HVAC Insulation Market Overview

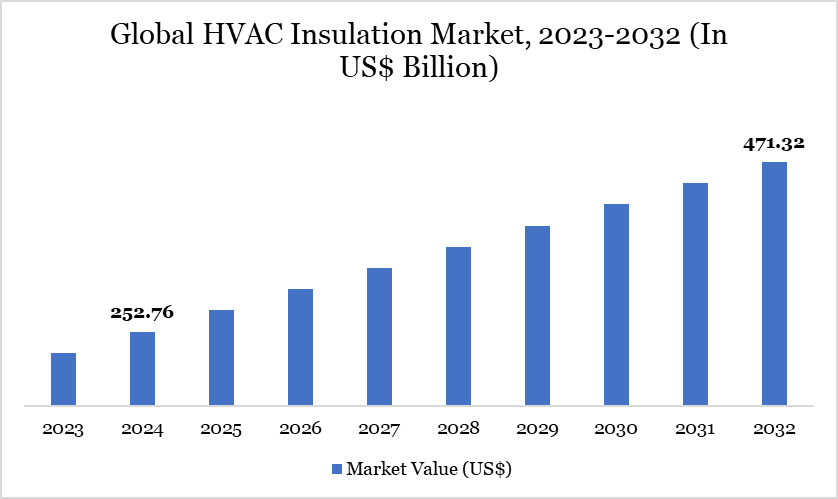

HVAC Insulation market reached US$ 252.76 billion in 2024 and is expected to reach US$ 471.32 billion by 2032, growing with a CAGR of 8.10% during the forecast period 2025-2032.

Heating, ventilation and air conditioning (HVAC) systems deliver thermal comfort and maintain the ideal temperature in buildings. To ensure a comfortable living environment, HVAC insulation can be utilized in large-scale commercial and residential structures, such as high-rise offices, apartment buildings, airports, hospitals, warehouses, and other industrial facilities. Adequate insulation is critical for maintaining the proper operating temperature for various system sections, from the piping to air conditioning insulation.

Working as effectively as possible is critical since these properties consume a lot of energy to maintain a comfortable environment. Insulating HVAC systems improves efficiency, lowers running costs and minimizes carbon emissions. It helps maintain indoor temperatures while using the least energy possible, resulting in a comfortable living environment for workers and inhabitants. Furthermore, because heating and cooling systems in large buildings may be extremely loud, insulating them enhances acoustic performance while also reducing noise disruption.

HVAC Insulation Market Trends

The global labels market is undergoing dynamic changes, shaped by evolving consumer behaviors, technological advancements, and increasing environmental concerns. One of the most prominent trends is the shift toward smart and interactive labels, such as RFID- and NFC-enabled solutions, which are widely adopted in retail and logistics for real-time tracking, inventory management, and anti-counterfeiting.

For instance, major retailers like Walmart and fashion brands such as Zara use RFID labels to improve stock accuracy and streamline supply chains. Another significant trend is the rise of digital printing in label production, which offers faster turnaround times, reduced waste, and greater design flexibility. This is especially relevant for small-batch production and customization—key requirements in today's e-commerce-driven market.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Product | Duct, Pipe, Wall, Others |

| By Material | Fiberglass, Wool, Plastic, Others |

| By Layer | Thin (Up to 50mm), Medium (50-100mm), Thick (More than 100mm) |

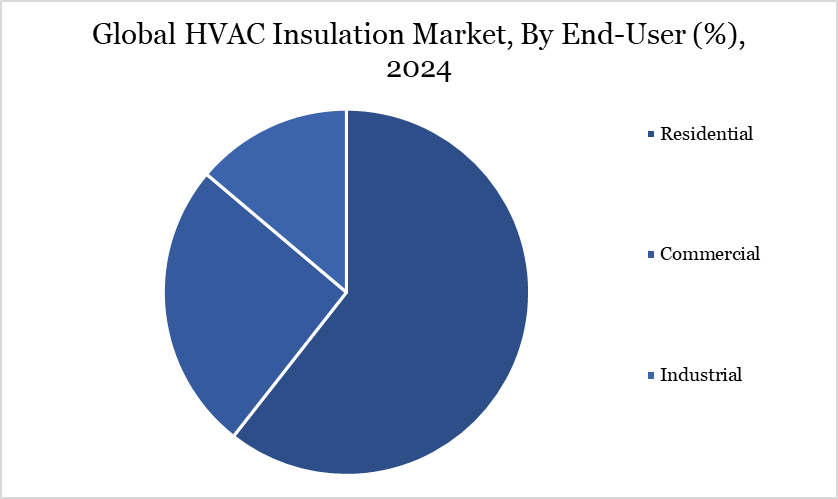

| By End-User | Residential, Commercial, Industrial |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

HVAC Insulation Market Dynamics

Increasing Demand for Energy-Efficient Solutions

The HVAC insulation market is rapidly growing, driven by rising energy costs, environmental concerns, and the need for energy-efficient buildings. HVAC systems account for a large share of electricity use in buildings, making advanced insulation crucial for reducing energy loss and carbon emissions.

Regulatory support, like the US Department of Energy’s Building Energy Codes Program, mandates high-performance insulation, encouraging innovation such as thermal and acoustic jackets. Partnerships like Armacell and AIS are addressing this demand with tailored solutions. Rising investment in energy-efficient buildings is another significant driving force behind the HVAC insulation market.

According to the US Census Bureau, construction spending in US was estimated at US$ 1.98 trillion in 2022, a significant portion of which was attributed to energy-efficient building upgrades. As construction activity continues to gain momentum, demand for high-quality HVAC insulation compatible with modern energy standards is rising. Thus, above factors helps to boost the market growth.

High Initial Costs of Advanced Insulation Material

One of the most important issues that has generally lagged the general adoption of advanced insulation materials in the US HVAC insulation market is its high cost for initial investment. Materials such as fiberglass, foam boards and elastomeric foam also present much better thermal efficiency compared to traditional materials, fire-resistant capabilities and longer durability, but the initial cost scares off many people, particularly from SMEs and budget-conscious homeowners.

For example, elastomeric foam insulation, famous for its excellent ability to resist condensation and reduce energy losses, is reportedly 30-40% pricier than the traditional fiberglass insulation. As a result, many end-users are left with no choice but to settle for cheaper, yet less efficient insulation products, at the expense of long-term energy savings and overall system performance.

HVAC Insulation Market Segment Analysis

The global HVAC insulation market is segmented based on product, material, layer, end-user and region.

Residential Construction and Energy Efficiency: Driving Global HVAC Insulation Trends

The residential segment is a major driver of the global HVAC insulation market, supported by increasing urbanization, rising energy costs, and growing demand for energy-efficient housing worldwide. As more countries commit to reducing carbon emissions and improving building efficiency, homeowners across both developed and emerging economies are investing in advanced insulation materials to optimize heating and cooling systems. According to the International Energy Agency (IEA), buildings account for about 30% of global final energy consumption, with residential homes forming a substantial portion—making HVAC insulation a key solution for energy savings.

Additionally, the rise of smart homes globally is also propelling demand for insulation solutions that integrate well with modern HVAC technologies, offering optimized temperature control and energy management. As global construction activity continues to expand, particularly in energy-conscious markets, the residential segment will remain a key growth engine for the HVAC insulation industry.

HVAC Insulation Market Geographical Share

Dominance of North America in the Global HVAC Insulation Landscape

North America continues to dominate the global HVAC insulation market, driven by a combination of stringent energy-efficiency regulations, high construction activity, and early adoption of advanced insulation technologies. The US, in particular, has seen a surge in demand for HVAC insulation across both residential and commercial sectors due to rising energy costs and growing awareness about environmental sustainability. According to the US Energy Information Administration (EIA), HVAC systems account for nearly 50% of energy consumption in American homes, making insulation a critical solution for improving energy efficiency and reducing utility bills.

Government policies and building codes have further accelerated this trend. The US Department of Energy’s Building Energy Codes Program mandates strict standards for HVAC performance and insulation, compelling builders and developers to invest in high-quality insulation materials. Additionally, the Inflation Reduction Act of 2022 has introduced tax credits and rebates for energy-efficient upgrades in residential properties, which include HVAC insulation improvements. This has led to widespread retrofitting of older buildings with modern insulation systems to comply with new energy standards.

Sustainability Analysis

Sustainability has become a central focus in the global HVAC insulation market, driven by the urgent need to reduce energy consumption and greenhouse gas emissions. HVAC systems are among the highest energy-consuming components in buildings, and insulation plays a key role in minimizing heat loss or gain, thereby improving system efficiency. As global efforts to meet climate targets intensify, both governments and industries are investing in sustainable HVAC insulation solutions.

Manufacturers are increasingly using eco-friendly materials such as natural fibers, recycled denim, aerogels, and plant-based foams that offer high thermal resistance with a lower environmental footprint. Thus, sustainability in the HVAC insulation market is being driven by green materials, regulatory compliance, low-carbon manufacturing practices, and energy-saving performance.\

HVAC Insulation Market Major Players

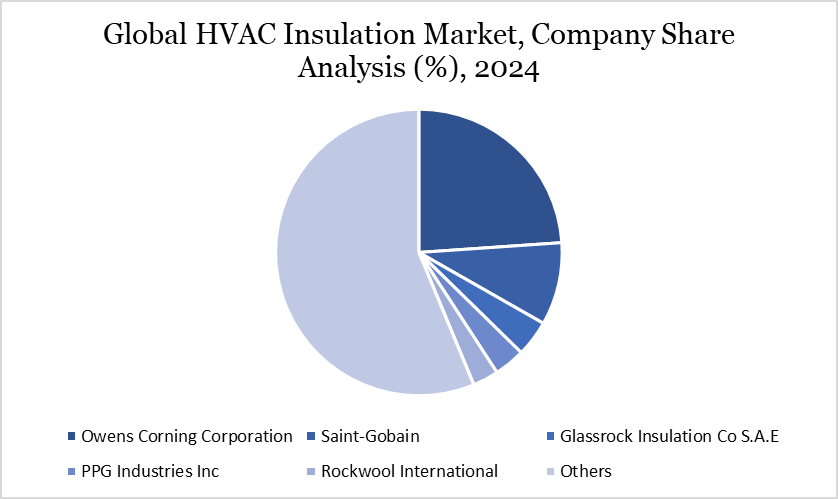

The major global players in the market include Owens Corning Corporation, Saint-Gobain, Glassrock Insulation Co S.A.E, PPG Industries Inc, Rockwool International, Knauf Group, Armacell International, Johns Manville, All Bay Insulation & HVAC, Xiamen Goot Advanced Material Co., Ltd and among others.

Key Developments

In 2025, Copeland, stated that AAON, a leader in high-performance and energy-efficient HVAC solutions, and several other original equipment manufacturers (OEMs) have recently selected Copeland to help advance their standard and cold-climate heat pump solutions. These strategic OEM partnerships follow the issuance of the Department of Energy’s (DOE) Residential and Commercial Building Cold-Climate Heat Pump (CCHP) Technology Challenges.

In 2024, Orion Group partnered with Josko Services (“Josko”). Josko is a full-service provider of HVAC, plumbing, and electrical services to apartment complexes throughout Florida. Orion builds national providers by partnering with exceptional field services businesses and supplying the resources needed to fuel their next chapter of growth.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies