Global Healthcare Cybersecurity Market – Industry Trends & Outlook

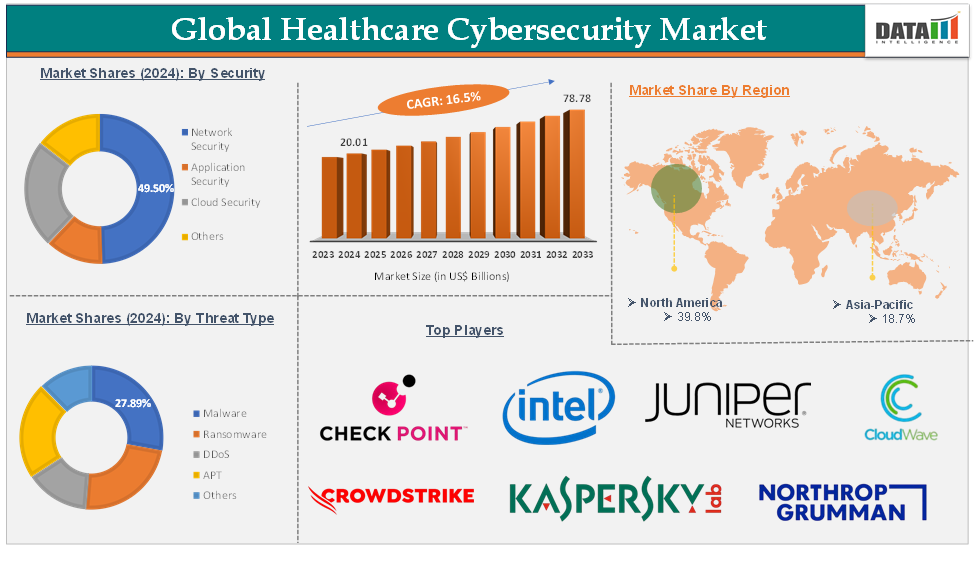

The global healthcare cybersecurity market reached US$ 20.01 Billion in 2024 and is expected to reach US$ 78.78 Billion by 2033, growing at a CAGR of 16.5 % during the forecast period of 2025-2033.

The global healthcare cybersecurity market encompasses a wide array of technologies, solutions, and practices aimed at safeguarding sensitive patient data, medical devices, and healthcare IT systems from digital threats such as ransomware, phishing, and data breaches. This sector is vital for hospitals, clinics, pharmaceutical companies, telehealth providers, and other organizations, as it ensures the confidentiality, integrity, and availability of electronic health records (EHRs), medical devices, and critical healthcare infrastructure.

Market growth is being driven by several key factors, including the rapid digitalization of healthcare services, the widespread adoption of EHRs and telemedicine, and the escalating sophistication and frequency of cyberattacks targeting healthcare institutions. Emerging trends in the healthcare cybersecurity market include the integration of artificial intelligence and machine learning for advanced threat detection, the adoption of zero-trust security models, and the increasing use of cloud security solutions.

Opportunities in this market are substantial, as healthcare organizations seek robust solutions to address new and evolving threats, secure remote care platforms, and comply with stricter regulations. The ongoing digital transformation of healthcare, combined with the need to protect against quantum computing threats and supply chain vulnerabilities, positions cybersecurity as a strategic imperative for ensuring patient trust and operational continuity in the global healthcare sector.

Global Healthcare Cybersecurity Market – Executive Summary

Global Healthcare Cybersecurity Market Dynamics: Drivers

Increasing cyberattacks and concerns related to security and privacy

The surge in cyberattacks and mounting privacy concerns are key drivers fueling the growth of the global healthcare cybersecurity market. As healthcare organizations increasingly adopt digital technologies and connected devices, they face escalating threats from sophisticated cybercriminals targeting sensitive patient data and critical IT systems.

In 2024, the industry experienced a record-breaking 168 million healthcare records exposed, stolen, or improperly disclosed, representing a dramatic rise from previous years. This included 26 data breaches, each affecting over 1 million records, with the largest single incident impacting more than 11 million individuals.

The majority of these breaches involved hacking incidents often linked to ransomware or extortion attempts, though some stemmed from unauthorized disclosures, such as the use of tracking pixels on healthcare websites. High-profile cases, like the breach at Kaiser Permanente, underscored the risks associated with online technologies, as personal information was inadvertently shared with third parties when patients accessed digital services.

In 2024, while the number of reported healthcare data breaches showed a slight decline, the total number of compromised records soared, driven by unprecedented incidents such as the Change Healthcare ransomware attack that affected an estimated 190 million individuals.

These trends highlight the urgent need for advanced cybersecurity measures in healthcare, as organizations must not only defend against increasingly complex attacks but also address regulatory requirements and protect patient trust in an environment where privacy risks are rapidly evolving.

Global Healthcare Cybersecurity Market Dynamics: Restraints

Lack of a cybersecurity policy framework in healthcare organizations

A lack of a comprehensive cybersecurity policy framework in healthcare organizations acts as a significant restraint on the growth and effectiveness of the global healthcare cybersecurity market. Without standardized policies and structured frameworks, healthcare providers often struggle to implement consistent security controls, risk management practices, and incident response protocols across their operations.

This inconsistency leaves organizations vulnerable to cyber threats, increases the likelihood of data breaches, and makes it difficult to comply with evolving regulatory requirements such as HIPAA, HITRUST, and the NIST Cybersecurity Framework. The absence of a unified policy framework also hampers interoperability and secure data exchange within increasingly digital and interconnected healthcare environments, as highlighted by studies on health data spaces and cross-border data sharing.

Furthermore, when technology and service providers supporting healthcare infrastructure are not held to uniform cybersecurity standards, it creates gaps in protection and accountability across the supply chain. These challenges not only expose healthcare organizations to greater cyber risks but also slow the adoption of advanced cybersecurity solutions, ultimately restraining market growth and undermining efforts to safeguard patient data and critical healthcare services.

For more details on this report, Request for Sample

Global Healthcare Cybersecurity Market - Segment Analysis

The global healthcare cybersecurity market is segmented based on threat type, solution, security, deployment, end-user, and region.

Security:

The network security segment is expected to hold 49.5% of the global healthcare cybersecurity market in 2024

The network security segment is projected to command the largest share of the healthcare cybersecurity market during the forecast period, driven by ongoing technological advancements and a rising demand for robust network protection.

Network security focuses on defending computer networks and systems against both internal and external cyber threats, ensuring the integrity, confidentiality, and availability of network infrastructure and data. Key components of network security include access controls, antivirus and anti-malware software, application security, network analytics, endpoint and web security, firewalls, VPN encryption, and wireless security measures.

These comprehensive strategies are essential for protecting healthcare organizations from cyberattacks, maintaining the continuous operation of medical systems and equipment, safeguarding patient data, and ensuring compliance with industry regulations. Recent legislative efforts, such as the US Senate’s proposed measures to strengthen healthcare cybersecurity under the Department of Health and Human Services (HHS), underscore the critical need to identify and address vulnerabilities that could compromise patient safety or data privacy.

For instance, in August 2024, Avant Technologies, Inc., an emerging technology company developing solutions in artificial intelligence (AI) infrastructure while exploring additional technologies in the biotechnology and healthcare sectors, announced its commitment to data security and privacy, particularly for its AI-driven healthcare applications.

Avant is building comprehensive cybersecurity measures into the very foundation of its intelligent solutions, ensuring the highest protection for sensitive patient information. Additionally, the Company plans to assess the industry's leading frameworks to integrate with its technology. These factors have solidified the segment's position in the global healthcare cybersecurity market.

Global Healthcare Cybersecurity Market – Geographical Analysis

North America is expected to hold 39.8% of the global healthcare cybersecurity market in 2024

North America is projected to maintain the largest share of the global healthcare cybersecurity market, driven by several key factors. The region benefits from a highly developed healthcare infrastructure, widespread adoption of digital health technologies such as electronic health records (EHRs), telemedicine, and IoT devices, and stringent regulatory frameworks like HIPAA that mandate robust data protection measures.

The prevalence and sophistication of cyber threats targeting healthcare organizations in North America have heightened awareness and urgency around cybersecurity, prompting significant investments in advanced security solutions, threat detection systems, and staff training. High-profile data breaches and ransomware incidents have underscored the vulnerability of patient data and critical systems, pushing healthcare institutions to prioritize cybersecurity as a strategic imperative.

The presence of leading cybersecurity vendors and continuous technological innovation further supports the region’s market dominance. Additionally, government initiatives and public-private collaborations are accelerating the adoption of next-generation cybersecurity products tailored to healthcare needs.

As healthcare organizations in North America continue to digitize operations and integrate connected devices, the demand for comprehensive cybersecurity solutions is expected to grow rapidly, ensuring the protection of sensitive medical data, maintaining patient trust, and supporting regulatory compliance.

For instance, in January 2025, the U.S. Department of Health and Human Services (HHS) will release its AI strategic plan, outlining a comprehensive roadmap for addressing both the opportunities and challenges of artificial intelligence in healthcare. This plan details how HHS will guide the responsible adoption, implementation, and oversight of AI technologies to improve healthcare outcomes while effectively managing associated risks. Thus, the above factors are consolidating the region's position as a dominant force in the global healthcare cybersecurity market.

Asia Pacific is expected to hold 18.7% of the global healthcare cybersecurity market in 2024

The Asia-Pacific healthcare cybersecurity market is experiencing rapid growth, driven by several key factors. Increasing digitization across the region’s healthcare sector, including the widespread adoption of electronic health records (EHRs), telemedicine, wireless medical devices, and IoT-enabled healthcare infrastructure, has expanded the attack surface for cybercriminals, resulting in a surge of cyberattacks targeting sensitive patient data and critical medical systems.

High-profile breaches and escalating ransomware incidents have highlighted vulnerabilities, especially as many healthcare organizations in the region still operate with outdated systems and limited cybersecurity awareness.

Government initiatives and regulatory reforms are also major drivers. Countries such as India and China have introduced stricter data protection laws, while others like Hong Kong and the Philippines are implementing reforms modeled after Europe’s GDPR, prompting healthcare providers to invest in advanced cybersecurity solutions to ensure compliance and safeguard patient privacy.

For instance, in April 2025, Singapore’s Health Sciences Authority (HSA) initiated a public consultation on its proposed Best Practices Guide for Medical Device Cybersecurity. This consultation invites feedback from industry stakeholders, healthcare professionals, and the public to help shape comprehensive guidelines aimed at enhancing the cybersecurity of medical devices in Singapore.

Thus, the above factors are consolidating the region's position as a dominant force in the global healthcare cybersecurity market.

Global Healthcare Cybersecurity Market – Competitive Landscape

The major global players in the healthcare cybersecurity market include Checkpoint Software Technologies Inc., Intel Corporation, Juniper Networks Inc., Cloudwave Sensato Cybersecurity, Crowdstrike Strike Holdings, Kaspersky Labs, Northrop Grumman Corporation, Palo Alto Networks, Broadcom, and Sophos Ltd., among others.

Global Healthcare Cybersecurity Market – Key Developments

In April 2025, Full Spectrum, a fast-growing product development and engineering services firm focused on the medical device, digital health, and life sciences sectors, introduced a comprehensive suite of cybersecurity services. As cybersecurity becomes increasingly vital, these offerings are designed to help companies safeguard privacy, ensure safety, and maintain reliability in an ever-more connected world.

In January 2025, the European Commission unveiled a comprehensive action plan to strengthen cybersecurity for hospitals and healthcare providers across the EU. This initiative addresses the rising number of cyber and ransomware attacks targeting the healthcare sector and aims to enhance the security and resilience of health systems.

In November 2024, Health Catalyst, Inc., a top provider of data and analytics solutions for healthcare organizations, launched an upgraded, AI-powered version of BluePrint Protect. This platform was originally developed by Intraprise Health, LLC.

In May 2024, the Department of Health and Human Services (HHS) launched a new program aimed at enhancing cybersecurity in hospitals. With an investment exceeding $50 million, the initiative will develop a software suite designed to automatically detect potential vulnerabilities that hackers might exploit.

In March 2024, Claroty introduced its Advanced Anomaly Threat Detection (ATD) Module for the Medigate Platform, aiming to elevate cybersecurity standards for healthcare organizations. This new solution delivers clinically-aware, agentless threat detection, enabling healthcare providers to identify, assess, and prioritize risks to connected medical devices, IoT, and building management systems with greater accuracy.

In April 2024, Anatomy IT, a premier provider of healthcare IT and cybersecurity solutions, announced the release of its enhanced end-to-end cybersecurity product suite. This expanded offering is specifically designed to protect healthcare delivery organizations against the increasing and evolving threats targeting IT systems.

Global Healthcare Cybersecurity Market – Scope

Metrics | Details | |

CAGR | 16.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Threat Type | Malware, Ransomware, DDoS, APT, Others |

Solution | IAML, Antivirus/ Antimalware, Firewall, Encryption, Tokenization, Others | |

Security | Network Security, Application Security, Cloud Security, Others | |

Deployment | On-Premises, Cloud-Based | |

End-User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Clinics | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global healthcare cybersecurity market report delivers a detailed analysis with 78 key tables, more than 80 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Table of Contents

Market Introduction and Scope

Objectives of the Report

Report Coverage & Definitions

Report Scope

Executive Insights and Key Takeaways

Market Highlights and Strategic Takeaways

Key Trends and Future Projections

Snippet by Threat Type

Snippet by Solution

Snippet by Deployment

Snippet by End-User

Snippet by Region

Dynamics

Impacting Factors

Drivers

Increasing Cyberattacks and Concerns Related to Security and Privacy

Rising Adoption of IoT and Connected Devices

Increasing Adoption of Cloud-Based Solutions in the Healthcare Industry

Restraints

Lack of Cybersecurity Policy Framework in Healthcare Organizations

Shortage of Skilled Professionals

Budget Constraints Related to Security in Developing Countries

Opportunity

Increasing Use of Healthcare IT Solutions in Outpatient Care Facilities

IoT Security Plays Critical Role in Healthcare Cybersecurity Sector

Impact Analysis

Strategic Insights and Industry Outlook

Market Leaders and Pioneers

Emerging Pioneers and Prominent Players

Established leaders with the largest-selling Brand

Market leaders with established Product

Latest Developments and Breakthroughs

Regulatory and Reimbursement Landscape

North America

Europe

Asia Pacific

South America

Middle East & Africa

Porter’s Five Forces Analysis

Supply Chain Analysis

Patent Analysis

SWOT Analysis

Unmet Needs and Gaps

Recommended Strategies for Market Entry and Expansion

Scenario Analysis: Best-Case, Base-Case, and Worst-Case Forecasts

Pricing Analysis and Price Dynamics

Global Healthcare Cybersecurity Market, By Threat Type

Introduction

Analysis and Y-o-Y Growth Analysis (%), By Threat Type

Market Attractiveness Index By Threat Type

Malware*

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%)

Ransomware

DDoS

APT

Others

Global Healthcare Cybersecurity Market, By Solution

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

Market Attractiveness Index By Solution

IAM*

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%)

Antivirus/ Antimalware

Firewall

Encryption

Tokenization

Others

Global Healthcare Cybersecurity Market, By Security

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%), By Security

Market Attractiveness Index By Security

Network Security*

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%)

Application Security

Cloud Security

Others

Global Healthcare Cybersecurity Market, By Deployment

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

Market Attractiveness Index, By Deployment

On-Premises*

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%)

Cloud-Based

Global Healthcare Cybersecurity Market, By End-User

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

Market Attractiveness Index, By End-User

Hospitals *

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%)

Healthcare Facilities

Pharmaceuticals and Biotechnology Companies

Telehealth and Digital Health Providers

Health Insurance Providers

Other

Global Healthcare Cybersecurity Market, By Regional Market Analysis and Growth Opportunities

Introduction

Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

Market Attractiveness Index, By Region

North America

Introduction

Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Threat Type

Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

Market Size Analysis and Y-o-Y Growth Analysis (%), By Security

Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

U.S.

Canada

Mexico

Europe

Introduction

Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Threat Type

Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

Market Size Analysis and Y-o-Y Growth Analysis (%), By Security

Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

Germany

U.K.

France

Spain

Italy

Rest of Europe

South America

Introduction

Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Threat Type

Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

Market Size Analysis and Y-o-Y Growth Analysis (%), By Security

Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

Brazil

Argentina

Rest of South America

Asia-Pacific

Introduction

Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Threat Type

Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

Market Size Analysis and Y-o-Y Growth Analysis (%), By Security

Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

China

India

Japan

South Korea

Rest of Asia-Pacific

Middle East and Africa

Introduction

Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Threat Type

Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

Market Size Analysis and Y-o-Y Growth Analysis (%), By Security

Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

Competitive Landscape and Market Positioning

Competitive Overview and Key Market Players

Market Share Analysis and Positioning Matrix

Strategic Partnerships, Mergers & Acquisitions

Key Developments in Product Portfolios and Innovations

Company Benchmarking

Company Profiles

Checkpoint Software Technologies Inc.*

Product Portfolio

Product Key Performance Indicators (KPIs)

Historic and Forecasted Product Sales

Product Sales Volume

Financial Overview

Company Revenue

Geographical Revenue Shares

Revenue Forecasts

Key Developments

Mergers & Acquisitions

Key Product Development Activities

Regulatory Approvals, etc.

SWOT Analysis

Intel Corporation

Juniper Networks Inc.

Cloudwave Sensato Cybersecurity

Crowdstrike Strike Holdings

Kaspersky Labs

Northrop Grumman Corporation

Palo Alto Networks

Broadcom

Sophos Ltd. (LIST NOT EXHAUSTIVE )

Assumptions and Research Methodology

Data Collection Methods

Data Triangulation

Forecasting Techniques

Data Verification and Validation

Appendix

About Us and Services

Contact Us

Suggestions for Related Report

For more healthcare IT-related reports, please click here