Filter Needles Market Size

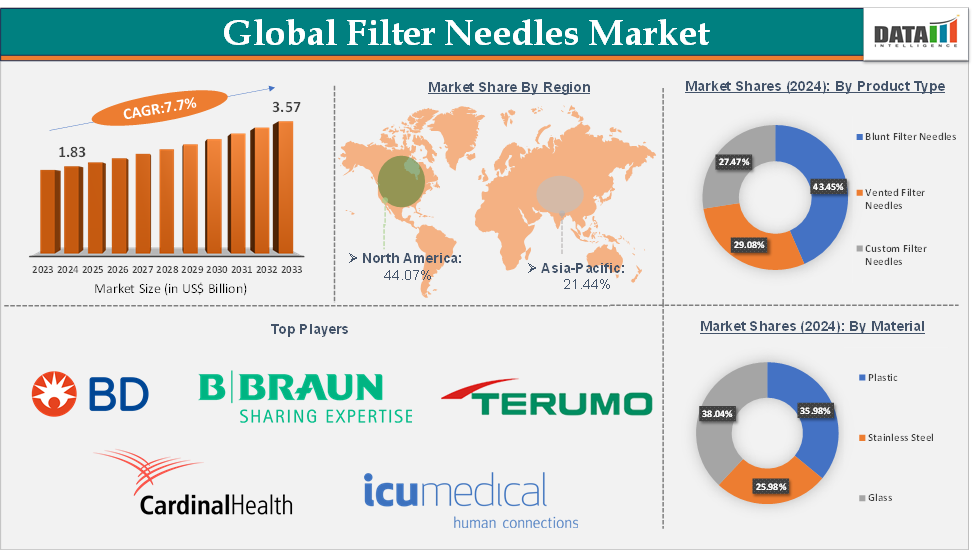

Filter Needles Market Size reached US$ 1.83 Billion in 2024 and is expected to reach US$ 3.57 Billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

Filter Needles Market Overview

Filter needles are medical devices used in healthcare settings to safely administer medications from vials or ampoules into syringes without contamination. These devices typically consist of a hollow needle with an integrated filter that allows fluids to pass through while blocking particulates such as glass shards, rubber particles, and other contaminants.

The filter needles market is experiencing significant demand due to various factors, including the increasing prevalence of chronic diseases and the growing emphasis on infection control in healthcare settings. Technological advancements in needle design are also driving demand by improving safety and efficiency. The market is expected to continue growing as these factors remain critical in medical procedures, particularly in regions with expanding healthcare infrastructure and increasing disposable incomes.

Executive Summary

For more details on this report – Request for Sample

Filter Needles Market Dynamics: Drivers & Restraints

Rising surgical and medical procedures are significantly driving the filter needles market growth

The rising number of surgeries worldwide, particularly in emerging markets, has led to higher demand for sterile equipment like filter needles to prevent contamination and ensure drug safety during administration. For instance, according to the Annals of Thoracic Surgery Short Reports, estimated that 1 to 1.5 million cardiac surgical procedures take place each year.

Additionally, according to the study conducted by the National Institute of Health(NIH), a total of 4,642 surgeries were performed per year for a population of 88,273. Cataracts (22.8%), Caesareans (3.8%), surgeries for fractures (3.27%), and hernia (2.86%) were the commonest surgeries. 44.2% of surgeries belonged to the essential surgeries. NIH estimated that 3,646 surgeries would be required per 100,000 Indian population per year. Additionally, according to the Annals of Thoracic Surgery Short Reports, estimated that 1 to 1.5 million cardiac surgical procedures take place each year.

Technological improvements in filter needle design, such as integrated safety features and enhanced materials, allow better filtering capabilities and reduce contamination risks. These advancements cater to the increased demand from healthcare providers performing complex procedures.

The risk of needle-related injuries is hampering the filter needles market's growth

The risk of needle-related injuries significantly hampers the growth of the filter needles market due to concerns over safety and the impact on healthcare workers’ well-being. Despite advancements in filter needle technology designed to minimize contamination and improve safety, the risk of accidental needlestick injuries remains a critical issue, particularly in less controlled environments such as hospitals, clinics, and in-home healthcare settings.

Needle-related injuries are still prevalent, affecting healthcare workers and patients. These injuries can lead to serious consequences, including infections from contaminated needles. This risk discourages the adoption of filter needles, especially among institutions and healthcare providers who are concerned about compliance with safety protocols. For instance, the Centers for Disease Control and Prevention (CDC) reported that more than 1 million events of needle sticks and sharp injuries (NSSIs) happen annually and represent 8% of in-hospital injuries.

Filter Needles Market Segment Analysis

The global filter needles market is segmented based on product type, material, application, end-user, and region.

The blunt filter needles from the product type segment are expected to hold 43.45% of the market share in 2024 in the filter needles market

Blunt filter needles are designed to prevent needlestick injuries and glove perforation risks by using a blunt, non-piercing tip. This makes them ideal for accessing medication vials and ampules without the risk of piercing through the vial's rubber stopper. This design reduces the risk of glass particles from ampules entering the medication during preparation, which is crucial for patient safety, especially when handling high-risk drugs and biologics. The use of blunt filter needles prevents injuries that could lead to serious health risks, such as infections from accidental needle sticks.

For instance, according to the National Institute of Health (NIH), the use of blunt needles reduced the risk of glove perforations with a relative risk (RR) of 0.46 (95% confidence interval (CI) 0.38 to 0.54) compared to sharp needles. The use of blunt needles will thus prevent one glove perforation in every six operations.

Hospitals and clinics frequently use blunt filter needles for drug administration and sample collection due to their ability to handle medications without contamination risks. This widespread use has established the segment as a standard in medical procedures where sterility and safety are paramount. Home healthcare adoption of blunt filter needles is also boosting, as patients and caregivers prefer safer, user-friendly options for self-administration of medications.

Filter Needles Market Geographical Analysis

North America is expected to dominate the global filter needles market with a 44.07% share in 2024

North America boasts a well-established healthcare infrastructure with widespread adoption of advanced medical technologies. The presence of major market players in North America, especially in the United States, is further driving the market growth through the development of filter needles with advanced features, particularly to prevent needlestick injuries.

For instance, in January 2025, Terumo Corporation announced the global launch of the Terumo Injection Filter Needle, a first step of the INFINO Development Program. Indicated for hypodermic as well as for intravitreal injections, the Injection Filter Needle features an integrated polyamide 5-micrometer mesh filter to prevent particles from being injected.

Additionally, in April 2025, Carr Tech Corp, a Maryland-based medical device startup founded by pharmacist-turned-entrepreneur Sue Carr, announced that the company has received FDA 510(k) Class II clearance for its flagship product, FROG (Filter Removal of Glass), an all-in-one filter needle designed to enhance safety and efficiency in medication preparation and administration.

In North America, there is a strong preference for safety-engineered needles, including blunt filter needles, due to the heightened awareness of healthcare-associated infections. These devices are widely used to minimize the risk of needlestick injuries, which are prevalent in healthcare settings. The use of blunt filter needles is particularly emphasized for drug administration, especially when dealing with biologics and high-risk medications.

Asia-Pacific is growing at the fastest pace in the filter needles market

The APAC region is experiencing rapid economic growth, which is leading to increased investments in healthcare infrastructure. This economic growth enables governments and private entities to improve medical facilities and access to healthcare services, thereby driving demand for advanced medical devices like filter needles.

For instance, countries like China and India are investing heavily in healthcare infrastructure, which is crucial for the adoption of safety-engineered needles. These investments include upgrading hospitals, clinics, and other medical facilities, making it easier to implement devices like filter needles.

There is a growing awareness among healthcare providers and the general population in the APAC region about the importance of infection control and patient safety. This has led to an increased demand for safety-engineered needles, such as blunt filter needles, which are effective in reducing the risk of contamination and needlestick injuries. For instance, the adoption of filter needles in countries like India and Indonesia is accelerating due to improved healthcare policies and rising awareness about safe drug administration practices.

Filter Needles Market Top Companies

Top companies in the filter needles market include BD, B. Braun Medical Inc., Cardinal Health, MYCO Medical Supplies, Inc., Terumo Corporation, ICU Medical, Inc., GBUK Group Ltd., Changzhou SUNTON Medical Technology Co., Ltd, and Medline Industries, LP, among others.

Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Blunt Filter Needles, Vented Filter Needles, and Custom Filter Needles |

Material | Plastic, Stainless Steel, and Glass | |

Application | Medication Preparation, Drug Delivery, Blood Collection and Processing, and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Academic Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global filter needles market report delivers a detailed analysis with 67 key tables, more than 65 visually impactful figures, and 147 pages of expert insights, providing a complete view of the market landscape.