Health Information Exchange Market Size

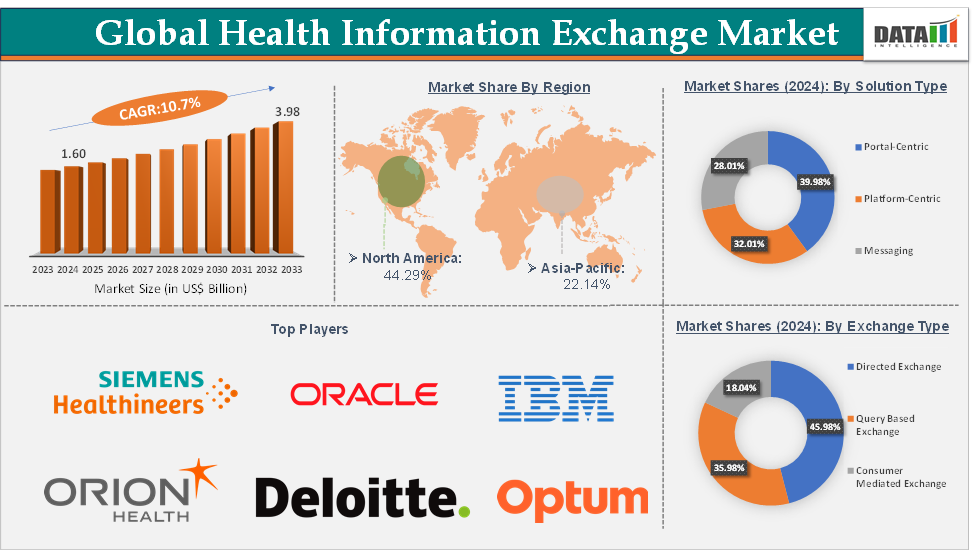

Health Information Exchange Market Size reached US$ 1.60 Billion in 2024 and is expected to reach US$ 3.98 Billion by 2033, growing at a CAGR of 10.7% during the forecast period 2025-2033.

The health information exchange market is experiencing significant growth, driven by the increasing need for efficient healthcare data management and the adoption of digital health solutions. The purpose of health information exchange is to ensure that the right health information is available at the right time to the right healthcare provider, enabling more informed decision-making, better coordination of care, and improved patient outcomes.

Executive Summary

For more details on this report – Request for Sample

Health Information Exchange Market Dynamics: Drivers & Restraints

Rising advancements in health information exchange technology are significantly driving the market growth

Advancements in interoperability standards like HL7, FHIR (Fast Healthcare Interoperability Resources), and CCD (Continuity of Care Documents) have made it easier for different healthcare systems to communicate and share patient data. For instance, in May 2024, the Union Health Ministry is setting up a National Health Claim Exchange (NHCX) platform to make the process of submitting health insurance claims easier. The payer and the service provider will communicate via the National Health Exchange platform. The National Health Authority (NHA) created this platform to guarantee interoperability and quicker processing of insurance claims.

Cloud computing has become a game-changer in health information exchange. By storing patient data on secure cloud platforms, healthcare organizations can access real-time data remotely, improving care delivery and reducing delays. Cloud-based health information exchange technologies allow healthcare providers to access centralized patient information without being tied to physical infrastructure.

For instance, in October 2024, Oracle introduced Oracle Health Clinical Data Exchange, a cloud-based technology that helps payers and healthcare providers exchange medical claims data more efficiently. Operating on Oracle Cloud Infrastructure, the platform seeks to replace the present manual medical record transmission procedures with a centralized, automated network. It is anticipated that this invention would speed up claims and payment processing, lessen administrative responsibilities, and expedite patient service approvals.

Data security and privacy concerns are hampering the growth of the health information exchange market

Data security and privacy concerns are significant barriers to the growth of the health information exchange market. The sensitive nature of healthcare data makes it a prime target for cyberattacks, and any breach or unauthorized access can undermine trust in these systems, slowing their adoption. HIE systems handle large volumes of personal and sensitive health information. A security breach can expose confidential patient records, leading to severe consequences such as identity theft, fraud, and privacy violations.

For instance, according to the HIPAA Journal, in 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day. In March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach.

Health Information Exchange Market Segment Analysis

The global health information exchange market is segmented based on exchange type, implementation model, setup type, solution type, application, end-user, and region.

The portal-centric segment from solution type is expected to hold 39.98% of the market share in 2024 in the health information exchange market

Portal-centric health information exchange systems are web-based platforms that allow users (healthcare providers, patients, and administrators) to access patient data from any location, using a computer or mobile device. This flexibility ensures that healthcare professionals can make timely, informed decisions, even when they are not physically present at the healthcare facility. Portal-centric HIEs enhance patient engagement by allowing individuals to take control of their health information. This improves transparency and empowers patients to make informed decisions about their care.

For instance, in December 2024, Medsynaptic launched ImageDoot, a revolutionary medical image exchange and patient engagement portal. ImageDoot is a cutting-edge, cloud-based platform designed to transform the secure exchange, access, and portability of medical images and records. With ImageDoot, Medsynaptic aims to bridge the communication gap between healthcare providers and patients, paving the way for a more connected and efficient healthcare ecosystem.

Portal-centric HIEs enhance patient engagement by allowing individuals to take control of their health information. Patients can review their medical history, lab results, and medication lists, and communicate directly with healthcare providers. This improves transparency and empowers patients to make informed decisions about their care. For Instance, the MyChart patient portal, developed by Epic Systems, allows patients to view test results, request prescription refills, and schedule appointments. MyChart has millions of users, further validating the growing popularity of portal-centric solutions.

Health Information Exchange Market Geographical Analysis

North America is expected to dominate the global health information exchange market with a 42.7% share in 2024

North America led the global health information exchange market in 2022 with a market size of US$ 0.64 billion and reached further to US$ 0.70 billion in 2023.

North America, especially the United States government, played a crucial role in the adoption of health information exchange systems through supportive policies and regulations. Key initiatives, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and the American Recovery and Reinvestment Act (ARRA), incentivized healthcare providers to adopt electronic health records (EHRs) and HIE systems. This has accelerated the growth of HIE in North America.

North America is a global leader in healthcare technology innovation, providing a strong foundation for the growth of health information exchange systems. The region's healthcare providers are early adopters of cutting-edge technologies, including cloud-based and cutting-edge solutions, all of which are increasingly integrated into HIE systems to improve data exchange, security, and interoperability.

For instance, in August 2024, MEDITECH unveiled Traverse Exchange, a cutting-edge national health information exchange network for US customers. This Traverse Exchange Canada solution will allow participating MEDITECH customers to safely and easily share health information with other MEDITECH customers as well as with organizations that use other vendor EHRs and exchange networks that adhere to interoperability standards. By connecting to the Health Gorilla QHIN, the solution puts MEDITECH and its clients in a good position for TEFCA and expands QHIN services across its network.

Asia-Pacific is growing at the fastest pace in the health information exchange market, holding 22.14% of the market share

Many Asia-Pacific countries have been adopting national healthcare IT policies to promote digital health transformation, including the integration of Health Information Exchange systems. Governments are investing in eHealth infrastructure, aiming to improve healthcare delivery and reduce costs. For instance, in China, the government has launched initiatives such as the National Health Information Platform, which promotes the integration of healthcare data across various regions and healthcare providers, facilitating seamless data exchange and improving healthcare accessibility.

Many countries in APAC, such as India, China, and Japan, are rapidly digitalizing their healthcare sectors. The adoption of Electronic Health Records (EHR), telemedicine, and cloud computing has created a conducive environment for the growth of HIE solutions, which enable seamless data exchange across different healthcare systems. Thus, many market players and emerging players in the region are focusing on the development of HIE platforms.

Health Information Exchange Market Major Players

The major global players in the health information exchange market include Siemens Healthineers AG, Oracle, IBM, Orion Health group of companies, Deloitte, Optum Inc., Veradigm LLC, Chetu Inc., Infor, Meditab and among others.

Key Developments

In March 2025, eClinicalWorks, the leader in the cloud-based ambulatory EHR market, announced the strategic integration with PointClickCare, a leading healthcare technology platform enabling meaningful care collaboration and real‐time patient insights. With this integration, eClinicalWorks can connect and exchange data with PointClickCare applications in long-term and post-acute care (LTPAC) settings to support remote and bedside physician encounters.

In March 2025, CommonWell Health Alliance launched the CommonWell Marketplace, a platform designed to connect healthcare providers with innovative solutions that enhance interoperability and improve patient care. The Marketplace will serve as a one-stop shop for leading-edge technologies and services, empowering healthcare organizations to optimize their nationwide health data exchange priorities.

In October 2024, Oracle launched its Oracle Health Clinical Data Exchange, a cloud-based platform designed to streamline the exchange of medical claims information between healthcare providers and payers. The platform, which operates on Oracle Cloud Infrastructure, aims to replace the current manual methods of transferring medical records with an automated, centralized network. This innovation is expected to reduce administrative burdens, expedite patient service approvals, and accelerate claims and payment processing.

Market Scope

Metrics | Details | |

CAGR | 10.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Exchange Type | Directed Exchange, Query-Based Exchange, and Consumer-Mediated Exchange |

Implementation Model | Centralized Model, Decentralized Model, and Hybrid Model | |

Setup Type | Private HIE and Public HIE | |

Solution Type | Portal-Centric, Platform-Centric, and Messaging | |

Application | Workflow Management, Web Portal Development, Internal Interfacing, and Others | |

End-User | Hospitals, Specialty Clinics, Public Health Organizations, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global health information exchange market report delivers a detailed analysis with 86 key tables, more than 83 visually impactful figures and 179 pages of expert insights, providing a complete view of the market landscape.