Europe Cold Chain Packaging Market Size

The Europe Cold Chain Packaging Market USD 22,256.4 million in 2022 and is projected to witness lucrative growth by reaching up to USD million by 2031. The market is growing at a CAGR of 14.2% during the forecast period 2024-2031. The pharmaceutical industry is one of the major end-users of cold chain packaging. With the increasing demand for temperature-sensitive drugs, the cold chain packaging market is also rising

The rise of e-commerce has led to an increase in the demand for cold chain packaging, as more and more consumers are purchasing perishable goods online. This has led to an increased need for packaging solutions that can maintain the temperature of the products during shipping which increases the cold chain packaging market value.

Market Scope

| Metrics | Details |

| CAGR | 14.2% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Material Type, Application and Country |

| Countrys Covered | Germany, U.K., France, Italy, Spain, Rest of Europe |

| Fastest Growing Region | Germany |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To know more insights - Download Sample

Europe Cold Chain Packaging Market Dynamics

Rising Demand From Various Industrial Applications Such as Medical Devices and Pharmaceuticals

While shipping temperature-sensitive products such as vaccines, capsules and tablets, it’s important to protect them from bumps, jostling, rough handling, bad weather and other unpredictable factors, all while ensuring a constant temperature range. According to WHO guidelines on the international packaging and shipping of vaccines, temperature monitoring devices should be included in all vaccine shipments to document whether temperature limits have been exceeded.

17% to 37% HCPs expose vaccines to improper storage temperatures. This respective factor led to increasing usage of cold chain packaging which raises the cold chain packaging market.

Rising Raw Material Prices Restrain the Market Growth

Rising raw material costs are anticipated to restrain the cold chain packaging market expansion. The two main raw materials utilized to create a cold chain packaging solution are polyurethane (PU) and polystyrene (PS). The price of polystyrene climbed rapidly by 13% in the first quarter of 2022 compared to Q4 of 2021. Polystyrene's cost on the European market in June was fixed at 2895 USD/MT per MT GPPS FD Hamburg, Germany. Hence the increasing raw material price is a hindrance to cold chain packaging market growth.

Europe Cold Chain Packaging Market Segment Analysis

The Europe cold chain packaging market is segmented based on nature, application, form, function, distribution channel and region.

Closed-air Low-thermal Conductivity, Case of Handling and Environmental Advantages that Maximize Energy Efficiency Boost the Demand for Expanded Polystyrene

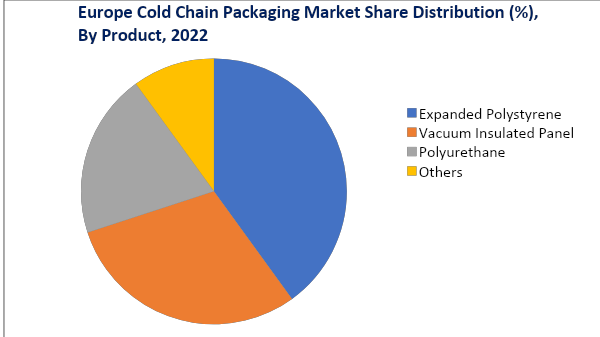

Depending upon the material type, the Europe cold chain packaging market is divided into expanded polystyrene, vacuum-insulated panel, polyurethane and others.

In 2022, the expanded polystyrene segment held the highest share of approximately more than 30% in the cold chain packaging industry, owing to its utilization as a natural sweetener in the food industry, usually in processed foods. EPS offers tangible environmental advantages that maximize energy efficiency, improve indoor environmental quality and enhance the durability of packaged products.

Moreover, expanded polystyrene is recyclable, inert non-toxic to the environment as it does not contain CFCs or HCFCs in the manufacturing process and doesn’t hinder the ozone layer.

Europe Cold Chain Packaging Market Geographical Share

The Increasing Demand from Pharmaceuticals to Increase Their Shelf Life and Safety Boost the Demand for Cold Chain Packaging in Germany

In 2022, Germany held the highest share of the cold chain packaging market. Germany’s market demand for cold chain packaging is driven by rising pharmaceutical industries and medical technology companies due to the surge in chronic ailments and infectious diseases.

According to the United Nations COMTRADE database on global commerce, Germany exported pharmaceutical products worth US$126.01 billion in 2022. Hence for transporting and maintaining the good shelf life of these products cold chain packaging market is raising in Germany.

Europe Cold Chain Packaging Companies

The major players include Saint-Gobain, Cryopak Industries Inc, Cold Chain Technologies, Inc., Americold Logistics, Dgp Intelsius LLC., Burris Logistics, CCL Industries, Intelsius, Softbox Systems, Sonoco Thermosafe

COVID-19 Impact on Market

Europe's economies suffered a major economic calamity due to the COVID-19 pandemic. However, as COVID-19 spread, effective cold-chain solutions took precedence. It is challenging to ensure that identical medications are provided to everyone without going bad, particularly considering how tough it is for European countries to supply adequate vaccines to immunize people. For this, efficient cold-chain logistics solutions were needed.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine conflict could potentially affect the Europe cold chain packaging market in several ways. The conflict disrupts trade routes and increases transportation costs, which impact the supply chain of temperature-sensitive products and affect the demand for cold chain packaging solutions. The conflict leads to political instability or economic sanctions, which impact the overall business climate in Europe and could have knock-on effects on various industries, including the cold chain packaging market.

Key Developments

- In January 2022, Packaging Technology Group, Inc. (PTG), a supplier of thermal packaging solutions and services, introduced the cold chain industry’s first extended-duration, curbside recyclable thermal shipper which maintains 2-8 degrees for 72 hours.

- In March 2021, Cold Chain Technologies paired with Luxembourg-based B Medical System to provide the life science market with end-to-end thermal transportation and storage solutions.

- In January 2021, Pelican BioThermal announced its collaboration with Asian Airlines, which broadens the business' expanding global network.

Why Purchase the Report?

- To visualize the Europe cold chain packaging market segmentation based on product type and application and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous Europe cold chain packaging market-level data points all for segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Europe Cold Chain Packaging Market Report Would Provide Approximately 36 Tables, 24 Figures and 102 Pages.

Target Audience 2024

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies