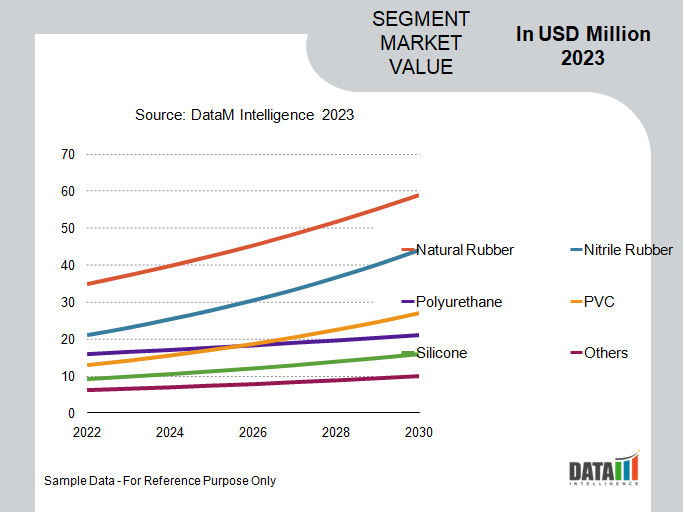

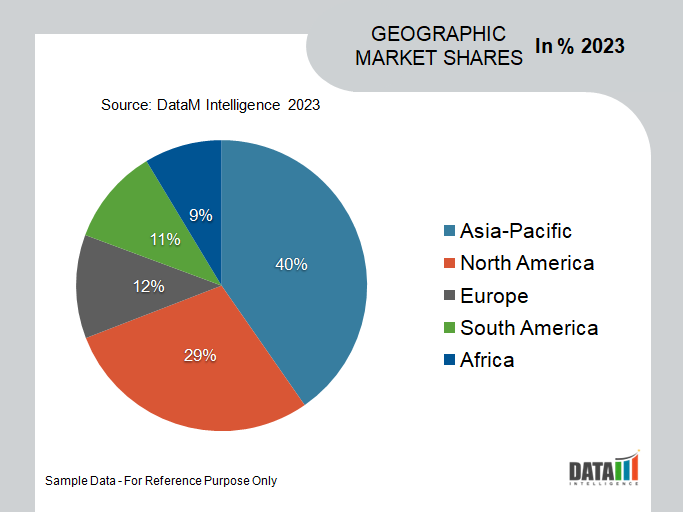

Global Hoses Market is segmented By Material (Natural Rubber, Nitrile Rubber, Polyurethane, PVC, Silicone, Others), By Type (Low-Pressure Hoses, Medium Pressure Hoses, High-Pressure Hoses), By Media (Hot Water and Steam, Air and Gas, Water, Oil, Others), By End-User (Water and Wastewater, Food & Beverages, Pharmaceuticals, Automotive, Oil & Gas, Chemicals, Mining, Agriculture, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024 - 2031

Hoses Market Size

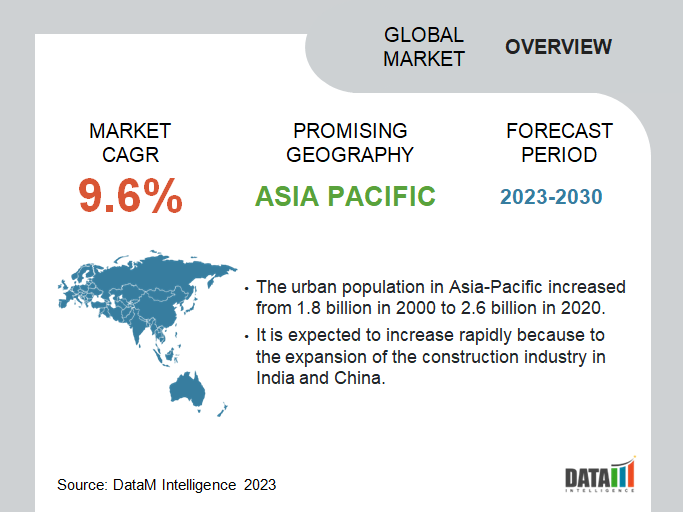

Global Hoses Market reached USD 11.2 billion in 2022 and is expected to reach USD 20.6 billion by 2030, growing with a CAGR of 9.6% during the forecast period 2024-2031. The growing demand for industrial hoses for essential uses in a variety of sectors, as well as growing infrastructure-related projects and rising demand for PVC material, are among the primary drivers expected to drive market expansion during the forecast period.

