Drone Data Services Market Overview

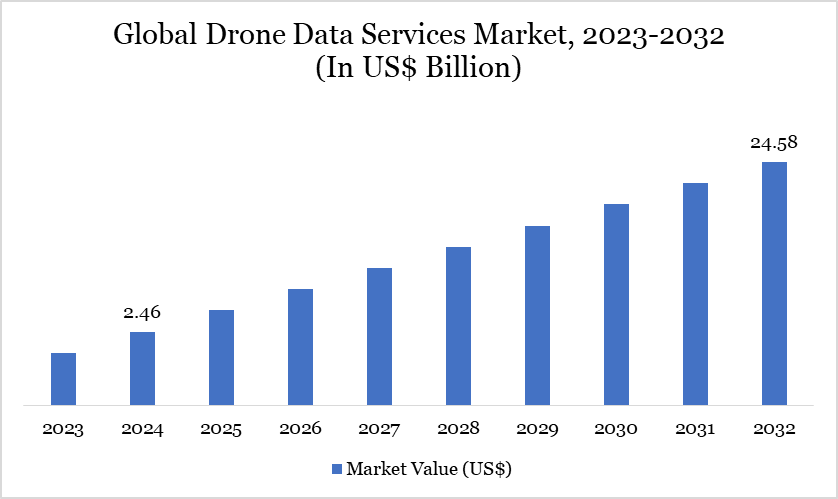

Drone Data Services Market reached US$2.46 billion in 2024 and is expected to reach US$24.58 billion by 2032, growing at a CAGR of 33.34% from 2025 to 2032.

Drone data services involve drones with sensors and cameras to capture and analyze data, improving operational efficiency and decision-making in various sectors. Their real-time data collection and aerial imaging capabilities contribute to cost savings and improved accuracy, aligning with the increasing emphasis on precision and efficiency in industries such as agriculture, construction and logistics.

The market for drone data services is experiencing rapid growth due to the rising demand for efficient and accurate data collection methods in sectors such as agriculture, where precision farming techniques are being adopted to maximize yield and optimize resource use. Regulatory frameworks such as the Federal Aviation Administration (FAA) regulations in the US and the European Union's regulatory updates for commercial drone operations are driving adoption by providing clear operational guidelines and safety standards, making drone data services a viable option for businesses.

Drone Data Services Market Trend

Across the global drone industry, many companies are shifting from merely selling drone hardware to offering Drone-as-a-Service (DaaS) a model that provides on-demand access to drones, data, and analytics without requiring customers to own or operate the equipment. For instance, in October 2022, India-based drone tech firm IdeaForge launched the country’s first app-based Drone-as-a-Service (DaaS) model, Flyght Franchise. This on-demand UAV service targets large enterprises and organizations. The Flyght service has already been deployed across Himachal Pradesh, Uttarakhand, Rajasthan, Odisha, and West Bengal. The model aims to make drone operations more accessible and scalable for business applications.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

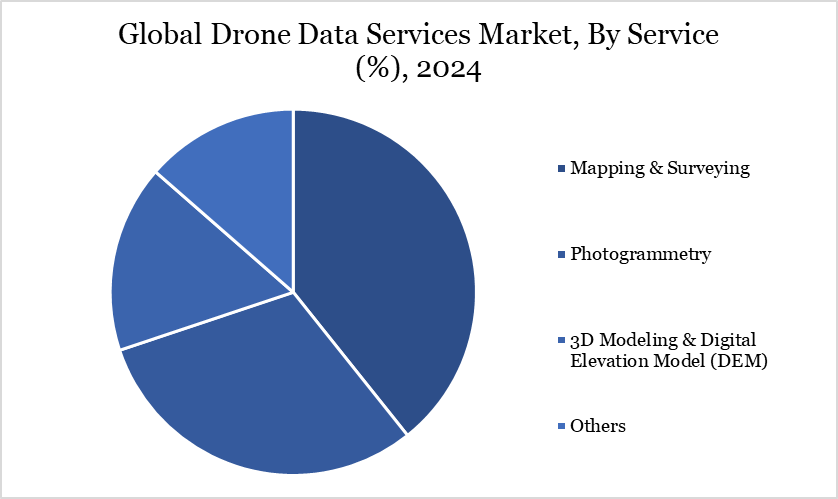

By Service | Mapping & Surveying, Photogrammetry, 3D Modeling & Digital Elevation Model (DEM), Others |

By Platform | Cloud-Based, Operator Software |

By Application | Surveillance & Inspection, Product Delivery, Data Acquisition & Analytics |

By End-User | Real Estate & Construction, Agriculture, Mining, Oil & Gas, Renewables |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Drone Data Services Market Dynamics

Cost-effective for Data Collection

The drone data services market is witnessing substantial growth, driven by the need for precise, efficient and cost-effective data collection methods across various industries. According to the International Civil Aviation Organization, drone data services are expected to become a critical component in sectors like agriculture, construction, mining and environmental monitoring.

To address this rising demand, drone service providers are investing in advanced AI and machine learning algorithms that can analyze vast datasets in real-time, enhancing the accuracy and speed of data processing for applications like crop monitoring, infrastructure inspection and resource exploration. Similarly, the development of advanced, high-performance drones equipped with LiDAR, multispectral and thermal imaging sensors is finding traction in the environmental and disaster management sectors.

The drones are designed to operate in diverse and challenging conditions, including high altitudes and extreme weather environments. A study in the Journal of Remote Sensing highlighted that drones equipped with LiDAR technology could achieve up to 95% accuracy in terrain mapping, even in dense vegetation areas. This precision and adaptability are becoming increasingly important as industries seek to optimize operational efficiency and enhance data reliability in complex applications.

High Cost of Deployment with Strict Government Regulation

A major factor influencing these costs is the price volatility of essential components such as drones, sensors and software systems. the average cost of commercial & professional drones has seen fluctuations between US$ 10,000 to US$ 50,000, heavily influenced by supply chain issues, rising demand and technological advancements. Additionally, the costs associated with high-quality sensors and imaging equipment can range from US$ 1,000 to US$ 5,000, further impacting the overall pricing structure of drone data services.

Furthermore, stringent regulatory requirements from legislative bodies such as the US Federal Aviation Administration (FAA) and the European Union’s GDPR (General Data Protection Regulation) hamper the further growth of the market. For instance, the FAA mandates compliance with various safety and operational standards for commercial drone usage, including Remote Pilot certification and adherence to airspace restrictions.

The FAA's regulations can lead to additional costs related to training, certification and ensuring compliance with flight authorization processes. Similarly, in Europe, regulations such as the European Union’s GDPR (General Data Protection Regulation) impose strict guidelines on data handling and privacy, impacting how drone data services operate.

Drone Data Services Market Segment Analysis

The global drone data services market is segmented based on service, platform, application, end-user and region.

Transforming Mapping and Surveying Across Industries

The demand for mapping and surveying services within the drone data services market is rapidly increasing, driven by technological advancements and the growing need for precise and efficient data collection. Drones' ability to cover large areas quickly, combined with their capacity to gather data in real-time, has transformed traditional surveying methods and is propelling the adoption of drone-based solutions.

The services are utilized across construction, mining, agriculture, urban planning, environmental monitoring and infrastructure development. Drones equipped with high-resolution cameras and LiDAR (Light Detection and Ranging) technology capture detailed aerial images, enabling the creation of precise maps and 3D models.

Regulations promoting the utilization of unmanned aerial systems (UAS) for commercial purposes have been backed by the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), resulting in market expansion. Government efforts in US, like the Integration Pilot Program (IPP), are focused on incorporating drones into the country's airspace to enhance their use in surveying tasks. Similarly, the EU's Urban Air Mobility (UAM) initiative encourages innovative drone services for urban development initiatives.

Drone Data Services Market Geographical Share

Booming Industry Adoption and Favorable Regulatory Support in North America

North America is set to lead the drone data services market during the forecast period, driven by technological advancements, expanding agricultural practices and the need for infrastructure monitoring in US, Canada and Mexico. According to the FAA, in the US, the commercial drone sector includes approximately 699,000 small drones in 2022, a growth rate exceeding 12% over the year before (2021), underscoring the increasing demand for efficient drone data services across various industries in the region.

Similarly, the oil & gas industry in Canada has increasingly utilized drone-based solutions for pipeline inspection and environmental monitoring. Moreover, in agriculture, US experienced emerging technology such as precision farming practices utilizing drone systems saw a significant increase in adoption between 2022 and 2023, reflecting a trend toward more efficient crop monitoring and yield analysis.

Sustainability Analysis

The drone data services market is increasingly emphasizing sustainability as industries such as agriculture, mining and environmental monitoring seek eco-friendly solutions for data collection and analysis. Companies are developing drones with reduced emissions and more efficiency, in line with worldwide initiatives to minimize carbon footprints. For example, SenseFly provides solar-powered drones that are meant to consume as little energy as possible while providing high-quality aerial imagery.

According to the International Emergency Drone Organization (IEDO), the demand for sustainable drone technologies has surged as companies aim to meet environmental regulations and sustainability targets. The IEDO emphasizes the importance of drone data services in cutting waste and energy use across multiple sectors, such as precision agriculture and infrastructure monitoring. Governments also back the use of environmentally friendly technologies, offering subsidies and grants for sustainable drone developments in numerous countries. Such measures are helping the drone data services market align with global environmental and regulatory goals, as emphasized by the IEDO and government publications on sustainability targets.

Drone Data Services Market Major Players

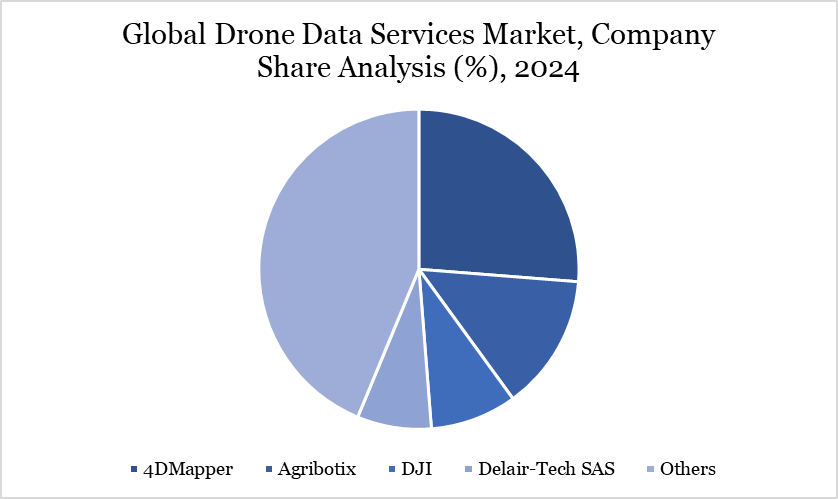

The major global players in the market include 4DMapper, Agribotix, DJI, Delair-Tech SAS, Hexcel Corporation, Pyrotek Inc., SABIC, Teijin Ltd., Toray Industries, Inc. and Victrex plc.

Key Developments

In October 2024, Globhe and OpenForests announced a strategic partnership aimed at enhancing environmental monitoring and project visualization. This partnership combines Globhe's advanced drone data marketplace with Explorer. land, providing organizations with a valuable tool to improve transparency, engagement and impact in their sustainability initiatives.

In February 2024, Skyports Drone Services (Skyports) and Ground Control have announced a new drone survey and AI data capture service with Network Rail. By collecting important environmental data like vegetation growth, tree health and type, the service helps UK railway infrastructure owners make informed decisions about vegetation management.

In May 2022, UAVIA and Parrot announced a strategic technology and marketing partnership aimed at enhancing the drone data services market. By integrating Parrot Anafi Ai with the UAVIA Robotics Platform, the two companies seek to make 4G autonomous drones more accessible. This partnership highlights advancements in drone technology and its increasing role in efficient data services.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies