Report Overview

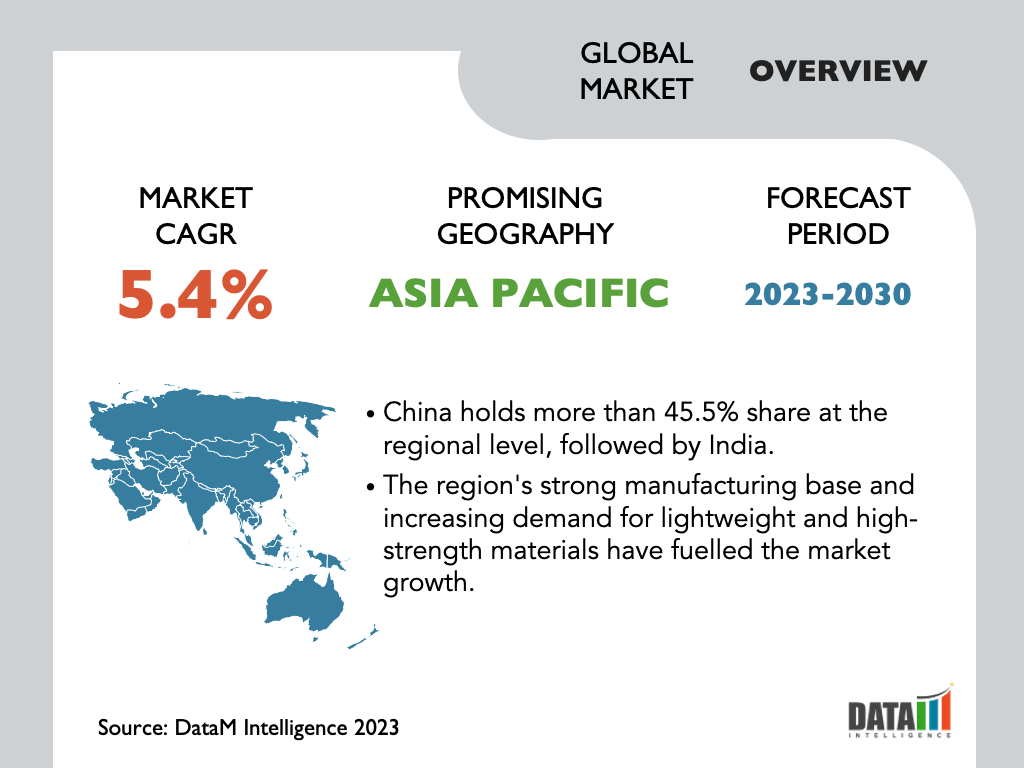

The Global High-Performance Alloys Market reached USD 8.2 billion in 2022 and is expected to reach USD 12.4 billion by 2031, growing with a CAGR of 5.4% during the forecast period 2024-2031.

The High-Performance Alloys Market has experienced significant growth in recent years. Industries such as aerospace, automotive, oil and gas, medical and electronics are experiencing the highest demand for the product.

These alloys offer superior mechanical properties, including high strength, corrosion resistance, heat resistance, and excellent performance in extreme environments, which are major market-propelling factors. The increasing need for lightweight and durable materials in these industries drives the demand for high-performance alloys.

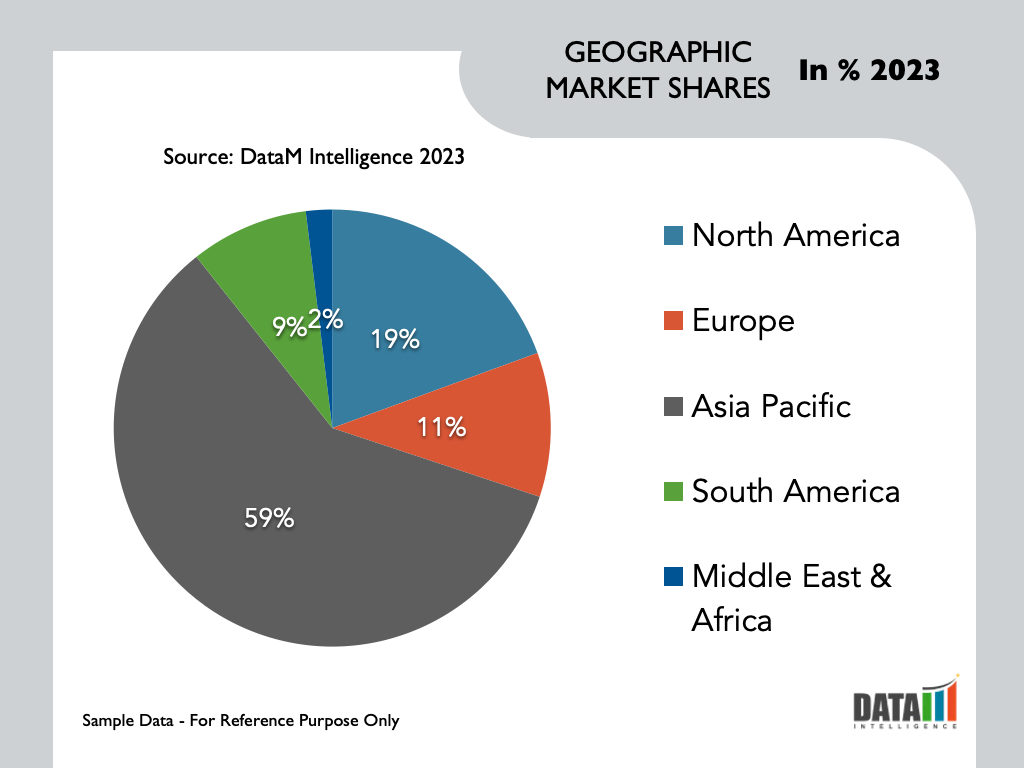

Asia Pacific holds the highest share covering more than 60.1% of the global high-performance alloys market in 2020 due to continuous improvement of construction activities and the automotive businesses in Japan, India, and China. China and India are expected to cover more than 2/3rd of the regional share due to government-supporting policies on cost reduction and improving the performance of alloys.

Market Summary

| Metrics | Details |

| CAGR | 5.4% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Material, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Market Dynamics

Extensive demand from a wide range of applications

High-performance alloys have existed in some form for several centuries, the introduction of the jet engine in the first part of the twentieth century accelerated the development of many of the HPAs that are now ubiquitous in the industry. Furthermore, HPA development in the present period is still pushed by the aerospace sector's more demanding needs and developing regions are investing in boosting the sector, creating growth opportunities for the product.

For instance, in November 2020, U.S. Senate planned to invest about USD 1.7 billion to buy 17 more F-35 fighter jets for the military in the fiscal year 2021. In FY21, the Air Force will get twelve F-35As and the Navy and Marine Corps will receive five F-35Cs for 96 jets. As a result of these trends in the aerospace and military industries, demand for aircraft and jets is predicted to increase, resulting in increased demand for high-performance alloys.

Technological Advancements

Continuous advancements in alloy compositions, manufacturing processes, and surface treatments have improved the performance and characteristics of high-performance alloys. Innovative alloy designs and manufacturing techniques allow for enhanced properties, such as higher strength-to-weight ratios and improved resistance to corrosion, wear and high temperatures. These technological advancements are driving the adoption of high-performance alloys in various applications.

The growing technological advancements have encouraged the key players to bring their latest products to the market. For instance, on 6 October 2021, Fehrmann Alloys GmbH & Co KG, Hamburg, Germany, added six new aluminum alloys to its portfolio, suitable for additive manufacturing processes. The business has now introduced AlMgty70, AlMgty100, conventional cast aluminum alloys AlMgty3, AlMgty5, AlMgty50 and the aluminum-zinc alloy AlZnty5, following the success of its corrosion-resistant, high-performance AlMgty80 and AlMgty90.

High Production Cost

High-performance alloys often involves complex manufacturing processes, such as melting, casting, forging and heat treatment. These processes require specialized equipment, skilled labor and stringent quality control measures, contributing to higher manufacturing costs. The expenses associated with manufacturing high-performance alloys are passed on to customers, making them more expensive than conventional alloys.

Furthermore, the production of high-performance alloys is often limited to specialized manufacturers with advanced facilities and expertise. Compared to more widely used alloys, the smaller scale of production results in challenges in economies of scale, leading to higher costs.

Market Segmentation Analysis

The Global High-Performance Alloys Market is segmented based on material, product, application and region.

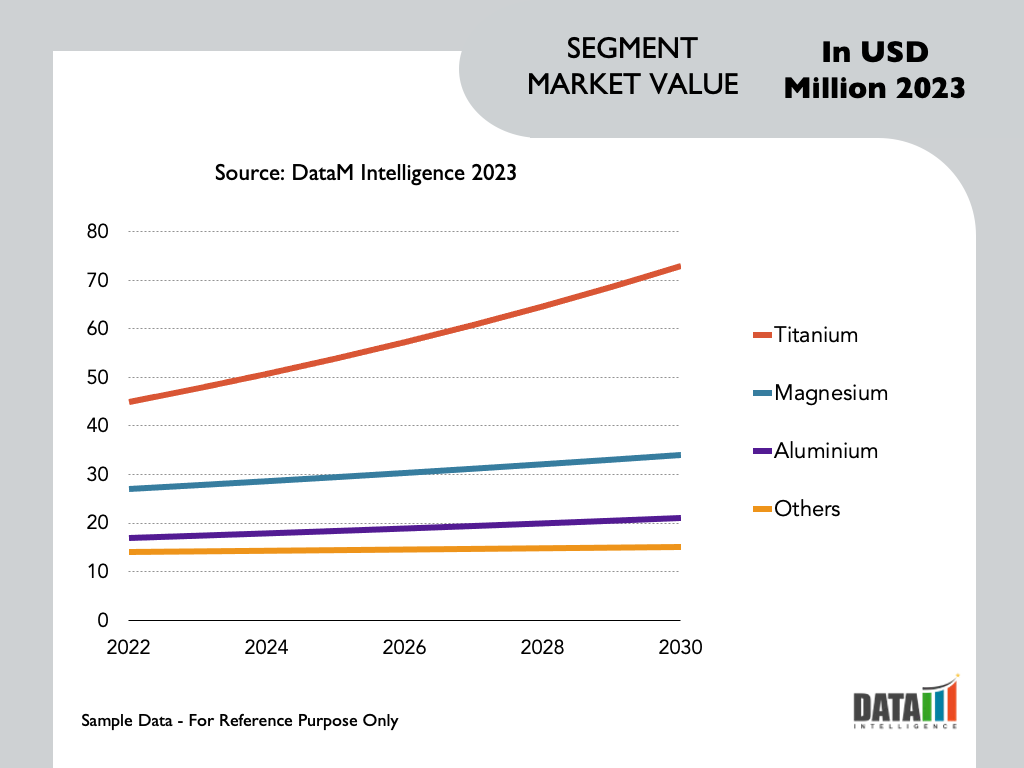

Rising Demand For Low Weight And Excellent Corrosion Resistance Alloys From Various End-User Industries

Titanium alloys hold a major share of more than 1/3rd of the Global High-Performance Alloys Market. Titanium alloys are materials made up of titanium and other chemical elements. Such alloys' tensile strength and toughness are extremely high (even at extreme temperatures). They are low in weight, have excellent corrosion resistance and can sustain high temperatures, making them used in various industries.

The aerospace industry is the prime end-user responsible for accelerating titanium alloy’s market use in jet engines and other related parts. Gas turbine engines and aircraft structures such as landing gear, spacecraft and helicopter rotors utilize these alloys. Emerging markets, particularly China and Russia, will likely expand their demand for titanium alloys in the forecast period.

Market Geographical Share

Asia-Pacific’s Increasing Demand For Lightweight And High-Strength Materials

The Asia-Pacific has witnessed significant growth in the high-performance alloy market due to rapid industrialization and infrastructure development in countries like China, India, Japan, South Korea, and ASEAN nations. China is the leading country in the region, owning more than 45.5% of the market share, closely trailed by India. The regional surge in the market is primarily propelled by a robust manufacturing infrastructure and an escalating demand for materials that amalgamate lightweight aspects with high-strength characteristics.

Furthermore, major alloy manufacturers have invested in expanding their production capacities in the Asia-Pacific to meet the growing demand. For instance, companies like Nippon Steel Corporation and JFE Steel Corporation in Japan, China Baowu Steel Group and POSCO in South Korea have announced expansions in their alloy production capabilities.

Market Key Players

The major global players include Precision Catparts Corp, Alcoa Inc, Outokumpu, Hitachi Metals Ltd., Aperam, Allegheny Technologies Incorp, Carpenter Technology, Haynes International Inc, VSMPO-Avisma Corp and ThyssenKrupp AG.

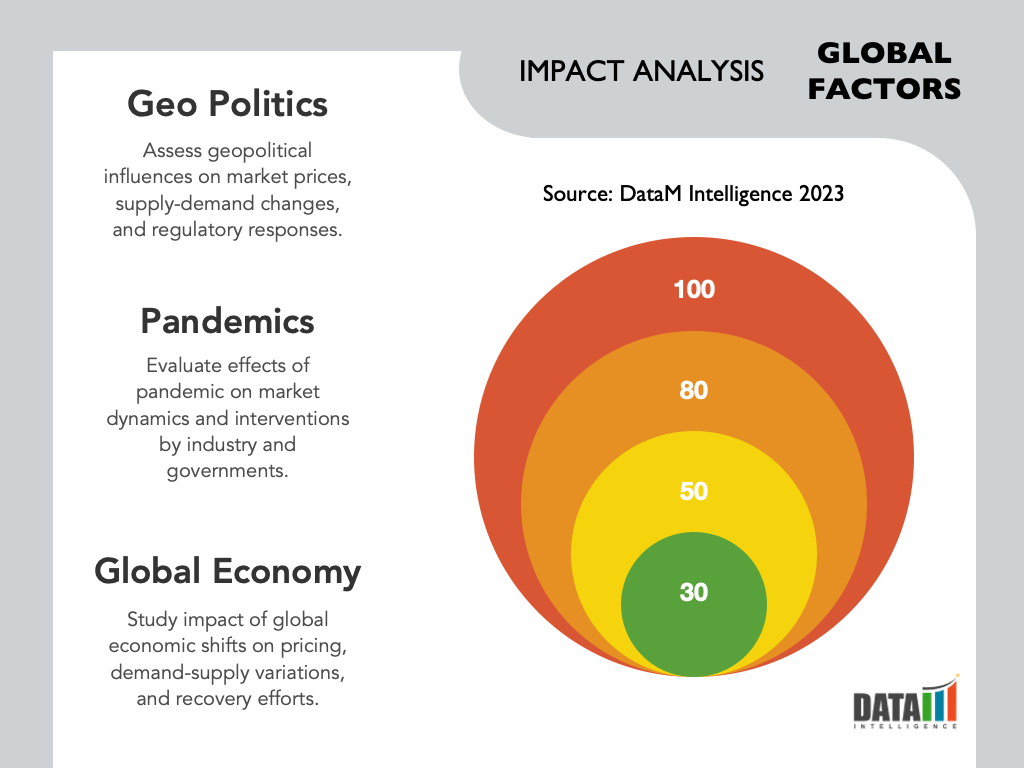

COVID-19 Impact on Market

COVID Impact

The global lockdowns, travel restrictions and temporary shutdowns of manufacturing facilities disrupted supply chains worldwide. It resulted in challenges related to sourcing raw materials, transportation delays and reduced production capacity for high-performance alloys. Disruptions in the supply chain hurt the availability of high-performance alloys, leading to potential delays in project timelines and reduced demand.

Furthermore, companies in various industries reassessed their priorities and budgets during the pandemic. The focus shifted to cost reduction, cash preservation and ensuring business continuity. As a result, adopting high-performance alloys, which are often associated with higher costs compared to conventional alloys, may have been deprioritized or postponed.

Ukraine-Russia War Impact

Ukraine is a significant producer of high-performance alloys, particularly titanium-based alloys. The conflict between Ukraine and Russia has disrupted supply chains, leading to uncertainties in the availability of raw materials and finished alloys. This disruption has affected global supply and created price volatility in the market.

Furthermore, the conflict has created geopolitical uncertainty, impacting investor confidence and decision-making. Investors may exercise caution in making long-term investments in the high-performance alloy market, affecting expansion plans, research and development activities and mergers and acquisitions. Uncertainty can also lead to delayed projects and a slower pace of innovation.

By Material

- Titanium

- Aluminium

- Magnesium

- Others

By Product

- Non-Ferrous Alloys

- Platinum Group Alloys

- Refractory Metal Alloys

- Super Alloys

By Application

- Automotive

- Aerospace

- Industrial Gas Turbines

- Oil & Gas

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 9 January 2023, Advantec Wheels, a start-up based in Delhi, India, announced to start off the production of high-performance alloy wheels for the passenger car aftermarket at its new facility in Jammu and scheduled to go on stream in August 2023.

- On 15 March 2021, Rio Tinto, a growing global mining and metals company, partnered with Amaero, a leader in metal additive manufacturing, to deliver a high-performance aluminum-scandium alloy that can be ground into powder for 3D printing and used for high-temperature applications.

- On 26 June 2020, Amaero, a metal AM expert, announced that the national phase, or fourth and final stage, of international patent acceptance has been reached for their high-performance 3D printing aluminum alloy, Amaero HOT Al. The patent application was made as part of the Patent Co-operation Treaty, under which an invention is recognized and protected by a single "international patent" in more than 150 participating nations. In this way, the innovator can have their work recognized globally without having to go through numerous patent applications.

Why Purchase the Report?

- To visualize the Global High-Performance Alloys Market segmentation based on material, product, application and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of high-performance alloys market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global High-Performance Alloys Market Report Would Provide Approximately 61 Tables, 61 Figures, And 208 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies