Freezing Fishing Vessels Market Size

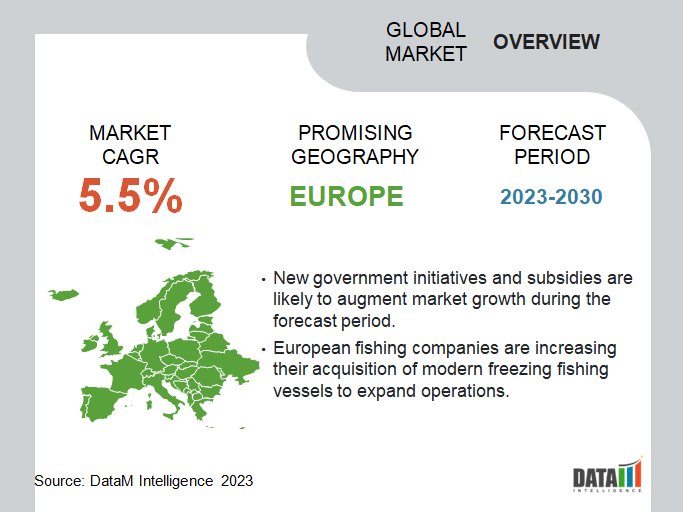

Global Freezing Fishing Vessels Market reached USD 1.6 billion in 2022 and is expected to reach USD 2.4 billion by 2030, growing with a CAGR of 5.5% during the forecast period 2024-2031. During the forecast period, increasing consumer demand for value-added seafood products is likely to propel the growth of the global freezing fishing vessels market.

Consumers are increasingly demanding value-added products such as marinated fish fillets and battered ready-to-fry fish portions.

Companies are making new vessel acquisitions and increasing their fishing quotas in order to cater to growing seafood demand. For instance, in September 2022, Brim, a major Icelandic fishing company, acquired a freezing fishing vessel and fishing quotas from its struggling competitor in a USD 79.4 million deal.

Market Scope

| Metrics | Details |

| CAGR | 5.5% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2023-2030 |

| Data Availability | Value (US$) |

| Segments Covered | Type, System, Vessel Length, Freezing Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

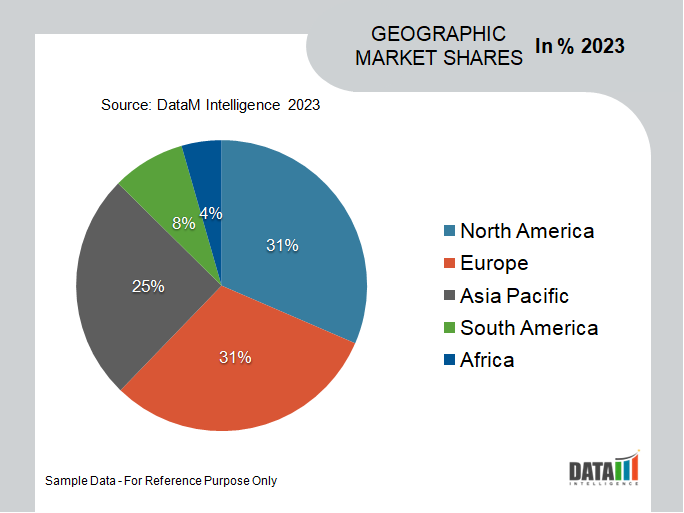

| Fastest Growing Region | Europe |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

Rising Global Seafood Demand

According to data from the food and agriculture organization (FAO) of the United Nations, global seafood production reached a record 178 million tonnes in 2021. Furthermore, the FAO estimates that global seafood demand is likely to double by 2030, mainly on account of rising affluence and income growth in developing regions.

Although fish farming has witnessed increased adoption in recent years, many of the fish species commonly used by the seafood industry are harvested from the wild. Commercial fishing companies are ramping up production using a variety of new fishing technologies. Freezing fishing vessels allows companies to readily process large amounts of fish. Growing seafood consumption is likely to increase demand for freezing fishing vessels over the medium and long term, especially in developed countries of North America and Europe.

Increasing Focus on Food Safety and Quality

Consumer awareness regarding food safety and quality have improved significantly over the years, due to increasing availability of information and government awareness programs. Therefore, modern seafood consumers prefer the freshest caught seafood which has been hygienically processed. Freezing fish below -4°F (-20°C) kills parasites and bacteria, rendering them safe for human consumption.

Quick freezing also prevents the formation of ice crystals, thus preventing freezer burn and preserving the texture and quality of the fish. Freezing fishing vessels allows fishing companies to simultaneously catch and freeze fish, thus minimizing processing time and preserving the quality and freshness of the fish for consumers.

Rising Concerns About Overfishing

Increasing global consumption of fish and other seafood products has led to rising concerns about overfishing and the sustainability of oceanic ecosystems. The world wildlife fund (WWF) estimates that nearly 24% of global fisheries are overexploited with a further 52% being fully exploited. According to estimates from the environmental non-profit NGO earth.org, according to current projections, the global oceans could be emptied of fish stocks by 2048.

Governments and other regulatory organizations are undertaking various steps to prevent overfishing. Seasonal closures, catch quotas and area restrictions are some of the measures being taken to prevent overfishing. Freezing fishing vessels are designed to catch and process fish on an industrial scales. The implementation of strict overfishing measures can lead to reduced investment in freezing fishing vessels as it would render then uneconomical without large-scale fishing.

Market Segment Analysis

The global freezing fishing vessels market is segmented based on type, system, vessel length, freezing capacity and region.

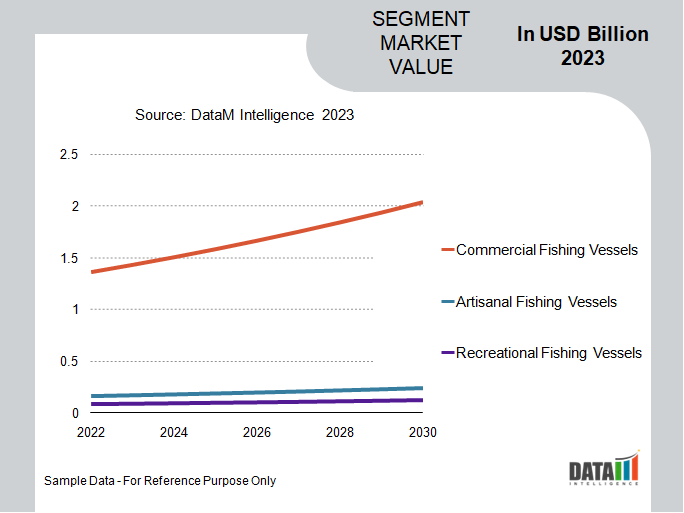

Commercial Fishing Vessels have the Leading Share of the Global Market

Commercial fishing vessels account for more than two thirds of the global market. Almost all major fishing activities in developed regions are carried out by fishing companies with a fleet of large commercial fishing vessels. Only fishing companies have the financial wherewithal for large scale adoption of freezing fishing vessels.

Although the majority of fishing in developing regions such as Africa and Asia-Pacific is mainly carried out through artisanal fishing vessels, most fishermen in these regions are too poor to invest in freezing equipment and machinery. Most artisanal fishing vessels typically utilize dry ice and insulated storage boxes for preserving catch.

Market Geographical Share

New Government Initiatives to Propel Market Growth in Europe

Europe is expected to grow at a faster CAGR of 5.5% during the forecast period. Europe is a high-income region with a well-developed and regulated fishing industry. Europe has some highly desirable fish species such as the atlantic mackerel, tuna, cod, pollock and salmon. The European European Union (EU)’s common fishing policy (CFP) sets annual quotas for members states for each species of fish.

The EU has unveiled the Fish-X project for the digital transformation of the European fishing industry. The project envisages usage of modern digital tools and data management to improve the sustainability and operational efficiency of the fishing industry. EU has also implemented the European Maritime, Fisheries and Aquaculture Fund (EMFAF) of about EUR 5.3 billion (USD 5.9 billion) for the further development of the fishing industry. With new government initiatives the adoption of freezing fishing vessels in Europe is likely to increase over the medium and long term.

Freezing Fishing Vessels Companies

The major global players include Astilleros Armon, Karstensens Skibsværft A/S, Ulstein Group ASA, Damen Shipyards Group, Integrated Marine Systems, Inc., Kongsberg Maritime, Thoma-Sea Ship Builders, LLC, Aresa Shipyard, Havyard Leirvik AS and United Shipbuilding Corporation.

COVID-19 Impact on Market

The COVID-19 pandemic created major challenges for the global freezing fishing vessels market. Pandemic restrictions such as lockdowns resulted in logistical challenges, thereby causing delays in the transportation of frozen fish and leading to volatility in market prices. Due to revenue uncertainty, many fishing companies delayed investments in new freezing fishing vessels.

The pandemic had an outsized impact on the hospitality industry, particularly restaurants and hotels, which are the among the largest consumers of frozen seafood. With restrictions on restaurants, hotels and catering services, demand for frozen seafood witnessed a sizeable decline. The reduction in demand led to reduced utilization of freezing fishing vessels, thus leading to a major reduction in demand for new and replacement vessels.

AI Impact Analysis

AI algorithms can be integrated with new vessels to assist in fleet management, by optimizing various functions such as vessel routing, fuel consumption and maintenance schedules. Big data analytics and machine learning can be used to analyze historical data, weather conditions and fishing patterns to significantly improve decision making leading to improved operational efficiency and reduce operational costs.

The integration of AI-based technologies will also significantly improve vessel operational safety and crew welfare. An array of smart sensors coupled with analysis of historical data can be used to identify potential risks predict equipment failures and optimize safety protocols. AI algorithms can also be used to optimize crew work schedules, mitigating fatigue-related risks, thus leading to improved crew welfare.

Russia- Ukraine War Impact Analysis

The ongoing conflict between Ukraine and Russia created problems for the Russian fishing industry. Almost all western countries imposed sanctions on Russia for the war, thus cutting it off from western technology, including for the fishing industry. Although EU countries have not enacted bans on Russian fish imports.

Russian fishing companies and shipyards have been forced to substitute western-made freezing equipment with local or Chinese alternatives. Furthermore, the disruptions in supply of various vessel components have disrupted timelines for various freezing fishing vessels currently under construction in Russia.

By Type

- Commercial Fishing Vessels

- Artisanal Fishing Vessels

- Recreational Fishing Vessels

By System

- Air Blast Freezing

- Plate Freezing

- Brine

- IQF (Individual Quick Freezing)

By Vessel Length

- Less than 20M

- 21-30M

- 31-40M

- More than 40M

By Freezing Capacity

- Less than 50 Tons

- 50-150 Tons

- 150-300 Tons

- More than 300 Tons

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2023, Russia’s state-owned United Shipbuilding Corporation (USC), handed over a new freezing fishing vessel, for usage by the Russian fishing company Atlantrybflot. It represents one of the first commissioned fishing vessels of the Project KMT02.02 series.

- In April 2023, Baffin Fisheries, a Canadian fishing company, announced plans to establish a seafood trading company and expand its fleet of freezing fishing vessels as the company ramps up harvest of Greenland halibut and coldwater shrimp.

- In May 2023, Severnaya Verf, a Russian state-owned shipyard, completed the construction of a new freezing fishing vessel for the Virma Fishing Company, a Russia-based seafood company. The new fishing vessel, christened Gandvik-1 has a length of 59 meters, a beam of 13 meters and a displacement of 2,200 tons.

Why Purchase the Report?

- To visualize the global freezing fishing vessels market segmentation based on type, system, vessel length, freezing capacity and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of freezing fishing vessels market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global freezing fishing vessels market report would provide approximately 64 tables, 70 figures and 210 Pages.

Target Audience 2024

- Fishing Companies

- Shipbuilding Companies

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies