Expanded Polypropylene Foam Market is Segmented By Product (Low-Density Expanded Polypropylene (EPF) Foam, Medium Density Expanded Polypropylene (EPF) Foam, High-Density Expanded Polypropylene (EPF) Foam), By End-User (Automotive, Packaging, Consumer Goods, Appliances, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Expanded Polypropylene Foam Market Size, Demand Insights

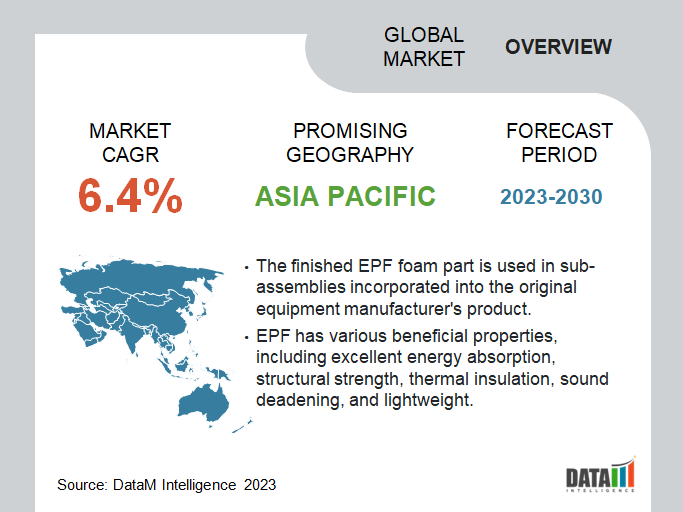

The Global Expanded Polypropylene Foam Market size, shares, recent trends, competitive intelligence, and future market outlook. Expanded polypropylene (EPF) foam usage to produce doormats is on the rise. Demand for automotive, packaging in ‘The Asia Pacific’ is growing. The competitive rivalry intensifies with JSP Corporation, BASF SE, Kaneka Corporation, and others active in the market.

Expanded Polypropylene (EPF) is a versatile closed-cell bead foam with exceptional energy absorption, multiple impact resistance, thermal insulation, buoyancy, water, and chemical resistance, exceptionally high strength-to-weight ratio, and 100% recyclability. EPF can be manufactured in various densities ranging from 15 to 200 grams per liter, which can then be molded into thicknesses ranging from 18 to 260 grams per liter. The steam chest molding process fuses individual beads into the final product form, resulting in a lightweight and robust shape.

Manufacturing is a complex process requiring technical expertise and specialized custom equipment. In a multi-step proprietary process, polypropylene resin is combined with other ingredients. Extruded pellets expand under tightly controlled conditions to form uniformly shaped beads of expanded polypropylene foam. Other specialized manufacturing techniques may produce variations in the final product form.

After that, EPF foam beads are injected into molds. In many cases, low-cost multi-cavity aluminum molds are employed. The beads are fused into a finished shape by pressure and steam heat. The finished EPF foam part is used in sub-assemblies incorporated into the original equipment manufacturer's product.

Expanded Polypropylene (EPF) Foam Market Scope and Summary

|

Metrics |

Details |

|

Market CAGR |

6.4% |

|

Segments Covered |

By Product, By End-User, and By Region |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other vital insights. |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Market Share |

North America |

To know more insights into the Market, Get Our Sample Brochure

Expanded Polypropylene (EPF) Foam Market Dynamics and Trends

Product penetration in packaging, consumer goods, and furniture is expected to significantly impact overall market growth over the forecast years. The rising application scope of the product in various industries can be attributed to its superior qualities such as durability, chemical and water resistance, thermal insulation, and recyclability. Furthermore, rising manufacturing investment across significant economies has increased automobile and consumer goods production.

Extensive properties of expanded polypropylene

EPF (expanded polypropylene) is a type of closed-cell bead foam. These foams are in the shape of a steam chest. EPF has various beneficial properties, including excellent energy absorption, structural strength, thermal insulation, sound deadening, and lightweight. Expandable polypropylene is shaped into EPF foam beads using a multi-stage proprietary process.

EPF foams are also used to produce doormats, headliners, and door pads. They allow for maintaining a constant air temperature in the cockpit and create ideal conditions for battery operations. The use of EPF foams in bumpers is increasing due to their excellent recoverability and ability to absorb impact energy.

Rising demand for EPF foam in the automotive industry

EPF foam is widely used in the automotive industry for acoustic management, thermal insulation, and impact absorption in the floor, door panels, seats, and bumpers. At the same time, the proportion of recyclable materials in vehicles that can be reused is increasing. Furthermore, the increased use of electric cars promotes the growth of the EPF foam market, as EPF foams play an essential role in making electric vehicles lightweight and thermally insulated, thereby improving energy absorption capabilities.

In a collision, molded EPF parts integrated into bumper bar systems reduce pressure and the amount of impact energy transmitted to the chassis. Over the projected period, the growing importance of reducing overall vehicle weight to improve fuel economy is expected to drive product demand in the automotive segment.

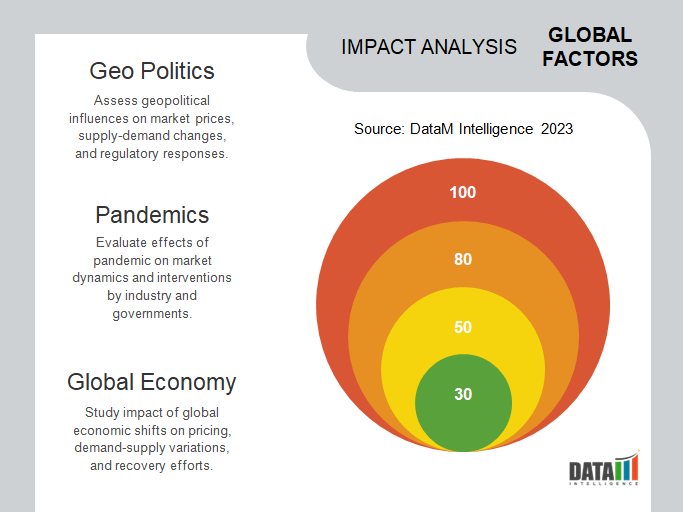

Volatility in material prices hinders the market growth

The easy availability of propylene, a key raw material used in producing EPF foam, in major economies has aided the global industry's raw material supply. The price volatility associated with the material is expected to impact final product prices, limiting the market growth.

COVID-19 Impact on Expanded Polypropylene (EPF) Foam Market Growth

COVID-19 harmed the market in 2020. As a result of the pandemic scenario, several countries worldwide went into lockdown to prevent the virus from spreading. The supply and demand chain disruptions caused by lockdowns significantly impacted demand for expanded polypropylene (EPF) foam in applications such as food packaging, automotive, furniture, and others. However, the situation is estimated to improve in 2021, potentially restoring the market's growth trajectory over the forecast period.

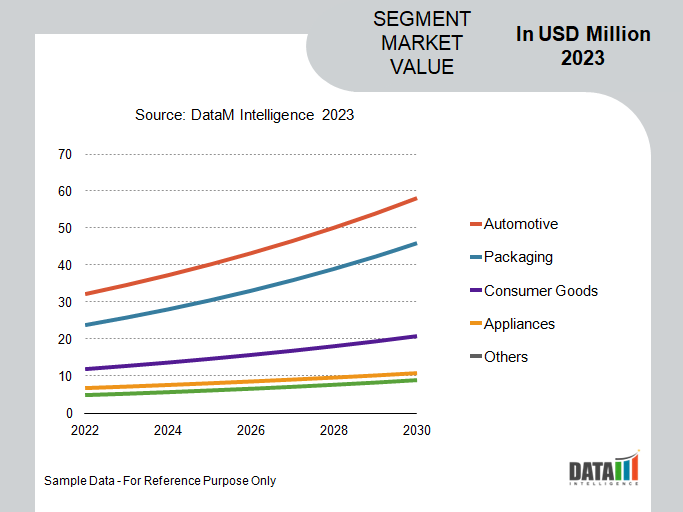

Expanded Polypropylene (EPF) Foam Market Segment and Shares Analysis

The expanded polypropylene (EPF) foam market is segmented by end-user into automotive, packaging, consumer goods, appliances, and others.

Rising product usage in passenger safety and NVH reduction applications

The segment is expected to grow steadily and maintain its lead throughout the forecast period, owing to increased product usage in passenger safety and NVH reduction applications. EPF foam is widely used in the automotive industry for acoustic management, thermal insulation, and impact absorption in the floor, door panels, seats, and bumpers. Over the forecast period, the rising importance of reducing overall vehicle weight to improve fuel economy is expected to drive product demand in the automotive segment.

According to OICA data, global automotive production fell by about 5% in 2019 to 91.78 million units. In 2019, car sales fell by more than 3 million. The impact of COVID-19 caused a significant drop in global automobile production in the first six months of 2020. According to OICA, global automotive production in 2020 was approximately 17,860 thousand units in the first quarter, 31,133 thousand units in the second quarter, and 52,009 thousand units in the third quarter, a decrease of roughly 23.1%, 32.4%, and 22.9%, respectively, from the previous year at the same time.

However, with growing concerns about pollution from gasoline and diesel-powered vehicles, the production of electric vehicles is expected to accelerate over the next five years. Over the forecast period, this will likely drive demand for EPF foams.

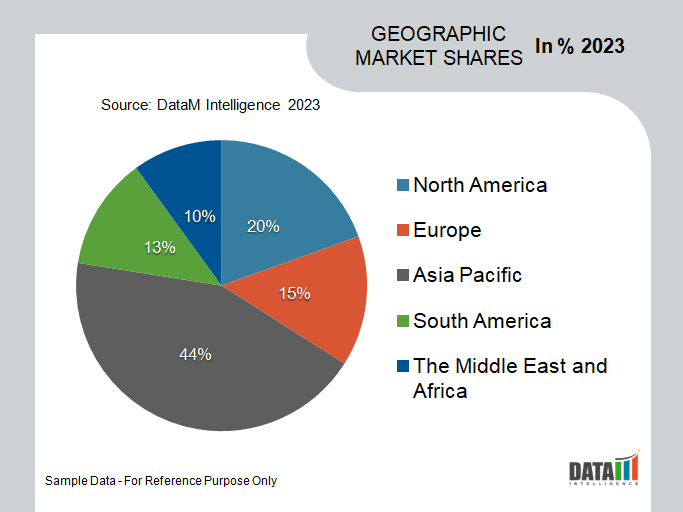

Expanded Polypropylene (EPF) Foam Market Geographical Analysis

Rising consumption of plastic and polymers in Asia-Pacific

Asia-Pacific is expected to have the fastest Expanded Polypropylene (EPF) Foam growth during the forecast period. China has the largest economy in Asia-Pacific in terms of GDP. China is the Asia-Pacific’s largest consumer and producer of EPF foams. The country's expanding manufacturing activities increase the region's consumption of plastics and polymers, which is expected to drive the expanded polypropylene (EPF) foam market. Due to growing environmental concerns, the country's automotive sector has been preparing for product evolution, focusing on manufacturing products that ensure fuel economy and minimize emissions (due to mounting pollution in the country).

Compared to other countries, China is a latecomer to the packaging industry, which has grown to be a large-scale industry over the years. CHINAPLAS 2019, a trade fair focused on technology and innovation, is helping shape the country's packaging industry's future. People in China are becoming more willing to invest in home decoration as their standard of living improves.

Expanded Polypropylene (EPF) Foam Companies and Competitive Landscape

Due to many manufacturers, fabricators, and distributors in the industry, the market faces moderate to high competition. Lower-cost substitutes in the market, such as Expanded Polyethylene (EPE) and Expanded Polycarbonate (EPC), increase competition. Most companies take an integrated approach, from raw material production to EPF foam beads to the distribution of molded sheets and other molded products to various end-use verticals.

Collaborations in technology between manufacturers, fabricators, and end-use industries are critical for growth, as molding and fabrication technologies enable the players to improve product quality, customization services, and customer reach. In the forecasted years, it is expected that research activities focusing on new materials that combine several properties will gain widespread acceptance in the industry.

Key players operating in the global Expanded Polypropylene (EPF) Foam market include JSP Corporation, BASF SE, Kaneka Corporation, DS Smith plc, Furukawa Electric Co., Ltd., Hanwha Corporation., Sonoco Products Company, Knauf Industries, Dongshin Industry, Inc. and Clark Foam Products Corporation.

JSP Corporation

Overview: JSP is a global company that provides expanded polymers to the automotive, construction, civil engineering, and packaging industries. The company has R&D and manufacturing facilities in the major industrial hubs of the Americas, Europe, and Asia-Pacific. JSP Corporation is the largest producer of expanded polypropylene plastics (EPF) globally, thanks to its proprietary foaming and extrusion foaming processes.

The company, which invented EPFs in the 1970s, sells them under the P-Block, ARPOR (in North America), EPFOR brand names, and its Super Blow line of hybrid foam technology products. JSP Corporation is a multinational corporation with manufacturing plants in the U.S., Mexico, France, Germany, Italy, Korea, Taiwan, Singapore, China, and Japan.

Product Portfolio: The company provides materials and products for subsequent transformation (molding etc.). ARPRO Expanded Polypropylene is a 3D engineering material that combines energy absorption with structural strength while highly lightweight. It is also chemically resistant and provides thermal and acoustic insulation. ARPRO is entirely recyclable.

Key Development:

In April 2020, JSP launched polymer foam made with 15% recycled maritime waste. The company is expanding its expanded polypropylene particle foam (EPF) product line to include recycled content. The new 'Arpro 35 Ocean' grade comprises 15% recycled maritime industry waste recovered from fishing nets and ropes. It has a medium bulk density (34 g/l) suitable for lightweight molded parts with densities ranging from 40 to 70 g/l. It has comparable physical properties and performance to Arpro made from new materials; Arpro 35 Ocean has a tensile strength of 615 kPa at 45 g/l and 830 kPa at 60 g/l.