Market Size

The global graves ophthalmopathy treatment market size reached US$ 2.09 Billion in 2024 and is expected to reach US$ 3.01 Billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033.

Market Overview

The Graves ophthalmopathy treatment market is experiencing a significant transformation, driven by advancements in treatment options with strong pipeline products, increasing disease awareness and growing global incidence. For instance, according to the study conducted by the National Institutes of Health, Graves' ophthalmopathy is clinically relevant in 25-50% of patients with Graves' disease and 2% of patients with chronic thyroiditis. The age-adjusted annual incidence of clinically relevant GO is 16 per 100,000 population in women and 2.9 in men. At the onset of ophthalmopathy, 80-90% of patients have hyperthyroidism, with the rest having euthyroidism or hypothyroidism. This consistent incidence and disease overlap with common thyroid disorders sustain long-term market growth.

Pipeline innovation is robust, with companies like Viridian Therapeutics, Immunovant and Argenx, among others, developing next-generation biologics, aiming to reduce cost, increase convenience and improve safety profiles. These formats are expected to penetrate underserved and outpatient markets.

Executive Summary

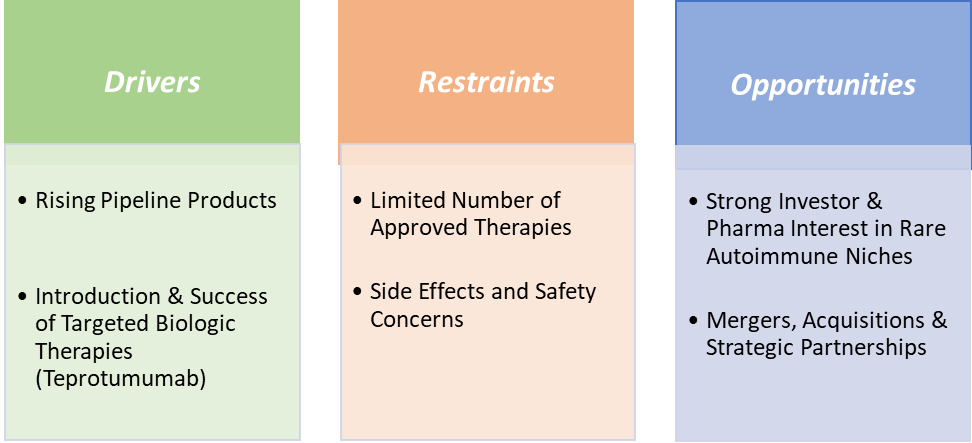

Market Dynamics

Drivers:

The rising pipeline products are significantly driving the market growth

Historically, treatment options were limited to high-dose corticosteroids, radiation or surgery, often with suboptimal outcomes and relapse rates exceeding 30–40%. The approval of Tepezza (teprotumumab) in 2020 marked the first targeted biologic therapy and opened the floodgates for R&D investment in TED. However, Tepezza's limitations, IV-only administration, high cost ($14,900 per vial) and side effects like hearing impairment created an opportunity for innovation. This has accelerated the development of next-generation therapies that are subcutaneous, oral or have novel mechanisms of action.

The growing pipeline products are a major growth driver for the Graves ophthalmopathy treatment market, as they address the unmet needs left by traditional therapies and expand access to more patients globally. For instance, in January 2025, Sling Therapeutics, Inc. announced topline efficacy and safety data from the Phase 2b/3 LIDS trial of linsitinib in patients with active, moderate to severe TED. Similarly, in May 2025, Viridian Therapeutics, Inc. announced that the United States Food and Drug Administration (FDA) granted Breakthrough Therapy Designation to veligrotug, the company’s lead anti-insulin-like growth factor-1 receptor (IGF-1R) drug candidate for the treatment of TED.

Restraints:

A limited number of approved therapies is hampering the Market growth

The limited number of approved therapies is a significant constraint on the growth of the Graves’ Ophthalmopathy treatment market, primarily because it restricts patient access, physician choice, and innovation in care strategies. As of now, Tepezza (teprotumumab), approved by the U.S. FDA in 2020, remains the only targeted biologic therapy specifically indicated for the disease. While Tepezza has demonstrated notable efficacy, its high cost, intravenous-only administration, and potential side effects make it unsuitable for all patient profiles.

This therapeutic bottleneck becomes even more problematic in regions outside the U.S., where regulatory approvals lag and access is limited or nonexistent. Patients in Europe and Asi often still rely on non-specific treatments like corticosteroids, radiation, or invasive surgeries, which offer inconsistent outcomes and higher complication risks.

For more details on this report – Request for Sample

Segmentation Analysis

The global Graves ophthalmopathy treatment market is segmented based on medication, disease severity, end-user, and region.

The monoclonal antibodies from the medication segment are dominating the Graves ophthalmopathy treatment market with a 34.43% share in 2024

Monoclonal antibodies (mAbs) are currently dominating the Graves’ ophthalmopathy treatment market due to their targeted mechanism of action, high efficacy, and growing clinical preference for biologics over traditional therapies. The most prominent instance is Tepezza (teprotumumab), a monoclonal antibody targeting the insulin-like growth factor-1 receptor (IGF-1R), which plays a key role in Graves ophthalmopathy pathogenesis. Approved by the U.S. FDA in 2020, Tepezza is the first and only approved therapy specifically designed for the disease. Its success has revolutionized treatment standards, delivering rapid improvement in proptosis, diplopia, and quality of life for moderate to severe patients.

Tepezza's commercial performance demonstrates the dominance of mAbs in this space. With high unmet need and lack of competition, mAbs are filling a crucial therapeutic gap. Additionally, new pipeline candidates, such as Viridian’s veligrotug (VRDN-001) and Sling Therapeutics’ linsitinib, though not all are mAbs, are targeting similar pathways, further reinforcing the biologics trend. Physicians are increasingly moving away from broad-spectrum immunosuppressants like corticosteroids, favoring mAbs for their predictable efficacy and reduced long-term toxicity.

Geographical Shares

North America is expected to dominate the global Graves ophthalmopathy treatment market with a 42.73% in 2024

North America, particularly the United States, is the dominant region in the global Graves ophthalmopathy treatment market, driven by early adoption of advanced therapies, strong healthcare infrastructure, and significant R&D investment. The region accounts for a major share of global revenue, largely due to the commercial success of Tepezza (teprotumumab), the first and only FDA-approved drug. Approved in 2020, Tepezza rapidly became a blockbuster.

The U.S. also leads in clinical trials and regulatory approvals, as seen in the development of pipeline candidates like veligrotug (Viridian Therapeutics) and linsitinib (Sling Therapeutics), both advancing rapidly through FDA-supported studies.

Competitive Landscape

Top companies in the Graves ophthalmopathy treatment market include Amgen Inc., Immunovant, Inc., Viridian Therapeutics, Inc., Argenx, Tourmaline Bio, Inc., F. Hoffmann-La Roche Ltd and Sling Therapeutics, among others.

Market Insights

Metrics | Details | |

CAGR | 4.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Medication | Monoclonal Antibodies, Corticosteroids, Antithyroid Medications and Others |

Disease Severity | Mild, Moderate and Severe | |

End-User | Hospitals, Specialty Clinics, Academic and Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Graves ophthalmopathy treatment market report delivers a detailed analysis with 53 key tables, more than 51 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.