Hoses are used in a variety of industrial sectors to prevent fatal incidents and to enable seamless material handling in harsh environmental and operating circumstances. During the forecast period 2023-2030, the automotive segment is estimated to account for around 1/3rd of the global hoses market. Increasing vehicle sales due to individuals' high disposable income and purchasing power are driving market expansion in the automotive segment.

Market Summary

| Metrics | Details |

| CAGR | 9.6% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Material, Type, Media, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Material Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

The Growing Adoption of Market Strategies by Major Players

The hoses industry's major companies frequently spend in research and development to produce innovative goods with enhanced performance, durability and efficiency. Customers demanding creative alternatives can be attracted by innovation, giving businesses a competitive advantage. Companies that offer a diverse selection of hose products for a variety of industries and applications can reach a wider consumer base by targeting different market segments.

NORRES GmbH, a renowned provider of technical hoses and flexible hose system solutions, purchased the Swedish hose distributor Jarl Elmgren AB ("Jarl Elmgren") in February 2020. The acquisition is consistent with NORRES' internationalization strategy and strengthens the company's market position in Scandinavia significantly.

Technological Advancements

Material science advances have resulted in the creation of new and advanced materials for hose manufacture. Advances in hose production methods, like the development of composite materials, continue to drive the industrial hose market forward. The use of composite materials in hose manufacture has resulted in lightweight, durable hoses that are resistant to chemicals, temperature and pressure.

As people become more concerned about industrial safety, there is an increased need for high-quality industrial hoses that can endure high pressure and temperature. In industrial situations, the usage of substandard hoses can lead to accidents and injuries. As a result, companies are increasing their investments in high-quality hoses to protect the safety of their employees and equipment.

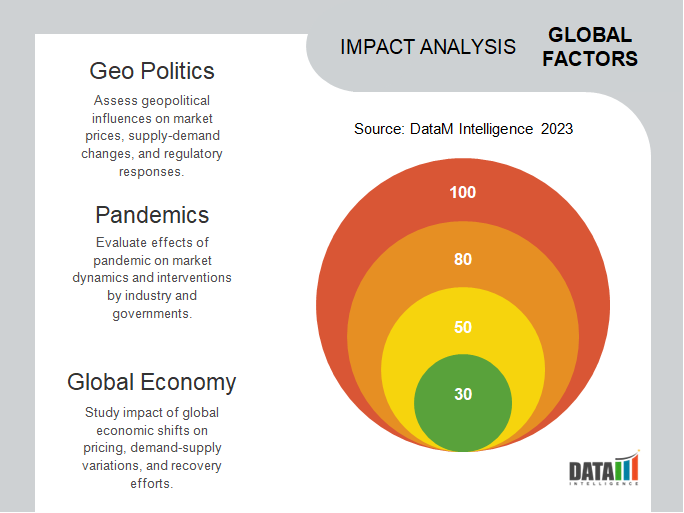

Fluctuating Price and Stringent Regulations

Raw material prices for hose manufacture, such as rubber, plastic and metal, fluctuate due to a variety of reasons, including supply and demand, currency exchange rates and geopolitical conflicts. The variations can have an impact on hose manufactures profitability and hamper their capacity to offer competitive costs to their customers.

Various rules govern the industrial hose market in terms of safety, quality and environmental sustainability. For hose producers, complying with the rules could be costly and time-consuming. Non-compliance can result in fines, legal obligations and damage to the company's reputation. Alternative items and technologies, including as pipes, tubing and flexible conduits, can provide equivalent functions in specific applications as hoses.

Market Segment Analysis

The global hoses market is segmented based on material, type, media, end-user and region.

The High Pressure and Flexibility of Natural Rubber

During the forecast period, natural rubber is expected to hold more than 1/3rd of the global hoses market. Natural rubber is commonly utilized in the manufacture of hoses due to its high pressure and flexibility attributes. Rubber hoses have excellent adhesion, abrasion resistance, oil resistance, erosion resistance, ozone resistance and oxidation resistance.

Furthermore, it has a strong overall performance, low plasticity and a high elasticity property. Rubber hoses are made by combining vulcanized rubber and synthetic polymers. It is used to transport water, fuel, air and construction materials. Yokohama Rubber Co., Ltd., for example, developed a material in 2021 that significantly decreases the weight of automotive air-conditioning hoses. The rubber is predicted to lower the weight of the hoses by 50%.

Market Geographical Share

The Rising Demand for Automobiles in Asia-Pacific

Asia-Pacific hoses market has witnessed significant growth covering more than 1/3rd of the global hoses market share in 2022. Owing to a growing demand for fuel efficiency in automobiles, the use of turbochargers in passenger cars has expanded significantly. Hoses are installed around the turbocharger system to mainly handle exhaust gas temperatures. The hoses are placed in the engine assembly to provide the required function while also increasing fuel efficiency.

Given the current developments and conditions, hose manufacturers are starting to invest in the production of high-performance hoses in order to meet the increasing demand from the automotive industry. For example, in May 2021, Continental announced the transfer of manufacturing lines from the induction systems facility in Nadab to the manufacturing location of heating/cooling rubber hoses in Carei.

Hoses Market Companies

The major global players include Eaton Corporation PLC, Continental AG, Transfer Oil S.p.A., Kurt Manufacturing, Kuriyama of America, Inc., Flexaust Inc., Parker-Hannifin Corporation, Ryco Hydraulics, Trelleborg Group and Gates Industrial Corporation PLC.

COVID-19 Impact Analysis

Due to closures of plants, transit constraints and raw material shortages, the pandemic caused disruptions in global supply chains. It had an influence on hose production and availability, which could have led to order fulfillment delays. During the pandemic, demand for hoses fluctuated across industries like as automotive, manufacturing, construction and agricultural.

Some industries, such as automotive and aerospace, witnessed decreased demand owing to shutdowns and economic downturns, but others, such as healthcare and agriculture, saw increased demand. With the onset of COVID-19, there was a sudden increase in demand for medical-grade hoses used for ventilators and medical equipment in the healthcare sector. In contrast, demand for hoses in non-essential industries decreased.

Russia- Ukraine War Impact

Russia's invasion of Ukraine could have a huge influence on hose manufacturing, particularly with carbon black, which is a major material for thermoplastic hoses. Carbon black is created by the reaction of oil or gas and accounts for 40-70% of the elements in black rubber components. Russia is a major exporter of carbon black, exporting over 700,000 tons per year, whereas U.S. imports over 200,000 tons per year. Any fluctuations in the carbon black market could give rubber hose makers and distributors extra troubles.

As the supply chain is becoming increasingly volatile, hydraulic hose manufacturers are being forced to adapt to increased raw material prices. Nobody is immune to the effects of scarcity and price volatility; every business is coping with major raw material price rises owing to a variety of unpredictable circumstances. Freight and distribution costs have also been continuously rising since the start of the COVID-19 epidemic and rising oil prices will add to this pattern.

Key Developments

- In August 2022, Bridgestone Corporation, an international tire and rubber manufacturing business, announced that it will increase hydraulic hose production capacity at Bridgestone NCR Co., Ltd., a Thai subsidiary that manufactures and sells industrial products. Production capacity will begin to expand in the second quarter of 2025 and hydraulic hose production capacity additions are expected to result in an increase of roughly 30% of present capacity globally by the first quarter of 2026.

- In July 2021, Baggerman Group, a producer and distributor of industrial hoses, couplings and accessories, was acquired by NORRES GmbH, a manufacturer, developer and distributor of flexible hose system solutions. The acquisition will help the company extend its global presence as well as its market share.

- In April 2020, Continental AG, a German multinational automobile parts manufacturer, produced medical hoses for the medical sector in Bergamo and the Lombardy region at its Italian location in Daverio, Italy. PVC hose can convey air, oxygen, nitrous oxide, helium and carbon dioxide.

Why Purchase the Report?

- To visualize the global hoses market segmentation based on material, type, media, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of hoses market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global hoses market report would provide approximately 69 tables, 78 figures and 206 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies