Genome Editing Market: Industry Outlook

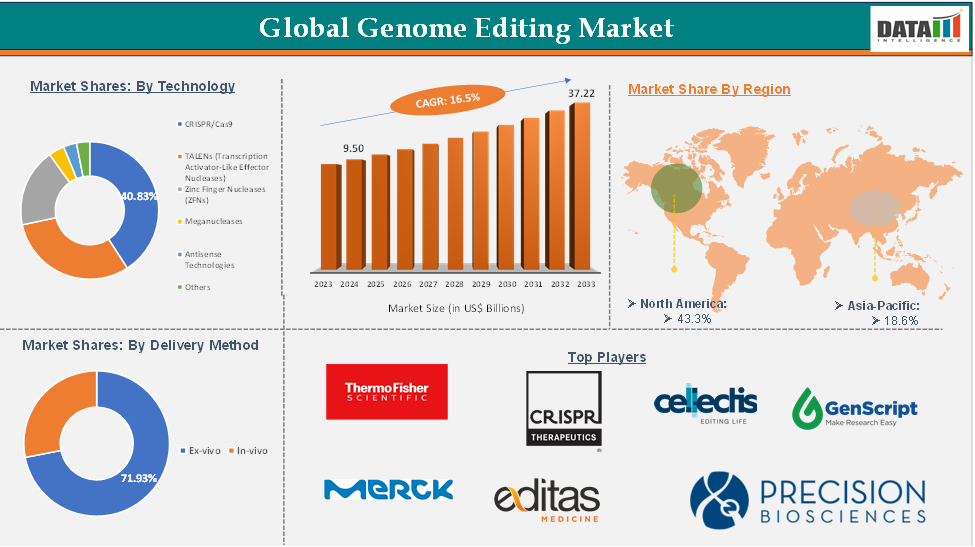

Genome Editing Market reached US$ 9.50 Billion in 2024 and is expected to reach US$ 37.22 Billion by 2033, growing at a CAGR of 16.5% during the forecast period 2025-2033.

The global genome editing market is accelerated by rapid technological innovation, the genome editing market is set for transformative growth with applications multiplying in healthcare, agriculture, and biotechnology sectors. CRISPR-Cas9 and many other such innovations are allowing genetic modifications to be done with increasing precision, efficiency, and ease, resulting in their wider use for gene therapy applications, crop improvement, and scientific research.

The escalating prevalence of genetic disorders and chronic diseases has led to a surge in demand for personalized medicines that largely involve genome editing. Simultaneously, growing investments of public and private nature in research and development initiatives are fueling the race globally.

Along with a promising future, major concerns include ethical issues, regulatory complexities, safety from off-target side effects, and high implementation costs. Yet, newer forms of innovation, future-friendly policies in emerging economies, and enhanced global collaborations are expected to lead this market into a promising, sustainable future.

Executive Summary

For more details on this report, Request for Sample

Genome Editing Market Dynamics: Drivers & Restraints

Driver: Increasing prevalence of genetic disorders

The global genome editing market is growing due to the rise in genetic disorders like cystic fibrosis, sickle cell anemia, Duchenne muscular dystrophy, and inherited cancers.

For instance, there are approximately 10,000 single-gene diseases, or monogenic diseases, caused by mutations in a single gene. The World Health Organization estimates that 10 out of every 1000 people are affected, affecting 70 to 80 million people globally. Despite the prevalence, individual single-gene diseases are considered rare.

Moreover, advances in genetic testing and awareness are leading to more diagnoses of these conditions. Genome editing offers a targeted, potentially curative approach, unlike traditional treatments.

This growing patient population is driving demand for innovative therapies that correct or silence faulty genes at the source. Both public and private sectors are investing heavily in genome editing research and clinical trials, highlighting its transformative potential in addressing unmet medical needs and reducing long-term healthcare burdens.

Restraint: High cost and limited accessibility

The global genome editing market faces challenges due to high costs and limited accessibility. The development and application of genome editing technologies involve expensive reagents, specialized equipment, and skilled personnel, increasing the overall cost of research and clinical implementation.

For instance, Genome editing therapies can cost between $373,000 and $2.1 million per treatment, with some sources suggesting individual treatments can cost up to $2.2 million. The cost is influenced by factors like the specific genetic condition being treated, the type of therapy used, and the procedure's complexity.

These therapies often cost hundreds of thousands to millions of dollars per patient, making them unaffordable for many and straining healthcare systems.

Low- and middle-income regions are underrepresented in research participation and treatment availability. To fully realize the global impact of genome editing, there is a need for cost-effective technologies, scalable manufacturing processes, and equitable distribution models.

Genome Editing Market Segment Analysis

The global genome editing market is segmented based on technology, delivery method, application, distribution channel, and region.

Product Type

The CRISPR/Cas9 segment from the product type is expected to hold 40.8% of the genome editing market

CRISPR-Cas9 is a revolutionary technology that enables geneticists and medical researchers to edit genome parts by removing, adding, or altering DNA sequences, making it the simplest, most versatile, and precise method of genetic manipulation in the scientific world.

The CRISPR/Cas9 segment is a significant player in the global genome editing market due to advancements in technology, regulatory approvals, and increased funding. The technology's precision and efficiency have been enhanced through innovations like base and prime editing, minimizing off-target effects, and broadening therapeutic applications. Regulatory approvals for CRISPR-based therapies, such as those for sickle cell disease and beta-thalassemia, validate its clinical potential, boosting investor confidence and accelerating market growth.

The expanding use of technology in agriculture, particularly disease-resistant and stress-tolerant crops, is also driving its adoption beyond healthcare. Despite ethical debates, the focus on somatic cell applications and regulatory adherence supports sustainable development, positioning the CRISPR/Cas9 segment as a central pillar in the evolving genome editing market.

For instance, in May 2025, A baby boy with severe CPS1 deficiency is thriving after receiving the world's first personalized CRISPR therapy, marking a significant step forward in personalized gene editing and showing early promise in improving his condition.

Genome Editing Market - Geographical Analysis

North America dominated the global genome editing market with the highest share of 43.3% in 2024

North America is a major player in the global genome editing market due to FDA approvals, its strong biotechnology infrastructure, significant research and development investments, and supportive regulatory environment.

For instance, in May 2025, A National Institutes of Health (NIH) research team successfully delivered a personalized gene editing therapy to an infant with a life-threatening genetic disease. The infant, diagnosed with carbamoyl phosphate synthetase 1 deficiency, responded positively to the treatment, marking the first time the technology has been successfully deployed to treat a human patient.

Moreover, in May 2025, the Danforth Technology Company (DTC) unveiled its latest startup this week with the launch of Spearhead Bio, which has developed a tool to complement existing gene editing techniques such as CRISPR.

Furthermore, advanced healthcare systems and strong intellectual property protection encourage the development of cutting-edge gene editing therapies. The growing prevalence of genetic disorders and awareness about personalized medicine further boost demand for genome editing solutions. Active collaborations between academic institutions, research organizations, and industry players drive breakthroughs in CRISPR/Cas9 and other genome editing technologies.

Hence, all these factors reflect the dominance of North America in the global genome editing market.

Asia-Pacific is the global genome editing market with a market share of 18.6% in 2024

The Asia-Pacific region is gaining prominence in the global genome editing market due to scientific advancements, supportive policies, and demographic factors. Countries like China, Japan, South Korea, and India are leading the way in research and development of genome editing technologies like CRISPR, TALEN, and ZFN. Government initiatives prioritize genomics research, positioning these nations as leaders in biotechnology.

The region's large and genetically diverse population provides valuable resources for genomic studies, facilitating the development of personalized medicine and targeted therapies. The increasing prevalence of genetic disorders and chronic diseases in Asia-Pacific countries underscores the demand for innovative gene-editing solutions. The cost-effectiveness of conducting research and clinical trials in Asia-Pacific attracts both domestic and international collaborations. This economic advantage, coupled with a growing number of biotech startups and innovation hubs, fosters an environment conducive to rapid advancements in genome editing.

For instance, in March 2025, A Japanese research team led by Associate Professor Takashi Ishida developed a genome editing method that partially inhibits gene function using CRISPR-Cas9 technology. The team used Arabidopsis thaliana to study HPY2, a gene essential for cell division and plant growth. The method introduces hypomorphic mutations that reduce and do not eliminate gene function, allowing for partial inhibition of gene function. The findings are published in the Journal of Plant Research.

Genome Editing Market - Key Players

The major global players in the genome editing market include Thermo Fisher Scientific Inc, Merck KGaA (Sigma-Aldrich), CRISPR Therapeutics AG, Editas Medicine, Inc., Cellectis S.A., Precision BioSciences, Inc., GenScript Biotech Corporation, Lonza Group Ltd., New England Biolabs, Inc., Integrated DNA Technologies, Inc. (IDT) and among others.

Genome Editing Market – Key Developments

In May 2025, Danforth Technology Company (DTC) launched Spearhead Bio, a startup that uses the plant's natural DNA to enhance crop genome engineering efficiency. The Transposase Assisted Homology Independent Targeted Insertion (TAHITI) technology enables seamless gene integration into both transgenic and non-transgenic crops.

- In April 2025, a new system developed by UCLA and UC Berkeley scientists could help ensure global food security by enabling heritable, transgene-free genome editing in plants. This method, which uses a miniature CRISPR system delivered by a common plant virus, is a significant improvement over current labor-intensive and costly methods that don't work for many important plant species. The system could significantly improve crop yields and adaptability to climate change.

Market Scope

Metrics | Details | |

CAGR | 16.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Technology | CRISPR/Cas9, TALENs (Transcription Activator-Like Effector Nucleases), Zinc Finger Nucleases (ZFNs), Meganucleases, Antisense Technologies, Others |

Delivery Method | Ex-vivo, In-vivo | |

Application | Genetic Engineering, Cell Line Engineering, Animal Genetic Engineering, Plant Genetic Engineering, Drug Discovery & Development, Gene-Modified Cell Therapy, Diagnostics, Others | |

End User | Biotechnology & Pharmaceutical Companies, Academic & Government Research Institutes, Contract Research Organizations (CROs) | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |