Fiberglass Market Size

The Global Fiberglass Market reached USD 17.6 billion in 2022 and is projected to witness lucrative growth by reaching USD 26 billion by 2031. The market is growing at a CAGR of 5.0% during the forecast period 2024-2031.

Metal biocides, especially silver biocides, are utilized in an ever-increasing range of products, including water treatment, fibers, dyes/paints and varnishes, polymers, washing machines, medical applications, sinks and sanitary ceramics and various 'consumer' applications such as disinfectants, baby bottles, cosmetics, cleaning agents, etc. This broad utilization of fiberglass in various fields is driving the fiberglass market growth.

Fiberglass Market Scope

| Metrics | Details |

| CAGR | 5.0% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Product, Glass Type, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To know more insights Download Sample

Fiberglass Market Dynamics

The Rising Demand for Antifouling Paints

Antifouling paints are used to prevent the growth of marine organisms on ships and other marine structures, which can cause damage and increase fuel consumption. These paints are typically formulated with fiberglass, which are the active ingredients that prevent the growth of these organisms.

According to the United Nations Conference on Trade and Development, the volume of maritime trade is expected to increase from 11 billion tons in 2016 to 19 billion tons by 2060. This is expected to drive the demand for antifouling paints, which, in turn, will increase the demand for fiberglass market.

Growing Environmental Concerns

Strict regulations on the use of biocides are a major restraint for the fiberglass market. Several countries have banned the use of harmful biocides due to their potential impact on human health and the environment. For instance, the European Union has banned the use of several biocides, including triclosan, in personal care products due to their potential endocrine-disrupting effects.

This has led to a decrease in the demand for fiberglass in these applications. Many countries have implemented strict regulations on the use of biocides to protect the environment. For instance, the US Environmental Protection Agency has set limits on the levels of copper and other metals that can be released into the environment from antifouling paints.

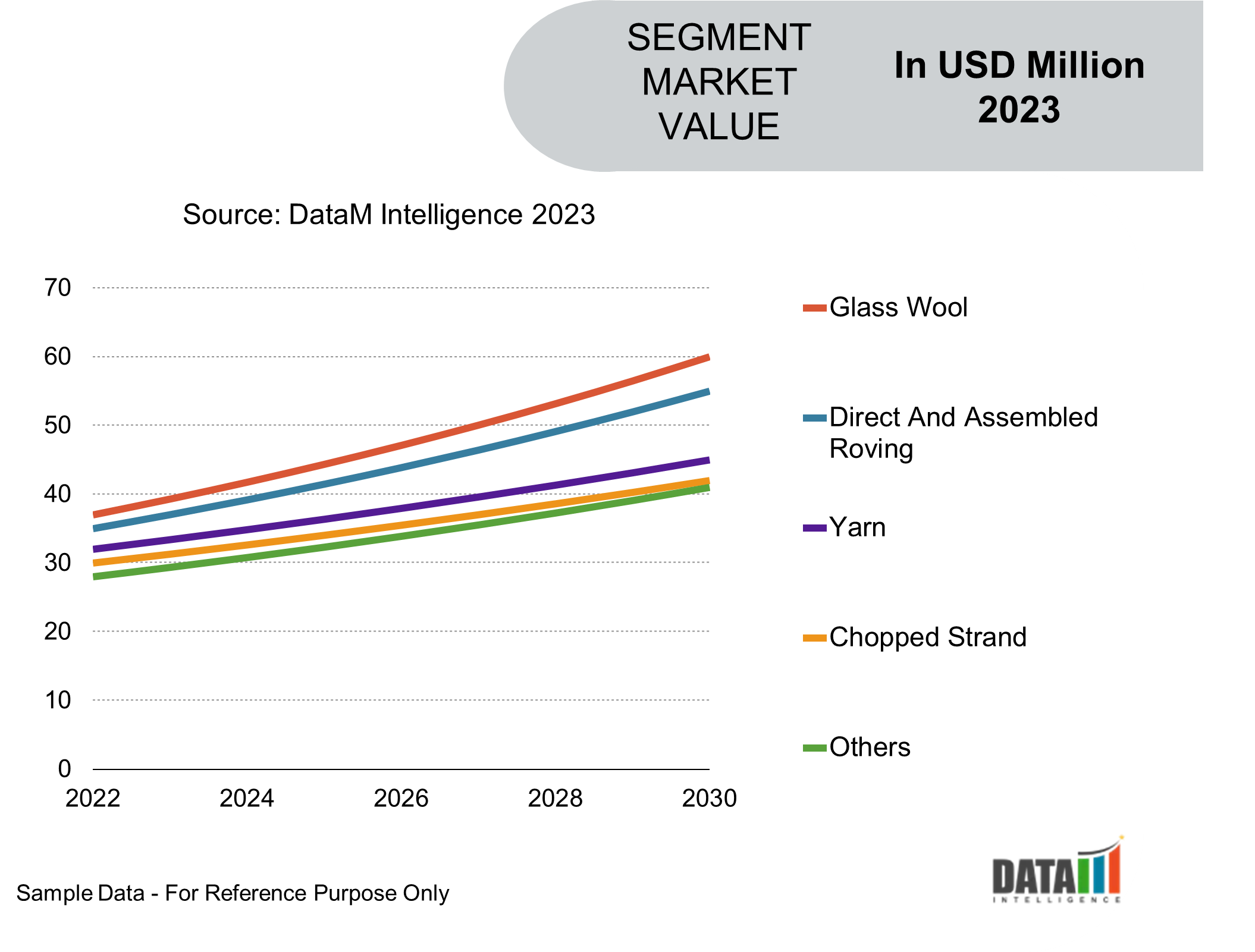

Fiberglass Market Segmentation Analysis

The Global Fiberglass Market is segmented based on type, end-user and region.

Due to Wide Range of Plastic Applications and their Versatility

Plastic has the highest share in the Global Fiberglass Market application segment due to its wide range of applications. Fiberglass-reinforced plastic (FRP), also known as glass fiber-reinforced plastic (GRP), is a composite material that combines the strength and durability of fiberglass with the moldability and flexibility of plastic.

This combination makes FRP an ideal material for various industries and applications. In sectors such as automotive, aerospace, construction, marine, electrical and electronics, and consumer goods, plastic-based fiberglass composites find extensive use.

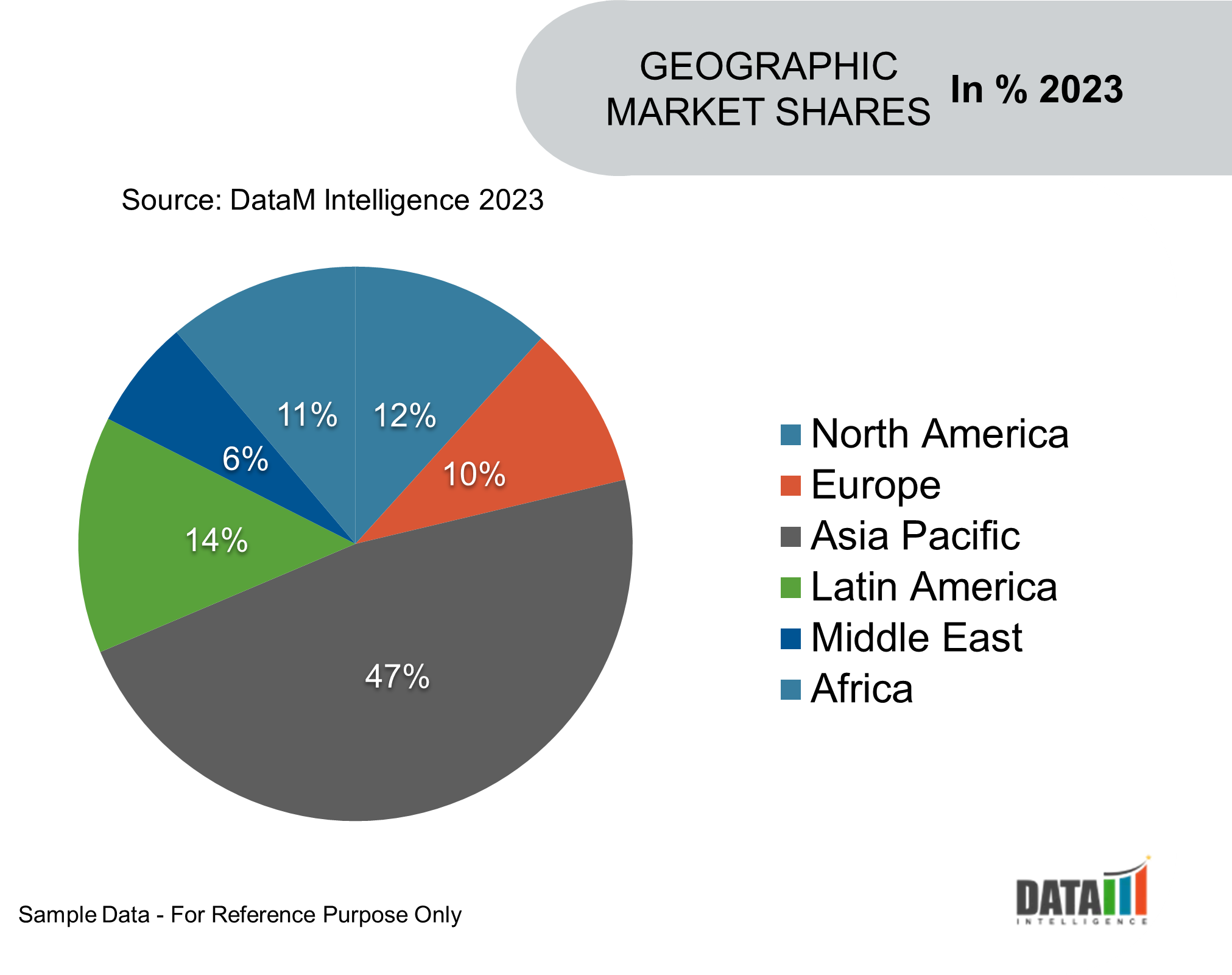

Fiberglass Market Geographical Share

Asia Pacific is Estimated to Grow at a Faster Rate During the Forecast Period

The Asia-Pacific is expected to dominate the fiberglass market and grow at CAGR of nealy 6.2% during the forecast period. The Asia-Pacific region has witnessed significant economic growth, increasing construction, infrastructure development, and industrialization. The region is experiencing a construction boom, with numerous residential, commercial, and infrastructure projects underway.

Fiberglass materials find extensive use in applications such as insulation, reinforcement, roofing, and facades. The region's growing population, urbanization, and focus on sustainable construction have contributed to the increased demand for fiberglass.

Fiberglass Market Companies

The major global players include China Jushi Co., Ltd., Owens Corning, PPG Industries, Inc., Chongqing Polycomp International Corp. (CPIC), Nippon Electric Glass Co., Ltd., Binani 3B-The Fibreglass Company, Taiwan Glass Ind. Corp., Johns Manville Corp., PFG Fiber Glass (Kunshan) Co., Ltd. and Asahi Fiberglass Co., Ltd.

COVID-19 Impact on Fiberglass Market

COVID Impact

COVID-19 pandemic has had a mixed impact on the Global Fiberglass Market. While the pandemic initially caused disruptions in supply chains, production, and demand, the industry has shown resilience and adaptability. The construction and automotive sectors, which are major consumers of fiberglass, were affected by lockdowns and reduced activity.

However, the increased focus on hygiene and health safety has boosted the demand for fiberglass products in applications like healthcare, sanitation, and personal protective equipment (PPE). Overall, the market has experienced challenges but also opportunities driven by changing consumer needs and industry dynamics.

Russia-Ukraine War Impact

The geopolitical situation and potential disruptions caused by the Russia-Ukraine war can lead to market volatility in the global fiberglass industry. Uncertainties regarding supply chain stability, pricing, and trade flows can impact market dynamics and decision-making processes for industry participants. Fluctuations in demand and supply patterns can affect market prices and profitability for fiberglass products.

Key Developments

- In April 2023, Saint-Gobain, the French multinational glass maker, bought a 400-crore (USD 33.02 million) stake in Indian fiberglass manufacturer Twiga Fiberglass Ltd. The company had previously agreed with Saint Gobain to manufacture glass wool. The acquisition is expected to strengthen Saint Gobain’s position in the Indian market.

- In May 2023, Jushi Group, one of China’s largest fiberglass manufacturers, donated high-technology equipment to Egypt’s National Research Center (NRC). The device is an Inductively Coupled Plasma Spectrometer (ICP) and is used to generate powerful quantitative and qualitative analysis of the mineral composition of glass fiber.

- In December 2022, Jushi Group’s subsidiary in Egypt commenced production at a new fiberglass production line with an annual capacity of 200,000 tons. The production line is a party of the company’s USD 320 million expansion plan in Egypt.

Why Purchase the Report?

- To visualize the Global Fiberglass Market segmentation based on the product, glass type, and application understanding of key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous fiberglass market-level data points all for segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Fiberglass Market Report Would Provide Approximately 57 Tables, 68 Figures and 182 Pages.

Target Audience 2024

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies