Global Fungicides Market is segmented By Origin (Bio-Fungicides, Synthetic Fungicides), By Mode of Application (Foliar Spray, Post-Harvest, Seed Treatment, Soil Treatment), By Form (Liquid, Water Dispersable Granule, Wettable Powder), By Product (Benzimidazoles, Chloronitriles, Dithiocarbamates, Phenylamides, Strobilurins, Triazoles, Others), By Application (Turf & Ornamental, Fruits & Vegetables, Oil crops & Pulses, Grains & Cereals, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Fungicides Market Size

The Global Fungicides Market reached USD 20.4 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 33.7 billion by 2031. The market is growing at a CAGR of 6.5 % during the forecast period 2024-2031.

Fungicides are chemical compounds used to kill or prevent fungi's growth, including dithiocarbamates, benzimidazoles, triazoles, strobilurins, and carboxamides. Biological fungicides are living organisms or their derivatives that can control fungal diseases, and they contribute to the Global Fungicides Market Size.

Contact fungicides are applied directly to the plant's surface, while the plant absorbs systemic fungicides and provides protection throughout the tissue, resulting in lucrative sales in the fungicide market revenue. In addition, protective fungicides create a barrier on the plant's surface to prevent fungal spores from germinating and infecting the plant, and these products also have significant sales in the global fungicides market revenue.

Market Summary

|

Metrics |

Details |

|

CAGR |

6.5% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Origin, Mode of Application, Form, Product, Crop Type and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Europe |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights about the Market Request free Sample

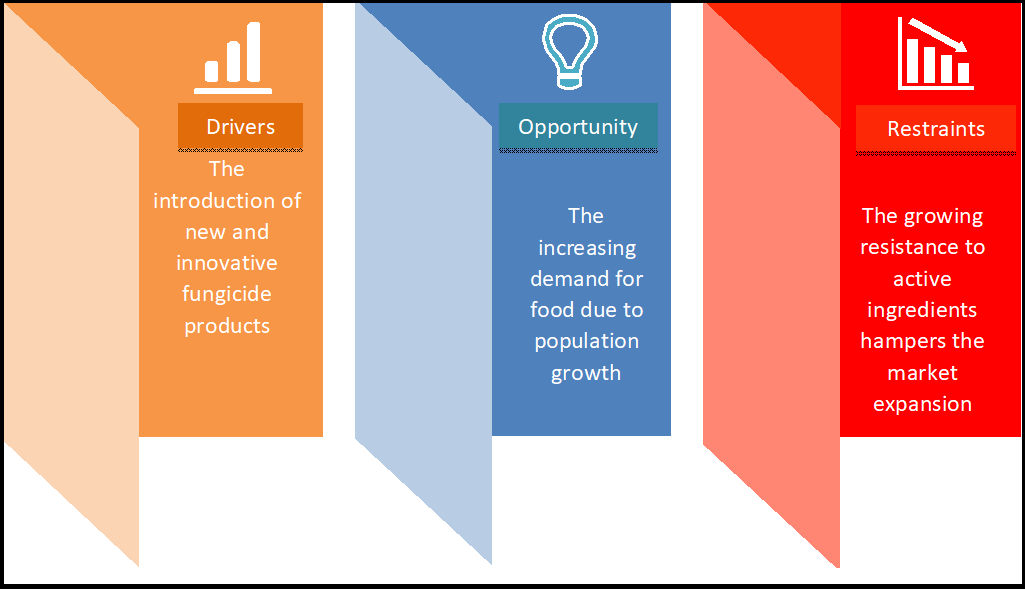

Market Dynamics

The Introduction of New and Innovative Fungicide Products

The cultivation of fruits and vegetables is expanding in response to changes in global food structures and cropping patterns, leading to a growing demand for fungicides with innovative active ingredients. For instance, on November 10, 2022, FMC Corporation launched three modes of action foliar fungicide targeting late-season diseases – adastri fungicide.

In addition, FMC Corporation's fluindapyr, was approved by the U.S. Environmental Protection Agency in 2021 for use in specialty crops and turfs. With strobilurin fungicides facing increasing disease resistance, manufacturers are prioritizing the development of strobilurin-based products in combination with other ingredients to improve efficacy and overcome resistance challenges.

Fungicides Market Segment Analysis

The Global Fungicides Market is segmented based on origin, mode of application, form, product, crop type, and region.

Grains & Cereals Segment Accounts for the Highest Share in Global Fungicides Market

The consumption of fungicide products is highest in the grains & cereals segment, which can be attributed to their increased application rate per hectare and the large areas harvested for crops such as corn, wheat, and rice - staple food items in regions such as America, Europe, and Asia-Pacific.

As the demand for these cereal crops increases, so does the need for fungal pesticide products that protect against diseases and pests. For instance, The Food and Agriculture Organization (FAO) reported a total production of 8358190.79 tons of cereals in 2021, highlighting the need for innovative fungicidal crop protection products.

Source: DataM Intelligence Analysis (2024)

Market Geographical Share

Asia-Pacific is the Dominating Region During the Forecast Period.

By region, the Global Fungicides Market is segmented into North America, South America, Europe, Asia-Pacific, Middle-East and Africa.

In 2022, Asia Pacific held the largest revenue share of approximately 32.9% and is projected to experience the highest growth rate during the forecast period. This region has an agrarian economy, and countries such as India, Indonesia, Thailand, South Korea, and Japan are highly dependent on crop yields each year. As a result, there is a significant demand for crop protective chemicals like fungicides and pesticides. For instance, on July 21, 2022, Rallis India launched two new fungicides, CAPSTONE and ZAAFU formulations.

However, governments in these countries are encouraging modern farming, in which farmers are educated on various factors such as chemical usage, crop type, soil conditions, and periodic application of fungicides. This approach is expected to significantly impact crop output with lower investment.

.

Source: DataM Intelligence Analysis (2024)

Market Companies

The major global players include BASF SE, ADAMA Agricultural Solutions Ltd., Bayer CropScience AG, DuPont, FMC Corporation, Monsanto Company, Nufarm Limited, Sumitomo Chemical Co., Ltd, Syngenta AG and The DOW Chemical Company.

Covid Impact

The COVID-19 pandemic has negative impact on the global fungicides market. The restrictions on movement and lockdowns have disrupted the supply chain and production of fungicides, leading to shortages in some regions. Additionally, the reduced availability of labor in many countries has impacted agricultural practices, leading to lower demand for fungicides.

However, the pandemic has also highlighted the importance of maintaining food security, leading to increased demand for fungicides to protect crops from fungal diseases and maintain yield. Moreover, the increased awareness of personal hygiene and cleanliness due to the pandemic has increased demand for antifungal products in the healthcare sector.

By Origin

- Bio-Fungicides

- Synthetic Fungicides

By Mode of Application

- Foliar Spray

- Post-Harvest

- Seed Treatment

- Soil Treatment

By Form

- Liquid

- Water Dispersable Granule

- Wettable Powder

By Product

- Benzimidazoles

- Chloronitriles

- Dithiocarbamates

- Phenylamides

- Strobilurins

- Triazoles

- Others

By Crop Type

- Fruits & Vegetables

- Oil Crops & Pulses

- Grains & Cereals

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On December 28, 2022, BASF launched its latest fungicide, Revysion (mefentrifluconazole), which was developed over an 11-year research process with an investment of €250 million. The event showcased the most relevant data regarding the new product.

- On March 30, 2023, Corteva Agriscience launched Adavelt Active, Bringing Farmers a New Mode of Action Fungicide.

- On November 28, 2022, Bayer, The US-based company, launched Luna Flex Fungicide Labeled for Eastern. Luna Flex is a versatile fungicide that effectively combats various diseases while minimizing the impact of secondary infections such as flyspeck and brown rot. With its broad-spectrum action, Luna Flex empowers growers to manage common diseases proactively.

Why Purchase the Report?

- To visualize the Global Fungicides Market segmentation based on origin, mode of application, form, product, crop type, and region, and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of fungicides market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Fungicides Market Report Would Provide Approximately 77 Tables, 82 Figures, And 195 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies