Food Contract Manufacturing Market Size

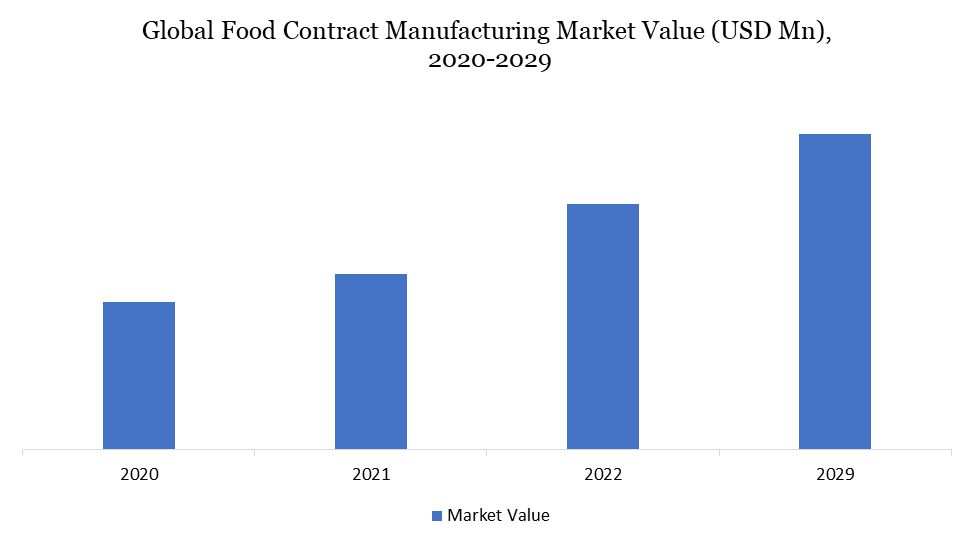

Food Contract Manufacturing Market was valued at USD XX million in 2021. It is forecasted to reach USD XX million by 2031, growing at a CAGR of XX% during the forecast period (2024-2031).

Food contract manufacturing is a form of outsourcing where one company will hire another to produce food products for it while the customer business focuses more on branding and marketing. Many companies do not have the resources or funding to manufacture and package high-quality products on time. In such cases, it makes sense to outsource production to a company that specializes in producing foods, beverages, or dietary supplements for a particular industry. Increasing demand for food manufacturing outsourcing is expected to have a positive impact on industry growth.

To Know more insights Download Sample

Food Contract Manufacturing Market Dynamics

Food processors are unable to meet the demand for manufacturing of food products, thus increasing the demand for food contract manufacturing

When demand for ready-to-eat food products surged in 2020, food processors could not produce on such a scale, so they had to rely on contract manufacturers. Outsourced manufacturing is on the rise, owing to the restricted manufacturing capacity of OEMs and growing food manufacturers. Food contract manufacturers have also begun to offer a variety of value-added services such as packaging, research, consultancy, and warehousing, allowing food companies to expand quickly. Many contract manufacturers were able to secure long-term contracts that led them to the top. In addition, private equity investments have allowed contract manufacturers to expand their capacity and provide other important services. Over the years, food companies have become smarter to use contract manufacturers to stay away from the additional costs associated with manufacturing. Food companies can also release cash flow, which has played an important role during a pandemic, and create a favorable environment for manufacturers to thrive.

Food Contract Manufacturing Market Segmentation

Manufacturing segment is expected to dominate the market in the year 2021

Manufacturing services led the market, accounting for XX% of the global revenue share in 2021. Manufacturing services include the manufacture of a wide range of products such as convenience meals, bakery goods, dietary supplements, confectionery products, and dairy products. Manufacturing services have the greatest market share due to the growing number of innovative manufacturing services given by contract manufacturers in response to the rapid rise in food product demand. As a core service, food contract manufacturers offer various processes such as dry blending, spray drying and extrusion through manufacturing. Some food companies also offer special food processing recipes that are expected to spur the industry's growth.

In terms of revenue, custom formulation and R&D are expected to expand at a CAGR of xx percent over the projection period. Small and medium-scale food companies often do not have a dedicated R&D team to formulate new products or the consumer insights needed to further growth. Food contract manufacturers can provide them with employees, equipment, and knowledge.

Food Contract Manufacturing Market Geographical Share

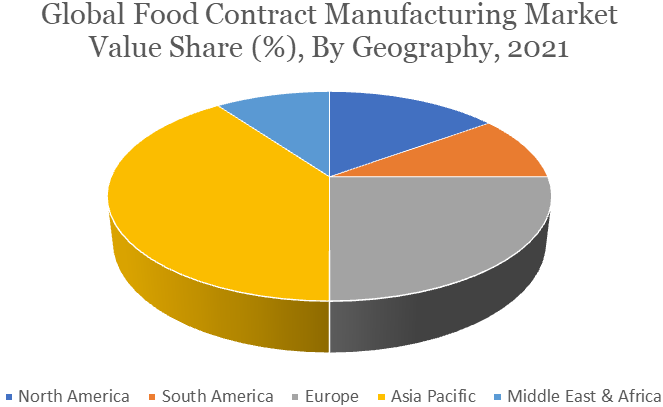

North-America is the dominating region during the forecast period

North America is expected to dominate the food contract manufacturing market as the region is increasingly outsourcing food processing and manufacturing services. In addition, food processing and manufacturing are increasing because contract manufacturers provide services at a low cost. Because of the rising demand for packaging in categories such as food and beverages, the food contract packaging market in North America is rapidly expanding. Various contract packaging companies in the US and Canada have learned to adapt to difficult business conditions. Many European firms, including Langen Group and Persson Innovation, have previously made investments in the US.

The Asia Pacific region is the fastest-growing region during the forecast period. The food industry has changed rapidly due to population growth, household income growth and industrialization. This has created a great need for food manufacturers in the region.

Food Contract Manufacturing Market Key Players

The food contract manufacturing market is reasonably fragmented and has many domestic and international suppliers. Key players in the food contract manufacturing market include Nutrascience Labs, Inc., NuWorld Foods, NVE Pharmaceuticals, Inc., Pacmore Products Inc., Thrive Foods LLC., Tree Top Inc., Van Law Food Products Inc. Companies in the market continue to expand their geographical proximity through partnerships and mergers. For example, in December 2017, Arla Foods and DMK Group (a German dairy company) signed a manufacturing contract with a third party. Under this agreement, DMK will annually produce 35,000 tons of mozzarella cheese for Arla Foods. Manufactured at the Nordhackstedt site in DMK in northern Germany, it has approximately 70,000 tons, half of which is used to produce mozzarella cheese.

COVID-19 Impact:

Positive impact on the global food contract manufacturing market.

The COVID-19 pandemic has resulted in panic buys of comfort foods and supply chain restructuring, which have benefited the contract manufacturing market. As a result of the prolonged lockdowns caused by the COVID-19 pandemic, there was a substantial increase in the consumption of convenience foods as people were confined inside their homes. Increased demand for processed foods has resulted in new contract opportunities for food contract producers. The pandemic also caused supply chain reorganization, projected to boost industrial growth.

Why Purchase the Report?

- Understand the current market scenario and viability of global food contract manufacturing market over the forecast period.

- Visualize the composition of the global food contract manufacturing market in terms of service and region identify major players, growth potential, and market strategies.

- Identify the key regulations prevailing in the market and understand their impact on the market over the forecast period.

- Understand the key business factors such as market competition, product pricing, new product developments, and patent filings pertaining in the market.

What we offer?

- PDF report with the most relevant analysis cogently put together after exhaustive qualitative interviews and in-depth market study.

- Excel data sheet with valuable data points of the global food contract manufacturing market – Regional and Country level segmentation.

- Product mapping in excel for the key products of all major market players.

- Market Share Analysis covering business revenues ($) and revenue share (%) of key market players.

The global food contract manufacturing market report would provide an access to approximately 45 market data tables, 35 figures and 180 pages

Target Audience:

- Food & Beverages Manufacturers

- Import and Export Companies

- Industry Investors

- Education & Research Institutes

- Research Professionals