Glioblastoma Treatment Market Size

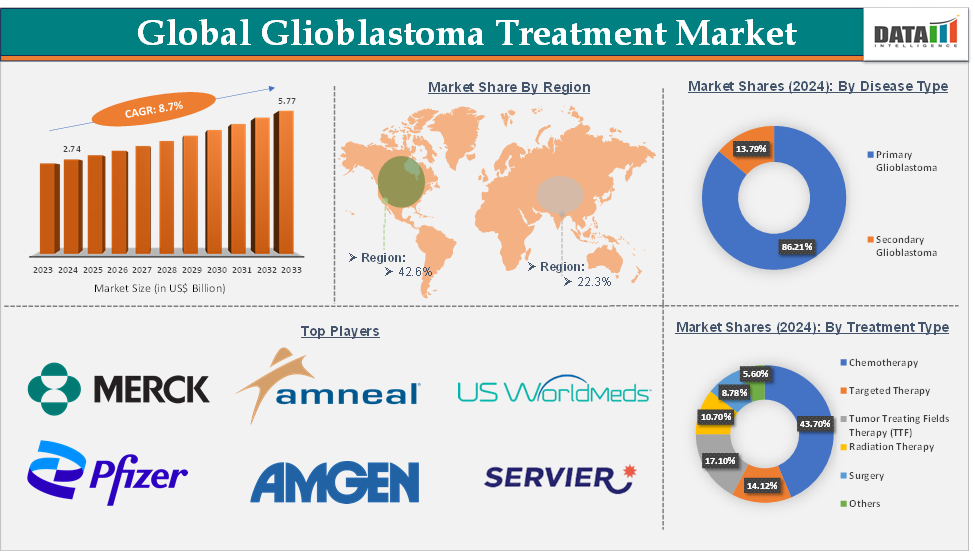

The global glioblastoma treatment market size reached US$ 2.74 billion in 2024 and is expected to reach US$ 5.77 billion by 2033, growing at a CAGR of 8.7% during the forecast period 2025-2033.

Glioblastoma Treatment Market Overview

The global glioblastoma treatment market is undergoing a significant transformation driven by increasing disease incidence, rising investments in oncology R&D, and a robust pipeline of innovative therapies. Glioblastoma multiforme (GBM), the most aggressive and lethal form of primary brain tumor, continues to pose significant clinical challenges due to its complex biology and resistance to conventional therapies. However, advances in precision medicine, immunotherapy, and targeted treatments are redefining the treatment landscape.

The glioblastoma treatment market is poised for transformative growth over the next 5–10 years. The convergence of genomics and next-gen therapeutics such as mRNA vaccines, CAR-T therapies, and blood-brain barrier (BBB) penetration strategies could revolutionize outcomes. With precision medicine becoming central to oncology care, the glioblastoma treatment market offers substantial opportunity for players that can innovate and navigate the complexities of CNS oncology.

Glioblastoma Treatment Market Executive Summary

Glioblastoma Treatment Market Dynamics: Drivers & Restraints

Focus on treatment combinations is significantly driving the market growth

The focus on treatment combinations is significantly driving the glioblastoma treatment market growth by addressing the complex nature of the disease, improving efficacy, and overcoming the limitations of single-treatment approaches. Glioblastoma is known for its resistance to traditional therapies, and its heterogeneous nature means that a multi-faceted treatment approach is often more effective than a single modality. As the focus on treatment combinations increases, the market players are focusing on innovative combination therapies.

For instance, in March 2025, Laminar Pharma announced optimistic results from its ongoing clinical trial evaluating LAM561 for the treatment of newly diagnosed glioblastoma (ndGBM), the most aggressive form of brain cancer, that has seen limited clinical improvement in the last 20 years. The trial, partially funded with an EU H2020 Grant (ClinGlio), has shown an improvement trend in progression-free survival (PFS) in MGMT-methylated patients receiving LAM561 in combination with chemoradiotherapy (radiotherapy plus temozolomide) as the standard of care (SoC) compared to placebo plus SoC treatment.

Additionally, in April 2025, Nanopharmaceutics, Inc. announced the initiation of a Phase 1 clinical study sponsored by the National Cancer Institute, part of the National Institutes of Health, titled “Testing the Addition of an Anti-Cancer Drug, Triapine, to the Usual Radiation Therapy for Recurrent Glioblastoma or Astrocytoma”. The primary objective of the phase 1 study will be to identify the safety and maximally tolerated dose (MTD) of oral Triapine used in combination with radiation therapy for patients with recurrent glioblastoma (GBM) or astrocytoma.

Immunotherapy is emerging as a promising treatment for glioblastoma, but the immune system’s ability to recognize and attack brain tumors is often limited due to the blood-brain barrier (BBB). Combining checkpoint inhibitors (e.g., nivolumab or pembrolizumab) with chemotherapy or radiotherapy can enhance immune activation and increase the effectiveness of the treatment by overcoming the immune suppression within the tumor microenvironment.

Limited effectiveness of current therapies is hampering the market growth

Glioblastoma has one of the poorest survival rates among all cancers, with a median overall survival (OS) of only 15–18 months. Despite aggressive treatment regimens, most patients succumb to the disease within a year or two. Even the standard of care treatment, which includes surgery, radiation therapy, and chemotherapy (specifically temozolomide), offers only limited benefit in prolonging life. This short survival rate underscores the limited effectiveness of existing therapies.

One of the main challenges in treating glioblastoma is the blood-brain barrier (BBB), a natural defense mechanism that protects the brain from potentially harmful substances. The BBB severely limits the effectiveness of many traditional chemotherapies and even newer targeted therapies. Many drugs simply cannot penetrate the BBB in sufficient quantities to treat the tumor effectively. For instance, drugs like temozolomide and bevacizumab (Avastin) are often ineffective in treating glioblastoma in the long term because they struggle to reach the tumor cells within the brain. The inability to deliver drugs directly to the tumor is a primary reason why glioblastoma treatments fail over time.

The limited effectiveness of current therapies is a significant restraint for the glioblastoma treatment market. The aggressive nature of glioblastoma, combined with challenges like the blood-brain barrier, high recurrence rates, and limited response to emerging treatments, prevents the market from achieving higher growth. While there is ongoing research to address these challenges, the persistent limitations of existing treatments mean that long-term patient survival remains low, which significantly hampers market development.

For more details on this report – Request for Sample

Glioblastoma Treatment Market Pipeline Analysis

Top phase III pipeline products for glioblastoma treatment:

Glioblastoma Treatment Market, Segment Analysis

The global glioblastoma treatment market is segmented based on disease type, treatment type, and region.

Treatment Type:

The chemotherapy segment is expected to hold 43.7% in the glioblastoma treatment market

Temozolomide (the current “gold standard” of care) is a chemotherapy drug that has become the backbone of treatment for glioblastoma. It is used as a part of the Stupp Protocol, which combines Temozolomide with radiation therapy. This regimen is the gold standard for newly diagnosed GBM patients. Temozolomide has been shown to improve progression-free survival and overall survival in patients with newly diagnosed glioblastoma.

Chemotherapy’s primary benefit is its ability to extend survival rates, even though it cannot cure glioblastoma. For instance, Temozolomide improves the median survival rate from about 12 months to 15–18 months in newly diagnosed patients. In recurrent cases, chemotherapy (including second-line treatments) may extend survival by several months, even if it does not provide a long-term solution.

After the first-line treatment (surgery, radiation, and TMZ), the tumor usually recurs. At this stage, chemotherapy remains a key treatment option. Bevacizumab (Avastin), although classified as an anti-angiogenic drug, is often used in conjunction with chemotherapy in recurrent glioblastoma cases to inhibit tumor growth by blocking the development of blood vessels (angiogenesis).

Glioblastoma Treatment Market, Geographical Analysis

North America is expected to hold 42.6% of the global glioblastoma treatment market

The U.S. Food and Drug Administration (FDA) plays a crucial role in the timely approval and availability of new treatments. North American patients have quicker access to the latest therapies, such as temozolomide (Temodar), bevacizumab (Avastin), and experimental drugs. The approval of immunotherapies and tumor-treating fields (TTF) therapy in the U.S. has expanded the treatment options for glioblastoma patients, further strengthening North America's position in the market.

For instance, in August 2024, Servier announced that the U.S. Food and Drug Administration (FDA) approved VORANIGO, an isocitrate dehydrogenase-1 (IDH1) and isocitrate dehydrogenase-2 (IDH2) inhibitor, indicated for the treatment of adult and pediatric patients 12 years and older with Grade 2 astrocytoma or oligodendroglioma with a susceptible IDH1 or IDH2 mutation following surgery including biopsy, sub-total resection, or gross total resection. VORANIGO is available and offers glioma patients the ability to actively manage their disease with the convenience of a once-daily pill.

North America leads the world in the adoption of innovative therapies for glioblastoma, including tumor-treating fields (TTF) and immunotherapies. The region's willingness to invest in new treatment modalities has expanded the market, as physicians and patients are more likely to use these options when they become available.

Asia Pacific is expected to hold 22.3% of the global glioblastoma treatment market

Governments in the Asia Pacific region, especially in Japan, are prioritizing the improvement of cancer care as part of their national health policies. These initiatives are making glioblastoma treatments, including Tumor Treating Fields (TTFields), surgery, chemotherapy, and radiation, more accessible to a broader population. For instance, the Japanese Ministry of Health, Labour and Welfare approved the recommendation by Japan’s Central Social Insurance Medical Council (Chuikyo) to provide reimbursement for Optune for the treatment of newly diagnosed glioblastoma (GBM).

In countries like India and China, the pharmaceutical and biotech sectors are growing rapidly, with companies focusing on developing and manufacturing both generic and branded chemotherapy drugs for glioblastoma. As a result, the availability of affordable treatments in these countries is increasing, helping to drive market growth. India is known for its generic drug production industry, and as global patents on older glioblastoma therapies like temozolomide expire, Indian manufacturers are increasingly supplying affordable versions of these drugs to the local market. This significantly increases access to treatments, especially in emerging economies.

Glioblastoma Treatment Market Competitive Landscape

Top companies in the glioblastoma treatment market include Merck & Co., Inc., Pfizer Inc., Amneal Pharmaceuticals LLC, USWM, LLC., Amgen Inc., Day One Biopharmaceuticals, Inc., Servier Pharmaceuticals LLC, and among others. And the emerging market players in the market include Laminar Pharma, Sapience Therapeutics, Inc., IN8bio Inc., GT Medical Technologies, Inc., Nanopharmaceutics, Inc., Chimeric Therapeutics Ltd., VBI Vaccines Inc., and Others.

Glioblastoma Treatment Market Scope

| Metrics | Details | |

| CAGR | 8.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Primary Glioblastoma and Secondary Glioblastoma |

| Treatment Type | Chemotherapy, Targeted Therapy, Tumor Treating Fields Therapy (TTF), Radiation Therapy, Surgery, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global glioblastoma treatment market report delivers a detailed analysis with 45 key tables, more than 41 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.