Market Size

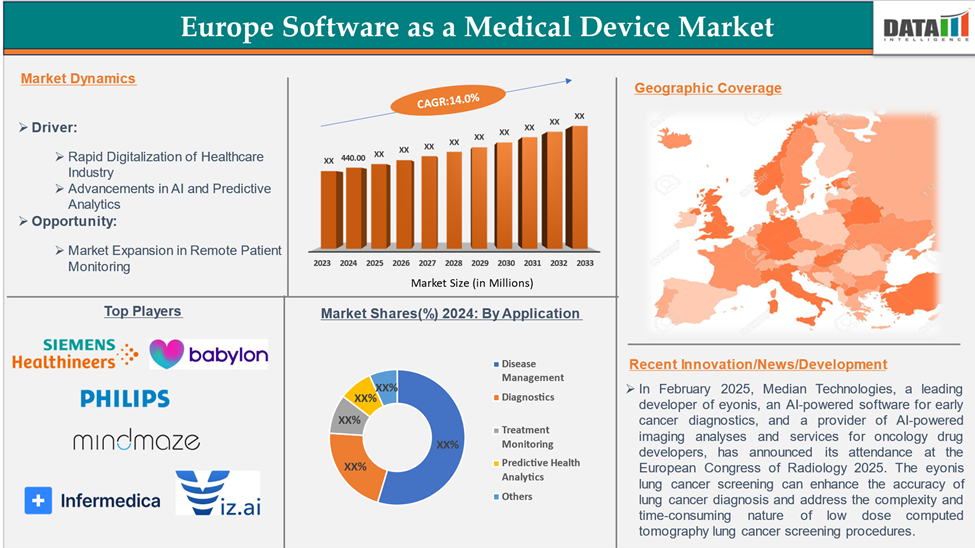

The Europe Software as a Medical Device Market reached US$ 440.00 million in 2024 and is expected to reach US$ 1,400.00 million by 2033, growing at a CAGR of 14.0% during the forecast period 2025-2033.

Software as a medical device refers to software that can perform the functions of a medical device without the necessity of any hardware devices. It means, that the software has the standalone capability to diagnose, monitor and provide medical decisions upon the given input. Several regulatory bodies across the world, define Software as a medical device (SaMD) differently.

SaMD has a wide range of applications including disease diagnosis, patient monitoring, clinical decision support, predictive analytics, treatment monitoring and many more. Fitted with advanced analytics such as Artificial Intelligence (AI), and Machine Learning (ML), SaMD can seamlessly integrate into the management and care of a patient. With the rising digitalization of the healthcare industry and advancements in predictive analytics, SaMD is currently experiencing lucrative growth.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rapid Digitalization of the Healthcare Industry

The growth in the global healthcare industry is rapidly digitalizing, creating new avenues for market growth and expansion. In recent times, medical devices have evolved greatly, and software is playing a crucial role in data processing and analytics. However, software solutions are currently so evolved that they are independently providing healthcare solutions without a need for medical hardware devices. Such software is termed software as a medical device, which goes under the same rigorous regulatory scrutiny for efficacy as medical devices.

In Europe, the adoption of digital health technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Medical Things (IoMT) is rapidly rising. AI and ML technologies are widely being adopted in SaMD devices to enhance their disease diagnosis, treatment monitoring, and predictive analytics capabilities. As per DataM estimates, the digital health sector in Europe is rapidly rising, accounting for ~ 57 billion in 2024, and is expected to reach ~ 128 billion by 2030. Hence, the above factors drive the market growth.

Regulatory Challenges

The regulatory landscape in Europe is continuously evolving, with new stringent regulations being enforced. The European Union Medical Device Regulation (MDR) and In-Vitro Diagnostics Regulation (IVDR) state that the software must comply with the regulatory standards. In the EU, medical device software’ or MDSW is used instead of ‘Software as a Medical Device’.

As per the regulations, the MDSW must have an independent medical purpose, thus meeting the definition of a medical device or an IVD. All the devices that are being placed in the EU market must obtain a CE mark before commercial use. In the case of MDSW, there are set criteria to be followed to get the approval. This process is often tedious as compared to medical devices. The reason is the integration of analytical technologies such as AI and ML.

Moreover, these guidelines are frequently changing, keeping the patient’s safety as the utmost priority. These MDSWs must comply with the changing requirements to continuously stand in the market.

Market Segment Analysis

The Europe software as a medical device market is segmented based on application and indication.

Application:

Disease management from the application segment is expected to dominate the software as a medical device market with the highest market share.

Disease management is a systematic approach to improving patient outcomes by coordinating healthcare interventions, implementing evidence-based treatments, regular monitoring, patient education, and collaboration between healthcare providers to reduce complications.

Software as a medical device plays a crucial role in disease management. It enables continuous monitoring and provides real-time health analytics of patients suffering from chronic conditions. The aging population and rising incidence of chronic diseases pose a significant opportunity for the adoption of software as a medical device in the European market.

The disease management segment is driven by various growth factors like the rise in chronic disease burden, AI adoption, telemedicine expansion, regulatory frameworks, and investments in healthcare digitization and patient-centric care models. For instance, in July 2024, WHO introduced MeDevIS, the first global open-access platform for medical device information, aiding governments, regulators, and users in decision-making on device selection, procurement, and use.

Major European Players

The major European players in the software as a medical device market include Siemens Healthcare Limited, Babylon Healthcare Services Ltd, Koninklijke Philips N.V., MindMaze, Infermedica, Viz.ai, Inc., Medtronic Plc, and Voluntis among others.

Key Developments

- In February 2025, Median Technologies, a leading developer of eyonis, an AI-powered software for early cancer diagnostics, and a provider of AI-powered imaging analyses and services for oncology drug developers, announced its attendance at the European Congress of Radiology 2025. The eyonis lung cancer screening can enhance the accuracy of lung cancer diagnosis and address the complexity and time-consuming nature of low-dose computed tomography lung cancer screening procedures.

Market Scope

| Metrics | Details | |

| CAGR | 14.0% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Application | Disease Management, Diagnostics, Treatment Monitoring, Predictive Health Analytics, Others |

| Indication | Diabetes, Mental Health, Oncology, Cardiovascular, Respiratory Conditions, Others | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Europe software as a medical device market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures and 159 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.