Market Overview

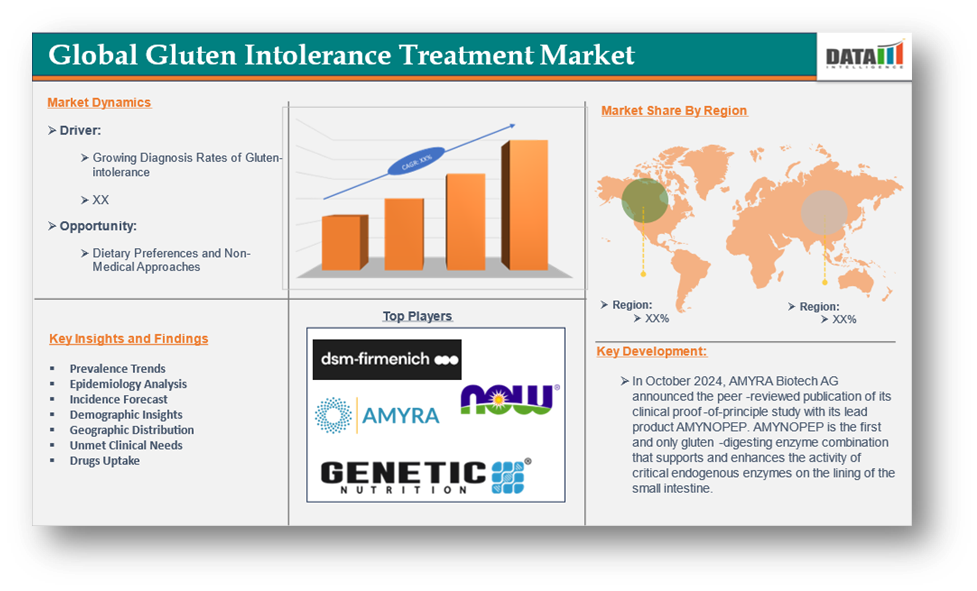

The Global Gluten Intolerance Treatment Market reached US$ 6.63 billion in 2024 and is expected to reach US$ 16.18 billion by 2032, growing at a CAGR of 11.8% during the forecast period 2024-2032.

Gluten intolerance, also known as non-celiac gluten sensitivity, is a condition where individuals experience symptoms such as abdominal discomfort, bloating, and fatigue after consuming gluten-containing foods, without having celiac disease or a wheat allergy. Unlike celiac disease, gluten intolerance does not cause damage to the small intestine but can still lead to significant discomfort and impact quality of life.

The gluten intolerance treatment market encompasses treatments aimed at alleviating symptoms and improving digestion, including dietary supplements, enzyme therapies, and emerging pharmaceutical options. As more people become aware of gluten intolerance and its symptoms, the market for supportive treatments and management solutions is expanding.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Growing Diagnosis Rates of Gluten-intolerance

Increasing diagnosis rates are expected to drive the gluten intolerance treatment market by leading to a larger patient population seeking medical interventions. As awareness of gluten intolerance and celiac disease grows among both healthcare providers and the public, more individuals are being accurately diagnosed. This rise in diagnoses translates to greater demand for effective treatment options, such as enzyme therapies, supplements, and emerging drug therapies.

Additionally, more diagnosed individuals are actively seeking solutions to manage their condition beyond a strict gluten-free diet, fueling the market for supportive treatments. As the number of diagnosed cases continues to rise, the market for gluten intolerance treatments is likely to expand significantly.

Dietary Preferences and Non-Medical Approaches

Dietary preferences and non-medical approaches are expected to hinder the gluten intolerance treatment market as many individuals prefer managing their condition through a gluten-free diet rather than relying on pharmaceutical interventions. The gluten-free diet is widely considered the primary and most effective way to control symptoms, which makes many patients less inclined to seek additional treatments such as enzyme supplements or medications. This reliance on dietary management limits the market demand for medical therapies.

Additionally, individuals may feel that non-medical approaches, such as lifestyle changes, are sufficient to manage their condition, reducing the urgency for new treatments and thus slowing market growth.

Market Segment Analysis

The global gluten intolerance treatment market is segmented based on treatment type, patient type, formulation, distribution channel, and region.

Type:

Nutritional supplements are expected to dominate the gluten intolerance treatment market due to their accessibility and growing popularity among patients seeking to manage symptoms alongside a gluten-free diet. Products like enzyme supplements and probiotics are gaining traction as they offer a convenient, non-invasive option to alleviate discomfort from accidental gluten exposure. Companies are focusing on developing these products which are increasingly gaining traction due to their increased safety and efficacy. For instance, in October 2024, AMYRA Biotech AG announced the peer-reviewed publication of its clinical proof-of-principle study with its lead product AMYNOPEP. AMYNOPEP is the first and only gluten-digesting enzyme combination that supports and enhances the activity of critical endogenous enzymes on the lining of the small intestine.

With increasing consumer awareness of the benefits of such supplements, the demand for these products is expanding, as they provide additional support without the need for prescription drugs. This trend positions nutritional supplements as a key segment in the market, driven by their ability to offer symptom relief and improve overall gut health for individuals with gluten intolerance.

Market Geographical Share

North America is expected to dominate the gluten intolerance treatment market due to high awareness, advanced healthcare infrastructure, and a large consumer base actively seeking treatment options. The U.S., in particular, leads in both diagnosis rates and adoption of gluten intolerance treatments, with a growing number of patients opting for enzyme supplements and emerging therapies.

Additionally, the presence of key pharmaceutical companies and the increasing availability of gluten-free products and treatments further strengthen North America's market share. The rising expansion of product availability in the region with rising innovative products is expected to contribute to the market growth in the region. For instance, in December 2024 GluteGuard, the first and only clinically proven product in Canada that helps to protect against the symptoms of accidental gluten ingestion is made available across the country. With the expansion of product expansion in the region, the market is expected to grow which contributes to the overall market growth. As awareness of gluten intolerance continues to rise, the region is likely to maintain its dominance in the treatment market.

Major Global Players

The major global players in the gluten intolerance treatment market include DSM-Firmenich, Genetic Nutrition, NOW Foods, Enzymedica, AMYRA Biotech AG, KLAIRE LABS, Precigen and Takeda Pharmaceutical Company Limited among others.

| Metrics | Details | |

| CAGR | 11.8% | |

| Market Size Available for Years | 2022-2032 | |

| Estimation Forecast Period | 2024-2032 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Treatment Type | Dietary Management, Pharmaceuticals, Nutritional Supplements, Others |

| Patient Type | Pediatric Patients, Adult Patients, Geriatric Patients | |

| Formulation | Tablets, Powders, Liquid | |

| Distribution Channel | Online Pharmacies, Retail Pharmacies, E-Commerce | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Global Gluten Intolerance Treatment Market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.