Endometrial Cancer Treatment Market Size

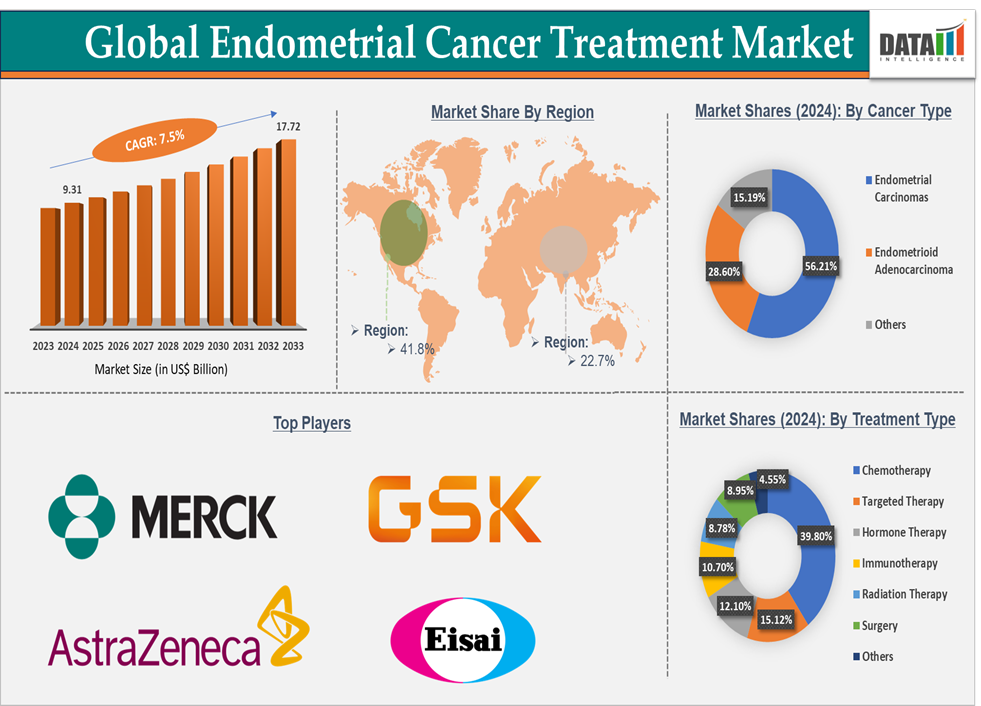

The global endometrial cancer treatment market size reached US$ 9.31 Billion in 2024 and is expected to reach US$ 17.72 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Endometrial Cancer Treatment Market Overview

The global endometrial cancer treatment market is poised for steady growth, driven by rising disease prevalence, increasing awareness, advancements in treatment options, and the introduction of novel therapies. Endometrial cancer, the most common gynecological malignancy in developed countries, primarily affects postmenopausal women, with risk factors including obesity, diabetes, hypertension, and prolonged estrogen exposure.

The market encompasses various therapeutic areas, including surgery, radiation therapy, chemotherapy, and hormonal therapy, as well as emerging therapies like immunotherapy and targeted therapy. North America holds the largest share of the endometrial cancer treatment market, driven by a high prevalence of the disease, developed healthcare infrastructure, and advanced treatment options. The U.S. FDA’s approval of innovative therapies such as Imfinzi (Durvalumab) and Jemperli (Dostarlimab-gxly) has enhanced the treatment landscape.

Executive Summary

For more details on this report – Request for Sample

Endometrial Cancer Treatment Market Dynamics: Drivers & Restraints

A strong pipeline of new treatment drugs is significantly driving the market growth

A strong pipeline of new treatment drugs is significantly driving the growth of the endometrial cancer treatment market by introducing innovative therapies that offer more effective, targeted, and personalized treatment options. These new drugs are aimed at improving outcomes, especially for advanced or recurrent endometrial cancer, which is often harder to treat with traditional methods like surgery, chemotherapy, and radiation. Thus, emerging market players are developing strong treatment products, which further accelerates the market growth.

For instance, in August 2024, ImmunityBio launched the Phase I/II QUILT 502 clinical trial of ANKTIVA (nogapendekin alfa inbakicept-pmln), plus the investigational AdHER2DC vaccine, as a potential therapy for patients with HER2-expressing endometrial cancer. It aims to explore the long-term effectiveness of ANKTIVA in replacing the short-term activity of checkpoint inhibitor immunotherapies.

There’s a growing focus on combining different treatment modalities to improve efficacy, particularly in advanced stages of endometrial cancer. Combinations of immunotherapy with chemotherapy or targeted therapy are showing promising results. For instance, in March 2025, Faeth Therapeutics and The GOG Foundation, Inc. announced that the first patient had been dosed in its Phase 2 combination trial of PIKTOR, which is FTH-001 (serabelisib) and FTH-003 (sapanisertib) with paclitaxel. The trial is the most advanced of its kind to investigate a novel approach of dual PI3Kɑ-mTORC1/2 inhibition targeting cancer metabolism in patients with endometrial cancer.

Additionally, in December 2024, IDEAYA Biosciences, Inc. dosed the first patient in the IDEAYA-sponsored Phase 1 trial evaluating the combination of IDE161, the company's investigational, potential first-in-class, small molecule poly (ADP-ribose) glycohydrolase, or PARG, inhibitor, in combination with Merck's anti-PD-1 therapy, KEYTRUDA (pembrolizumab), in endometrial cancer patients with high microsatellite instability (MSI-high) and microsatellite stable(MSS).

Side effects of current treatments are hampering the market growth

The side effects of current treatments for endometrial cancer are a significant restraint on the market, as they impact patient quality of life, treatment adherence, and overall treatment success. While treatments like chemotherapy, radiation therapy, and surgical procedures have been effective, the side effects associated with these methods often lead to complications, delays in treatment, or discontinuation of therapies altogether.

Chemotherapy is a common treatment for advanced endometrial cancer, but it comes with a broad range of adverse side effects such as fatigue, nausea, vomiting, hair loss, weakened immune system, and increased susceptibility to infections. These side effects can make patients reluctant to pursue chemotherapy as a treatment option, limiting the adoption of this widely used modality.

Radiation therapy is used for certain stages of endometrial cancer, particularly for patients with locally advanced disease. However, it can lead to long-term complications, including bowel damage, bladder irritation, and vaginal dryness, which can impact sexual health and overall well-being. As radiation side effects can persist long after the treatment is over, patients may be reluctant to opt for it, limiting its use in certain populations and encouraging the market to seek more tolerable therapies.

Immunotherapies like Pembrolizumab and targeted therapies (such as Lenvatinib) have emerged as promising treatments for endometrial cancer, but they too come with their own set of side effects, including immune-related adverse events like colitis, pneumonitis, and hypothyroidism. These side effects, while less common than those from chemotherapy, still pose challenges in patient management and may deter some patients from opting for these therapies, particularly if they have existing comorbidities or are sensitive to immune system changes.

Endometrial Cancer Treatment Market Pipeline Analysis

Top phase III pipeline products for endometrial cancer:

Endometrial Cancer Treatment Market, Segment Analysis

The global endometrial cancer treatment market is segmented based on cancer type, treatment type, and region.

Treatment Type:

The chemotherapy segment is expected to hold 39.8% in the endometrial cancer treatment market

Chemotherapy is the standard treatment for advanced and recurrent endometrial cancer when surgery and radiation are not sufficient. Carboplatin and Paclitaxel are commonly used in combination as a first-line treatment for advanced endometrial cancer. These drugs have been proven effective in shrinking tumors and managing disease progression. Even in the era of immunotherapy and targeted therapies, chemotherapy remains the cornerstone for many advanced cases.

Unlike newer therapies like immunotherapies or targeted treatments, chemotherapy is widely available in most healthcare settings, including developing countries, and is relatively more affordable. This makes it the go-to treatment for a large proportion of patients, especially in resource-constrained settings. For instance, in lower-middle-income countries, chemotherapy regimens like Paclitaxel and Carboplatin are often more accessible due to their lower cost compared to newer immunotherapies like Pembrolizumab. The low-cost nature of chemotherapy helps drive its dominant position in these markets.

Chemotherapy is often used in combination with other treatment modalities, such as radiation therapy and surgery, which enhances its overall effectiveness in managing endometrial cancer. The ability to combine chemotherapy with other therapeutic modalities ensures its continued dominance in the treatment landscape. For instance, in June 2024, AstraZeneca’s Imfinzi (durvalumab) in combination with carboplatin and paclitaxel, followed by Imfinzi monotherapy, was approved in the United States as treatment for adult patients with primary advanced or recurrent endometrial cancer that is mismatch repair deficient.

Endometrial Cancer Treatment Market Geographical Analysis

North America is expected to hold 41.8% of the global endometrial cancer treatment market

North America, particularly the United States, is home to many of the world’s leading pharmaceutical companies and biotech firms, which heavily invest in research and development (R&D) for cancer therapies. These companies are at the forefront of developing innovative treatments for endometrial cancer, including targeted therapies and immunotherapies.

For instance, Companies like Merck (which developed Pembrolizumab, an immunotherapy for endometrial cancer) are headquartered in North America and are leading the charge in bringing new therapies to market. North America’s strong presence in clinical trials, drug approvals, and regulatory pathways accelerates the availability of new treatments. This innovation-driven market, supported by substantial investments in R&D, ensures that North America remains a leader in the global endometrial cancer treatment market.

North America, particularly the U.S. Food and Drug Administration (FDA), has a relatively fast and efficient regulatory approval process for new cancer treatments. The FDA’s Breakthrough Therapy Designation and Accelerated Approval pathways have allowed promising treatments for endometrial cancer, like Pembrolizumab and Niraparib, to gain rapid approval.

For instance, in July 2023, the United States Food and Drug Administration approved GSK’s dostarlimab-gxly (Jemperli) with carboplatin and paclitaxel, followed by single-agent dostarlimab-gxly, for primary advanced or recurrent endometrial cancer that is mismatch repair deficient, as determined by an FDA-approved test or microsatellite instability-high.

Asia Pacific is expected to hold 22.7% of the global endometrial cancer treatment market

Asia-Pacific, especially Japan, is a leader in the adoption of innovative cancer treatments such as immunotherapies and targeted therapies. The country’s regulatory bodies facilitate fast-track approvals for new drugs, enabling patients to access advanced therapies. For instance, in December 2021, Eisai and Merck & Co., Inc., announced that the Japanese Ministry of Health, Labour and Welfare (MHLW) approved the combination of LENVIMA, the orally available multiple receptor tyrosine kinase inhibitor discovered by Eisai, plus KEYTRUDA, the anti-PD-1 therapy from Merck & Co., Inc., for the treatment of patients with unresectable, advanced or recurrent endometrial carcinoma that progressed after cancer chemotherapy.

Japan is home to a significant number of clinical trials focused on endometrial cancer, and there is an increasing push to develop personalized treatment options. Japanese research institutions and pharmaceutical companies are leading efforts to improve the understanding of endometrial cancer and discover more effective therapies. These research efforts not only improve the standard of care but also position Japan as a hub for cutting-edge cancer research, attracting attention from global pharmaceutical companies and boosting market growth in the region.

Endometrial Cancer Treatment Market Top Companies

Top companies in the endometrial cancer treatment market include Merck & Co., Inc., AstraZeneca, GSK, Eisai Inc., and among others. And the emerging market players in the market includes Karyopharm Therapeutics Inc., Chia Tai Tianqing Pharmaceutical Group Co., Ltd., Kartos Therapeutics, Inc., BioNTech SE, Bio-Thera Pharmaceuticals Co., Ltd., Faeth Therapeutics, ImmunityBio, Inc., IDEAYA Biosciences, Inc., Mersana Therapeutics, Inc., and Others.

Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Cancer Type | Endometrial carcinomas, Endometrioid Adenocarcinoma, and Others |

| Treatment Type | Chemotherapy, Targeted Therapy, Hormone Therapy, Immunotherapy, Radiation Therapy, Surgery, and others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global endometrial cancer treatment market report delivers a detailed analysis with 36 key tables, more than 40 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.