Gelatin Market Size

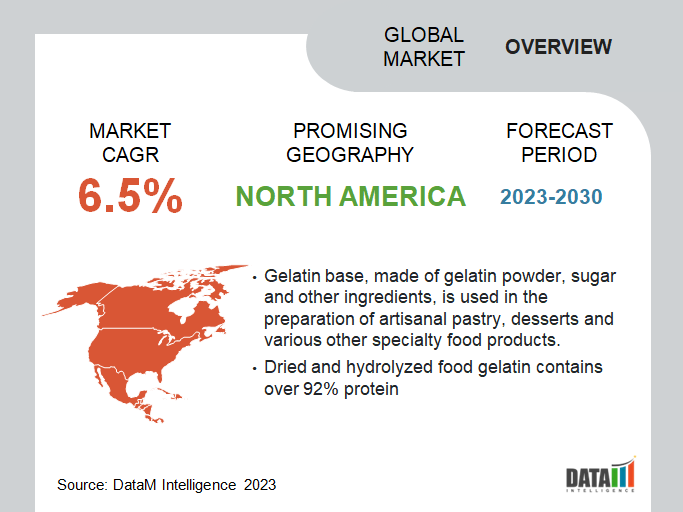

The Global Gelatin Market size reached USD 2.6 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 4.4 billion by 2030. The market is growing at a CAGR of 6.5% during the forecast period 2024-2031. The global gelatin market is growing in the forecast period due to the rising demand for clean and hygienic packaged options as awareness of various health issues, such as gastrointestinal diseases brought on by drinking contaminated water, grows.

According to the United Nations University data published in 2023, nearly 270 billion US dollars and 350 billion liters of gelatin are sold globally each year. Drinking water shortages in several areas further increase the need for safe drinking water, which drives product sales and boosts market expansion. Additionally, factors like an increase in urban population, higher disposable income, higher standards of living and the development of eco-friendly bottle materials are significant drivers of the gelatin market's expansion.

Market Scope

| Metrics | Details |

| CAGR | 6.5% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Type, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights Download Sample

Market Dynamics

Growing Demand for Functional and Specialty Food and Beverages

The functional food industry and the food supplement sectors are witnessing growth at a faster rate. The specialty food industry is experiencing demand growth, due to increasing consumer preferences for high-quality food products. Gelatin base, made of gelatin powder, sugar and other ingredients, is used in the preparation of artisanal pastry, desserts and various other specialty food products.

Gelatin, in the hydrolyzed form, is used in protein to fortify dietary foods. Dried and hydrolyzed food gelatin contains over 92% protein. Pure food gelatin powder contains no carbohydrates or fats, but protein. A one-ounce packet of gelatin powder contains approximately 23 calories and six grams of protein.

Stringent Government Rules and Regulations Hamper Market Growth

The food industry is regulated by stringent laws governing animal-based raw materials and ingredients that are used in the production of the product. Countries such as Europe and North America are actively involved in framing such regulations. For instance, gelatin manufacturers in Europe are required to comply with the specifications and requirements notified in Regulation (EU) 2016/355.

The regulation states that the raw materials used in gelatin production that is intended for human consumption should adhere to certain rules, for instance, they should abide by stated residual limits and go through specific treatments to reduce the disease occurrence among humans.

Market Segment Analysis

The global gelatin market is segmented based on type, application and region.

The Increasing Demand for the Cosmetic Industry Helps to Boost the Growth of Skin Gelatin.

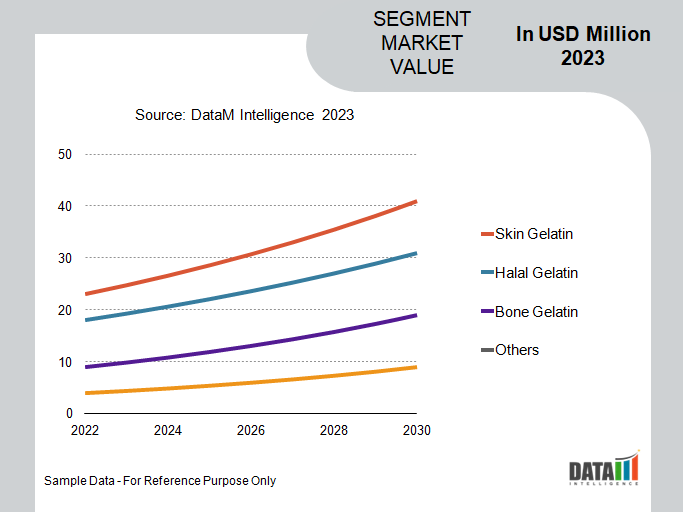

Gelatin has been segmented by source as skin gelatin, bone gelatin and halal gelatin.

Gelatin sourced from pig skin is preferred over other sources owing to its cheaper price. Pork skin gelatin is a natural protein, which is derived from the hydrolysis of collagen that exists in the skin of the pork. Pork skin has unique properties, which can be used as a thickening, stabilizing and gelling agent. The functional properties of pork skin such as its antioxidant and antihypertensive nature shape the segment growth.

Market Geographical Share

Increasing Imports of Gelatin in North America

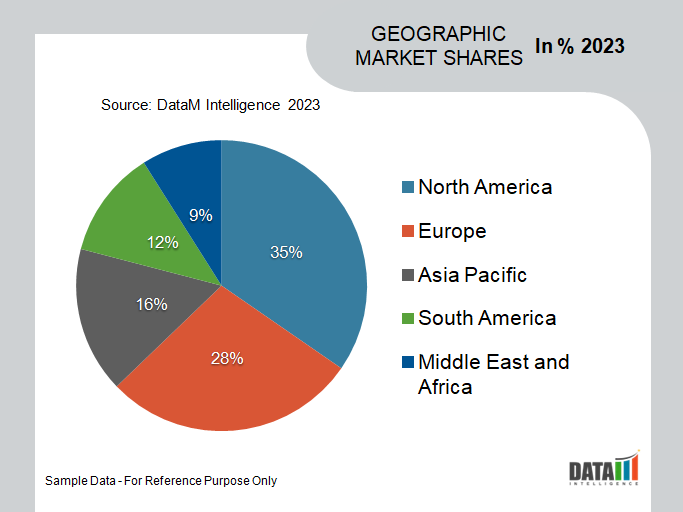

By region, the global gelatin market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east and Africa.

North American region held a significant market share due to the presence of long-term and well-established meat processors including JBS; Tyson Foods, Inc.; and Cargill, incorporated in the U.S. on account of easy access to consumables is expected to promote the application of gelatin in the country. The United States and Canada are major share-holding countries in the region due to an increase in the disposable income of consumers. An increase in the demand for gelatin in the food and beverages industry helps to boost market growth over the forecast period. According to the OEC, in 2021, the United States imported D 317M of gelatin and become one of the largest importers of gelatin in the world. In 2021, Gelatin was 626th the most important product in the United States.

Market Companies

The major global players include Gelita, Rousselot, PB Gelatins, Nitta Gelatin, Weishardt Group, Sterling Gelatin, Ewald Gelatine, Italgelatine, Darling Ingredients Inc., and Dongbao Bio-Tec.

COVID-19 Impact on Market

During the ongoing COVID-19 pandemic, trade disruptions due to border restrictions are the main factors challenging the sales of the gelatin market. Such trade-related challenges are being witnessed in countries that are most affected by the COVID-19 pandemic.

Consequently, production has gone down about 30-40%, according to, the managing director of Narmada Gelatin and chairman of Ossein and Gelatin Manufacturers Association (OGMA). Slaughterhouses had been shut through the early phases of the lockdown. While they are slowly opening up now, the transportation of cattle remains a critical piece.

Key Developments

- On January 21, 2021, Nitta Gelatin India launched intl standard gelatin, especially for the hotel and restaurants. The newly launched product is manufactured with Japanese technology as per GMP and HACCP systems and under European Regulation (EC).

- On April 29, 2022, Rousselot Biomedical launched phenol-functionalized gelatin in the market named as X-Pure GelDAT. The phenolic modification properties of the X-Pure GelDAT grant superior adhesion properties to human tissues.

- On November 01, 2022, PB Leiner launched TEXTURA for chefs. It is introduced to culinary professionals. It helps to reduce the cooking and setting time of the food product.

Why Purchase the Report?

- To visualize the global gelatin market segmentation based on type, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of gelatin market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Gelatin Market Report Would Provide Approximately 53 Tables, 44 Figures and 195 Pages.

Target Audience 2024

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies