Functional Food Market Size and Growth

Functional Food Market reached US$ 195.4 billion in 2022 and is expected to reach US$ 316.1 billion by 2030 growing with a CAGR of 6.2% during the forecast period 2024-2031.

Consumers are increasingly recognizing the importance of gut health for overall well-being. Functional foods with probiotics, prebiotics, and fiber that support gut health and promote a healthy microbiome are in high demand. Increasing health consciousness, growing interest in preventive healthcare, and demand for convenient and personalized nutrition solutions drive the growth of the functional food market. Nutraceuticals and functional foods are two overlapping categories that focus on utilizing bioactive compounds and ingredients to provide health benefits beyond basic nutrition, offering a synergistic approach to improving overall well-being.

Fortified foods, as a type of functional food, are specifically formulated to provide additional nutrients and health benefits, combining essential nutrients with bioactive compounds to support overall well-being and address specific health concerns. Functional ingredients are key components in functional foods, contributing to their health-promoting properties by providing specific benefits beyond basic nutrition, making functional food a powerful vehicle for delivering targeted nutrition and improving overall health and wellness. Fiber-enriched foods, as a type of functional food, are formulated with added dietary fiber to support digestive health, promote regular bowel movements, and contribute to overall wellness by providing the benefits of increased fiber intake in a convenient and accessible way.

Market Scope

| Metrics | Details |

| CAGR | 6.2% |

| Size Available for Years | 2024-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Ingredient, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | Asia Pacific |

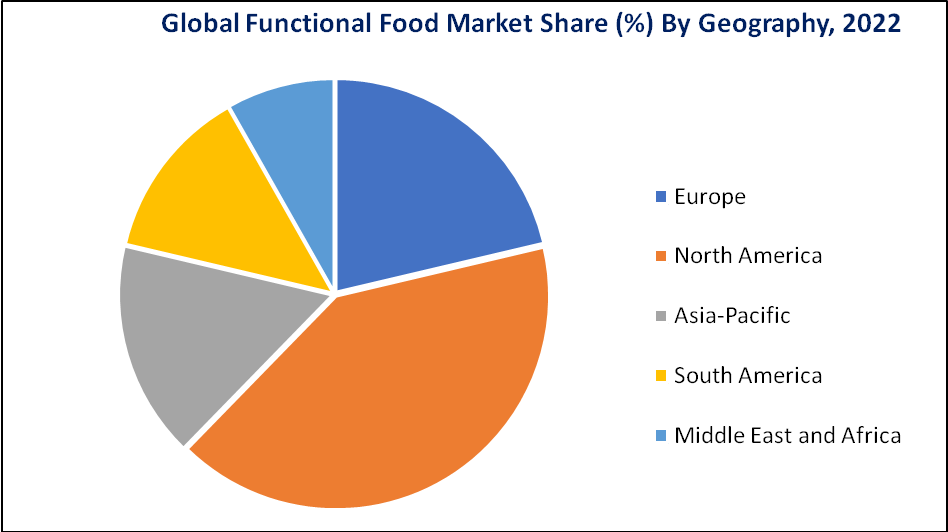

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics and Opportunities

Increasing Demand for the Functional Foods to Improve Overall Health

The increasing consumer awareness about health helps to boost the nutrient demand to enrich food like functional food. Increasing consumer interest in diet and health increased the demand for functional food. The prevalence of obesity across the world is continuously growing worldwide. It is a major public health challenge affecting almost every country worldwide. It is now one of the world's most important public health problems.

According to the World Health Organization data given in 2022, More than 1 billion children and adults are living overweight and obesity. WHO estimated that by 2025, approximately 167 million peoples will become less healthy because they are obase or iverweight.The hectic lifestyle and work stress have contributed to the prevalence of such health disorders. The growing awareness and shift in eating habits have led to a trend of eating smaller meals during the day. These factors have boosted healthy foods and replaced meals with healthy biscuits, snacks, and energy or protein bars.

Growing Demand for Sports Nutrition Among the Consumers is Driving the Market Growth

The rise in popularity of functional foods and dietary supplements in sports nutrition among working professionals is expected to boost functional food consumption. With consumers getting more health conscious and constantly looking out for solutions to improve their nutritional balance, the demand for functional food is increasing. Moreover, functional food showing beneficial results in lowering blood pressure and ultimately helping in the prevention of chronic diseases has helped it gain popularity as a nutritional ingredient.

An increase in product launches by key players in sports helps to boost the market growth. For instance, on April 24, 2023, CJ FNT launched the functional nutrition brand ActiveNrich in the market. In response to consumer demand, a new specialty brand has been created that focuses on nutritional solutions for the food and supplement categories. This innovative solution, which is created by natural fermentation and has glutathione as its main component, can be utilized as the basis for a variety of health meals.

Volatility in Raw Material Prices of Functional Food Hampers Market Growth

Changes in the global supply and demand for raw materials can cause price fluctuations. Factors such as weather conditions, crop yields, disease outbreaks, and geopolitical events can disrupt the availability and production of key raw materials used in functional foods, leading to price volatility. Trade policies, including import/export tariffs and trade disputes between countries, can influence raw material prices. Imposition of trade barriers or changes in trade agreements can disrupt supply chains, increase costs, and result in price fluctuations for raw materials used in functional foods.

Fluctuations in energy prices, particularly oil and gas, can impact the cost of transportation and logistics for raw materials. Higher energy prices can increase production and transportation costs, thereby affecting the overall price of raw materials used in functional foods. Many raw materials used in functional foods, such as fruits, vegetables, and grains, have seasonal production cycles. Supply variations due to seasonal factors, including weather patterns and harvest cycles, can impact the availability and pricing of these raw materials.

Market Segments

The global functional food market is segmented based on ingredient, product, application, and region.

Increased Demand for Probiotics in Functional Food Drives Probiotic Segment Growth

The global functional food market by ingredient has been segmented by probiotics, minerals, proteins & amino acids, prebiotics & dietary fibers, vitamins and others.

Probiotics play a significant role in the functional food industry. Probiotics are commonly added to various functional food products to enhance their nutritional value and provide specific health benefits. Probiotics are known for their ability to support and promote digestive health. They can help maintain a healthy balance of gut microflora, improve digestion, and alleviate symptoms of gastrointestinal disorders, such as irritable bowel syndrome (IBS) and diarrhea. Functional foods like yogurt, fermented milk, kefir, and cultured dairy products often contain probiotic strains like Lactobacillus and Bifidobacterium.

An increase in the research and use of probiotics in functional food drives segment growth. On October 03, 2022, Teijin established the Teijin Meguro Institute to advance its probiotic research and production for inclusion in functional foods. Utilizing the probiotics knowledge of its predecessor, the new company will offer functional food ingredients that satisfy the needs of health-conscious consumers. Probiotics are microorganisms that enhance the balance of intestinal lactic acid bacteria, etc. and the prebiotics that feed them, thereby improving human health.

Market Geographical Trends

Increased Consumption of Functional Food in the North America

North America is one of the largest and most developed functional food markets globally. The market has been experiencing strong growth due to increasing consumer interest in health and wellness, rising awareness of the benefits of functional foods, and a growing demand for natural and organic products. Consumers in North America are increasingly conscious of their health and seek functional foods that provide specific health benefits. There is a growing demand for functional foods targeting areas such as digestive health, weight management, heart health, immunity, and cognitive function.

An increase in product launches by major key players in the region helps to boost segment growth over the forecast period. For instance, on July 21, 2022, Burcon NutraScience Corporation, a Canada-based company launched the protein ingredient, Peazazz C pea protein in the market. It is the different pea protein that gives a grit-free and smooth texture in ready-to-drink beverages. It has low viscosity and is produced from yellow field peas.

Top 10 Companies

The major global players include Lotus Bakeries, Nestlé S.A., Hearthside Food Solutions LLC, Valio Eesti AS, The Kellogg's Company, Abbott Laboratories, PepsiCo Inc., Danone SA, Clif Bar & Company and General Mills.

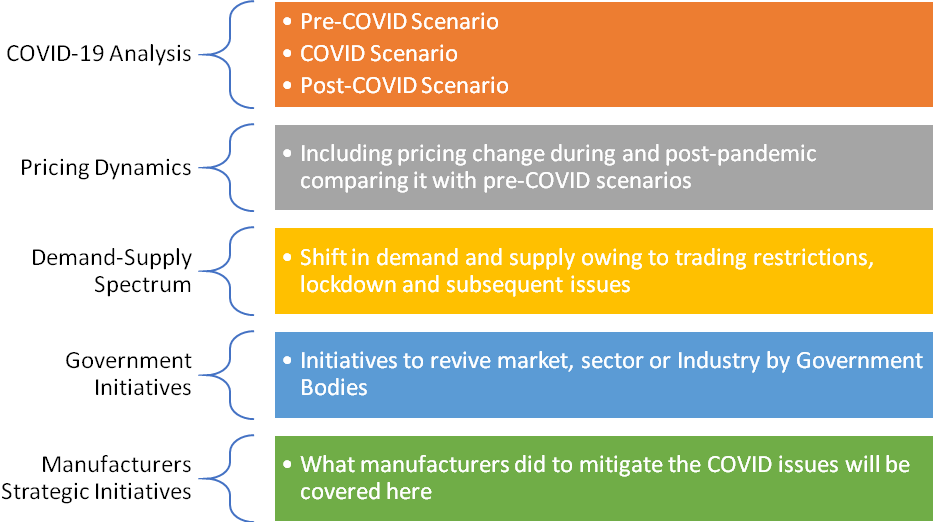

COVID-19 Impact Analysis

The pandemic has heightened the focus on immunity and overall health. As a result, there has been a surge in demand for functional foods that are believed to support immune function, such as foods fortified with vitamins, minerals, antioxidants, and probiotics. The pandemic has influenced consumer preferences and purchasing behaviors. People are seeking products that can help them maintain good health and boost their immune systems. This has led to increased interest in functional foods and supplements, particularly those containing ingredients known for their immune-boosting properties.

With lockdowns and social distancing measures in place, there has been a greater demand for convenient and easy-to-prepare foods. Functional food products that offer health benefits and convenience, such as meal replacement shakes, bars, and pre-packaged snacks, have experienced increased popularity.

Russia-Ukraine Impact Analysis

Political tensions and conflicts lead to trade disruptions between Russia and Ukraine. Trade barriers, import/export restrictions, or changes in trade policies affect the availability of functional food products from both countries. This results in reduced product choices and limited access to certain functional food items. Disruptions in trade between Russia and Ukraine can also impact the supply chains of functional food companies. Manufacturers may face difficulties in sourcing raw materials, ingredients, or packaging materials from either country, leading to potential supply shortages or increased costs. This can impact the production and availability of functional food products.

Political tensions between Russia and Ukraine influence consumer preferences and behaviors. Some consumers choose to support domestic brands and products over those from the opposing country. This lead to shifts in demand and consumption patterns, affecting the sales of functional food products from one country in the market of the other.

By Ingredient

- Probiotics

- Minerals

- Proteins & Amino Acids

- Prebiotics & Dietary Fibers

- Vitamins

- Others

By Product

- Bakery & Cereals

- Dairy Products

- Meat

- Fish & Eggs

- Soy Products

- Fats & Oils

- Others

By Application

- Sports Nutrition

- Weight Management

- Clinical Nutrition

- Cardio Health

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 31, 2023, Kirin and Kellogg partnered together to launch functional food products. This new functional food can be enjoyed as daily meals. The functional food is derived from wheat bran and contains a blend of L. lactis strain Plasma (postbiotic) and fermented dietary fiber arabinoxylan.

- On May 24, 2022, Plix, India’s leading nutrition brand, expanded its product portfolio by launching Plant-based Snackable foods in India. These Snackable meals can be had whenever, whenever, and without any additional preparations to satisfy the body's physical and mental needs as well as to quell the hunger.

- On April 11, 2023, PLT planning to launch a new breakthrough ingredient called Nutricog. It is good for the multiple cognitive domains, such as learning, memory, sustained attention, working memory and executive function.

Why Purchase the Report?

- To visualize the global functional food market segmentation based on ingredient, product, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of functional food market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global Functional Food market report would provide approximately 63 tables, 65 figures and 122 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies