Global Human-Computer Interaction (HCI) Market: Industry Outlook

The global human-computer interaction (HCI) market is expanding rapidly as governments and enterprises integrate immersive and intelligent technologies into mainstream use. The US National Science Foundation allocated over US$ 140 million in 2023 toward AI- and AR/VR-related projects, directly boosting HCI innovation in education, healthcare, and defense. In parallel, the European Commission launched its Digital Europe Programme with €7.5 (US$ 8.83) billion in funding to support digital transformation initiatives, including AR/VR and accessibility-focused interfaces, driving large-scale adoption of HCI tools.

Asia-Pacific is also a critical growth hub, with Japan’s Ministry of Economy, Trade, and Industry funding AI and robotics integration for manufacturing, which directly relies on intuitive HCI systems. South Korea’s Ministry of Science and ICT in 2024 announced strategic investments in extended reality and metaverse platforms, advancing HCI applications across entertainment, retail, and digital services. These government-backed initiatives underscore how policy support and R&D funding are enabling global demand for adaptive, intelligent, and user-centered interaction technologies.

A unique trend shaping the HCI market is the integration of accessibility-driven innovation, where governments are prioritizing inclusivity in digital transformation. The World Health Organization reported that over 1 billion people globally live with a disability, creating a strong need for voice recognition, gesture-based, and brain-computer interface systems. The US Department of Education has funded adaptive learning platforms, while the European Accessibility Act (2025) mandates usability standards across digital products. These efforts are accelerating the shift from traditional interfaces to universal, accessible, and human-centric HCI models.

Key Market Trends & Insights

- North America as the largest region: Supported by over US$ 200 billion in US federal IT spending (2023), with significant allocations toward AI, accessibility, and immersive HCI-driven defense systems.

- Asia-Pacific as the fastest-growing region: Driven by Japan’s robotics-HCI integration and China’s state-backed AI and AR/VR projects, positioning the region as the global innovation hub.

- Accessibility and inclusivity are emerging as central priorities, with laws like the European Accessibility Act ensuring all future HCI technologies address universal usability needs.

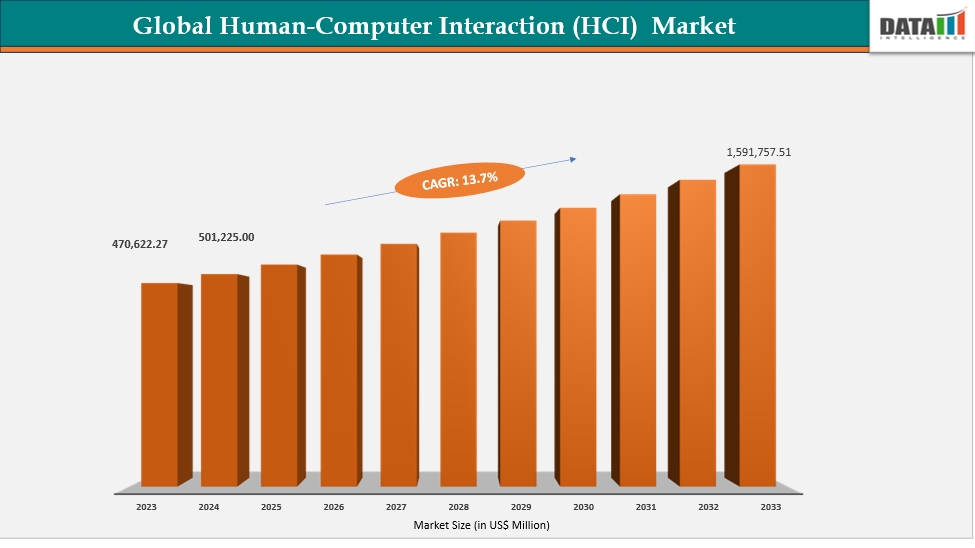

Market Size & Forecast

- 2024 Market Size: US$ 501,225.00 million

- 2033 Projected Market Size: US$ 1,591,757.51 million

- CAGR (2025–2033): 13.7%

- Asia Pacific: Fastest growing market in 2024

- North America: Largest market

Market Dynamics

Driver: Advancements in Brain-Computer Interfaces Enhancing Next-Gen Human-Computer Interaction

Advancements in brain-computer interfaces (BCIs) are driving growth in the global human-computer interaction (HCI) market by enabling direct communication between neural activity and digital systems. The US National Institutes of Health reported in 2023 that federally funded BCI research projects exceeded US$ 120 million, reflecting strong government support for neural technology development. Similarly, South Korea’s Ministry of Science and ICT announced new funding initiatives in 2024 to advance brain signal processing and AI-driven BCIs, highlighting Asia’s role in accelerating adoption. These developments are positioning BCIs as a transformative driver for next-generation HCI applications across healthcare, defense, and assistive technologies.

Restraint: High Hardware and Development Costs Limiting Large-Scale HCI Adoption

High hardware and development costs are acting as a restraint in the global human-computer interaction (HCI) market, as advanced devices like AR/VR headsets and brain-computer interface systems remain expensive for mass adoption. For example, the US Bureau of Labor Statistics reported that consumer spending on computing hardware rose by over 6% in 2023, reflecting growing costs of high-performance devices. Similarly, Japan’s Ministry of Economy, Trade and Industry highlighted that development costs for next-gen immersive technologies, including gesture and voice-based systems, remain a key challenge for manufacturers aiming for scale.

Segmentation Analysis

The global human-computer interaction (HCI) market is segmented based on component, technology, application, and region.

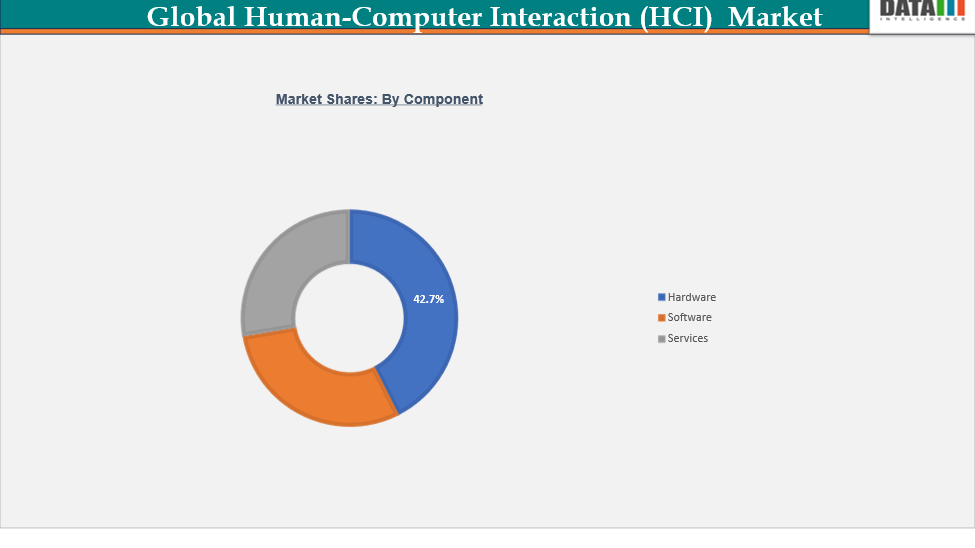

Component:Software segment is estimated to have 42.7% of the human-computer interaction (HCI) market share.

The Banking, Financial Services, and Insurance (BFSI) sector is a dominant force in IT Asset Management (ITAM) software adoption, accounting for around 42.7% of the global market share. Financial institutions operate some of the most complex IT infrastructures, requiring robust lifecycle management of hardware, software, and cloud assets. In the US, the Federal Financial Institutions Examination Council (FFIEC) mandates strict IT asset inventory and risk management protocols to ensure data security and regulatory compliance. Similarly, the Reserve Bank of India has issued guidelines for IT governance and risk management, requiring banks to maintain comprehensive IT inventories and enhance system audits. These compliance frameworks are directly fueling the adoption of ITAM solutions across the BFSI sector.

At the company level, leading banks are already heavily invested in ITAM platforms to improve visibility and control over their IT estates. JPMorgan Chase reported technology expenses exceeding US$ 17.8 billion in 2023, with significant allocations toward IT modernization and asset tracking initiatives. In Japan, major insurers such as Nippon Life and Dai-ichi Life have accelerated digital transformation projects, leveraging cloud infrastructure and requiring detailed software asset management to support compliance under the country’s Act on the Protection of Personal Information (APPI). These examples highlight how regulatory pressure, combined with rising cybersecurity threats and digitalization initiatives, is consolidating BFSI as the single largest driver of ITAM software demand globally.

Geographical Analysis

The Asia-Pacific human-computer interaction (HCI) market was valued at 19.23% market share in 2024

Asia-Pacific is experiencing the fastest growth in the HCI market, driven by rapid digitalization, government policies, and consumer adoption of interactive technologies. In Japan, the Ministry of Internal Affairs and Communications reported that internet penetration reached over 93% of households in 2023, boosting demand for devices with multimodal interaction capabilities. The Japanese government, through initiatives like “Society 5.0,” is actively promoting the integration of HCI technologies in smart cities, healthcare robotics, and industrial automation. Similarly, South Korea’s ICT Ministry highlighted that 92% of its population used smartphones daily in 2023, creating strong demand for gesture, voice, and AR/VR-based interaction systems.

Government-led initiatives also contribute to this rapid growth. Singapore’s Smart Nation program emphasizes the use of HCI in public services, from voice-based kiosks to AI-enabled translation systems. In India, the government’s Digital India initiative has fueled the adoption of interactive education technologies, benefitting over 250 million students with digital learning platforms that integrate HCI tools. These advancements, combined with booming smartphone penetration, 5G rollout, and growing investments in AR/VR, are positioning Asia-Pacific as the fastest-growing market for human-computer interaction technologies.

The North America Human-Computer Interaction (HCI) market was valued at 35.22% market share in 2024

In North America, demand for HCI solutions is accelerating due to government-backed digital transformation programs and strong adoption of emerging technologies. The US Department of Labor reported that nearly 27% of American workers in 2023 engaged in some form of remote or hybrid work, fueling the need for intuitive interaction platforms such as gesture recognition, voice interfaces, and immersive collaboration tools. The National Science Foundation (NSF) has also invested heavily in AI-driven interaction research, committing over US$ 140 million in 2023 to projects that improve usability and inclusivity in digital systems. This policy and funding landscape drives enterprises to embed advanced HCI into consumer electronics, workplace collaboration, and healthcare systems.

Industry adoption further reinforces North America’s dominance. The US Department of Veterans Affairs, for instance, has implemented voice-assisted and augmented reality interfaces in telehealth programs, expanding accessibility for millions of patients. Tech giants such as Microsoft, Apple, and Google continue to pioneer natural user interfaces across operating systems, cloud services, and devices. These factors make North America the largest and most mature HCI market globally, supported by government initiatives and enterprise innovation.

Competitive Landscape

The global human-computer interaction (HCI) market features several prominent players, including Microsoft Corporation, Apple Inc., Google LLC, IBM Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Intel Corporation, Meta Platforms, Inc., Lenovo Group Limited, and LG Electronics Inc among others.

Microsoft Corporation: Microsoft Corporation plays a pivotal role in advancing HCI through its Windows operating system, Surface devices, and Azure AI platforms, which integrate voice, touch, and gesture recognition technologies. The company is also investing in mixed reality through HoloLens, supporting enterprise and healthcare applications that enhance immersive interaction. With billions of active Windows users worldwide, Microsoft leverages its scale to continuously refine user interfaces, accessibility features, and AI-driven personalization. Its focus on creating seamless, adaptive, and inclusive user experiences positions it as a global leader in shaping the future of HCI.

Market Scope

| Metrics | Details | |

| CAGR | 13.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Technology | Touch-Based Interaction, Gesture Recognition, Voice Recognition, Augmented Reality (AR) & Virtual Reality (VR), Artificial Intelligence (AI) & Machine Learning (ML), Others | |

| Component | Software, Services, Hardware | |

| Application | BFSI, IT & Telecom, Energy & Utilities, Healthcare, Manufacturing, Retail and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global human-computer interaction (HCI) market report delivers a detailed analysis with 62 key tables, more than 59 visually impactful figures, and 230 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here