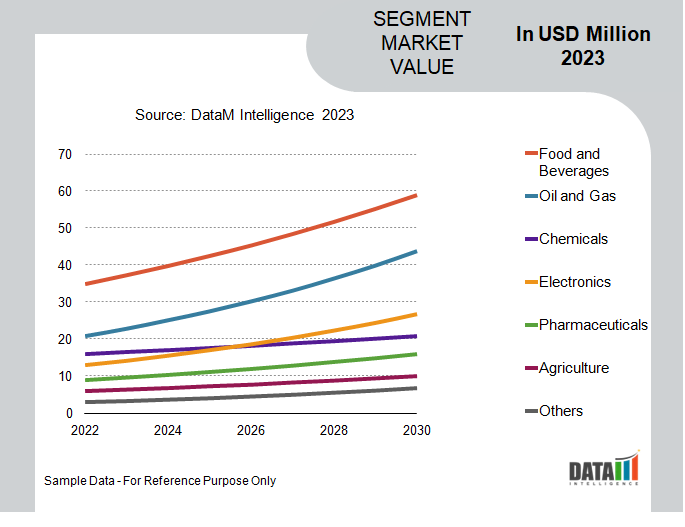

GCC Liquid Carbon Di-Oxide Market is segmented By Grade (Food Grade Liquid Carbon Di-Oxide, Medical Grade Liquid Carbon Di-Oxide, Industrial Grade Liquid Carbon Di-Oxide), By Application (Food and Beverages, Oil and Gas, Chemicals, Electronics, Pharmaceuticals, Agriculture, Others), By Region (GCC) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

GCC Liquid Carbon Di-Oxide Market Report Overview

GCC liquid carbon di-oxide market reached US$ 334.8 million in 2022 and is expected to reach US$ 667.4 mllion by 2030, growing with a CAGR of 9.0% during the forecast period 2024-2031.

For enhanced oil recovery (EOR) activities, the oil and gas sector in the GCC region depends on liquid CO2. Due to the region's huge oil deposits, there is enormous growth potential for the application of injecting liquid CO2 into oil reservoirs to improve oil extraction efficiency.

For instance, in May 2020, The opening of a factory that generates liquefied carbon dioxide, which is extensively utilized in a number of food and manufacturing industries, was announced by ZonesCorp, the leading operator of purpose-built economic zones in the United Arab Emirates.

The new plant, which was opened by Al Ghaith Industries in the Industrial City of Abu Dhabi I (ICAD I), has a total production capacity of 60 tonnes per day and a total area of 100,000 square meters. The first of its type plant in the UAE recycles toxic gases from the production process into a clean and environmentally friendly product using innovative green technologies. Therefore, UAE holds more than 1/3rd of the regional shares and is expected to grow at the highest CAGR.

GCC Liquid Carbon Di-Oxide Market Scope

|

Metrics |

Details |

|

CAGR |

9.0% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Grade, Application and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Country |

UAE |

|

Largest Country |

Saudi Arabia |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Grade Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

GCC Liquid Carbon Di-Oxide Market Dynamics

Growing Food and Beverage Industry

In the GCC region, there is a rising demand for carbonated drinks like soft drinks, carbonated water and energy drinks. A crucial component used to carbonate these drinks is liquid CO2. The demand for liquid CO2 to produce the appropriate fizz and effervescence grows along with the use of carbonated beverages. The market for liquid CO2 is expanding as a result.

Beer and spirits demand, particularly in the GCC region, has increased significantly. The carbonation of beer and as a cooling agent during fermentation are two common uses of liquid CO2 in breweries and distilleries. The brewing and distilling industries are seeing a surge in demand for liquid CO2 as the craft beer movement picks up steam and customer preferences change.

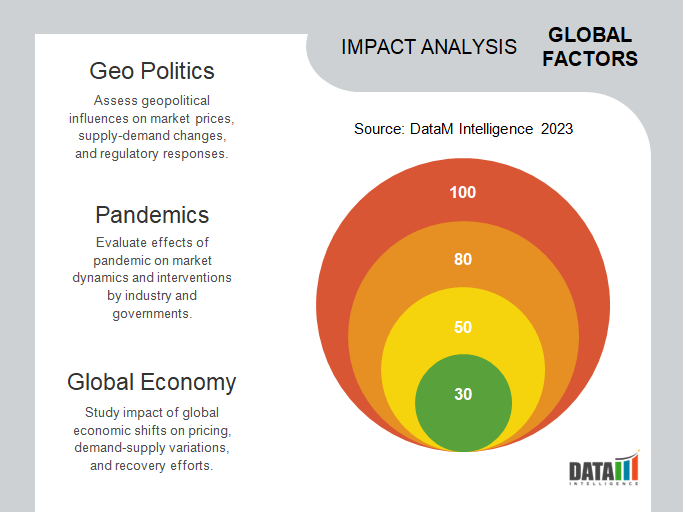

Environmental Concerns and Regulations

The GCC region has the problem of regulating CO2 emissions from these companies because it is a significant hub for oil and gas production. In order to absorb and store CO2 emissions from industrial operations, carbon capture and storage (CCS) methods are being explored. Liquid CO2 may be extracted, cleaned and securely buried, keeping it from evaporating into the atmosphere and causing climate change. The uptake of CCS technologies fuels the need for liquid CO2 and the expansion of its market.

In June 2023, Saudi Aramco signed an agreement with Weatherford, a UK-based oilfield services company, to provide oil well drilling services for a period of three years. The expansion of drilling operations will generate significant demand for liquid CO2, since it is used as a solvent in well stimulation operations during drilling.

Fluctuating Crude Oil Prices

Collecting and refining CO2 from industrial processes or from natural sources, such as oil and gas operations, is a common step in the manufacturing of liquid CO2. For producers of liquid CO2, fluctuating crude oil prices can have an impact on the total cost of production. The cost of CO2 capture and purification procedures may rise if oil prices rise dramatically, which could have an effect on how profitable the manufacturing of liquid CO2 is.

GCC Liquid Carbon Di-Oxide Market Segmentation Analysis

The GCC liquid carbon di-oxide market is segmented based on grade, application and region.

Growing Demand for Liquid CO2 in Offshore Oil Well Drilling Operations Drives Market Expansion

In recent years, there has been the expansion of new offshore oil well drilling operations due to the declining production of onshore sites. Liquid CO2 is used for well stimulation during well drilling operations. The liquid CO2 is pumped into wells to create fractures in the rock formation and facilitate the extraction of oil and gas. It is considered a more sustainable process since it requires very little water.

In November 2022, Saipem, an Italian multinational oilfield services company, announced that it had secured three offshore well drilling contracts from the middle east for a combined US$ 800 million. Therefore, the oil and gas application segment dominates the global market with more than 1/3rd of the total global segmental market share.

GCC Liquid Carbon Di-Oxide Market Geographical Share

Saudi Arabia's Extensive Oil and Gas Industry Drives the Market Growth

Among the GCC states, Saudi Arabia produces the most oil and it also ranks among the top oil-producing countries worldwide. Liquid CO2 is in high demand in the nation due to the sizeable oil and gas industry, particularly for well stimulation during oil drilling operations. Saudi Arabia is positioned as a prominent consumer and contributor to the expansion of the liquid CO2 market in the area due to the size of its oil production and associated activities.

In December 2022, Cryogenic carbon capture technology is being used in a pilot project by the Saudi Electricity Company (SEC), King Abdullah University of Science and Technology (KAUST), ENOWA and NEOM's Energy & Water to capture 30 tonnes of carbon dioxide per day from the Green Duba Integrated Solar Combined Cycle (ISCC) power plant. Therefore, Saudi Arabia dominates the GCC liquid carbon di-oxide with a significant global market share.

GCC Liquid Carbon Di-Oxide Companies and Competitive Landscape

The major global players include Linde plc, Hunan Kaimeite Gases, Continental Carbonic Products, Inc, Taiyo Nippon Sanso Corporation, SOL Group, Ras Gas, Gulf Cryo, Kuwait Oxygen and Acetylene Company (KOAC) , Dubai Industrial Gases (DIG) and Buzwair Industrial Gases.

COVID-19 Impact On GCC Liquid Carbon Di-Oxide Market

Industrial operations in the GCC region were disrupted as a result of COVID-19. The overall demand for liquid CO2 was impacted by lockdown procedures, travel restrictions and temporary business closures. Reduced production and operations in sectors like manufacturing, oil and gas and food and beverage production had a direct influence on the need for liquid CO2.

The pandemic presented substantial difficulties for the food and beverage sector, a key consumer of liquid CO2. The demand for carbonated beverages and packaged foods, which depend on liquid CO2 for carbonation and preservation, was impacted by restaurant closures, decreased tourist and decreased consumer expenditure. The liquid CO2 market in the GCC was directly impacted by this reduction in demand.

Scope

By Grade

- Food Grade Liquid Carbon Di-Oxide

- Medical Grade Liquid Carbon Di-Oxide

- Industrial Grade Liquid Carbon Di-Oxide

By Application

- Food and Beverages

- Oil and Gas

- Chemicals

- Electronics

- Pharmaceuticals

- Agriculture

- Others

By Region

- GCC

- Saudi Arabia

- UAE

- Oman

- Kuwait

- Bahrain

- Qatar

Key Developments

- In June 2023, Saudi Aramco signed an agreement with Weatherford, a UK-based oilfield services company, to provide oil well drilling services for a period of three years. The expansion of drilling operations will generate significant demand for liquid CO2 since it is used as a solvent in well stimulation operations during drilling.

- In December 2022, Cryogenic carbon capture technology is being used in a pilot project by the Saudi Electricity Company (SEC), King Abdullah University of Science and Technology (KAUST), ENOWA and NEOM's Energy & Water to capture 30 tonnes of carbon dioxide per day from the Green Duba Integrated Solar Combined Cycle (ISCC) power plant. The majority of the carbon collected at the pilot plant would be utilized for producing e-fuels intended to replace fossil fuels for internal combustion engines. This pure liquid CO2 would be ready to transport and acceptable for food and beverage applications.

- In May 2020, 60 tonnes of CO2 will be recycled everyday at the new Al Ghaith factory for use in industry. ZonesCorp will house a 100,000 square meter liquid CO2 plant that will use innovative methods to capture and recycle industrial emissions.

Why Purchase the Report?

- To visualize the GCC liquid carbon di-oxide market segmentation based on grade, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of GCC liquid carbon di-oxide market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The GCC liquid carbon di-oxide market report would provide approximately 39 tables, 26 figures and 180 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies