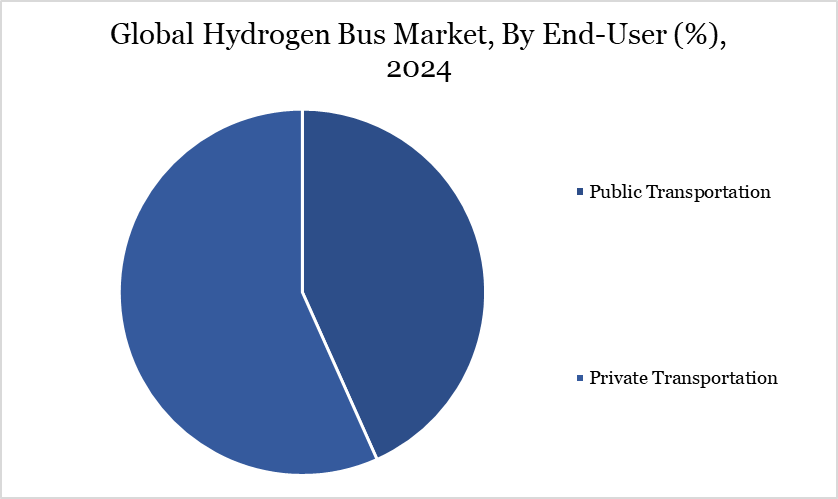

By End-User | Public Transportation and Private Transportation |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Hydrogen Bus Market Dynamics

Government Support and Clean Energy Mandates

Government policies and mandates to reduce carbon emissions are driving the hydrogen bus market's growth. In Europe, regulations such as the European Green Deal, which aims for a 55% reduction in carbon emissions by 2030, are pushing cities to adopt hydrogen buses to meet environmental targets.

Similarly, US Environmental Protection Agency (EPA) has introduced the Clean Bus Program, allocating over US$ 1 billion to support the purchase of zero-emission buses, including hydrogen models. The regulatory incentives are encouraging public and private transportation sectors to invest in hydrogen bus fleets to comply with environmental standards and reduce operational costs associated with traditional fuel use.

In addition, investment in hydrogen infrastructure is increasing globally, enabling the expansion of hydrogen refueling stations. The Hydrogen Council reports that more than 1,100 hydrogen refueling stations are now operational globally, with deployment growing by 60% from 2021 to October 2023, with significant growth expected in Europe and Asia-Pacific. This infrastructure development is crucial for supporting the widespread adoption of hydrogen buses.

Technological Advancements and Declining Hydrogen Costs

Rapid advancements in hydrogen fuel cell technology, coupled with declining hydrogen production costs, are significantly driving the adoption of hydrogen buses. Innovations in fuel cell efficiency, power density and hydrogen storage systems are improving the range and performance of hydrogen buses, making them more commercially viable.

IEA analysis finds that the cost of producing hydrogen from renewable electricity could fall 30% by 2030 as a result of declining costs of renewables, driven by increased investments in renewable energy sources like wind and solar power, which are integral to hydrogen production. Moreover, advancements in hydrogen refueling infrastructure have made it easier for municipalities to transition from traditional buses to hydrogen-fueled ones.

According to the International Council on Clean Transportation, more than 120 total retail hydrogen stations may be available by 2025 to support up to 60,000 fuel cell vehicles, as newer stations are expected to have higher delivery capacities. The technological breakthroughs and cost reductions are propelling the hydrogen bus market forward, allowing public transport operators to meet sustainability targets while benefiting from improved fuel efficiency and reduced operating costs..

High Cost of Deployment with Strict Government Regulation

The high upfront costs and limited refueling infrastructure present challenges to market expansion. The price of hydrogen buses is significantly higher than that of traditional diesel or battery electric buses, often exceeding. Additionally, the infrastructure required to support hydrogen fueling stations remains underdeveloped, particularly in regions such as Latin America and Africa.

Similarly, to meet the growing demand for hydrogen vehicles, more than 4,000 refueling stations will need to be operational globally by 2030, representing a significant capital investment in infrastructure. Furthermore, the cost of hydrogen production and distribution remains a challenge, as hydrogen produced through electrolysis is still 2-3 times more expensive than diesel fuel. These factors hinder the mass adoption of hydrogen buses in the short term, particularly for regions lacking the necessary hydrogen infrastructure.

Hydrogen Bus Market Segment Analysis

The global hydrogen bus market is segmented based on bus type, technology, power output, application, end-user and region.

Public Transportation Sector Leads Adoption

The public transportation sector is at the forefront of hydrogen bus adoption due to the pressing need for sustainable and emission-free transportation solutions in urban areas. Cities across Europe and Asia-Pacific are rapidly integrating hydrogen buses into their public transport fleets, driven by government policies and environmental regulations.

For instance, the Department for Transport provided a EUR 30 million grant to the West Midlands to purchase 124 hydrogen-fueled buses. The buses are powered by green hydrogen, which is generated from renewable energy and emits only water vapor. Similarly, South Korea’s Ministry of Environment plan aims to roll out on the street at least 35 hydrogen buses in 2019 ramping this number up to 2000 by 2022 and 41000 by 2040 as part of its Hydrogen Economy Roadmap.

