Green Methanol Market Size and Growth

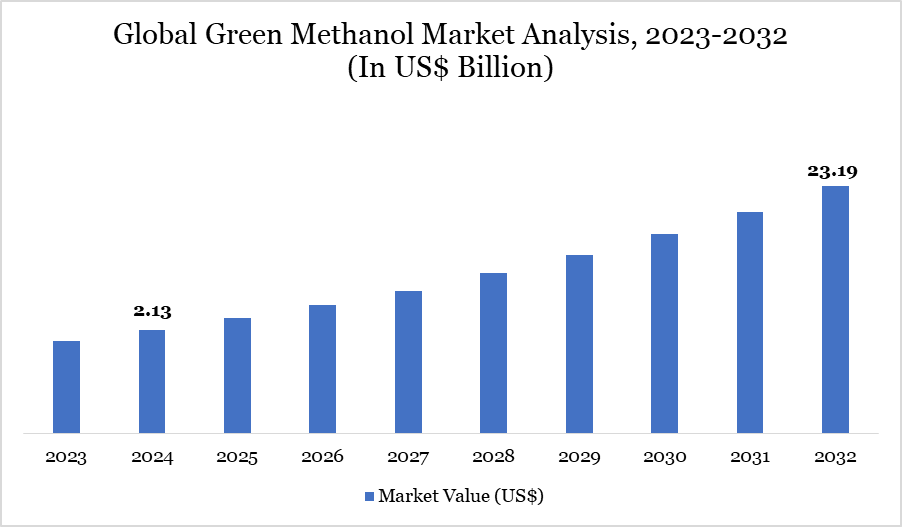

Global Green Methanol Market size reached US$ 2.13 billion in 2024 and is expected to reach US$ 23.19 billion by 2032, growing with a CAGR of 34.78% during the forecast period 2025-2032.

The global green methanol market is witnessing significant growth, driven by rising sustainability goals, stringent environmental regulations, and increased integration of renewable energy sources. Green methanol, produced from biomass, carbon dioxide, and green hydrogen, is increasingly preferred in sectors such as transportation and chemicals due to its lower emissions profile.

Its application as a fuel for automobiles, ships, boilers, and as a feedstock in the production of formaldehyde, acetic acid, and plastics positions it as a viable alternative to fossil fuels. With growing consumer awareness and the global urgency to limit the rise in global temperatures to 1.5°C, there has been a surge in interest from governments and industries alike.

Although currently hindered by high production costs and limited output, green methanol is expected to become cost-competitive by 2050 with the implementation of supportive policies. Consequently, the market is expected to experience substantial investment and technological innovation, making it a cornerstone in the global transition to net-zero carbons emissions.

Green Methanol Market Trend

One of the dominant trends shaping the green methanol market is the shift towards a circular economy and low-carbon solutions. Governments and industry leaders are actively seeking sustainable alternatives to mitigate climate change, particularly by promoting fuels that reduce greenhouse gas emissions.

Green methanol fits seamlessly into this narrative, offering up to 95% CO₂ emissions reduction, 80% NOₓ reduction, and complete elimination of particulate matter emissions compared to conventional fuels. Additionally, it can be used directly in existing combustion engines, avoiding infrastructure overhaul costs. New policies under Europe’s Emissions Trading System and directives such as the Fuel Quality and Air Quality Directives are reinforcing this trend by encouraging renewable energy use.

Blending initiatives in countries like China, Israel, India, and Italy are further expanding the scope for green methanol. These developments highlight the market’s transition from early adoption to broader commercialization, propelled by regulatory frameworks and global climate commitments.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details | |

| By Type | Biomethanol, E-Methanol | |

| By Production Route | Power to Methanol, Biomethane Reforming, Biomass Gasification, Waste to Methanol | |

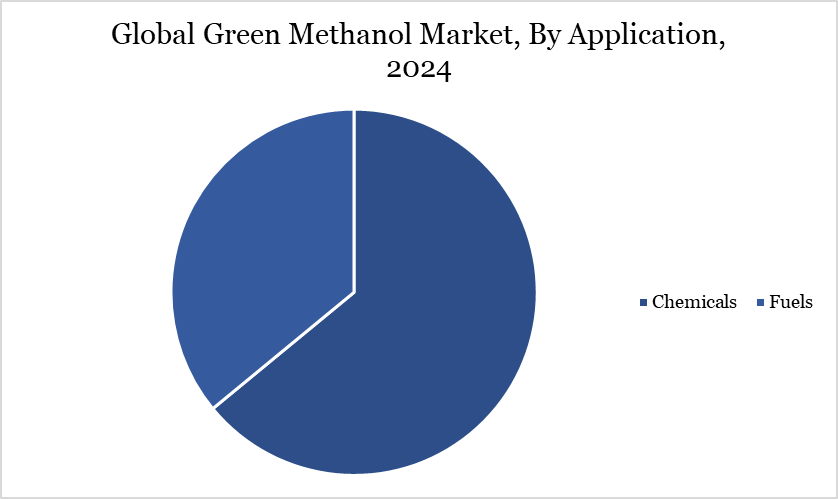

| By Application | Chemical, Fuel | |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East & Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Green Methanol Market Dynamics

Government Initiatives Bolstering Green Methanol Demand

A critical driver for the green methanol market is the wave of government initiatives aimed at reducing carbon emissions and promoting renewable fuels. Countries worldwide are recognizing the potential of green methanol to serve as a low-emission alternative in hard-to-decarbonize sectors.

China mandates methanol blending in gasoline across various provinces, while nations like Israel, Egypt, and India are testing methanol-gasoline blends with positive outcomes. Additionally, green methanol’s versatility allows its use in existing infrastructure and engines, enabling a smoother transition to sustainable energy systems. These initiatives are reinforced by climate policies such as the EU Emissions Trading System, aimed at decarbonizing the industrial and transportation sectors.

With mounting pressure to meet the global target of net-zero emissions by 2050, governments are increasingly investing in and incentivizing green methanol production and adoption. This regulatory backing is expected to significantly accelerate market growth.

High Production Costs Limit Market Expansion

Despite its vast potential, the high production cost of green methanol remains a key restraint to market expansion. The process relies heavily on bio-feedstocks, municipal solid waste (MSW), and green hydrogen, each contributing to the elevated cost structure. Feedstock costs alone can range from US$ 0.5 to US$ 17 per gigajoule, while biomass prices vary significantly, from US$ 320 to US$ 770 per ton. These fluctuations create investment uncertainties, deterring large-scale commercial adoption.

The limited availability of sustainable feedstocks and low-scale green hydrogen production exacerbate the issue. Until cost-effective production techniques are established and supply chains are optimized, green methanol’s market penetration will remain limited. Addressing these economic challenges is critical to realizing its full potential as a climate-friendly alternative to fossil fuels.

Market Segmentation

The global green methanol market is segmented based on type, production route, application and region.

Accelerating Growth in the Green Methanol Fuel Market: Technological Innovation, Policy Support, and Global Adoption

The green methanol fuel segment is witnessing the highest compound annual growth rate (CAGR), which has been driven by favorable government policies, quickening technology developments, and growing environmental awareness globally. Maersk's order of twelve methanol-powered vessels, which are expected to be delivered in 2024, is an example of how the maritime industry has embraced green methanol, especially in light of the International Maritime Organization's (IMO) 2020 sulfur emission restrictions.

In 2022, the Geely Auto Group launched the first passenger car powered by methanol, conforming to China's decarbonization goals. In order to reach the International Air Transport Association's (IATA) 2050 net-zero goal, the aviation industry is also making progress in this area, with businesses like Prometheus Fuels and Carbon Clean Solutions creating Sustainable Aviation Fuel (SAF) technology.

Market development is further supported by laws like the U.S. Inflation Reduction Act of 2022 and the EU's Fit for 55 packages. With its Green Deal, Europe sets the regional standard, while China and Canada follow following with calculated investments and alliances, like Methanex Corporation's 2023 cooperation with Enerkem Inc.

Market Geographical Share

Asia-Pacific Leads the Global Market Through Aggressive Capacity Expansion and Clean Energy Initiatives

Asia-Pacific is emerging as the most dominant region in the global green methanol market. This growth is largely attributed to aggressive capacity expansion in China, which is expected to account for approximately 90% of regional production and consumption by the end of 2025, according to the Methanol Institute.

China, already the world’s largest producer and consumer of methanol, is leveraging its energy transition goals to promote renewable methanol as a cleaner alternative to fossil fuels. The nation faces pressing challenges around air pollution and energy security, making green methanol a strategic solution.

Strong government support for renewable energy development, including wind, tidal, and geothermal power, provides a conducive ecosystem for market growth. The region’s rapid urbanization, expanding transportation sector, and environmental initiatives are further contributing to its dominance in the global green methanol market landscape.

Sustainability Analysis

Green methanol is a major advance in sustainable chemical synthesis. It is created by combining green hydrogen, which is generated through water electrolysis driven by renewable energy, with collected carbon dioxide (CO₂). Green methanol provides a carbon-neutral substitute for traditional methanol made from fossil fuels, significantly lowering greenhouse gas emissions.

This is especially important in industries that are difficult to decarbonize, including shipping and chemical manufacture, where conventional processes can release up to 1.5 metric tons of CO₂ for every ton of methanol produced. By using waste CO₂ as a feedstock and renewable energy sources like solar and wind, the switch to green methanol is in line with global climate goals and presents a viable path toward decarbonization.

However, there are operational difficulties with incorporating intermittent renewable energy into manufacturing systems. Using a dual-comparative approach, this study evaluates four seasonal renewable energy configurations backed by hybrid energy storage devices in order to resolve such complications. The results enhance the resilience of sustainable industrial pathways and optimize the production of green methanol.

Major Global Players

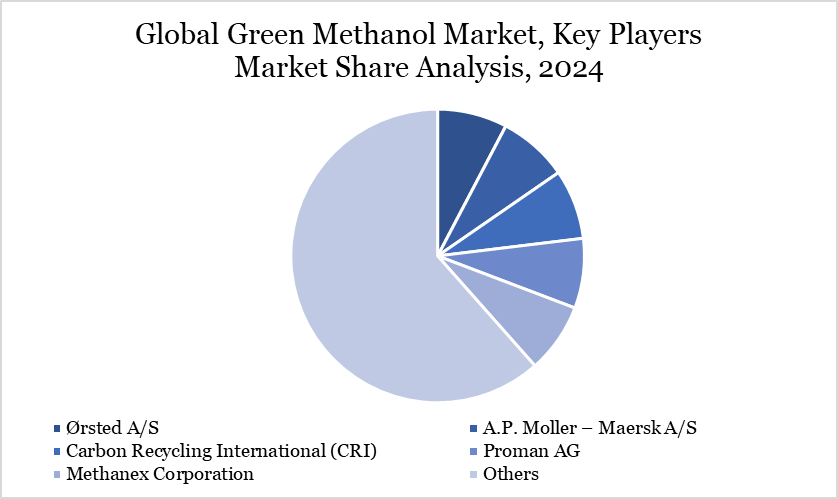

The major global players in the market include Ørsted A/S, A.P. Moller – Maersk A/S, Carbon Recycling International (CRI), Proman AG, Methanex Corporation, OCI N.V., BASF SE, Liquid Wind AB, WasteFuel, Southern Green Gas.

Key Developments

- In January 2024, BASF announced a new partnership with green technology vendor Envision Energy. Together, the two businesses created a sophisticated and dynamic process design to turn carbon dioxide and green hydrogen into e-methanol.

- Perpetual Next Company announced in December 2023 that it was building a second bio-methanol manufacturing plant in Estonia. It is anticipated that the plant, which would have a 220-kiloton output capacity, will be operational by 2027.

- In December 2023, Cepsa and C2X Companies announced a collaborative proposal to invest more than US$ 1 billion to build a new production unit to create green methanol. The company will position itself to satisfy the worldwide demand for green methanol from the shipping industry, aviation, chemicals, and other sources with this capacity growth plan.

- In September 2023, OCI Global declared its intention to expand its capacity for producing green methanol in the US. With a 400-kiloton production capacity, the plant is expected to be operational by 2025.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies