Overview

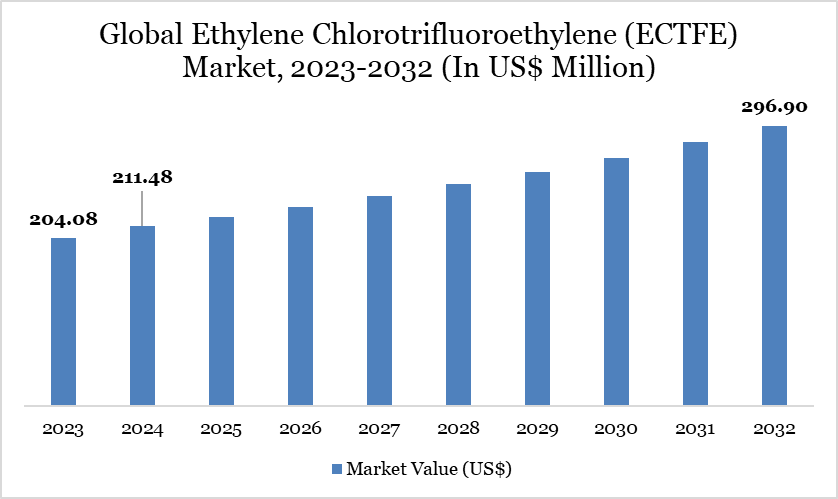

The global Ethylene Chlorotrifluoroethylene (ECTFE) market reached US$211.48 million in 2024 and is expected to reach US$296.90 million by 2032, growing at a CAGR of 4.4% during the forecast period 2025-2032.

The global ECTFE market is experiencing steady growth, driven by its exceptional resistance to corrosive chemicals, high-purity processing capabilities and performance under extreme conditions. With global industrial infrastructure investment rising, ECTFE is increasingly utilized in sectors such as semiconductors, pharmaceuticals, chemical processing and water treatment. Its long service life and low permeability make it a cost-effective alternative to metal alloys, traditional coatings and less stable polymers.

According to the Semiconductor Industry Association (SIA), global semiconductor sales reached US$179.7 billion in Q2 2025, growing 7.8% from Q1 and 19.6% year-on-year. This surge is particularly relevant for the ECTFE market, as chip manufacturing facilities rely heavily on ultra-high-purity (UHP) fluid handling systems. ECTFE’s strong chemical resistance and low leachability make it ideal for fume exhaust systems, chemical delivery piping and tank linings in cleanroom environments. With Asia Pacific and the Americas leading chip growth (34.2% and 24.1% YoY, respectively), ECTFE demand in these regions is expected to remain robust.

Asia-Pacific and North America lead in ECTFE consumption, supported by semiconductor fab expansions and infrastructure upgrades. Europe is driving adoption through sustainability-focused regulations, while China, with 13.1% year-on-year chip sales growth, is investing heavily in chemical-resistant systems for electronics and wastewater applications.

Ethylene Chlorotrifluoroethylene (ECTFE) Market Trend

The Ethylene Chlorotrifluoroethylene (ECTFE) market is growing due to its excellent chemical resistance and durability in harsh environments. Increasing demand in industries like chemical processing, automotive, and electronics is driving growth. Rising adoption for corrosion-resistant coatings and films further boosts the market. Innovation in manufacturing and expanding applications are expected to sustain this trend.

Market Scope

Metrics | Details |

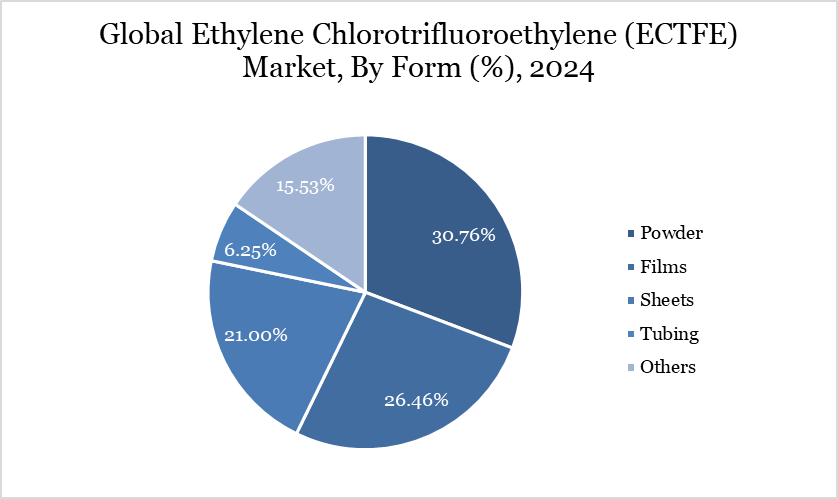

By Form | Powder, Films, Sheets, Tubing, Others |

By Application | Oil & Gas, Semi-conductor, Food and Beverage, Automotive, Chemical processing, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand from the Semiconductor Industry

The sustained growth of the global semiconductor market is directly contributing to rising demand for Ethylene Chlorotrifluoroethylene (ECTFE) in fabrication processes. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached US$59.0 billion in May 2025, reflecting a 19.8% year‑over‑year increase and a 3.5% rise from April 2025, underscoring the sector’s robust momentum. This expansion is driven by strong performance in the Americas (45.2% YoY growth) and Asia Pacific (30.5% YoY growth), fueling investments in advanced fabrication facilities where ECTFE is essential for critical applications such as wet benches, chemical delivery systems, high‑purity piping and exhaust management.

Additionally, the demand for ECTFE is witnessing strong growth as global semiconductor production expands under major initiatives such as the US CHIPS Act, the European Chips Act and large-scale investments across Asia. These programs are transforming the semiconductor landscape by funding state-of-the-art fabs, advanced packaging plants and pilot production lines, all of which require materials with exceptional chemical resistance, purity and durability.

High Material and Processing Costs

ECTFE production relies on high-cost monomers such as chlorotrifluoroethylene (CTFE), which involve energy-intensive synthesis and limited global supply chains. The reliance on fluorspar is primarily sourced from China, further subjecting ECTFE pricing to commodity volatility. These factors drive up the base cost of ECTFE resin, positioning it well above mainstream engineering plastics and many fluoropolymers.

ECTFE requires advanced fabrication techniques, including high-temperature extrusion, specialized welding and precise lining applications. The need for dedicated equipment and skilled labor increases capital and operational expenditure for end-users. This limits its adoption primarily to large-scale or technically demanding projects with the capacity to absorb higher upfront costs. With relatively low production volumes and a niche demand base, ECTFE manufacturers struggle to achieve cost efficiencies through scale. This keeps unit costs persistently high and constrains broader market penetration, especially when compared to more established fluoropolymer families.

Segment Analysis

The global ethylene chlorotrifluoroethylene (ECTFE) market is segmented based form, application and region.

Powder Form Has a Significant Share in the Market Due to Versatile Processing Applications

ECTFE powder coatings have been increasingly adopted in industrial settings due to their excellent chemical resistance and adaptability to automated coating technologies. One of the most prominent indicators of this trend is the deployment of advanced powder coating equipment in key manufacturing regions like Hebei and Guangdong in China.

In Hebei Province, Shandong Bonita Machinery Co., Ltd., a notable supplier of powder coating equipment, has enabled coating applicators to drastically improve operational performance. According to technical details published on Bonita’s export catalog, their fully enclosed powder coating lines are engineered for high-efficiency throughput, offering automation capabilities such as vibration-assisted powder feeders, multi-stage filtration and high-precision cyclones for powder recovery. These systems are built to maintain a powder utilization rate of up to 95%, with recycling efficiency reaching as high as 98% in optimized lines.

Geographical Penetration

Asia-Pacific Holds Significant Share in Ethylene Chlorotrifluoroethylene (ECTFE) Market Due to Rapid Industrial Growth

In the Asia-Pacific region, the demand for ECTFE has seen steady growth due to the region’s rapid industrialization and expanding chemical, semiconductor and packaging sectors. In India, trade and customs data from the World Bank’s World Integrated Trade Solution (WITS) database indicates significant reliance on imports for specialty fluoropolymers. In India, rising imports from US$ 70 M in 2022 to US$ 89 M in 2023 under HS 390469 point to a growing requirement for advanced fluorinated polymers, including ECTFE. China’s significantly higher import value (over US$ 421 M in 2023) indicates scale of demand for fluoro‑polymers in chemical and materials-intensive industries. Similarly, Japan’s imports of US$ 292 M reflect mature industrial usage relating to electronics, pharmaceuticals and specialty applications.

Further evidence of demand can be found in India’s environmental clearance filings. The Ministry of Environment, Forest and Climate Change (MoEFCC) provides publicly available environmental assessment data on new industrial proposals. For instance, a specialty chemicals manufacturing project approved in Gujarat (Project ID: SIA/GJ/IND3/68050/2021) was granted clearance to produce 75 tons per month of fluorinated polymers, including ECTFE, PCTFE and CTFE copolymers. This approval highlights that the Indian government is facilitating domestic production of advanced fluoropolymers in response to market demand, likely to reduce import dependence and support local value-added manufacturing.

Pricing Analysis

The pricing of Ethylene Chlorotrifluoroethylene (ECTFE) is primarily influenced by the volatility of its key raw materials, chlorotrifluoroethylene (CTFE) and ethylene. CTFE production is tied to the availability of HCFC-22 and is impacted by the global fluorochemical supply chain and regulatory phase-downs under agreements like the Kigali Amendment. Ethylene pricing, on the other hand, is closely linked to crude oil and natural gas fluctuations. These factors create inherent volatility in ECTFE production costs, prompting major producers to frequently adjust their pricing models to reflect changes in feedstock expenses.

Production costs for ECTFE are also shaped by specialized polymerization processes, which are energy-intensive and capital-heavy. The need for strict process control, compliance with stringent safety and environmental regulations such as the EPA and REACH and effective waste management further elevates manufacturing expenses. Producers with integrated upstream fluorochemical capabilities, such as Syensqo, often achieve better cost control, while non-integrated players face stronger exposure to price fluctuations in the feedstock market.

Trade policies and tariffs add another layer of complexity to ECTFE pricing. Recent 20–25% tariffs on Chinese imports and additional duties on goods from the EU, Canada and Mexico have sharply increased the landed costs for raw materials and finished ECTFE products in the US and other importing regions. These measures, combined with regional incentives for domestic fluoropolymer production, are reshaping global sourcing patterns, driving up near-term costs and influencing long-term pricing strategies.

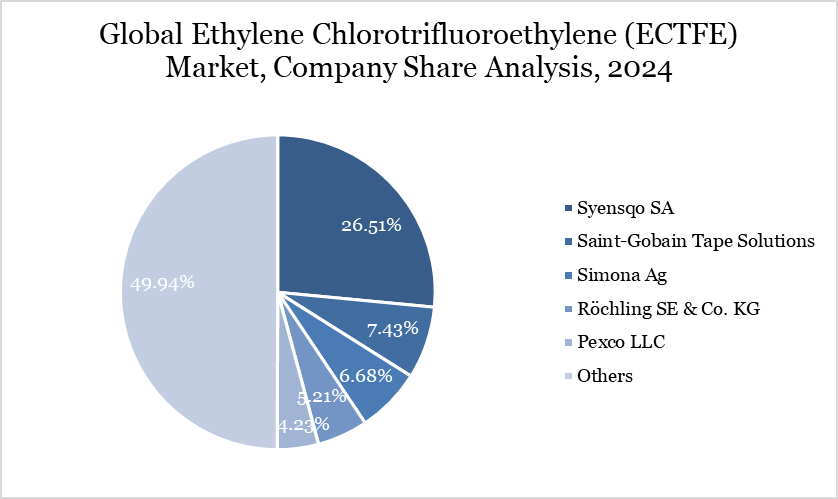

Competitive Landscape

The major global players in the market include Syensqo SA, Saint-Gobain Tape Solutions, Swami Plast Industries, Simona Ag, Röchling SE & Co. KG, Vandit Polycraft PVT. LTD, Pexco LLC, Goodfellow Cambridge Ltd., Polytech Plastics, Jiangsu Rana Fluorine Material Technology Co., Ltd., Quzhou Best Make Technology Co., Ltd., Jinhua Jadeflon Chemical Technology Co., Ltd.

Key Developments

In March 2021, Pexco LLC expanded its presence in the high-performance polymer market through the strategic acquisition of Altaflo, a company based in Sparta, New Jersey. This move strengthened Pexco’s capabilities in advanced polymer processing and broadened its footprint in the specialty plastics industry.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies