Global Drug Delivery Infusion System Market – Industry Trends & Outlook

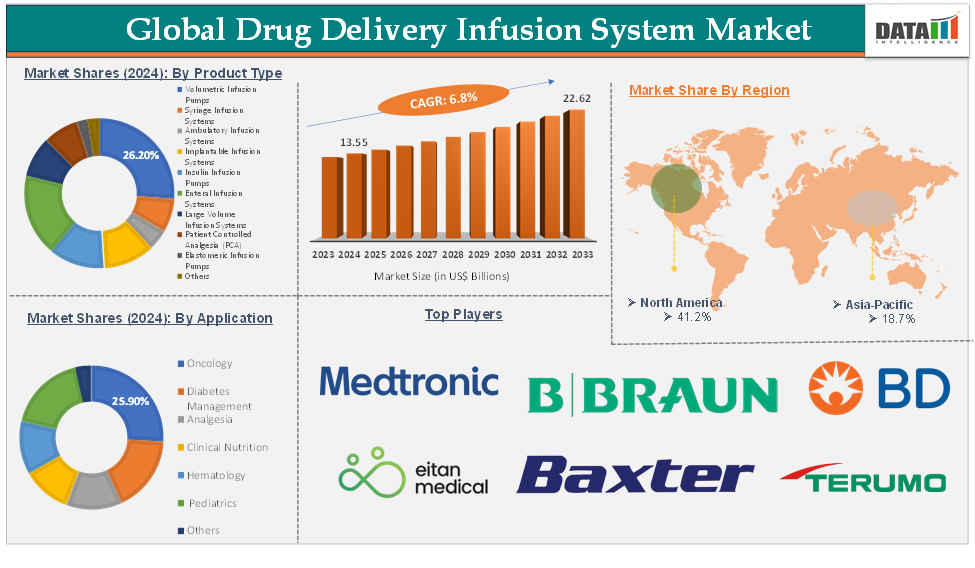

The global drug delivery infusion system market was valued at US$ 12.80 Billion in 2023. The market size reached US$ 13.55 Billion in 2024 and is expected to reach US$ 22.62 Billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025-2033.

The global drug delivery infusion system market refers to the sector encompassing medical devices and technologies designed to administer medications or fluids directly into a patient's body in controlled amounts, typically through intravenous, subcutaneous, or other non-oral routes.

Key drivers fueling this expansion include the rising prevalence of chronic diseases such as cancer and diabetes, which necessitate precise, safe, and continuous drug administration. The aging global population and increasing hospital admissions also contribute significantly to market demand.

Technological advancements are a major trend, with the industry rapidly adopting smart infusion pumps featuring dose error reduction software, programmable settings, wireless connectivity, and AI-powered monitoring for enhanced medication safety.

The integration of infusion systems with electronic health records and the development of wearable and home-based infusion devices are further transforming patient care and expanding the market’s reach. Additionally, the shift toward personalized medicine and the emergence of disposable, eco-friendly infusion products are opening new opportunities for innovation and market penetration.

Global Drug Delivery Infusion System Market – Executive Summary

Global Drug Delivery Infusion System Market Dynamics: Drivers

Technological advancements

Technological advancements are a primary driver for growth and transformation in the global drug delivery infusion system market, fundamentally changing how therapies are administered and improving patient outcomes. Recent innovations include the integration of nanotechnology, advanced materials, AI-powered systems, and smart device connectivity, all of which are making drug delivery more precise, efficient, and patient-friendly.

Artificial intelligence and machine learning are being embedded in infusion pumps and related devices, enabling real-time monitoring, dose optimization, and personalized therapy adjustments based on individual patient data. These technologies support better treatment efficacy, safety, and adherence, particularly in chronic disease management. Furthermore, innovations in materials science, such as bioresponsive polymers and hydrogels, are enabling sustained and controlled drug release, improving therapeutic consistency and patient compliance.

For instance, in June 2025, TriSalus Life Sciences introduced the TriNav FLX Infusion System, engineered with improved trackability by incorporating twice as much flexible material at the distal tip. This design enhancement allows for easier and smoother navigation through complex, tortuous blood vessels.

Growing trend of outpatient care and home healthcare services

The shift toward outpatient care and home healthcare is creating substantial opportunities for the global drug delivery infusion system market. This trend is driven by rising chronic disease prevalence, patient demand for convenience, and healthcare system efforts to reduce costs and hospital stays. It drives demand for innovative, patient-centric devices that enable safe, effective, and convenient therapy outside traditional clinical settings, supporting both market expansion and improved health outcomes.

Global Drug Delivery Infusion System Market Dynamics: Restraints

Product recalls

Product recalls are a significant restraint for the global drug delivery infusion system market because they directly impact patient safety, manufacturer reputation, regulatory compliance, and financial performance. Recalls often occur due to device malfunctions, software anomalies, or material defects that can lead to serious patient harm or even death, as seen in recent FDA Class I recalls involving leading brands and models of infusion pumps and related software.

For instance, in September 2024, Fresenius Kabi USA issued a recall for specific Ivenix Large Volume Pump (LVP) Primary Administration Sets after discovering a manufacturing defect that could cause uncontrolled medication flow, leading to the risk of medication overdose and potentially death.

Also, in May 2024, OptumHealth Care Solutions initiated a recall of its Nimbus II Plus infusion pump systems, following an earlier recall by the manufacturer, InfuTronix, due to multiple serious device failures. For example, issues such as unexpected device shutdowns, inaccurate dosing, delayed system responses, and software failures have prompted urgent recalls, disrupting clinical workflows and putting patients at risk.

Global Drug Delivery Infusion System Market Dynamics: Opportunities

Expansion in emerging markets

Emerging markets such as Asia-Pacific, Latin America, Eastern Europe, and Africa are rapidly transforming the landscape of the global drug delivery infusion system market. These regions present substantial growth opportunities due to demographic trends, rising disease burden, and evolving healthcare infrastructure. Manufacturers that invest in local partnerships, cost-effective production, and tailored innovation are well-positioned to capture significant market share and drive the next phase of industry growth

For more details on this report, Request for Sample

Global Drug Delivery Infusion System Market - Segment Analysis

The global drug delivery infusion system market is segmented based on product type, application, end-user, and region.

Product Type:

The volumetric infusion pumps product type segment is expected to hold 26.2% of the global drug delivery infusion system market in 2024

Volumetric infusion pumps are advanced medical devices designed to deliver precise and controlled amounts of fluids, such as medications, nutrients, or blood products, directly into a patient’s bloodstream over a set period. These pumps use sophisticated mechanisms and sensors to ensure accurate dosing, making them essential in settings where exact fluid management is critical, such as intensive care units, operating rooms, and during chemotherapy or parenteral nutrition.

Key segment drivers for the volumetric infusion pumps market include the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions, which require precise and continuous medication or fluid administration. The rapidly growing geriatric population, which is more susceptible to chronic illnesses and requires frequent medical interventions, further boosts demand for these devices.

Advancements in infusion pump technology, such as smart features, wireless connectivity, and integration with electronic health records, enhance safety, efficiency, and usability, making volumetric pumps more attractive to healthcare providers. Additionally, the shift toward home-based and outpatient care is increasing the need for portable and user-friendly infusion systems, allowing patients to receive treatment outside traditional hospital settings.

For instance, in April 2024, Baxter International Inc. announced that its Novum IQ large volume infusion pump (LVP) with Dose IQ Safety Software received 510(k) clearance from the U.S. Food and Drug Administration (FDA). This clearance adds the LVP modality to the Novum IQ Infusion Platform, which already includes Baxter’s syringe infusion pump (SYR) with Dose IQ Safety Software and the IQ Enterprise Connectivity Suite, allowing clinicians to use a unified, integrated system across various patient care environments. These factors have solidified the segment's position in the global drug delivery infusion system market.

Global Drug Delivery Infusion System Market – Geographical Analysis

North America is expected to hold 41.2% of the global drug delivery infusion system market in 2024

The North America drug delivery infusion system market is experiencing robust growth, driven by several key factors. One of the primary drivers is the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions, which require precise and continuous medication administration.

The region’s rapidly aging population further increases demand, as older adults are more likely to need long-term infusion therapies. Technological advancements such as the integration of smart features, wireless connectivity, and interoperability with electronic health records are enhancing the safety, accuracy, and efficiency of infusion systems, making them more attractive to healthcare providers.

North America’s well-established healthcare infrastructure, high healthcare spending, and early adoption of innovative medical technologies further support market expansion. The presence of leading medical device manufacturers and pharmaceutical companies in the region also accelerates product development and adoption.

Additionally, key players in the industry are product launches and approvals that would propel this market growth in the region. For instance, in April 2025, ICU Medical received FDA 510(k) clearance for several major additions to its infusion pump portfolio, marking the initial launch of its IV Performance Platform.

The new clearances include the Plum Solo precision IV pump, a single-channel device designed to complement the dual-channel Plum Duo, as well as updated versions of the Plum Duo pump and the LifeShield infusion safety software. Thus, the above factors are consolidating the region's position as a dominant force in the global drug delivery infusion system market.

Asia Pacific is expected to hold 18.7% of the global drug delivery infusion system market in 2024

The Asia-Pacific drug delivery infusion system market is expanding rapidly, driven by several interrelated factors. A primary driver is the increasing burden of chronic diseases such as diabetes and cancer, which require ongoing, precise medication administration.

The region's rapidly aging population and urbanization are also contributing to higher demand for advanced infusion systems, as more patients require long-term and home-based care solutions. Improved healthcare access and rising investments in healthcare infrastructure across emerging economies, particularly China, India, and Southeast Asian countries, are further fueling market growth.

Technological innovation is another significant driver. The adoption of user-centric and smart infusion devices, including wearable and electronic infusion pumps, is on the rise. These devices offer enhanced convenience, accuracy, and safety, supporting the shift toward at-home and ambulatory care. Government-backed digital health initiatives in countries like Japan and South Korea, along with the integration of infusion systems into mobile health platforms, are accelerating the uptake of these advanced solutions. Thus, the above factors are consolidating the region's position as a dominant force in the global drug delivery infusion system market.

Global Drug Delivery Infusion System Market – Competitive Landscape

The major global players in the drug delivery infusion system market include Medtronic, Eitan Medical, B.Braun SE, BD, Baxter, Terumo Corporation, Insulet Corporation, Fresenius Kabi AG, Arcomed, and ICU Medical, Inc., among others.

Global Drug Delivery Infusion System Market – Key Developments

In June 2025, TriSalus Life Sciences introduced the TriNav FLX Infusion System, engineered with improved trackability by incorporating twice as much flexible material at the distal tip. This design enhancement allows for easier and smoother navigation through complex, tortuous blood vessels.

In April 2025, ICU Medical received FDA 510(k) clearance for several major additions to its infusion pump portfolio, marking the initial launch of its IV Performance Platform. The new clearances include the Plum Solo precision IV pump, a single-channel device designed to complement the dual-channel Plum Duo, as well as updated versions of the Plum Duo pump and the LifeShield infusion safety software.

In February 2025, Koru Medical Systems announced a significant new development agreement with a major global pharmaceutical company to create a next-generation infusion system specifically designed for subcutaneous immunoglobulin (SCIg) therapy.

In November 2024, TriSalus Life Sciences expanded its Pressure-Enabled Drug Delivery (PEDD) portfolio with the launch of the TriNav LV Infusion System and TriGuide Guiding Catheters, aiming to improve the treatment of tumors, especially in patients with challenging vascular anatomy.

In January 2024, AbbVie introduced PRODUODOPA (foslevodopa/foscarbidopa) in the European Union, marking it as the first and only subcutaneous infusion therapy that provides continuous 24-hour delivery of levodopa for individuals with advanced Parkinson's disease.

Global Drug Delivery Infusion System Market – Scope

Metrics | Details | |

CAGR | 6.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Volumetric Infusion Pumps, Syringe Infusion Systems, Ambulatory Infusion Systems, Implantable Infusion Systems, Insulin Infusion Pumps, Enteral Infusion Systems, Large Volume Infusion Systems, Patient Controlled Analgesia (PCA), Elastomeric Infusion Pumps, Others |

Application | Oncology, Diabetes Management, Analgesia, Clinical Nutrition, Hematology, Pediatrics, Others | |

End-User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Clinics | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global drug delivery infusion system market report delivers a detailed analysis with 62 key tables, more than 65 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.