The benefits of hydrogen buses in reducing air pollution, especially in congested cities, are driving demand. Compared to battery electric buses, hydrogen buses offer longer ranges and shorter refueling times, making them suitable for long-distance routes. Public transportation agencies are increasingly adopting hydrogen buses as a sustainable alternative to meet their operational needs while complying with national emissions reduction targets.

Hydrogen Bus Market Geographical Share

Asia-Pacific Dominates Hydrogen Bus Market

Asia-Pacific is the dominant region in the global hydrogen bus market, driven by government initiatives and investments in hydrogen infrastructure. China has set a goal to have 50,000 fuel cell vehicles on its roads by 2025, according to its hydrogen development plan that was released in 2022. Government subsidies and investment in hydrogen refueling stations are key drivers of this growth.

For instance, in China’s northern region of Inner Mongolia, a hydrogen industry valued at 100 billion CNY (approximately US$ 15.4 billion) is set to be developed by 2025, according to a report by the Hydrogen Council. Similarly, Japan and South Korea are also major contributors, with hydrogen buses playing a critical role in achieving their respective zero-emission targets. In 2020, Japan announced plans to install 1,200 hydrogen refueling stations by 2030 to support its growing fleet of hydrogen vehicles.

Sustainability Analysis

Hydrogen buses are a critical component of achieving global zero-emission transportation goals. The use of hydrogen fuel cells eliminates harmful emissions, offering a sustainable alternative to traditional fossil-fuel-powered public transport. According to the International Energy Agency (IEN), in 2022 global CO2 emissions from the transport sector grew by more than 250 Mt CO2 to nearly 8 Gt CO2, 3% more than in 2021, with hydrogen buses providing a pathway to reduce this figure significantly.

Moreover, hydrogen buses contribute to the circular economy by utilizing renewable energy sources for hydrogen production, particularly green hydrogen generated from solar and wind power. The global push towards sustainable energy solutions has increased investments in green hydrogen projects.

For example, the EU is developing renewable hydrogen and it aims to produce 10 million tons and import 10 million tons by 2030, providing a renewable energy source for numerous applications including hydrogen buses. These initiatives align with the global transition to net-zero emissions, positioning hydrogen buses as a sustainable and scalable solution for future urban transportation networks.

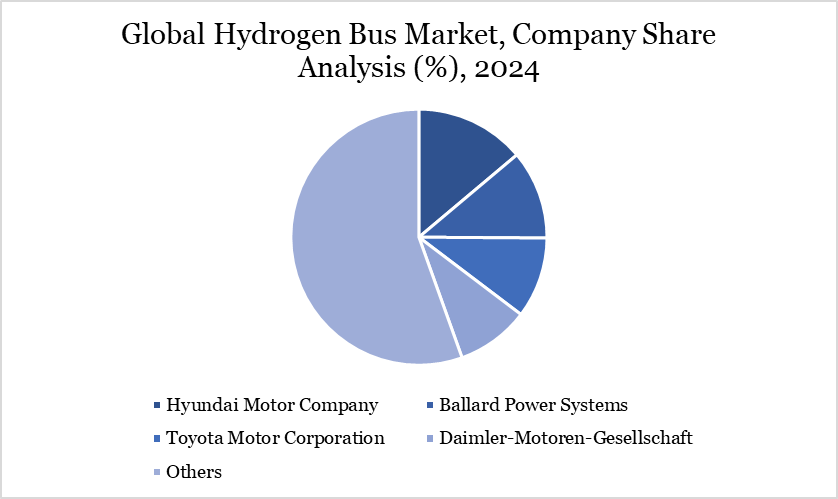

Hydrogen Bus Market Major Players

The major global players in the market include Hyundai Motor Company, Ballard Power Systems, Toyota Motor Corporation, Daimler-Motoren-Gesellschaft, Wrightbus, Solaris Bus & Coach, New Flyer, BYD, Iveco and Nel Hydrogen.

Key Developments

In March 2025, India launched a US$23 million pilot initiative to advance hydrogen-powered transportation, deploying 37 fuel cell and internal combustion engine vehicles across key routes in cities such as Delhi, Mumbai, Ahmedabad, Kochi and Bhubaneswar. Led by the Ministry of New and Renewable Energy, the project will establish nine hydrogen refueling stations and is expected to be commissioned within 18–24 months.

In March 2025, Wrightbus unveiled the Streetdeck Hydroliner 2.0, its next-generation hydrogen-powered double-decker bus, featuring Ballard’s advanced FCmove-HD fuel cell engine. Offering over 300 miles of range, increased efficiency and greater passenger capacity at reduced cost, the model serves as a direct diesel replacement. With over 2 million operational miles since 2021 across major UK and European cities, the Hydroliner reinforces Wrightbus’ leadership in zero-emission public transport innovation.

In October 2023, Toyota will deploy hydrogen buses for the Paris 2024 Olympics, produced by Caetano and retrofitted by GCK. Toyota's collaboration with Hysetco for hydrogen refueling stations and Air Liquide for low-carbon or renewable hydrogen.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies