Ethylene Oxide Market is segmented By Type (Ethylene Glycol, Ethoxylates, Ethanolamines, Glycol Ethers, Polyethylene, Others), By Class (Class A, Class B1, Class D1A, Class D2A, Class E, Class F), By Application (Engine Antifreeze, Household Cleaning, Shampoo, Medical, Clothes, Others), By End-User (Textile, Personal Care, Pharmaceutical, Agriculture, Food, Chemical Industry, Automotive, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Ethylene Oxide Market Overview

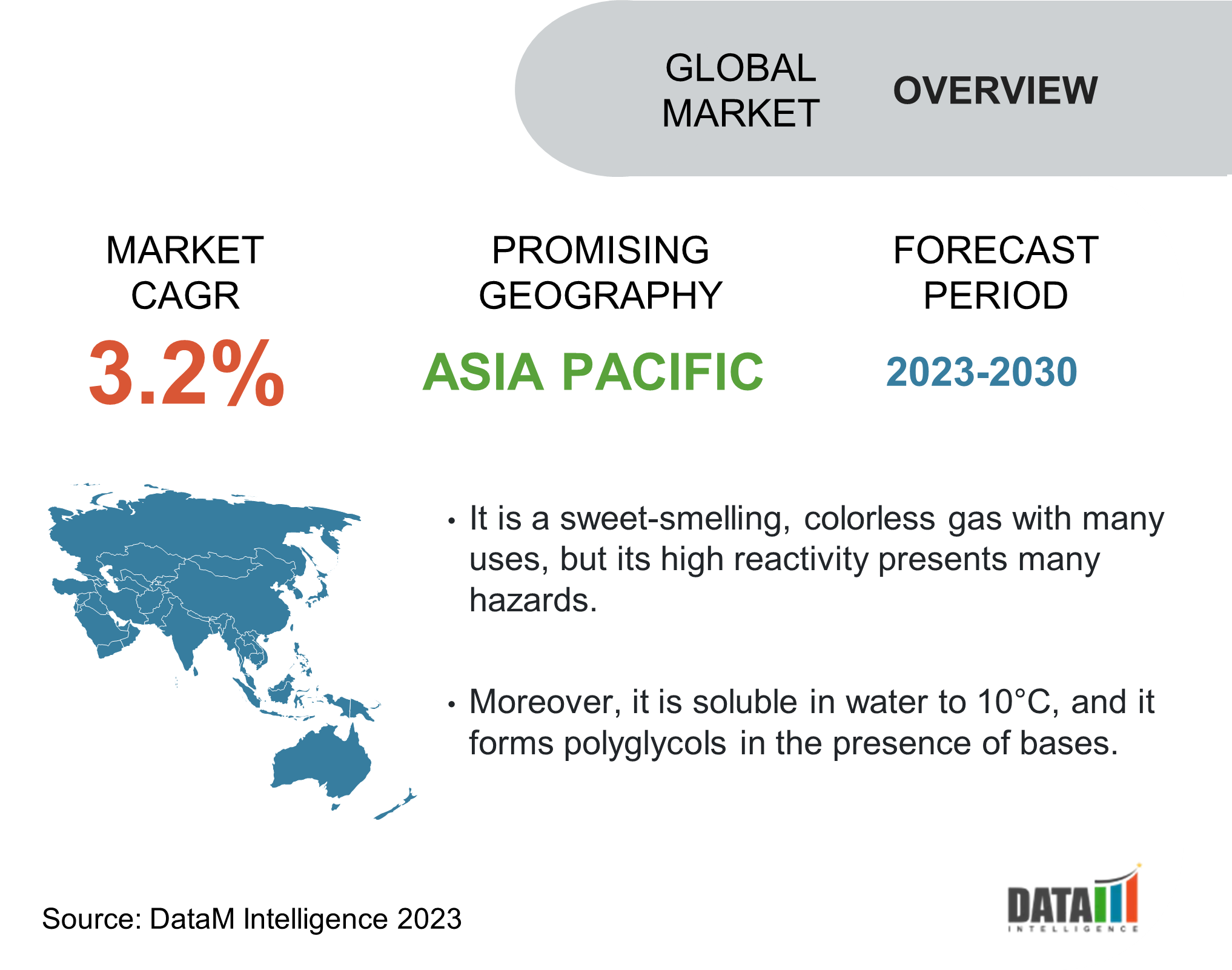

A Report by DataM Intelligence estimates the Global Ethylene Oxide market to grow at a CAGR Of 3.2% during the forecast period 2024-2031. The market is expected to grow due to increasing demand from Textile, Personal Care, Pharmaceutical, Agriculture, Food, Chemical Industry. The competitive rivalry intensifies with DowDuPont Inc., BASF SE., Bayer Material Science LLC, and others operating in the market. In addition, its primary use is as a raw material for the industrial manufacture of ethylene glycol and its oligomers, glycol ethers, and ethanolamines. Also, it is highly flammable & explosive that is occasionally used in pure form and usually used in diluted mixtures.

Ethylene Oxide Market Scope

|

Metrics |

Details |

|

Market CAGR |

3.2% |

|

Segments Covered |

By Type, By Class, By Application, By End-User and By Region |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other key insights. |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Market Share |

Asia Pacific |

To know more insights Download Sample

Ethylene Oxide Market Dynamics

The increasing consumption of ethylene oxide due to growing demand in the textile, food and personal care industry is expected to boost the market growth during the forecast period. According to industry analysis, the personal care industry is expected to reach USD226,950 million in 2021, with a CAGR of 3.40% during the forecast period. In addition, the food market is expected to reach USD 8,049,230 million in 2021, with a CAGR of 3.10% during the forecasted period.

Furthermore, the increase in ethylene oxide in the pharmaceutical industry is expected to drive market growth during the forecast period. Moreover, ethylene oxide (EO) sterilization is the most common industrial sterilization technique for medical devices. In addition, it is a relatively cold sterilization technique and offers high compatibility with most materials used in the manufacture of medical devices such as polymers, plastics, glass and metals. Its fatal is driven by a chemical reaction with the DNA of bacteria, molds, viruses, insects and yeasts. Care is needed when designing a cycle to ensure thorough consideration of any potential limitations in materials, products, coatings, bonds or packaging. In addition, the pharmaceutical industry has generated a revenue of USD 1.1 trillion in 2019 and is expected to increase during the forecast period.

However, the emergency hazards such as dangerously reactive (polymerizes vigorously), extremely flammable gas (distant ignition and flashback are possible), compressed gas (contains gas under pressure), very toxic (fatal if inhaled), corrosive (skin burns and eye damage), cancer hazard, reproductive hazard (damage fertility) and mutagen (genetic defects) are expected to hinder the market growth during the forecast period.

Ethylene Oxide Market Segmentation Analysis

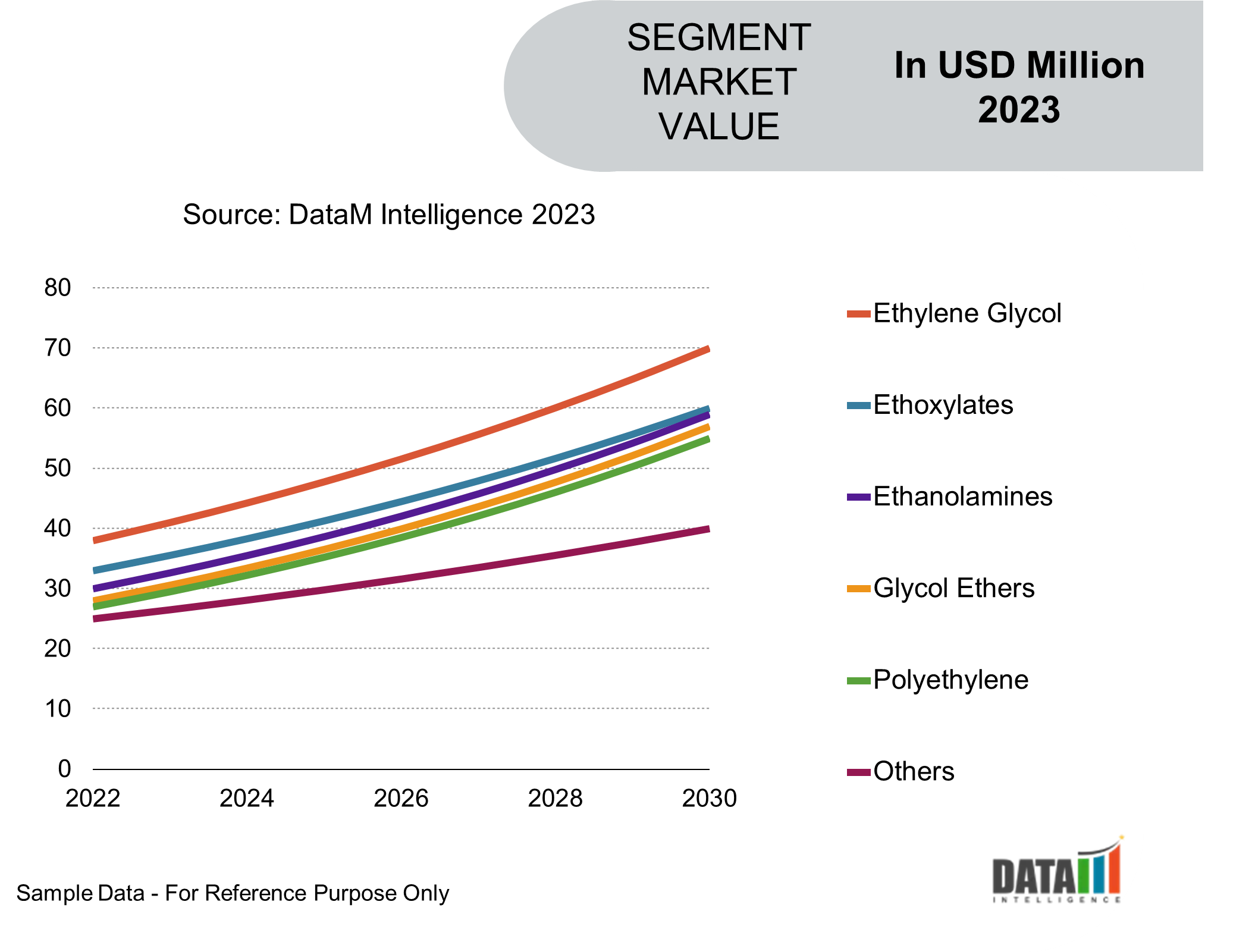

By type, the market is segmented into ethylene glycol, ethoxylates, ethanolamines, glycol ethers, polyethylene and others. By class, the market is segmented into class A, class B1, class D1A, class D2A, class E and class F. By application, the market is segmented into engine antifreeze, household cleaning, shampoo, medical, clothes and others. By end-user, the market is segmented into textile, personal care, pharmaceutical, agriculture, food, chemical industry, automotive and others.

The class of ethylene oxide is differentiated based on Class A – compressed gas, Class B1 – flammable gas, Class D1A – very toxic, Class D2A - very toxic (carcinogenicity; mutagenicity; reproductive toxicity), Class E – corrosive, Class F - dangerously reactive.

Ethylene glycol global production is expected to reach more than 64 million metric tons from the recorded value of 41 million metric tons during the forecast period.

Ethylene glycol is a chemical usually used in many commercial and industrial applications, including coolant and antifreeze. Moreover, it helps keep the car’s engine from freezing in the winter and acts as a coolant to reduce overheating in the summer. In addition, other essential uses of ethylene glycol include heat transfer fluids used as industrial coolants for gas compressors, ventilating, heating, air-conditioning systems, and ice-skating rinks.

Furthermore, ethylene glycol is also used as a raw material in the production of a wide range of products, including polyester fibers for clothes, upholstery, pillows & carpet; fiberglass used in products such as bathtubs, jet skis & bowling balls; and polyethylene terephthalate resin used in packaging film and bottles. Many of these products are energy-saving and cost-efficient as well as recyclable.

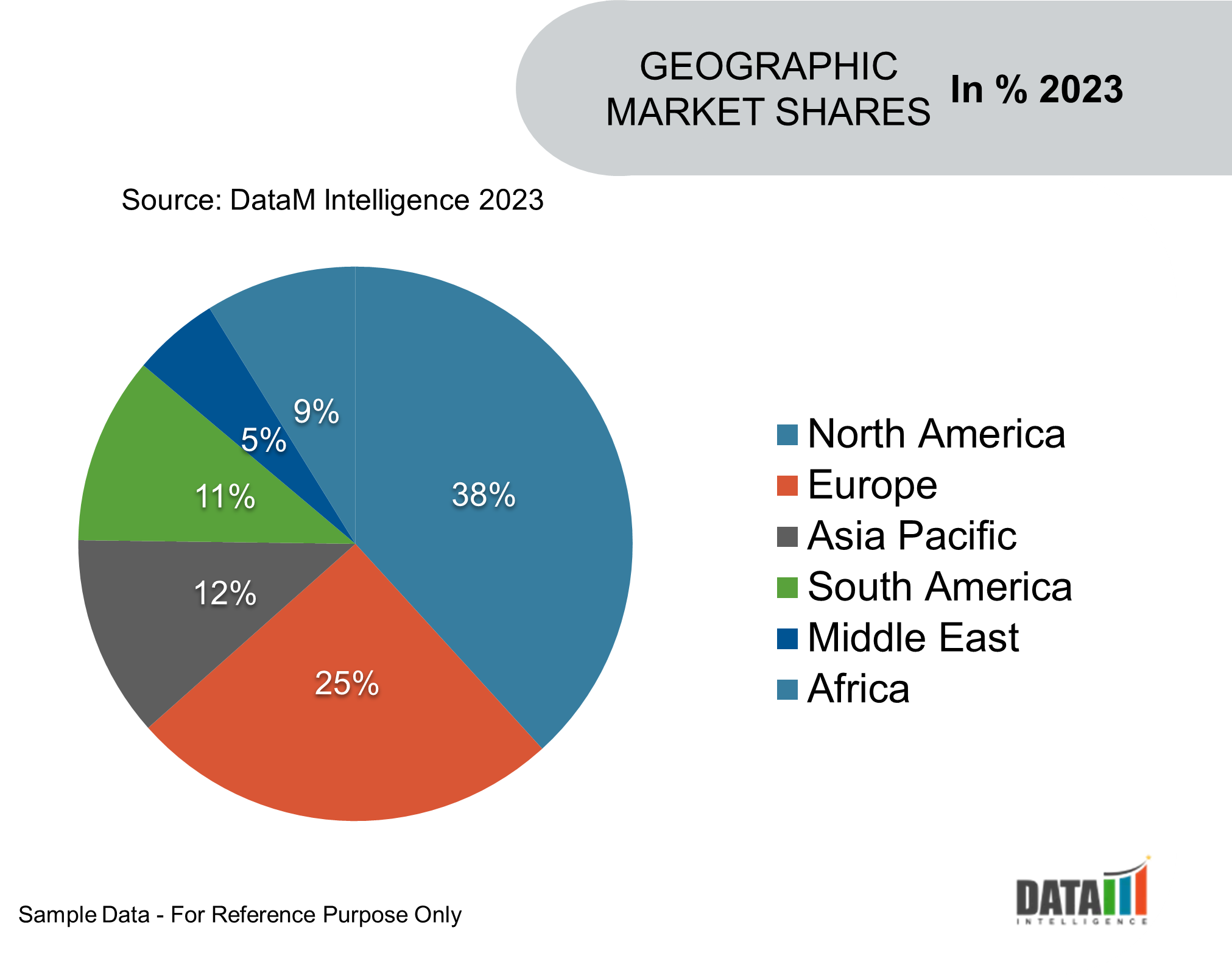

Global Ethylene Oxide Market Geographical Share

APAC dominates the global ethylene oxide market due to increased ethylene oxide consumption in various industries, including textile and automotive. China accounts for ethylene oxide's major consumption and its derivatives in this region due to being the largest clothing exporter. According to industry analysis, China generated revenue of approximately USD 119 billion in 2019 for the textile exporter sector due to low cost & vast labor, reduced commercial barriers, and material supply availability are a few of the country's competitive advantages for the clothing manufacturing industry. In addition, increasing industrialization is expected to boost the market growth in the Asia Pacific region during the forecast period. However, the industry makers are going through a depressing industrial restructuring. While the country is still the world's largest clothing exporter with enormous production capacity, oversupply at home, high labor costs, and rising global protectionism have eroded its competitiveness.

North America and Europe are expected to contribute to the significant market growth during the forecast period due to the growing demand for pharmaceuticals and the food industry. In North Africa, big giants are opening up their plants and developing this compound due to the increasing demand for ethylene oxide worldwide. According to industry analysis, the food industry is expected to reach USD 25,655 million from the recorded value of USD 21,319 million with a CAGR of 4.73% during the forecast period.

Ethylene Oxide Market Companies and Competitive Landscape

The ethylene oxide market is fragmented with the presence of regional and global players. The competitive contour lies with the increase in the regional company and growing investment in upstream application. Croda Inc., DowDuPont Inc., BASF Corporation, Bayer Material Science LLC, Celanese Ltd., Champion Technologies, Dow Chemical Company, Eastman Chemical Company, Honeywell, Shell Chemical LP are the major player in the oxide market. The major players adopt several growth strategies such as product launches, acquisitions, and collaborations, contributing to growing the ethylene oxide market globally.

Croda Inc.

The company has manufactured the first bio-ethylene oxide, 100% renewable, 100% bio-based surfactants. Moreover, the 100% bio-based ECO Range is the broadest range of 100% renewable surfactants on the market. Using an alternate route to EO with bioethanol from biomass sources significantly increases the bio-based content of ethoxylated products and reduces reliance on fossil fuels. In addition, the ingredients are manufactured with renewable energy.

Furthermore, the ECO Range caters to the tremendous consumer need for greener products. Now, with the 100% renewable, 100% bio-based ECO Range, customers won’t have to choose between meeting their sustainability goals and delivering high-performance products to consumers.

The company also offers various significant features such as

- 100% renewable

- 100% bio-based1

- Reduces reliance on fossil fuel feedstocks

- Manufactured with renewable energy

- Performance identical to petro-based options

- Lower carbon footprint than petro-based versions

- Tested and Registered to the USDA BioPreferred® Program2

- RSPO Supply Chain Certified via Mass Balance3.